The Future of Finance?

In a world where digital is the new normal, the benefits of central bank digital currency (CBDC) are too potent to ignore. Picture a financial system that tosses aside hurdles to include everyone, slicing through red tape to connect pockets and markets worldwide with astounding speed. It’s not just about keeping pace; it’s about redefining the race. CBDC could make slow, costly banking a tale of the old days. As we journey through each transformative facet—be it the inclusion for all income levels, the high-speed rail of payment processing, or the new stronghold of economic balance—we unveil a financial universe where efficiency and stability reign supreme. Cross-border payments? They become swift strokes rather than tangled knots, injecting vitality into global trade while protecting your hard-earned cash from the grasp of excess fees. Security isn’t just a promise, but a bulletproof reality, armored by the latest in tech armor. Strap in, as we dive deep into this groundbreaking evolution, where financial empowerment is tangible and tech innovation leads the charge.

Enhancing Financial Inclusion and Efficiency

Facilitating Greater Access to Banking Services

CBDCs open doors for millions who lack bank accounts. They make banking simple and reachable for everyone, everywhere. This is how we bring in financial inclusion. Everyone gets a fair chance to join in the economy.

How does CBDC help those without banks? CBDC provides them digital currency that’s easy to use. They can pay for things, get money, and save without a bank. It changes lives, especially in far places with no banks nearby. People there can now be part of the bigger economy without stress.

The digital currency of the central bank lets us use money with just our phones. This means we can join the financial world right from our homes. No need to travel to a bank or wait in lines. With just a few taps, we’re in!

Streamlining Payment Systems for Speed and Reliability

CBDCs also offer a boost in how we pay. They can move money faster than ever before. This means we can shop, trade, and do business without delays. Everybody likes getting paid fast, right? CBDCs make sure that happens.

Why are fast payments so good? With quick payments, shopping gets easier, and businesses run smoother. When money flows quick and easy, our economy grows because everybody can do more, in less time.

Efficiency in payment systems isn’t all about speed. It’s also about trust. With CBDC, money moves reliably. And guess what? With strong reliability, we trust that our money gets where it needs to go. That builds a strong bond between buyers and sellers.

Reducing banking costs with digital currency is another big win. Remember when we paid fees for just about everything? With CBDCs, those costs fall sharply. This means more money stays in our pockets where it belongs. We save on fees, so we have more to spend on what matters to us.

Having central bank digital money benefits our whole money system. It’s safe too, thanks to high-end security features of CBDC. Knowing our money is secure gives us peace of mind. And peace of mind is priceless, isn’t it?

Digital currency convenience shows itself in how we live our daily lives. Need to pay rent or utilities? It can be done in an instant from our digital wallets. Thanks to CBDC, our days of running to the bank are over. Now we can handle money with ease, at any moment.

These changes don’t just improve today, they shape a bright future. As we move toward a cashless society, CBDC stands ready to make life easier and safer. Think of it as a golden key. It unlocks a world where money moves free and quick, where everyone can take part with ease. Now that’s a future worth working towards, wouldn’t you say?

Elevating Monetary Policy and Economic Stability

Influencing Monetary Policy Through Digital Currency Tools

Central Bank Digital Currencies (CBDCs) are like magic keys to newer, better money handling. They help our central banks guide the economy with more control and less hassle. Imagine having a wand that lets you tweak money flow and watch the economy react—CBDCs are that powerful.

CBDCs let banks create rules for money that can change how it is used. Think of it like setting a curfew for your kids—you make sure they’re safe and home when needed. In the same way, CBDCs put our dollars on a leash, so they do exactly what we need them to, like supporting people who need it most or keeping prices stable.

CBDCs give out money faster and to the right hands when a crisis hits. If an unexpected event shakes our world, having CBDCs means you can send help straight to those who need it. No waiting, no lost time, just swift action to keep the economy from tripping.

Ensuring Economic Stability in a Digital Age

As we move toward less cash, CBDCs step in to keep our economy steady and fair. They have built-in smarts to stop illegal activities and shine a light on money’s path. And get this—they reduce the number of fake bills out there by making sure real money is easy to spot.

CBDCs show us where every penny flows. This leads to fewer sneaky deals and a clear map of our financial journey. It’s like having a GPS for your money, ensuring it doesn’t wander off into dark corners.

Digital money from central banks also makes sure that all people, even those far from a bank, join in the economy. This brings more voices to the table, making our economic decisions richer and fairer. That’s a win for society!

With CBDCs, sending money across borders is like tossing a paper airplane. It’s speedy, crosses over walls, and opens up new ways to trade and build together. This helps good and services zip around the globe, keeping prices fair and everyone in the game.

Imagine building a Lego set where all pieces fit just right—CBDCs make that true for our financial world. They smooth out the banking system’s gears, so everything clicks together. This means banks talk to each other better, and your money gets where it needs to go without a fuss.

By boosting how our money moves, CBDCs really do pave the way for a bright financial future. They carry the promise of a sturdy, stable economy that stands tall in the face of change. With clever tech and a shake-up in money rules, CBDCs are steering us toward a tomorrow where everyone’s wallet is a bit more secure and a lot more powerful.

Revolutionizing Cross-Border Payments and Reducing Costs

Impact of CBDC on International Trade and Transactions

A major win for CBDC is in international deals. We buy and sell across borders more easily. Central bank digital money can make payments faster and cheaper. No waiting for checks to clear or wire transfers to go through. Instead, digital dollars or euros can whiz across the world in seconds.

With traditional money, people often pay high fees for international trades. CBDC cuts these costs. It also helps people trust the process more. When we use central bank digital money, banks can trace it. This ensures that nobody gets scammed, and money reaches its right place.

But how does it work? Think about buying a toy from another country. Instead of waiting days for payment to clear, CBDC makes it instant. This is because CBDCs use technology like blockchain. It’s like a super ledger that’s very secure. Not just anyone can make changes to it.

So, no more long waits or big fees. That’s a big deal for businesses big and small. Also, it’s great for people sending money to family in other countries.

The Role of Central Bank Digital Currency in Minimizing Banking Expenses

Now, let’s talk about bank costs. These can be annoying, right? Every time we do something with our money, banks often charge us. Enter CBDCs. They are like superheroes slashing through fees.

When banks move to digital currencies, they save on many costs. Think less paper, no need for vaults, and snappier systems. They can pass these savings onto us. This means we could pay less for banking services.

Here’s where CBDCs shine. Their magic lies in making the money move without a heavy cost. Say you’re paying back a friend. With a digital wallet, you can do this instantly. And without those pesky fees. CBDCs are built for this – quick and easy payments.

And why does this matter? It makes life simpler for every one of us. We can manage our money without extra costs dragging us down. Also, for people who find banking pricey, CBDC opens doors. Everyone gets to join in.

To sum it up, central bank digital money doesn’t just sit in an account. It helps folks trade across the world without breaking the bank. It also helps us save on fees so we can do more with our cash. We’re talking about a money makeover here, and it’s all thanks to CBDCs.

Strengthening Security and Advancing Technological Innovation

Implementing Advanced Security Features in CBDC

When we talk about money, we think “secure.” Let’s talk about how central bank digital currency (CBDC) is bringing new, strong security to our money. CBDC is like a superhero for our finances, always on guard. With advanced tech, it fights off bad guys like hackers and fraudsters. Each digital dollar has unique security that’s tough to crack. We’re talking tight like a drum!

Here’s why that’s big news: With beefed-up security, your money is safer than ever. Plus, using smart tech, CBDC keeps your personal details under wraps. Think Fort Knox, but for your digital cash. You’ll sleep well knowing your money is snug as a bug in a rug!

The Intersection of Blockchain Technology and Central Bank Strategy

Now, we merge two worlds: blockchain and central bank smarts. Blockchain’s a whiz kid of tech – it can record every move your digital buck makes. Why is that neat? Because it means each time money changes hands, it’s jotted down in an unchangeable ledger. It’s all about trust and being able to track what’s what.

Let’s break it down: CBDC on the blockchain makes sure your money’s history is clear as day. Nobody can pull a fast one and change the story. Need to send money far away? No sweat! CBDC shines in making payments across borders, quick and cheap. Say goodbye to waiting and crazy fees.

For folks without usual bank access, CBDC gives a high-five to financial inclusion. It opens doors, inviting everyone into the financial party. By making it easier to join in, CBDC works for fairness and makes sure no one’s left out.

As we step into a less-cash world, CBDC helps us leap forward. It’s about making life easier with fast, secure payments, any time, any place. No more digging for coins between the couch cushions. Now, tap and go; you’re all set.

Alright, picture your wallet getting slim and sleek. With digital wallets linked to CBDC, you’re cutting down on bulk and going light. It’s like having a bank in your pocket, minus the hassle. Cool, right?

And here’s the kicker: CBDC is not just about saving time. It’s a game-changer for the whole financial playground. We’re talking lower cost for banks, which can mean fewer fees nibbling at your savings. Your bank can work smarter, not harder, which is great news for your pocketbook.

With CBDCs, central banks get new superpowers. They can handle money like never before, making every penny do more. We’re not just talking about spending and saving. This can shake up everything on how countries handle their cash.

So there you have it. CBDC and blockchain are joining forces. They’re on a mission to amp up security and tech smarts in our financial world. This twin-power team is blasting full speed ahead, making sure our money is safe, sound, and ready to roll!

In this post, we looked at how digital currency can change banking. We saw it opens doors, making banking easy for more people. Faster, safer payments are now possible, critical for our fast-paced world.

Next, we dived into how this tech impacts policies that keep our economy stable. It’s a fresh tool for managing money supply and growth.

We also explored how it shakes up global trade. It makes buying and selling across borders cheaper, a big win for businesses large and small.

And we can’t ignore security – it’s top-notch with digital currency. Plus, it rides the wave of new tech like blockchain to stay ahead.

Here’s the bottom line: Central Bank Digital Currency isn’t just a new way to pay. It’s a step toward smarter, swifter, and more stable money for us all. Let’s embrace this change for a brighter economic future.

Q&A :

What are the main advantages of central bank digital currency (CBDC)?

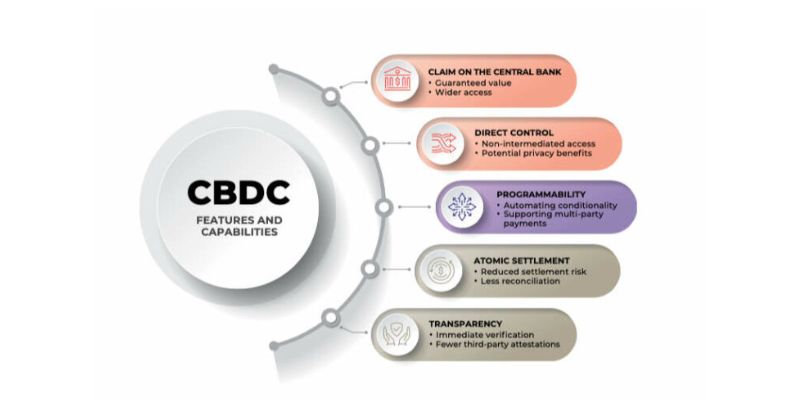

Central bank digital currencies (CBDCs) offer several potential advantages, such as improved financial inclusion by providing access to digital payment systems to unbanked or underbanked populations. They also promise increased transaction efficiency with faster and potentially cheaper transfers, especially across borders. Enhanced security and lower risks of financial crimes are also potential benefits due to the traceability and programmability of CBDCs. Furthermore, CBDCs can provide a more stable and reliable digital currency option as they are backed by the state, unlike private cryptocurrencies.

How could central bank digital currency transform monetary policy?

Central bank digital currency could significantly influence monetary policy by allowing central banks to implement policy changes more directly and efficiently. CBDCs can facilitate the direct transfer of funds to citizens, enabling more targeted fiscal interventions. They could also affect interest rates more directly by setting rates on holdings of CBDC, influencing spending and saving decisions of consumers and businesses. The presence of a CBDC could also improve the transmission of monetary policy through the financial system.

Can central bank digital currency reduce costs associated with money management?

Yes, one of the potential benefits of central bank digital currency is the reduction in costs related to money management. Handling, storing, and securing physical cash all incur costs that could be substantially decreased with the adoption of a CBDC. Additionally, digital currency systems can streamline payment processing and settlement, reducing costs for banks and other financial institutions. The increased efficiency of a CBDC system could result in lower transaction fees for consumers and businesses as well.

What role can CBDC play in ensuring financial stability?

CBDC has the potential to enhance financial stability by providing a safer and more stable form of digital currency, as it is backed by the central bank. This trustworthy digital asset could become a reliable alternative to bank deposits during financial crises, potentially preventing bank runs. Moreover, the programmable nature of CBDC allows central banks to dynamically regulate the money supply and implement automated stabilizing measures, making the overall financial system more resilient.

How will central bank digital currency impact cross-border payments?

CBDC is poised to significantly impact cross-border payments by making them faster, cheaper, and more accessible. Traditional cross-border payments can be costly and time-consuming due to intermediary banks and currency conversion. A CBDC could circumvent these intermediaries, providing real-time or near-real-time transactions. This could benefit businesses with international operations and individuals who send remittances, promoting greater economic efficiency and connectivity on a global scale.