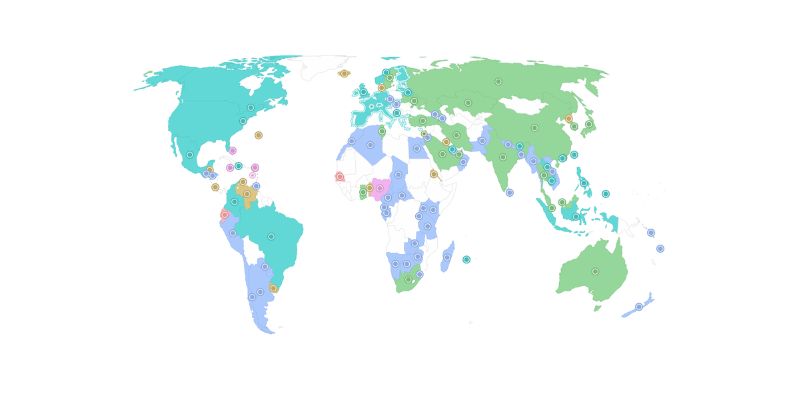

Countries launching CBDC are reshaping the global monetary map. As an expert in digital economy shifts, I’ve seen firsthand the wave of change as nations big and small power up their own versions of digital money. Imagine a world where money moves at lightning speed without the heavy fees. That’s the world CBDCs promise. China leaps ahead with its Digital Yuan, while the European Central Bank crafts a Digital Euro blueprint—each racing to set a new standard. This isn’t just tech talk; it’s a financial revolution that could change your wallet’s future. Let’s dig in and uncover how these currencies aim to transform the way we think about money itself.

The Vanguard of CBDC Development: Countries Leading the Charge

China’s Foray with the Digital Yuan

China is making big moves in the world of money. The nation is rolling out its own version of a digital currency, named the Digital Yuan. This isn’t just a digital version of the cash you have in your pocket. It’s built on complicated tech called blockchain. This makes money move fast and safe.

Let me simplify this: Imagine you want to buy a toy online. Right now, you might use paper money or a card. With the Digital Yuan, you could pay straight from your phone, quick and easy, no waiting. China has tested this new money in big cities with lots of folks using it. They’re one of the first countries to do this on a large scale.

Now, when I say blockchain, you might think of Bitcoin. But this is different. The Chinese government runs the Digital Yuan, not some unknown group. This means they have more control over how it’s used. For a country as big as China, that’s a major plus. They can now track where money goes more closely and make smart choices about their economy.

European Central Bank’s Exploration of a Digital Euro

Across the globe, Europe isn’t sitting still. The European Central Bank, or ECB for short, is busy looking into a digital form of the Euro. This digital Euro would be like the coins and notes we use now, but you can’t touch it. It’d live in your phone or a special digital wallet.

This idea is still in the works, and they’re thinking hard about how it might change things. They want to get it just right. I bet you’re curious why they would go through all this trouble. Well, it’s because times are changing. More of us are shopping online and sending money through the web. The ECB wants to stay up-to-date and make sure everyone can join in, even if they don’t have a regular bank account.

Just like with the Digital Yuan, a digital Euro would make paying for stuff simpler and snappier. Plus, it’d be super secure because of the blockchain stuff I mentioned earlier. That’s important for people and businesses alike. The ECB is also thinking about how this digital money should fit in with laws and keep your details private.

When you look at these two big projects – in China and Europe – it’s clear that the way we think about money is changing fast. It’s not just about cash or cards anymore. These digital forms called CBDCs might be the future, and these countries are trying to get there first. They want to shape how we all buy, sell, and save in the years ahead.

Advancing Monetary Policy: How CBDCs Reshape Finance

Monetary Policy Implications of National Digital Currencies

Imagine money that moves at the speed of text messages. That’s what CBDCs can do. CBDCs stand for central bank digital currencies. These are the digital form of a country’s money. They’re like the cash in your wallet but in a digital form. They’re not like Bitcoin; they are safer because they have the backing of the country’s central bank.

Now, let’s talk about how they can change money rules, or as fancy folks say, monetary policy. CBDCs can help banks do their job better. They can control the flow of money more easily. When people spend more, the economy gets a boost. When they don’t, CBDCs can help to put the brakes on.

It’s like having a super-precise thermostat for the economy. You can turn it up or down just right. With CBDCs, central banks can track money movements in real time. They can see what’s going on much faster than before. This means they can make smarter decisions to keep the economy stable.

Enhancing Financial Inclusion through Digital Currency Initiatives

Now, onto another cool thing about CBDCs – they can help include everyone in the bank system. You see, some people find it hard to get bank accounts. It could be because they live too far from a bank or don’t have enough money.

CBDCs can change this. How? Well, because they’re digital, you can access them from a phone or computer. No need to travel far or have loads of money to start. They make it easy for more people to join in the money system.

This means even those who were left out before can now save money safely, pay for things easily, and not worry as much about theft or loss. Countries are noticing this. They’re starting projects to pilot these digital currencies – exploring and testing to get it just right.

From the Bahamas to Sweden and China, they’re all trying out CBDCs. Each country is learning and shaping the best way to bring in this new kind of money. The goal is the same: make money and banking better for everyone.

Countries around the world are reshaping finance as we know it. They’re making it more inclusive and stable – all thanks to the power of digital. This is only the beginning, and the future of money looks bright! And that’s what the buzz about CBDCs is all about. They’re not just a new tech toy; they’re a tool for better money for everyone. Keep an eye on this space – it’s going to be exciting to see how it unfolds!

The CBDC Ecosystem: Legal and Technological Frameworks

Establishing Legal Frameworks for CBDC Operation

When countries develop their CBDCs, they first need to create laws for them. These laws help make sure that when you use CBDCs, it’s safe and follows rules. They look at things like how to stop crime, keep your money safe, and make sure your privacy is protected when you use CBDCs. You could say these laws are like a guide for how to use new digital money in everyday life.

For a CBDC to work well, it needs strong laws behind it. These laws should fit with how we use money now. Countries often change their laws as they learn from global CBDC pilot projects. For example, when a country is trying out a new digital currency like the Bahamas Sand Dollar, they watch how it works. They then adjust the rules to make it better. It’s a bit like finding the best way to play a new game.

Integrating Blockchain Technology in Central Bank Digital Currencies

Now, let’s chat about how central banks make CBDCs using blockchain. This is the same technology behind cryptocurrencies like Bitcoin, but CBDCs use it differently. Central banks build their own kind of private blockchain. This lets them take advantage of blockchain’s security to protect your money.

Blockchain central banking also helps countries control their CBDCs. It helps make sure that the digital money is safe from fraud and people can’t make fake copies. It’s like giving each digital dollar a secret code that shows it’s real.

For the blockchain to work well with CBDCs, central banks often team up with fintech companies. These tech whizzes work with the banks to add new features to make CBDCs easy and fun to use. They focus on retail cbdc projects for you to use when shopping, as well as wholesale CBDC implementation for big business deals.

Integrating blockchain tech means the digital money needs to be able to talk to other banks’ systems. CBDCs from different countries need to understand each other. This is called interoperability, and it’s super important for doing things like sending money to friends in other countries without delay.

Using blockchain helps central banks invent the future of money. It’s like designing a new type of car that is really cool and doesn’t harm the planet. It lets us move money faster, cheaper, and in safer ways. It’s also key in helping everyone get access to money services — we call this financial inclusion digital currency.

In short, the laws for using CBDCs make sure everything is fair and safe. Blockchain helps keep your digital money secure and lets you do neat things with it. Together, they’re like the rules and tools that build a brand new game — a game where everyone can win.

The Challenges and Opportunities of CBDC Interoperability

Navigating Cross-Border Transactions with CBDCs

Cross-border payments can be slow and pricey. CBDCs can change that. They let folks send money fast and for less. But countries use different CBDC systems. Getting them to work together is hard. This means we need that systems talk to each other smoothly. How do we do this? Let me tell you.

For starters, we make sure each country’s digital currency can “speak” the same tech language. Think of it like friends who talk to each other. They need to understand one another to have fun. Just like this, CBDCs must share info well to work.

Countries are testing out CBDCs now. Like Sweden with its e-krona and the Bahamas with the Sand Dollar. Countries learn from these tests. They see how to make their digital money good for folks at home and abroad.

Some groups help with this. The Bank for International Settlements works on it. They check how CBDCs across borders can be a win for everyone. This matters because it helps money move around our big world better.

Privacy and Transparency in Emerging CBDC Systems

Folks worry about their secrets when we talk about digital money. Nobody wants someone peeking at what they buy or where they spend money. CBDCs have to keep our secrets but also follow the rules.

Think of it as a game. We all play but also stick to the rules to make it fair. CBDCs must do that too. They keep your secrets but still play fair with the law.

Blockchain helps here. Think of it like a magic book that keeps all secrets safe. But it also shows enough so we know nobody’s cheating. It’s a tricky balance. But if we get it right, we all win.

We’re still figuring it out. Changing from regular money to digital money isn’t simple. It’s like learning a new game. But with good minds working together, we can make sure CBDCs are safe and fun for everyone.

As we move forward, remember this. We want CBDCs to help us pay for things quick and easy. We want them to be buddies with other countries’ moneys. And we want our secrets kept safe. This is the big plan for digital money around the world. It’s exciting to think about how it all will shape the future of money.

In this post, we dived into the exciting world of Central Bank Digital Currencies (CBDCs). From China rolling out its digital yuan to the European Central Bank testing the waters for a digital euro, CBDCs are no longer just a concept—they are becoming a reality. These digital forms of money could change how we think about cash and policy.

We explored how CBDCs could shift monetary policy and offer new ways for people to take part in the economy. Laws are being written to make sure CBDCs work smoothly and tech like blockchain is key to their success.

Lastly, we tackled the big task of making different CBDCs work together. Issues of privacy and being open come into play as these digital currencies touch borders.

After diving deep into CBDCs, I see them as a tool that can truly reshape our financial world. The ride ahead is full of both chances and hurdles, but the potential payoffs for our wallets and society can’t be ignored. Let’s keep a keen eye on how CBDCs evolve. Our money may never be the same.

Q&A :

Certainly! Below, you’ll find a uniquely crafted list of FAQs based on the keyword “Countries launching CBDC” (Central Bank Digital Currency), presented in a manner that’s tailored for SEO optimization:

Which countries are leading the CBDC race?

Several nations are at the forefront of the Central Bank Digital Currency (CBDC) development, with pilot programs or advanced research stages. China’s digital yuan, the eCNY, is one of the most prominent CBDC projects, having undergone extensive trials and public tests. The Bahamas has launched the Sand Dollar, making it one of the first countries to officially deploy a CBDC. Additionally, countries like Sweden are exploring e-Krona, and the European Central Bank is investigating a digital euro.

How will CBDCs change the future of global finance?

CBDCs are poised to revolutionize global finance by offering improved transaction speed, reduced costs, enhanced security, and greater financial inclusion. They will also enable direct policy implementation by central banks, possibly leading to more effective monetary systems. Furthermore, as digital currencies become more prevalent, they could challenge the current dominance of traditional financial institutions and pave the way for a new era of international trade and cross-border payments.

What are the biggest challenges facing countries launching CBDCs?

Countries looking to launch CBDCs face a series of challenges, including technological hurdles, cybersecurity risks, and the need for comprehensive regulatory frameworks. Ensuring the interoperability between CBDC systems and existing financial infrastructure is complex. Protecting against potential threats to digital currency security is critical to maintaining user trust. Additionally, governments must address concerns over privacy, as well as the impact on traditional banking and the broader economy.

Are all countries in favor of launching their own CBDC?

Not all countries are in favor of launching their own CBDCs. While many are exploring the concept, others remain skeptical due to the complexities involved, including technical implementation, economic impact, and regulatory challenges. Some countries are concerned about the potential for CBDCs to disrupt the existing financial system and to centralize financial data, raising privacy and surveillance concerns.

What is the potential environmental impact of CBDCs?

The environmental impact of CBDCs largely depends on the technology used for their implementation. Unlike cryptocurrencies such as Bitcoin, which require intensive computational power and energy for mining, CBDCs are typically designed to be more energy-efficient, relying on centralized ledgers managed by central banks. However, it’s essential for central banks to prioritize sustainability in their digital infrastructure, which could involve leveraging green energy sources and optimizing transaction-processing efficiency to minimize the carbon footprint of digital currencies.