Monetary policy impact: it’s like driving a car but for our whole economy. We don’t see it, but it leads us forward. I’m here to show you how. Imagine holding the wheel. You turn it, the economy veers. That’s what policy makers do with interest rates and money flow. They steer us away from high prices and job losses. And just like driving, these moves can take us to smooth rides or bumpy roads. Keep reading, and I’ll guide you through every turn and twist of how these invisible hands shape your cash, jobs, and future.

Deciphering the Mechanics of Monetary Policy Impact

Understanding the Dual Mandate: Inflation and Employment

Money. It makes the world go round. But who keeps it spinning just right? The central bank does. Their big job? Handle two things: how much stuff costs (that’s inflation) and making sure we have enough jobs (that’s employment). When they tweak things, it can make a big ripple or a huge splash in our backyards.

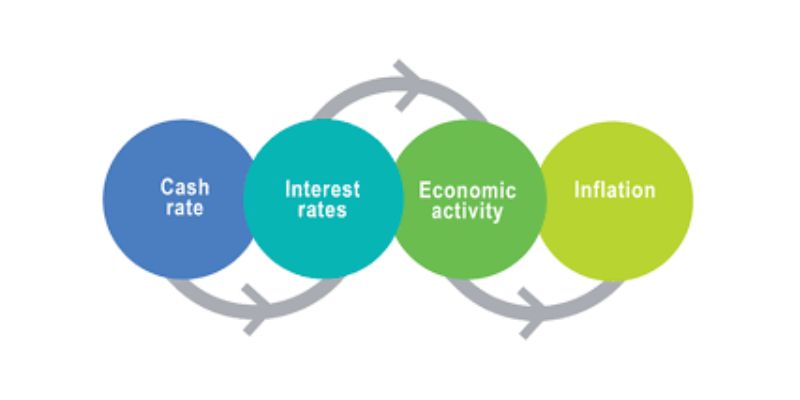

So, how does the central bank stop prices from flying high or dropping too low? They push buttons like changing interest rates or buying government bonds. This way, they can make it easy or tough to get money. When money is easy to get, people spend and businesses hire. Prices may go up. When money’s hard to get, spending slows down, and so do price hikes.

But what if there aren’t enough jobs? The central bank jumps in again, nudging banks to lend more easily. This can help businesses grow and hire people.

Dissecting Interest Rate Changes and Money Supply Control

Now let’s slice into interest rates and the flow of money. Picture a lake. The depth of the water? That’s like our pool of money. The central bank is like a dam. It can open up to let more water out, or keep things tight to hold water in. That’s how they control money out there for us to use.

Why does this matter? Let’s say you want a new bike, and it costs lots. If interest rates are low, it’s like a cheap ticket to borrow money. You might say yes to that bike now. But when rates go up, borrowing gets pricey. You might skip the bike and wait.

These interest rate changes can do a lot. They touch how much stuff costs, whether you’ve got a job, and even if it’s a good time to start a business. And what about all that money out there? The central bank keeps an eye on it. Too much money can make prices jump; not enough, and we might stop buying things. It’s a big balancing act.

The central bank uses smart moves, like open market operations, to make sure money flows just right. They can buy stuff like bonds or bump up the reserve ratio, which is how much banks need to keep in their vaults.

Every move by the central bank sends waves across the ocean of our economy. Tweaks on interest rates and controlling money can make for sunny days or big storms. It’s a tricky thing getting it just perfect, but it’s all to keep us sailing smooth on the sea of money.

Scrutinizing the Outcomes of Central Bank Decisions

Analyzing Quantitative Easing Consequences

Let’s dive into the big moves central banks make. Think of it like a game of chess. Each piece plays a crucial role. Quantitative easing (QE) is like the queen on the board. It can move in mighty ways. QE means the bank buys a lot of stuff, like government bonds, to pump money into the economy.

Why does this matter? Well, it’s like having more gas in the car. It can make the economy zoom faster. But, if there’s too much gas, prices everywhere start to jump. That’s called inflation. No one likes paying more for the same stuff, right? Central banks use QE to help folks find jobs and businesses to grow. Yet, it’s a careful balance. Too much QE can lead to too much inflation, just like too many snacks can lead to a tummy ache.

Tracing the Influence of Fiscal Expansion on Economic Growth

Now let’s chat about fiscal expansion. This is when the government spends more or cuts taxes. Imagine you get more allowance or fewer chores. You’d be pretty happy, wouldn’t you? This can heat up the economy, getting more people to work and businesses to make more things.

But here’s the catch. If the government spends a lot, it might need to borrow money, pushing up interest rates. When rates go up, loans for houses or cars get pricier. Also, saving money becomes more attractive than spending it. That can cool things down a bit, which is sometimes good if the economy is too hot.

Central banks and governments work together like a team. One can’t win the game alone. They push and pull to keep the economy just right – not too hot, not too cold, but just perfect. Like Goldilocks and her porridge. When they get it right, people have jobs, and money keeps its value. It’s a win for everyone.

Evaluating Interest Rate Adjustments and Fiscal Measures

The Interplay Between Interest Rate Hikes and Inflation Targeting

Central banks aim to control inflation and keep prices stable. They change interest rates to do this. Higher rates can slow inflation. Lower rates can boost it. These moves affect our wallets and savings. They impact what we pay on loans and earn on deposits.

How do interest rate changes influence inflation? They alter the cost of borrowing. Higher rates make loans expensive. This cools off spending and slows price rises. Lower rates make borrowing cheap. This sparks more spending. Prices can climb when spending goes up.

Interest rate hikes don’t just battle inflation. They also impact jobs, growth, and exchange rates. Tighter credit can slow down businesses and hiring. People might spend less. The dollar can get stronger, affecting trades with other countries.

Measuring the Effects of Expansionary Versus Contractionary Policies

Expansionary policy is when central banks lower interest rates and reserve requirements. This makes more money available for people to spend. It aims to stir up economic activity and reduce unemployment. Expansionary steps can boost consumer spending and prompt businesses to expand.

What is the goal of contractionary monetary policy? It’s meant to tighten the flow of money. It keeps the economy from overheating. This can mean higher interest rates and reserve requirements for banks. It aims to prevent too-fast growth and high inflation.

If a central bank buys assets as part of an expansionary policy, it boosts the money supply. This can lower interest rates further. It encourages banks to lend more. This can be good short-term. But if done too much, it could lead to too much inflation later on.

Conversely, selling assets in a contractionary policy can reduce the money base. It often leads to higher interest rates. It can cool down an economy that’s too hot. But if overdone, it might cause a recession.

Banks’ lending practices can change due to central bank decisions. Higher reserves needed mean banks might lend less. Lower reserve needs can mean more loans out in the economy. This alters money available for homes, cars, and businesses.

These measures guide where the economy heads. They impact jobs, prices, and overall economy health. Inflation targeting strategies help central banks set clear goals. Central bank actions can push against deflationary pressure or uncontrolled inflation.

Understanding these effects guides future policy. Policymakers look at past actions to plan next steps. Evaluating the impact of their decisions is key. It helps ensure strategies work for economic stability. Reflecting on the outcomes leads to more informed decisions next time around.

Anticipating Economic Waves: Long-Term Prognosis

Projecting Long-Term Currency Valuation Amidst Central Bank Policies

Central banks hold the keys to currency value. Their decisions can make our money worth more or less. Say the central bank hikes interest rates. This often means your money could buy more abroad. Why? Higher rates can lure foreign investors. They seek better returns. This demand can boost the money’s value.

Yet, not just rates shape currency. Open market operations do too. Through these, central banks buy or sell government bonds. This move can swell or shrink the money supply. More money floating around often means each bill in your pocket is worth less. Less money can have the opposite effect.

Central bank policies form a complex dance with currency valuation. They weave together interest changes, bond plays, and money supply tweaks to sway economic tides. We often see this play out in foreign exchange rates. A stronger currency makes imports cheaper but can hurt exporters. A softer currency may do the reverse.

Forecasting Economic Health: Employment Rates, Investment, and Consumer Spending

The health of an economy is like a living, breathing creature. It grows, shrinks, and reacts to various stimuli. Central banks aim to keep this creature fit and running.

Employment rates are one big health check. In simple terms, more people working means more money spent. Central banks often tweak interest rates to encourage hiring. Lower rates can mean cheaper loans for businesses. This can lead to more hiring and more cash in people’s wallets.

Investment and consumer spending are also vital signs of economic health. When central banks make borrowing cheap, companies invest. They build new facilities and buy equipment. People might also spend more. They can take out loans for homes or splurge on goods.

But there is a delicate balance. High spending can spike inflation. Central banks must then act to cool the economy. They might up the rates, which can slow borrowing and spending. Despite their efforts, timing and precision are tough. Their decisions ripple across economies, often with a lag.

Central bank moves shape the economy’s future. Each rate tweak, each policy change plays a part. They try to keep employment steady, investments flowing, and inflation in check.

Keeping a constant eye on the economic horizon, central banks steer us toward calmer waters. It’s a forecast full of predictions and course corrects. We trust central banks to guide us. With careful moves, they aim for a future where money retains its strength, jobs abound, and spending balances with saving. They mold the monetary landscape, crafting the backdrop for your financial tomorrow.

In this blog, we dove deep into the nuts and bolts of how money policy works. We looked at how central banks aim to tame inflation and boost jobs. We picked apart how changes in interest rates and the money pile work. We saw how these moves shape our economy’s flow.

We also eyed up the outcomes from these big bank choices. We checked out how easing up on money can lead to more cash flowing. We looked at how more spending from the government helps grow the economy.

Then, we matched up interest rate hikes with efforts to hit the right inflation rate. We checked the impact of policies that either pump up spending or rein it in.

In the end, we tried to guess the long game for our money’s worth and our economy’s health. We thought about how jobs, cash for people to spend, and folks investing might change.

So, what do I think? Well, smart moves in money policy can lead to solid ground for our wallets and jobs. That’s big. It’s about finding that sweet spot where everything balances just right. Keep an eye on these moves, and we’ll see a future that’s strong and steady. Trust me, it’s worth paying attention to.

Q&A :

How does monetary policy affect the economy?

Monetary policy, instituted by a nation’s central bank, impacts the economy by influencing interest rates and the supply of money available. When a central bank adjusts the interest rates, it affects borrowing costs for consumers and businesses, which in turn can stimulate or cool down economic activity. An increase in money supply typically lowers interest rates and promotes spending and investment, while a decrease in money supply can raise interest rates and reduce spending, influencing overall economic growth, inflation, and unemployment rates.

What are the main objectives of monetary policy?

The main objectives of monetary policy are to maintain price stability, control inflation, and achieve a stable rate of economic growth while aiming to reduce unemployment. Central banks strive to balance these goals. They use tools such as interest rate adjustments, open market operations, and changing reserve requirements to influence the amount of money and credit in the economy.

Can monetary policy influence unemployment rates?

Yes, monetary policy can have a significant influence on unemployment rates. By lowering interest rates and increasing the money supply, a central bank can create a more favorable environment for investment and spending, which can lead to job creation and lower unemployment. Conversely, tightening monetary policy, with higher interest rates and reduced money supply, can slow down the economy and potentially increase unemployment as businesses scale back due to higher borrowing costs and reduced demand.

What are the limitations of monetary policy?

Monetary policy has its limitations, including the time lag between implementation and the noticeable effects on the economy. Additionally, its efficiency can be affected by factors such as the global economic climate, levels of existing interest rates, and the public’s expectations of future economic conditions. Monetary policy is less effective in dealing with supply-side shocks, such as sudden increases in oil prices or natural disasters that monetary tools can’t directly address.

How does quantitative easing fit into monetary policy?

Quantitative easing (QE) is an unconventional monetary policy tool used by central banks to stimulate the economy when standard monetary policy has become ineffective, typically during periods of very low or zero interest rates. Through QE, a central bank purchases long-term securities, such as government bonds, to inject money directly into the economy, with the aim of lowering long-term interest rates, encouraging borrowing, and stimulating economic growth.