As an expert in Sustainable Investing Regulations, you’re about to dive into the complex world where finance meets the future of our planet. It’s no secret; money talks. But now, it’s also taking action for a greener tomorrow. Get ready to navigate the twists and turns of rules and standards shaping how we invest sustainably. You need to know what’s on the horizon for your green investments. So stick with me as we explore the ins and outs of a financial frontier that promises to support both your wallet and the world. Let’s get started!

Understanding the Landscape of Sustainable Investing Regulations

Exploring Environmental, Social, and Governance Standards

Let’s talk about what guides a smart, green investment. First, we have these rules called ESG investment criteria. They look at how a company acts on important stuff like caring for nature, treating people right, and running the business well. We check them out to pick investments that are good for both our pockets and the planet.

Say we’re eyeing a company. We ask: Do they help save the earth? Do they treat workers and neighbors well? Are the bosses fair and honest? If it’s a yes across the board, they’re likely a green light for green investing. This way, we help our future while we grow our money.

The Role of Sustainable Finance Regulations in Guiding Investment

Now, money talks. But it can also do a lot of good. That’s where sustainable finance regulations step in. They’re like rules to make sure our investments are solid and kind to the world. These rules push money towards stuff that fixes big problems, like climate change.

We’ve got things like the EU sustainable finance taxonomy. Big word, but it’s simple really. It’s a list that shows if an investment is truly eco-friendly. If a company makes the list, we know our money supports a cleaner world.

Also, investing in a smart future means not putting money in old, harmful stuff. We’re talking about laws that prevent putting cash into things like fossil fuels. This shift helps us all breathe easier and live better.

Now, when companies share what they’re doing about these issues, that’s mandatory ESG reporting. And this matters ’cause we can see which companies are really making a difference. If they’re just talking big but not doing much, we can call them out.

These rules are more than just must-dos. They guide us to make money moves that we can be proud of. We’re talking about a future where both our finances and our grandkids’ world look bright. With these standards, we’re building a cool planet and a hot portfolio.

So, remember these ESG standards and finance rules. They’re not just fine print. They’re the map to a treasure that’s not only gold but also green. They show us how our greenbacks can help the green Earth. Making money count for more – now that’s a solid plan!

Aligning Investment Strategies with ESG Investment Criteria

Integrating ESG Metrics into Investment Analysis

When we invest, we want our money to do good while it grows. To make this happen, we look at ESG—environment, social, and governance—at each step. This stands for how a company treats our planet, people, and how it runs itself.

Why does this matter? Companies that care for these areas tend to do well long-term. They might face fewer risks from laws or changes in how we live. So, by using ESG in our choices, we aim to pick winners for the planet and our wallets.

For example, when a company works on cutting its carbon, this is good for the air we all breathe. It could also mean they are ahead of the game. They might do better when new rules come in to limit pollution.

But how do we know if a company is really doing what it says? We dive into reports and scores that tell us about their ESG work. These scores are like grades that measure how well a company performs in caring for the planet, looking after its people, and how it is led and managed.

Fiduciary Duties and the Incorporation of Socially Responsible Investing Rules

As someone who helps others with their money, I have a big job. I must be careful with their money, as if it were my own. This is known as a fiduciary duty. When I add ESG to investing, it means I look for chances that are not just about cash but also about making a good impact.

What does this look like? Say a friend wants to invest their money in a way that’s good for the world. They don’t want to hurt the earth or people. So I would find funds that back clean energy or help cut waste.

Many places around the world now have rules for this kind of investing. They tell people like me how to include ESG and still meet our duty to clients. By sticking to these rules, we help make sure that investing is not just about profit, but also about building a better world.

Making money and doing good do not have to be in different corners. With rules and guides helping us, we pick the best places for money to grow. We also help our planet and people live better. It’s like guiding a ship with a strong moral compass and a clear map towards a green future.

In all, investing with ESG in mind is not just a passing trend. It is our path to a future where business and values share the same lane. And it’s a trip worth taking for everyone on our planet.

Regulatory Frameworks Impacting Sustainable Investments

Navigating SEC Climate Disclosure Requirements and EU Taxonomy

When we buy stocks, we often look for gains. Now, how the money gets made matters too. It must help our planet. This is the heart of ESG investment criteria. So, to make sure this happens, there are rules. Some are from the US SEC. Others are from the EU. Both aim to keep Earth safe.

The SEC asks companies in the US to tell us how they affect the climate. They must be clear about greenhouse gases they make. This is known as climate risk disclosure mandates. It’s like a report card for how green a company is. It helps us choose firms that care for the Earth.

The EU has its own rule book. It’s the EU sustainable finance taxonomy. This tells us which investments are green. It’s like a green stamp of approval. For a company to get it, they must prove their work helps the Earth.

Investors like us use these rules to pick where to put our money. We wish for profits but not at the Earth’s cost. It’s a balance of green and gain.

Compliance with Green Bonds Regulatory Framework and Investor Stewardship Codes

Green bonds are like loans you give so companies can fund eco-friendly projects. The green bonds regulatory framework makes sure our money goes to the right green spots. We look for this sticker before we invest. It means the bond will truly help the Earth.

Stewardship codes for investors are like golden rules. They guide big money folks to invest with a conscience. They push them to ask tough questions and make sure companies run clean and fair. It’s about having a voice and using it for good.

These rules and codes don’t just guard our planet. They guard our morals and wallets too. We now know how our money works for or against the Earth. It’s a big win for us and our blue and green home. We wear the investor hat and the Earth hero cape at the same time.

Remember, it’s not just about the money. It’s about making money matter for more than ourselves. We stick to these rules to make sure of that. It’s our way of shaping the world of tomorrow. With every dollar we invest, we cast a vote for the kind of world we want. And every time, we vote green.

Forging the Future with Green Finance and Impact Investing Policies

Investment in Renewable Energy and the Push Toward a Net-Zero Economy

We live in exciting times where money meets morals in big ways. Green finance helps us put our cash where our earth is. It’s about backing up projects like solar plants and wind farms. This push isn’t just nice; it’s a need to hit net-zero, a balance between the gases we emit and remove from our air.

ESG investment criteria make you think before you spend. They guide us to support firms that care for the planet and its people. This means dropping cash into businesses that take carbon footprints seriously.

Green bonds are a cool tool for this. They raise money for projects that help our air, water, and land. Think of it as a promise where people give money now for projects that pay back through a cleaner, cooler world.

Evaluating the Effectiveness of ESG Scoring Systems and Sustainable Investment Funds Regulation

ESG stands for Environmental, Social, and Governance. It’s a checklist for weighing up how each firm behaves. Do they look after the planet? Are they good to the people? Do they run their company clean and straight? ESG scores rate firms on these, so you know who’s really going green, not just talking it.

But with cash flowing into these funds, we need to check the rule book. Sustainable investment funds regulation is about making sure every green dollar does what it promises. The aim is to keep things clear, avoid green-washing, and make sure our money’s moving us toward a better future.

We’re fitting all the pieces together. Impact investing policy links the money to the mission—pumping funds into work that does good in big ways. Dropping coal and oil stocks is part of this story. It’s called fossil fuel divestment and it’s growing fast.

Now, to answer “What is the EU sustainable finance taxonomy?” It’s Europe’s way of categorizing what’s truly green. It’s like having a dictionary that says, “This counts as green, this doesn’t.” It helps people across the world invest with a clear conscience.

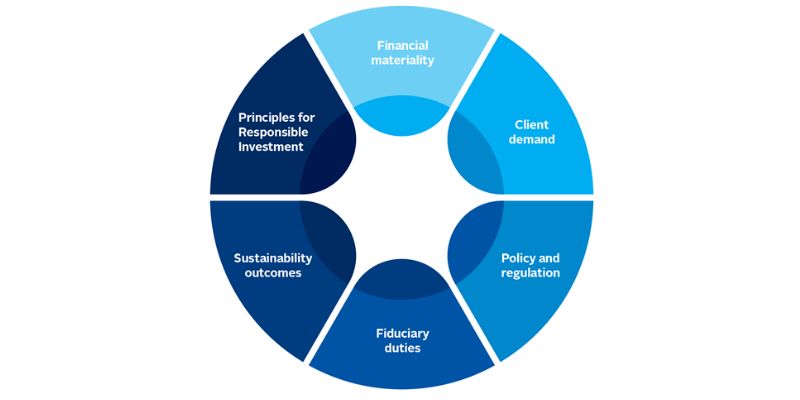

Behind all of this, from climate risk disclosure mandates to the PRIs, lie big ideas about what money can do—for us, our kids, and their kids too. It’s about seeing our savings not just as a personal nest egg, but as a tool to shape the kind of world we all want to wake up in. A world a little cleaner, fairer, and kinder than the one we found.

With every dollar, euro, or yen, we’re building that world. It’s a journey, for sure, but with each step we take, we’re not just investing. We’re voting for the future we believe in.

We’ve covered a lot, from ESG standards to green finance. These rules guide us in choosing the best places to put our money. They help us do good with our investments and still make a profit.

By using ESG metrics, we make smarter choices. We aim to do right by the planet while looking after our pockets too. It’s more than money. It’s about our future.

We also dove into the rules that shape our green choices. The SEC, EU, and others set these rules. This keeps things fair and clear.

Finally, we looked at what’s next for our money and our world. Investing in clean energy and other good projects is key. We want a world that’s safe and clean for all. This push could make a big difference.

So, let’s keep pushing for investments that care for our planet and our future. This way, we all win.

Q&A :

What are the current regulations for sustainable investing?

Sustainable investing, also known as ESG (Environmental, Social, and Governance) investing, is governed by a set of evolving regulations and guidelines that vary by region. In the EU, the Sustainable Finance Disclosure Regulation (SFDR) requires fund managers to disclose how they incorporate ESG risks in their investment decisions. In the US, the SEC is focused on ensuring proper disclosure of sustainable investment practices to prevent greenwashing. Additionally, organizations like the Global Reporting Initiative (GRI) provide frameworks for sustainability reporting.

How do sustainable investing regulations impact investors?

Sustainable investing regulations directly impact investors by ensuring greater transparency and standardization in ESG investing. With clear regulations, investors can make more informed decisions and compare investment opportunities on a like-for-like basis. The regulations aim to protect investors from misleading claims about the sustainability of their investments, known as greenwashing. Enhanced disclosures required by regulations also enable investors to assess the true sustainability performance of their investment portfolios.

Can sustainable investing regulations affect investment returns?

While some investors may be concerned that adhering to sustainable investing regulations could impact returns, evidence has shown that investments with strong ESG ratings can perform as well as, or even outperform, traditional investments in the long run. Regulations can help mitigate ESG-related risks that might otherwise be overlooked, potentially leading to more stable and profitable investments. However, it’s important to note that like all investments, returns are not guaranteed and can be affected by various market factors.

What are the challenges of implementing sustainable investing regulations?

Implementing sustainable investing regulations poses several challenges, including the need for clear and consistent definitions of what constitutes ‘sustainable’ practices. There is also the challenge of establishing reporting standards and metrics that can be universally applied. Moreover, the potential administrative and financial burden on firms to comply with these regulations can be significant. Finally, there is a risk of regulatory fragmentation across different countries and regions, which can create complexity for global investors.

How are sustainable investing regulations expected to evolve?

Sustainable investing regulations are expected to evolve to become more stringent and comprehensive as the global understanding of sustainability issues deepens. Standardization of ESG metrics and reporting practices is likely to improve, facilitating better comparability across companies and investment products. We may also see an increase in mandatory requirements rather than voluntary guidelines and a greater emphasis on climate-related disclosures following global initiatives like the Paris Agreement. Additionally, technological advancements will play a role in enhancing data collection and analysis for ESG reporting.