Impact Investing Surge: Why It’s Winning Hearts and Wallets

Money talks, and lately, it’s chatting about how much good it can do. As we all try to make the world a bit better, the growing popularity of impact investing is no surprise. It’s the sweet spot where real change meets real earnings. But why? What’s behind its rise? It’s simple: we’re seeing a new wave of savvy investors. They’re not just after profit; they want their cash to count for more. They’re choosing to put their money where their values are, making an impact where it counts. Get ready to dive into the mechanics, the success stories, and the future of investing that’s changing the game.

The Mechanics Behind Impact Investing’s Rise

Understanding the Appeal: Values Meets Value

People want to make money and do good. And they’re finding ways to do both. That’s what’s at the heart of impact investing. It’s about putting funds into projects that help people or the planet while still making a profit. And this idea is catching on fast. More people are seeing how their investments can reflect what they care about.

Decoding the Growth: Market Drivers and Investor Appetite

The big push in impact investing comes from folks who want more than just cash returns. They are looking for their money to have a positive impact on the world. This shift in the tide has its roots in a few things. First, there’s a growing understanding of risk. People see social and environmental issues as real risks to their investments. So, by backing good causes, they can actually protect their money.

Then, there’s the power of information. With the internet, people can learn about global problems and also find ways to help. They can choose what issues matter to them. And, they can find investments that address those issues.

But let’s not forget the market itself. Products like green bonds are now more available. And what are green bonds? They’re like a loan you give to a project that’s good for the environment. They show that ‘green’ projects can be good business too. They’re getting more attractive to people who are worried about things like climate change.

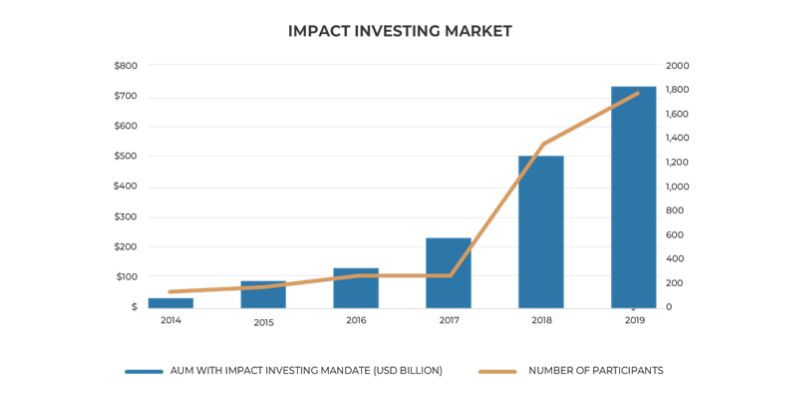

All these parts come together. They make up the mechanics that are pushing impact investing up and up. We see it in the growth of ethical investment strategies and the special funds that focus on good causes. There’s also been an uptick in attaching investments to the UN Sustainable Development Goals. These goals lay out a plan to help the world by 2030. They are leading many investors to put money into social or environmental work.

Investment portfolios are changing. People want to see gains in their wallet and gains for the world. They are looking for the best ways to measure if their investment made a difference. They’re not just looking at numbers, but at the actual change in people’s lives and the health of the planet. This is what we call the social return on investment, or SROI. It’s a way to see if investments in things like renewable energy or clean water are really working out.

When we talk about the appeal of impact investing, it’s clear. People like seeing their cash do good out there. It’s not just about picking the best stock anymore. It’s about picking the best future. So, as more and more people want to make a difference, impact investing keeps growing. More folks are betting on it. They are betting on a world where making money doesn’t have to cost the earth. And this trend? It’s only going up.

Impact Investing and the UN Sustainable Development Goals

Aligning Investments with Global Priorities

People all over the world care about doing good. We want our money to make a change. That’s where impact investing shines. It’s not just about cash. It’s about making life better for everyone. Impact investments look to help end poverty, give good health, and more. They aim to hit targets set by the UN called Sustainable Development Goals, or SDGs for short.

Why do these goals matter? Well, the UN made a list of big problems we need to fix. There are 17, like clean water for all and stopping climate change. By putting money into projects that tackle these, investors help the world out. For example, if you invest in a clean water project, you could help lots of folks. They get fresh water, and you get to feel good about your choice.

Think of buying a bond that helps schools or funding a wind power plant. That’s money doing good work. Investors now love to join in on this. They enjoy seeing their money make a real difference. More and more, people care about where their cash goes. It’s not just about raking in the bucks.

Investing with Purpose: Success Stories

Everywhere, people are swapping stories about winning with kind investing. Take solar energy. Folks are cashing in by helping the planet get more sunlight power. Or look at women’s health. Money put there helps girls and women live better. These are wins all around.

Let’s talk about a company that you’ve probably heard of: Tesla. It’s all about electric cars, right? Many folks see investing in Tesla as a good move. They get green cars rolling, cut down pollution, and give investors something to smile about.

Some folks choose to put money into things that grow but don’t harm the earth. They find farms that don’t use harsh chemicals. By doing this, they help make food safer and protect the land. This kind of farming isn’t just about growing crops. It’s about growing the future.

Not all the stories are big name stuff. Some are about folks like you and me. Regular people who want to make a dent in problems close to home. Community investing is about local businesses or housing that’s fair priced. It’s about small steps that make a large impact.

And let’s not forget, it’s not just a nice thing to do. The returns on impact investments can be just as tasty as regular investing. Yes, it might take time and you must choose wisely. But with the right know-how, it can pay off.

Remember, investing with purpose doesn’t mean you’re just giving away money. It means you’re putting your wealth where your heart is. And, as more people catch on, we’ll see even more good changes in the world. We’ll see more health, more smiles, and a planet that’s happier. That’s something worth investing in, wouldn’t you say?

Assessing the Returns: Financial Gains and Social Dividends

Balancing the Portfolio: Risks and Returns in Impact Investing

When we talk about impact investing, people often ask, “Can I make money and do good?” Yes, you can. Returns on impact investments can compete with traditional investing. Yet, they also tackle social and environmental issues. I’ve seen many investors grow their wealth while driving positive change. For example, renewable energy funding reaps financial returns and benefits the planet.

Impact investment trends show more people are choosing to invest with purpose, and I’m proud to be part of this movement. We see a sustainable investing surge where ethical investment strategies are key. ESG investing growth isn’t just a buzz—it’s a promise for a better future. Investors realize that value comes from values. They want their money to support companies that care about people and the planet.

Green bonds are drawing lots of interest. They offer a clear path to invest in clean projects. Sustainability isn’t limited to just the environment. It includes funding for affordable housing and clean water projects. Also, there’s a growing focus on financial inclusion initiatives. These programs help bring economic opportunities to underserved communities.

Investing in these areas takes courage and foresight. One must understand the risks involved, but the potential rewards are immense—not just in dollars, but in making a difference too. For instance, gender lens investing supports women’s leadership and equal rights. Community investing rise shows faith in local economies. This synergy drives a big part of the impact investing allure for me.

Measuring Success Beyond the Balance Sheet

How do we know if an impact investment is successful? Look beyond the balance sheet. Measure its social dividends. This is where concepts like social return on investment and social impact bonds come in. We calculate SROI to understand the social impact of our dollars. It is challenging but vital. It helps prove that our investments are truly making a difference.

To measure impact investment success, we must track progress toward the UN Sustainable Development Goals. These goals guide us to invest in essentials like education, health, and equality. They make sure we are part of a global effort that seeks sustainable solutions for all.

We also consider other ways to evaluate success. These include environmental impact funds’ achievements or how a startup funded by venture philanthropy is flourishing. Reflecting on the achievements in emerging markets gives us hope. There, impact investments help build infrastructure and improve lives.

Impact investment in emerging markets often reflects a high social impact. At the same time, these markets can be very profitable. Sustainable agriculture investing feeds people and creates jobs. It helps small farmers grow while preserving our planet’s resources.

For me, the true win is in the harmony of profit and purpose. Each day, I am inspired by stories of global change fueled by impact investing. I know the path isn’t always easy, but it’s worth it when we see our investments building a fairer, greener world. Investment strategies now mirror a moral compass pointing towards sustainability and regeneration. This is why impact investing is winning hearts and wallets everywhere. It calls to us to be bold, to care, and to invest in the world we all wish to see.

The Future Frontier of Impact Investing

Innovations and Trends Shaping Tomorrow’s Investments

Impact investing is the future, no doubt. More folks each day decide it’s the way to go. They want their money to work for good and still make a profit. This works because of new ideas and trends in the world of investing. It’s not just about the green stuff in our wallets; it’s also about green living.

Now, ethical investment strategies are key. People look for ways to put cash into what’s right. This means companies who care about the earth and everyone living on it. You see, investors now say a firm “no” to harm and “yes” to help. And this yes means looking for high returns on impact investments that do good.

Sustainable investing isn’t a buzzword; it’s a surge, a wave that’s here to stay. Why? Look around at how climate change is hitting us hard. We see it, we feel it, and so, we act on it. That’s why climate change conscious investing is big. People want in on the action to cool down our world.

The rise in interest for green bonds shows this. When you buy green bonds, you’re betting on a cleaner, brighter future. And it’s not just for us, but for our kids and their kids, too. This bond says, “I care about the air, the water, and the trees.”

Now let’s talk social responsible investing popularity. It’s soaring because folk see it makes a difference. From solar projects to giving a hand to small local businesses, SRI has power. It’s not just talk; it’s real action, and the world sees it.

Money in environmental impact funds is another sign. These funds aim to fix what’s broken in nature. They put cash towards clean water projects, green energy, and more. And guess what? They’ve been beating traditional investing in some ways. They show that doing good and winning can be two sides of the same coin.

What about social impact bonds? They are a way for investors to help with social issues like education or health. By investing, they back projects that aim for big, bold changes. If these projects win, so do the investors.

So, preparing for a responsible investing revolution is wise. It’s about knowing that how you invest can change the world. It’s about seeing the truth: our choices today shape tomorrow. This is a call to do more than make money. It’s a call to make a difference.

With every dollar put in, with every bond bought, we’re writing the future. Clean energy, good health, and strong communities all come from this. It’s a future where money does more than just grow—it blooms. Each investment is a seed for a brighter, fairer world.

Preparing for a Responsible Investing Revolution

Get ready for huge shifts. Investing responsibly is becoming the norm. People want their money to reflect their morals. They’re ready to support causes close to their hearts. And it’s not just for show. Returns are real, and they’re competitive.

From gender lens investing to backing fresh startups, money makes waves. It gives power to those who need it to build something better. We see a community investing rise, with more local projects getting a boost. It’s about lifting everyone up, not just those on top.

Emerging markets are prime spots for impact investment, too. New places mean new chances to do good and do well in profits. By knowing where to look, you can help folks climb up while your wallet gets fuller.

Let’s talk UN Sustainable Development Goals (SDGs). You’ve seen these goals, right? They’re about ending hunger, good health, and more. Impact investment portfolios now aim to hit these targets. It’s about cash that fights for a cause, that builds a world we’re proud to live in.

Corporate social responsibility (CSR) funds are in, too. Businesses are getting it; they need to play fair and clean. When they do, everyone wins. More clients, happier workers, and yes, better returns.

We’re gearing up for a low-carbon economy, and investments lead the way. We want a world that runs without hurting the planet. So, cash flows to where it can make this change happen. Look at wind farms, solar panels—all funded by folks like you.

Venture philanthropy mixes giving with investing. You give a hand and get returns when projects take off. It’s a smart mix for those who want change and growth. And it’s taking off now.

Ready for a revolution? It’s happening, it’s now, and it’s real. Investing’s future isn’t just about the next big tech; it’s about the next big step for us all. Step in, join the move to impact investing. Watch your cash build a future we all want to share.

We dove deep into impact investing and its impressive rise. We saw how values blend with profit and why more folks are getting on board. Markets change and so does what investors want. We learned how this new trend meets those needs.

We also explored how impact investing backs big global goals. Real success stories showed us that doing good can also mean making good money. We looked at both the cash benefits and the social perks. It’s clear that success isn’t just about what’s in the bank.

Finally, we peeked into the future. Innovation fuels this field. A big change in how we invest is on the horizon. Let’s get ready to make money that makes a difference. Impact investing isn’t just a trend – it’s our future. And that future looks bright for both our wallets and our world.

Q&A :

What is impact investing and why is it gaining traction?

Impact investing is an approach to investment that aims to generate positive, measurable social and environmental outcomes alongside a financial return. It is gaining traction due to a growing awareness of global issues, such as climate change and social inequality, and the desire among investors to contribute to solutions for these problems while also earning a return on their investments.

How does impact investing differ from traditional investing?

Unlike traditional investing, which typically focuses solely on financial performance, impact investing considers the potential effects on society and the environment. Impact investors actively seek out opportunities that can create tangible social or environmental benefits, such as renewable energy projects, affordable housing, or healthcare initiatives that are also expected to result in financial gain.

What types of returns can investors expect from impact investing?

Investors in impact investing can expect a range of returns, from market-rate or above, to below-market-rate, depending on the specific investment’s objectives and assets classes involved. While some impact investments aim to be competitive with traditional investments, others may prioritize the impact over the financial return, potentially resulting in lower returns.

How do I start impact investing?

To start impact investing, you can:

- Research and identify your impact goals and themes that resonate with your values.

- Consider your risk tolerance and financial return expectations.

- Explore different impact investment products and platforms.

- Talk to financial advisors who specialize in impact investing.

- Allocate a portion of your portfolio to impact investments and monitor their performance and impact over time.

Who can engage in impact investing?

Impact investing is accessible to a range of investor types, including individual retail investors, institutional investors, foundations, family offices, pension funds, and governments. As the market for impact investing grows, more investment products and vehicles are becoming available that cater to different levels of investment and impact interest.