Financial Impact of War and Sanctions: it’s a loaded phrase, isn’t it? Imagine a pebble tossed into a pond. The ripples spread, reaching far beyond the initial splash. That’s how armed conflict and punitive measures send shockwaves through economies the world over. You may think the effects don’t touch you, but the truth is they reach markets, alter trade, and shift budgets everywhere. I’m here to guide you through this tangled web. Let’s dive into how these events shake the very foundations of global financial stability, and what it means for your pocket. Buckle up as we assess the economic aftershocks of battlefields and the silent wars waged with sanctions.

Assessing the Economic Shockwaves of Armed Conflict

Grasping the Economic Consequences of Armed Conflict

Wars hit economies hard, like giant waves crash on a peaceful beach. Think about your own budget, but for a whole country. During war, the money a country has must go to its military. This means less money for schools, roads, and hospitals. People often lose their jobs, and things we all need can cost a lot more.

These economic consequences of armed conflict are everywhere. They affect how much bread and milk cost at your store. Banks get scared to lend money. So businesses can’t grow, and it’s harder for folks to buy homes. It’s like when your piggy bank is empty, but on a huge scale.

Deciphering Global Market Disruption Due to Conflict

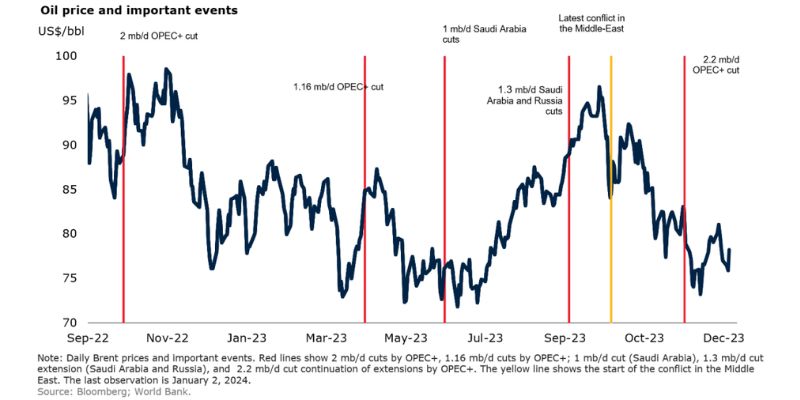

Now imagine a spider web. It’s like the global markets, all connected. If one string shakes – say, due to a war far away – the whole web dances. This means the price you pay for gas can go way up. It happens because oil prices are super sensitive to fights far away from home.

Goods struggle to travel around the world when wars mess with supply chains — it’s like a traffic jam but with ships and planes. These wars can make the things you want to buy less common and more pricey. It’s tough on everyone.

Countries often use sanctions to try and stop wars. Think of it like saying “no TV” when someone breaks the rules. Sanction effects on international trade can make it hard for countries to buy or sell what they need. This can mean folks might not get the medicine or food they need, which is really sad.

People may have to leave their homes, looking for safety. This refugee crisis economic burden is huge — it’s like when a friend crashes at your place, but instead of one friend, it’s millions, and they need everything: a place to sleep, food, and help to get by.

Let’s not forget about money value. In war, a country’s money can buy less than before, which is called currency devaluation in wartime. Imagine if the money in your wallet could only buy half a candy bar instead of a whole one.

Dealing with these effects takes smarts. Countries have to do things differently when sanctions hit them. They might start trading more with friends who are still trading with them. Or they might focus on making stuff at home instead of buying from others. These are called wartime emergency fiscal policies, like a family cutting back on spending when money is tight.

These are the kinds of things I look at every day. My job is to unwrap these complicated money puzzles and see how deep the ripples go. I dig into numbers to help figure out the best steps forward. It’s like being a detective, but for money and people’s lives.

War and sanctions — they’re not just about tanks and rules. They change everyday life in big and small ways. They make us think hard about how we live, what we buy, and who we can count on when things go sideways. They remind us that peace is priceless, and working together is the best way to keep our world web strong.

Scrutinizing the Reach of Sanctions and Trade Embargoes

Understanding Sanction Effects on International Trade

Sanctions can stop countries from doing business with each other. This sounds simple but it has huge effects. For example, imagine a country cannot sell its stuff. This means less money and jobs for people. Other countries may also feel this pinch. Shops may not have what you want, or it could cost more. Now, what about a country that can’t buy what it needs? Things people use every day might run low. Here’s something else: when countries can’t trade, they can’t make friends as easily. So, sanctions can change how countries get along.

Now, let’s dig deeper. When a country faces sanctions, it can’t use its money freely around the world. Money gets stuck. This can push the country’s currency down, making everything more costly to buy from outside. Sanctions shake up stock markets, too. People who invest get nervous and stocks can tumble. The effects ripple through the world. Other countries have to adjust what they sell and where they buy from.

Exploring Import-Export Restrictions and Sanctions

Trade barriers go up when there’s conflict. Countries may stop selling important goods like oil or wheat to each other. They do this to try and force change. But this can also backfire. Prices for everything can soar, hurting everyone’s wallet. Farmers and makers of things can’t sell as much. This means less money for them to grow and make more. Workers may lose jobs. Families feel this hard.

During war, countries spend a lot on their military. They need to protect people but this costs a lot. Money that could build schools or roads goes to tanks and soldiers instead. This can leave a country with big debts after the war.

But there’s more. Countries not in the fight feel this too. If one country is a big buyer and stops buying, sellers lose out. If that seller used to send a lot of stuff, the loss is big. Countries sending help to fix things after a fight spend loads too.

Now, think about folks who have to leave their homes because of war. They need food, houses, and care. This costs the ones helping them. Also, where they go may not have enough jobs or houses. This can make things tough for everyone. And what about their old homes? Farms and towns may turn to ruins, and bringing them back takes lots of work and money.

You might wonder, do all these efforts make a difference? Sometimes they can help stop fights or make things a bit better. But it’s not just the countries fighting that take a hit. It’s a big web and when you tug on one part, the whole thing moves. That’s why we watch these sanctions and trade issues. We need to find ways to make things better without causing more problems.

In conflicts, going about our daily business gets tough. When you can’t trade, it’s like a giant roadblock for goods, cash, and making friends. As an expert, I keep an eye on this, knowing that the things we buy, sell, or need can be caught in the middle. Finding the balance is key – it’s about being strong without breaking down bonds we all rely on.

The Costs of Militarization: Budgets, Inflation, and Investments

Military Expenditure and National Budget Adjustments

War costs a ton. Nations spend big on their armies. This cash could help schools and roads. Yet, it goes to tanks and planes. Each bullet bought means less for hospitals. In war, countries must change their national budgets. They take money from helpful places. They put it in their military. This shift hurts.

When there’s war, leaders say, “We need more soldiers. We need better guns.” So, they spend more on these things. Schools and other key parts can get less money. It’s hard for folks at home. Kids might not get books they need. Roads might break down. All because of the cost of fighting.

Military budgets are huge. They have to pay for many things. It includes soldiers’ pay and new weapons. It also covers tanks and jets. Sometimes, the cost can be really high. That’s true when a war lasts a long time.

Defense firms make more money when there’s a war. They make the guns and jets. Their business grows big in these times. People working there might get more jobs. But this also means that weapons spread more around the world.

War-Induced Inflation Rates and Foreign Direct Investment Trends

With war, prices often go up. This is called inflation. Things like bread and milk cost more. People can’t buy as much with their money. Why’s that? War can mess up how things get from place to place. This makes stuff harder to find. So, prices rise.

Let’s talk about how wars change investment from overseas. This is known as foreign direct investment (FDI). When fighting starts, folks with money get nervous. They might not want to build a factory in a place where there’s war. They fear the risks are too big. It causes FDI to go down in these areas.

Inflation from war hits hard. Say a farmer can’t get seeds because trucks can’t get past fighting. The farmer can’t grow food. We then have less food in stores. What food there is then costs more.

For money from outside to come in, there needs to be peace. People want to feel sure they won’t lose their money. War makes this hard to guess. So, money might flow to safer places.

At times, war can even make a country’s money worth less. This is bad for everyone. People outside the country might stop buying things. That’s because it costs them more. So, the country with war sells less. This makes them even poorer.

In summary, war changes a lot about money and business. It costs a lot to fight. Prices go up, and outside money might stay away. This can make life hard for people in the country. It takes a lot of work to fix this after the war is over.

From Destruction to Development: The Post-War Economic Landscape

Rebuilding Post-War Economies and Humanitarian Aid Financing

When wars end, the hard work of rebuilding begins. Cities and lives are in ruins. Help from others is key to start over. But how much does it cost to fix a country after war? It costs billions, sometimes trillions, of dollars. The cash aims at mending homes, roads, and schools. Giving health care, food, and jobs is also part of the deal.

Money for rebuilding comes from many places. Countries that are friends will often help. They give money, things, and folks to aid. Big groups like the UN pitch in too. They collect cash from many countries. Then they send it where it’s most needed.

A big worry is making sure the money is well spent. It must help people and make peace strong. Some say this aid could make a country lazy. They fear it won’t find its own cash to grow. But without aid, a hurt country would suffer more. It could find peace harder to keep.

Shops need to re-open. Farms need to grow food again. Kids need to get back to class. All this needs money from beyond a country’s borders. Without it, a country may fall apart again, fast.

Strategies for Economic Resilience and Recovery

After war, a country needs to think ahead. It can’t just fix what’s broken. It must grow strong against new troubles. This is being resilient. It means a country doesn’t fail when life gets tough. It can face big shocks and not break down.

So, what does a country do to become resilient? It looks at what went wrong. Then it plans to make those things right. Learning from past war helps a lot. If farms were ruined, it finds ways to farm better. If shops were shut, it makes it easier to open them again.

It also saves money for tough times. This is like keeping spare money in a piggy bank. It’s smart. If hard days come, there’s cash to help fast. Having strong friends also counts. They can lend a hand when you’re in a bind.

And what about folks who had to leave their homes? They need help to settle down again. They must find jobs and schools. This helps the whole country. It starts to mend and get strong again.

Money matters, of course. But it’s not just about that. It’s about teaching people new skills. Giving them hope. Keeping them safe. These things let a country heal after war. They let it build a bright future that will last.

To wrap it up, fixing the damage from war takes time and effort. It means helping right away. But it also means thinking big and far ahead. Countries need to be smart to rise from the ruins. They need to be ready for what comes next. That’s how they keep growing and don’t look back.

In this post, we’ve explored the heavy toll armed conflict takes on economies. We studied how wars shake up global markets and push countries to change their trade through sanctions and embargoes. We saw the huge costs of boosting military budgets and how these funds could instead support growth. When wars end, rebuilding starts, but it’s a hard road to economic strength and stability.

I believe it’s crucial to understand these impacts not just on paper, but in real lives. Countries must think hard before entering conflicts. We all feel these costs. As we’ve seen, wars can tear down what takes years to build. Finding ways to avoid conflict and promote peace is not just wise; it’s key to global prosperity. Let’s push for solutions that keep peace and build strong economies for all.

Q&A :

How do wars and economic sanctions affect global financial markets?

Wars and economic sanctions can lead to significant volatility in global financial markets. The prospect of military conflicts often results in uncertainty, leading to fluctuations in stock prices, commodity markets, especially in oil and precious metals, and currencies. Economic sanctions can disrupt trade flows and supply chains, impacting businesses and economies directly involved and those connected internationally. Investors may seek safer assets, such as gold or government bonds, leading to shifts in investment and capital flows.

What are the long-term economic consequences of war on a country’s economy?

The long-term economic consequences of war on a country’s economy can be dire. Infrastructure destruction, loss of human capital, and a disruption of economic activities are common. The increased government spending on military efforts often leads to higher levels of public debt, potentially triggering inflation. Post-war, countries typically require significant reconstruction efforts and foreign aid to rebuild, which can take many years and substantial financial resources. Moreover, the war can damage a country’s reputation and make it less attractive to investors, prolonging economic recovery.

How do international sanctions impact a country’s financial health?

International sanctions can severely impact a country’s financial health by isolating it from the global economy. Sanctions can limit a country’s ability to export goods, restrict access to international banking systems, and reduce foreign investments. These restrictions can lead to shortages of goods, increased unemployment, inflation, currency devaluation, and a decrease in overall economic productivity. The severity of the impact often depends on the country’s economic resilience and the nature of the sanctions imposed.

Can the imposition of sanctions lead to economic instability in regions beyond the targeted country?

Yes, the imposition of sanctions can lead to economic instability in regions beyond the targeted country. Sanctions can disrupt regional trade and cause supply chain issues, affecting neighboring countries and trade partners. This can lead to a decrease in regional economic growth rates, increases in the cost of goods, and broader economic uncertainty. Additionally, there may be a ripple effect in financial markets as investors reassess risks associated with the region.

What strategies can governments employ to mitigate the financial impact of war and sanctions?

Governments can employ various strategies to mitigate the financial impact of war and sanctions. One critical strategy includes diversifying the economy to reduce reliance on affected sectors or markets. Seeking new trade partnerships and alliances, as well as investing in domestic industries, can help bolster economic resilience. Another strategy is to build up foreign exchange reserves and strengthen social safety nets to support citizens during times of economic hardship. Lastly, diplomatic efforts to resolve conflicts and negotiate the lifting of sanctions can be instrumental in stabilizing the economy.