How Geopolitics Reshape Your Investment Landscape: The Untold Impact on Stock Markets

How Geopolitics Affect Stock Markets isn’t just news fodder; it’s the unseen hand pushing the pieces across the global stock market board. As an investor, you might watch your portfolio’s line chart zig and zag with each political headline. Understanding these moves means knowing the often overlooked link between global events and market trends. Today, I’ll guide you through the direct ties between international dramas and your investment outcomes. From the ripples of military showdowns to the hard swerves of political showdowns, prepare to uncover how even a whisper of geopolitical change can send shockwaves through your financial strategy. Strap in as we decode the art of smart investing in a world where the next move on the geopolitical chessboard could be the pivotal moment for your stock’s performance.

Understanding Geopolitics and Market Performance

Linking International Relations and Market Dynamics

When countries get along, markets often soar. But when tensions run high, stocks can plunge. Say two countries start to argue over trade. One may slap extra costs on the other’s goods. This is bad for business in both places. Companies sell less, and their stocks might drop. Smart investors watch these relations closely.

The Ripple Effect of Military Conflicts on Stock Valifications

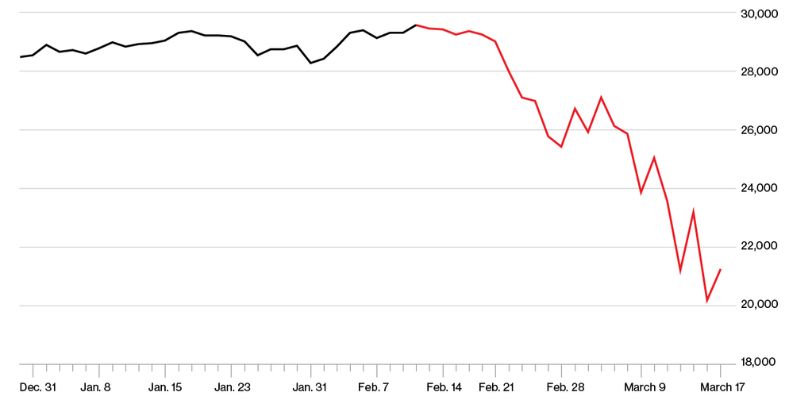

Now, think about war. War scares people, and it costs a lot. Stocks usually fall when there’s talk of war, and more so if war breaks out. Why? War means uncertainty, and stock markets hate that. Businesses may lose money, or even stop working in areas hit by war. And this can pull down their stock prices. Investors often get nervous and may pull out their money, seeking safer places for it. This can make the fall in stock prices even bigger.

Remember, war can also make goods cost more, especially oil. When oil prices soar, it hits markets everywhere. Airline and shipping companies face higher fuel costs. This can slice into their profits and drag down their stock prices.

Smart investors always keep an eye on such events. They know that where there’s risk, there’s also a chance for reward. They look for safe bets during tough times but also for opportunities that may pop up. For example, defense companies might perform well in wartime. But spots like this are rare. Most feel the strain of war’s impact on the economy.

Knowing how these risks play out is key for your investment choices. Stay sharp, stay informed, and you might just steer through these rough waters.

Tracking the Financial Fallout from Political Events

Economic Sanctions and Equity Reactions

When a country gets hit with sanctions, it’s big news for stocks. These penalties can block trade. They often stop resources from moving across borders. That hits companies hard, especially those in energy, finance, and tech. Look at Russia, for instance. After sanctions hit them, global markets felt the shock. Stocks dipped in many nations.

Sanctions can make you rethink where to put your money. You might look for safer bets. Or, you could hunt for deals if prices drop. It’s a tricky game. You need to watch the news and know which areas will feel the pinch.

One major thing to note is that sanctions can last a long time. They have long tales of impact. This means a long wait before some stocks bounce back. It also makes some investors shy away. They fear sudden losses from new penalties.

How Trade Agreements Reshape Investment Strategies

Trade agreements shake up the market like few other things can. They change the rules. Countries shaking hands on a new deal can spark life into stocks. Let’s say two nations agree to cut down trade barriers. That’s usually good for business.

Businesses can make and sell more. They can reach new customers. This often gives a boost to stock prices. But, it cuts both ways. If talks fail, or deals go south, stocks can tank. This is where having a sharp eye helps.

Knowing the fine print in these deals is key. Same goes for knowing who wins and who takes a hit. This helps you choose your stocks smartly. You zoom in on the winners. You dodge the losers.

Trade deals can open doors for investors. Sectors like farming and tech can surge. On the flip side, other sectors might get a cold shoulder. You’ve got to keep tabs on who’s talking trade and what’s on the table.

What’s the takeaway? Political plays change the game for stocks. Sanctions can hurt, but trade deals can heal or help soar. Your move is to stay woke on what’s happening in the world. This way, you make the market work for you, not against you.

Navigating Market Turbulence Amidst Political Developments

The Influence of Regional Conflicts and Foreign Policy on Trading

When a region flares up with conflict, stock markets feel it. It’s like when someone yells “fire” in a crowded room. People panic. Stocks do the same. Take when two countries fight. Often, global stocks drop fast. For traders, it’s key to watch these events.

Why do stocks drop when there’s war? War can close trade routes, raise costs, and scare investors. It can even hit resources hard. This makes the road tough for companies that rely on those areas. It’s like when the road to your favorite store gets blocked. It’s harder to get what you need. And it’s not just war. If a country changes its foreign policy, stocks react. Let’s say a country decides to be less friendly with others. That can cause trouble in trade. Stocks often fall because investors get worried.

For example, when the US or Europe put sanctions on a nation, it can shake things up. Companies in that nation might find it hard to sell goods, and stocks can fall. If those countries are big players in things like oil, the effects spread worldwide. You use oil in many ways, like in cars or making plastic. So a change in oil prices can make waves in global markets.

When countries agree to trade differently, stocks move too. It could be good or bad. A new trade deal can open doors and lift stocks. But if trade gets tight, stocks may drop. This happens because companies could have a harder time selling goods.

Political Risk Assessment: A Tool for Investor Foresight

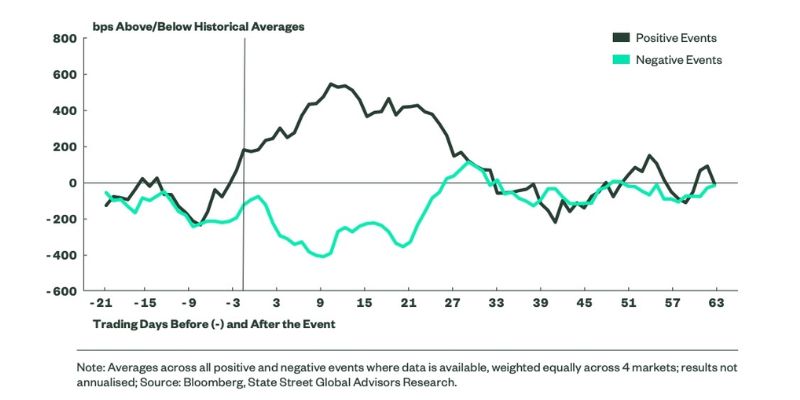

Smart investors use something called political risk assessment. Think of it as a weather report for stocks. It tells you what might go wrong in the world. And how that might hurt your stocks. Will there be a storm, or is it smooth sailing? That’s what this tool helps figure out.

This assessment looks at stuff like elections, or if leaders are fighting. It checks how stable a country is. This stuff can really move markets. A new leader might change old rules and shake things up. If investors think a leader might be trouble for business, they may sell stocks. That can make prices fall fast.

But how can you do this? First, you’d look at the news. See what leaders are up to. Check if countries are getting along. This helps you guess what might happen next. You could also use reports from experts. They spend their time figuring out these risks.

So, if you hear about a vote in another country, or a new law, think about your stocks. What might change? If a country is mad at another, or if there’s a big vote coming up, stocks could take a hit. Keep an eye on these things. It might just help your investments stay on track.

Always remember, the world is linked. What happens far away can touch your wallet. So stay sharp, watch the news, and think ahead. That’s how you ride the waves in a stormy stock market.

Strategic Investment in a World of Geopolitical Uncertainty

Recognizing Opportunities Amidst Global Tensions and Financial Markets

Do world events get your attention? They should, especially when you’ve got money in stocks. Global fuss, like fights between countries, can do a big dance on market prices. Be smart. Keep an eye on the news.

When countries face off, wise folks look for chances to buy or sell stocks. Sometimes, stocks dip low or shoot high. It all depends on our big globe’s mood. Get this. Market shifts don’t always mean a loss. They might mean a chance to win big.

What can you do? For starters, don’t panic. Sure, things look rough when leaders argue or armies move. But remember, every challenge could lead to an open door. Hunt for stocks that stand strong or might bounce back when peace comes back.

You’ve got to see the whole chessboard. If one place gets hit, another might gain. Say country X can’t sell oil anymore because it’s in a big mess. Country Y’s oil companies might then see more cash rolling in. You catch the drift?

Adapting Market Strategies to Geopolitical Shifts and Outcomes

Here’s the deal. No one likes surprises that hit their wallet. But in our big world of trade and deals, they happen. How you play the game can shift your cash.

Think about how deals between nations can play nice with your bank account. If two countries make friends and trade more, their stocks might give you a high-five. On the flip side, if they cut ties, your stocks might need a hug.

Don’t just sit and watch. Adapt. Make your moves with a cool head. Study how past brawls or deals changed the game. Gear up for how new scoops could twist your stocks.

Know where you stand. When you hear “election” or “sanction,” think hard about your next move. New leaders might like new rules. That shakes things up. Even smart whispers about policy changes can tie knots in stock prices.

It’s like tracking weather before a trip. Just like you’d swap shorts for a coat if a storm’s coming, shift your stocks if you sniff out a big change in the wind. Get a feel for the way wind blows in different parts of our world.

Remember, everything you need to know is out there. Read. Listen. Watch. Yes, our world’s a puzzle. But you can solve it. Stocks move to the beat of our globe’s drum. Learn to dance to it, and you might just skip ahead.

By watching the world stage, you can move to the market’s rhythm. Stay in tune with the global groove, and keep your investments on beat. The world’s moves are your clues. Don’t miss out! Keep your eyes wide open, and watch your stocks dance to the tune of global chess.

In this post, we’ve seen how big events around the world can shake up markets. We looked at how fights between countries can make stock prices jump or fall. We also saw that when countries don’t get along, and sanctions hit, it can change the game for investors. Good trade deals can lead to smart investment moves too.

But the ride doesn’t stop there. When politics get rough, markets feel it. Smart investors keep an eye on these fights to stay ahead. They use tools to guess risks and make better choices. And in this tricky game of global tensions, there are chances to win big.

So here’s the final scoop: world news is big news for your wallet. Know what’s going on out there, plan well, and you could do well, even when times are tough. Be smart, stay alert, and you can ride the wave instead of getting wiped out. Let’s use what we know to make wise moves in this wild world of money and power.

Q&A :

How does geopolitics influence global stock markets?

Geopolitical events can have significant impacts on global stock markets as they influence investor confidence and risk perceptions. Uncertainty around political stability, international relations, and government policies can lead to volatility as investors react to the potential economic implications of these events. This can include factors such as trade policy changes, sanctions, military conflicts, and elections, affecting everything from currency values to commodity prices, and ultimately, stock markets worldwide.

What are some recent geopolitical events that have moved the stock markets?

Several recent geopolitical events that have had notable effects on stock markets include trade disputes between major economies, tensions in the Middle East, Brexit negotiations, and the economic implications of the global COVID-19 pandemic. These events introduce elements of uncertainty and risk which can prompt market fluctuations as investors assess the potential for disruption to global supply chains, economic growth, and corporate profits.

Can geopolitical risks be predicted and their impact on stock markets mitigated?

While it is challenging to predict the precise timing and outcome of geopolitical events, many investors and analysts monitor political developments and use various risk assessment tools to gauge the potential impact on markets. To mitigate risks, investors might diversify their portfolios, invest in safer assets like bonds, or use financial instruments such as options and futures to hedge against potential market downturns.

How should investors respond to geopolitical uncertainty?

Investors typically adopt a range of strategies in response to geopolitical uncertainty, from adopting a ‘wait and see’ approach to taking more active steps such as rebalancing portfolios towards less risky assets. Some investors view periods of heightened geopolitical risk as opportunities for buying undervalued stocks. However, the appropriate response can vary greatly depending on an individual’s investment time horizon, risk tolerance, and goals.

Do all stock markets react the same way to geopolitical events?

Not necessarily. Different stock markets may react differently to the same geopolitical event depending on various factors such as the market’s proximity to the event, the level of exposure to affected industries, and the overall economic resilience of the country. Emerging markets, for example, may experience more pronounced reactions to certain geopolitical risks compared to more established markets due to perceived higher vulnerability and less mature economic systems.