**The tides are shifting in the realm of Fintech payment platforms trends, and you don’t want to miss the wave. Picture a world where paying for coffee, sending money overseas, or buying a car is just a tap away. No fumbling for cash. No endless wait for bank approvals. This vision is now a burgeoning reality, and it’s reshaping the fabric of commerce. My deep dive into this tech-led revolution will reveal how the digital landscape is far from stagnant. With each swipe, click, or tap, we’re stepping into a future where every transaction is a seamless blend of speed and security. If you’re eager to see where the bits and bytes of financial tech are taking us next, stick with me. I’ve got the insights you’ve been looking for.

Embracing the Cashless Society: Discerning the Transformative Trends

The Surge of Digital Payment Solutions

Let’s talk about money but not the kind you hold in your hands. Digital payment solutions are on the rise, leading us to a future where cash seems like an old tale. Imagine buying ice cream with just a tap of your phone. That’s not a dream; it’s happening now, and it’s getting bigger.

Predictions on Contactless Payment Uptake and Mobile Payment Evolution

Everywhere we look, people are tapping their phones to pay. Grocery stores, gas stations, and even lemonade stands are going high-tech. What does this mean for the cash in our pockets? Let me tell you, it’s going bye-bye. Contactless payment is not just easy; it’s lightning fast. And security? Better than ever.

Mobile payment evolution is a big chapter of this story. It has turned our phones into wallets we can’t leave at home. And here’s a twist: soon, you might be able to wave your hand or smile to pay. Yes, you heard that right, thanks to biometric payment systems.

We are witnessing an unstoppable march toward a cashless society. The forecast for this change is concrete – more taps, less cash. Now, imagine crossing a border and paying with a swipe. Cross-border payment innovation is tearing down walls, making shopping from another country as simple as buying veggies from your local store.

Think of all the people who send money to family across seas. Remittance services advancements mean they can do it in a snap, no more waiting days. And what’s powering these lightning speeds? 5G, coming to a phone near you, making mobile payments faster than you can text “LOL”.

Now let’s merge finance with tech, something I like to call fintech. The blend is creating brand new ways to pay, like e-wallets that are soaring high in popularity. Mobile payment evolution is a race, and everyone’s trying to win.

Did I mention voice-activated transactions? Imagine just saying “pay” and it’s done. Sounds like magic, but it’s tech, and it’s on the horizon. And behind the scenes, artificial intelligence and machine learning are the wizards making it all safe and smooth.

However, not all is a smooth sail. Digital payment solutions face tough waves like new rules and security hurdles. But with open banking on our side, we can share data securely and make payment systems that talk to each other nicely. It’s a big teamwork to keep our money safe while we enjoy the ease of all these new ways to pay.

So, what’s the takeaway from this dive into digital payment solutions trends and mobile payment evolution? Hang on tight; a cashless society is not just coming, it’s here. And it’s bringing friends like biometric systems, contactless cards, and a whole lot of convenience. It’s more than a trend, it’s a lifestyle switch that’s happening right now, under our very fingertips. And I’m here, keeping tabs and telling you all about it. Welcome to the future of transactions, where every tap or wave is another step into an exciting cashless world.

The Secure Future of Fintech: Blockchain and Biometric Innovations

Integrating Blockchain for Digital Payment Security

Are we keeping our money safe? This question bugs many of us each day. Thanks to blockchain, we can breathe easy. It’s not just for buying Bitcoin. Blockchain now keeps digital payments safe. Think of it as a digital lockbox that no one can crack.

Each transaction makes a “block” and links to a chain. No one can change these. They’re set in stone, or should we say, digital stone. Banks love this. It means they can trust where the money’s been. And we can too.

Using blockchain, our cash moves silently across the globe. It does not wave hello to fraudsters or say bye to details. It keeps everything under a shroud. We get peace of mind, knowing our money’s journey is secret and secure.

Advancing Authentication through Biometric Payment Systems

Now, let’s put a face—or a finger—to making payments. Enter biometric systems. No two people are the same. And biometrics verify this. It uses what makes you, you. Your fingerprint, your voice, or the twinkle in your eye can confirm your identity.

Biometric payment systems are not just cool; they’re smart. You might forget a PIN or lose a card. But do you forget your finger at home? No. Biometrics bring ease to payments. It’s like your body is the password.

With a simple scan, you’re good to go. It’s super fast. You don’t have to dig for cash or cards anymore. Lineups at checkouts could soon be just a bad memory. Just picture paying for groceries with a smile—literally.

Plus, it’s tough to trick these systems. It’s hard for someone else to mimic your biometric data. This means fewer chances for thieves to get their hands on your money. Your face or finger does the job to keep your money safe.

As we sprint towards more tech in our wallets, keep an eye out. The future promises even more exciting ways to secure your money and make payments a breeze. Blockchain and biometrics are just the start. Welcome to the era where “you” are the ultimate key to your cash.

Facilitating Frictionless Finances: Real-Time and Cross-Border Developments

The Rise of Real-Time Payment Services and Cross-Border Payment Innovation

We want quick and easy when it comes to paying for stuff. That’s what real-time payment services give us. What are real-time payment services? They let us send and get money without any wait. Our cash moves fast, like sending a text message.

People also ask: Why do we need real-time payments? It’s about time, friends. We used to wait days for a check to clear. Now, in seconds, we buy, sell, and get paid. This is huge for business and for you and me.

Are real-time payments safe? Yes! The tech running these, from “Advanced Encryption Standard” (AES) to “Transport Layer Security” (TLS), keeps our money safe. Think of it like a super-secure locker for your cash, online.

Cross-border payments are going the same way. They were slow, now they’re getting faster. These payments link different currencies and countries. They used to be like a marathon; now they’re more like a sprint.

Businesses love this trend. They trade all over the world. Now their money zips across borders with less fuss. This makes goods and services move smoother too. Everybody wins.

Pioneering P2P Payment Systems and E-Wallet Growth

Peer-to-peer (P2P) payments let us send money to each other easily. Think of it like sharing a slice of pie. You can pass it straight to your friend. That’s P2P in a nutshell.

More people use their phones to pay each other back. Why? It’s handy. You’re out with pals, split a pizza, and zap — pay your share right from your phone. It’s that easy.

E-wallet growth is part of the fun too. What’s an e-wallet? It holds your payment info in a digital form. It means no digging for cards or cash. Just pick your phone and tap to pay. Easy and quick, right?

People wonder: Will e-wallets replace wallets? Many say yes. They’re safer — no lost cash or cards — and smarter. Plus, you get deals and track spending. It’s like having a money assistant in your pocket.

QR codes add to the mix. You know them — those square barcode things. They make paying super simple. A quick scan, and you’ve paid for your coffee, book, or bus ride.

Did you know all this is part of a cashless society forecast? That’s where we’re heading. Less cash, more digital. It’s all about making paying and getting paid simple and secure.

To sum up, real-time and P2P are game changers. We’re talking speed, safety, and smart tech. The ways we buy and sell are evolving fast. And with this, we’re not just watching the future — we’re in it, making every tap, scan, and send way more fun.

Smart Tech in Transaction: AI and Regulatory Adaptations

The Role of AI and Machine Learning in Payment Processing

Did you know AI makes paying for things smart and fast? It’s true! We see AI everywhere in how we pay. It checks for fraud and makes things secure. It also suggests offers that you might like. This smart tech learns from what you do to make things better each time you use it.

When you shop online and check out, AI steps in. It helps decide if your payment is safe or if someone might be using your card wrongly. This is good for you and the shops you’re buying from. Shops can sell more without worry, and you can shop with ease.

AI does more than keep things safe. It can guess what you like by looking at what you buy. Then, it gives you deals you’ll want to use. This means you can save money and find new stuff you like. AI is cool, right?

Think about when you talk to your phone to send money. AI is working there too. It knows what you said and whom to send money to. Plus, it makes sure it’s really you talking and not someone else. We can thank machine learning for these smart check-ups. It gets smarter as it goes, making each check better than the last.

This tech keeps changing, and so do the rules on how to use it. My job is to watch these changes and help everyone keep up. We still have much to learn, but one thing’s sure: AI is making paying for stuff way better for all of us.

Navigating the New Norms of Digital Payment Regulations

Now, let’s talk about rules. You know, the ones that make sure our money moves rightly and safely. New ways to pay mean we need new rules too. These rules help keep our money safe when we pay or get paid online.

There are big changes happening in how our money is looked after. This matters to everyone – you, me, the banks, and even the places we buy from. New rules can be tough to get, but they play a big part in our money’s safety.

They check on how shops and banks handle our card details. They make sure nothing wrong happens when we pay or move money. They also keep an eye on new things like paying with our face or fingerprint. The goal is to make sure that no one’s money gets taken without it being okay.

The cool thing is, these rules help bring new ways to pay. And they make it so money can move across borders quicker than before. We see new tech like QR codes pop up and change how we think about paying.

Staying on top of these rule changes is key. I help ensure the tech we use sticks to the rules. This means when you tap your phone to pay or use your fingerprint, you’re not just using neat tech. You’re also using tech that’s checked to be safe and right.

New tech in how we pay is super exciting. With AI and new rules, we can all look forward to safer and faster ways of handling money. There’s always more to learn, so let’s keep our eyes open for what’s next!

We looked at how paying with cash is fading, making room for safer and faster tech. We saw digital payments boom and what might come next. With blockchain, we’re set for secure money moves. Biometrics will make sure it’s really us paying.

We shared how money moves fast, across the world without pause. Peer-to-Peer exchanges and e-wallets are growing fast. AI is making paying easy, and new rules are guiding us safely.

My final thought? The way we pay is changing fast, and it’s exciting. Let’s stay smart and adapt to keep our money safe.

Q&A :

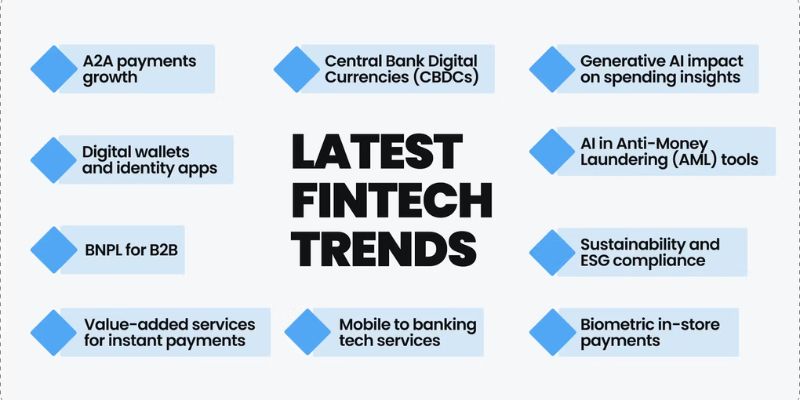

What are the latest trends in Fintech payment platforms?

In recent years, Fintech payment platforms have seen a surge in innovation, driven by changing consumer expectations and technological advancements. Key trends include the rise of contactless payments, increased use of blockchain for security and transparency, and the adoption of artificial intelligence for personalized services and fraud prevention. Moreover, there’s a growing emphasis on cross-border payments and simplifying complex financial transactions.

How is the adoption of mobile payments affecting Fintech trends?

The widespread use of smartphones has significantly impacted Fintech trends, with mobile payments at the forefront. Consumers are increasingly relying on mobile wallets and contactless payments which offer convenience and speed. This move towards mobile has pushed Fintech companies to develop seamless, user-friendly apps, and payment solutions that facilitate quick transactions and improved user experiences. Additionally, mobile payment data is being leveraged to offer customized financial services.

What role does AI play in shaping the future of payment platforms?

Artificial Intelligence (AI) is pivotal in advancing payment platforms, by enabling more secure and efficient operations. AI algorithms are used to detect and prevent fraudulent transactions, manage risk, and personalize offerings to individual users. Looking to the future, AI is expected to drive innovation in predictive analytics, allowing for anticipatory payment services and more intuitive customer support through chatbots and virtual assistants.

Are cryptocurrencies influencing Fintech payment platform trends?

Cryptocurrencies have definitely started to influence Fintech payment platform trends, as they bring the potential for decentralized finance (DeFi) and lower transaction fees. Although adoption varies by region and demographic, the interest in integrating blockchain technologies for payment processing is on the rise. This could lead to more platforms offering crypto transactions and bringing forward a new era of digital currency inclusion in everyday finance.

What impact do regulations have on Fintech payment platform innovation?

Regulations play a dual role in the Fintech industry. On one hand, they ensure consumer protection, data security, and fair competition. On the other, they can pose challenges and potentially stifle innovation if they are overly stringent. Fintech companies must navigate the regulatory landscape by remaining compliant while also pushing the boundaries of what is possible within the confines of those regulations. Adapting to new regulatory frameworks is critical for the continued growth and innovation in payment platforms.