Imagine keeping more cash in your pocket and getting the financial power you deserve. That’s the reality with benefits of financial disintermediation for consumers. This isn’t just about skipping a trip to the bank. It’s about cutting the middleman. Now, we’re diving headfirst into a world where your financial control is limitless. Peer-to-peer lending? It’s all you. Investing in a startup through crowdfunding? Absolutely. And the best part? Every penny you save on fees is money you can spend, save, or invest how you see fit. Ready to break free from traditional banking chains? Let’s explore how financial disintermediation not only levels up your finance game but also puts you in the driver’s seat of your financial journey.

Unpacking Financial Independence Through Disintermediation

Embracing P2P Lending and Crowdfunding

Peer-to-peer lending and crowdfunding are game changers. They let people lend, borrow, and fund projects without banks. This means you can get loans or grow your savings right from other folks, not just big companies. It’s easy to see why it’s so popular. When you cut out the banks, both the saver and the borrower can win more.

Let’s talk about what this looks like. For a person who lends money on a P2P platform, the benefits are clear. They can earn higher interest than a bank would offer. On the flip side, if you’re borrowing, you might score a lower interest rate. It’s all because we remove the middleman who takes a slice of the pie. Plus, the process is usually simpler and quicker.

Crowdfunding is another way to go. You might have a brilliant idea but not enough cash. Crowdfunding allows you to pitch your idea online and if people like it, they can back you up with their own money. It’s power in numbers. This means more dreams come to life without needing a bank to say “yes.”

The Rise of Fintech and Blockchain in Consumer Finance

Now, fintech and blockchain are shaking things up. They’re making it even easier to handle money without the banks. With apps and tech, investing, saving, and even sending cash can all be touched with a tap on your screen.

And blockchain? It’s like a super safe digital ledger that keeps track of every deal without any mistakes. This tech lets anyone send money across the world, fast and without high fees. It’s all about making sure you have more power over your cash.

Fintech innovation helps you do more with your money, without waiting in line at a bank or filling out piles of paperwork. You can buy stock, insure your car, or even save for retirement all on your own. It’s your money, your choices.

This independence is huge for folks who never had simple access to these tools. Now, someone far from a bank or in a hard spot can tap into the same deals as everyone else. That’s financial inclusion. It means the playing field is getting more level every day.

So, next time you think about your money, remember: You’ve got options. P2P lending, crowdfunding, fintech, and blockchain are all out there ready to help you reduce your reliance on banks and take charge of your future. All it takes is a little know-how and a push towards action. Welcome to a world where you call the shots, friend. It’s pretty great, isn’t it?

Cutting Costs: How Disintermediation Saves Money

Lowering Transaction Fees and Removing Bank Charges

Banks love fees, right? They tap our pockets for almost any service. But here’s a shift: imagine paying less to manage money. Enter disintermediation. This buzzword means cutting out middlemen. No banks, no brokers, just you and your money. Savings grow when the middleman goes.

Less fees? Yes, please! By going direct, we avoid those pesky bank charges. Whether wiring money, paying for checks, or using ATMs, these fees add up. Disintermediation puts the letup on these costs. Peer-to-peer lending platforms and direct banking options are shaking things up. They cut the need for bank networks, letting us hang onto more of our cash.

The Impact of Direct Banking on Savings and Investment Returns

Alright, let’s dive deeper. Banks give us tiny interest on savings, don’t they? But what if we set the terms ourselves? By investing without brokers or stashing cash through direct banking, we see our money grow faster. It’s not magic. It’s about cutting the slack in the system—the overheads that eat into our interest rates.

Investing used to involve brokers and complicated fee structures. With disintermediation, we invest directly. No middlemen, no hidden fees. This means we get a bigger slice of the return pie. Direct stock purchase plans, for example, let us buy from the company itself. The cost savings here are crystal clear.

Crowdfunding and peer-to-peer lending earn us better yields than traditional savings accounts. By lending money directly to others, we get higher interest rates. Also, we help someone else skip the bank loan cycle. It’s a win-win. Fintech apps are in on this game too; they streamline the process, making sure our investments are easy and fruitful.

So, what’s clear? By embracing financial independence through disintermediation, we take charge. We reduce reliance on banks. We get the full benefit of our financial moves. And isn’t that the point? They say money talks, and taking these steps turns the whisper of our savings into a shout.

Gaining Autonomy: Consumer Empowerment in Personal Finance

Decentralized Financial Services and Increased Control

Think of a world where you call the shots. This is what decentralized financial services offer. They put you in charge. Instead of using banks, we can use tech to manage our money. This means no high fees or long waits. It’s finance made simple, just for you.

Here’s the best part. Peer-to-peer lending lets you borrow or lend money directly. No needed middleman. You could get better rates and terms this way. And on the flip side, you could earn more when lending out cash.

Decentralized finance uses blockchain too. This is a safe way to send and keep your money. It also lets you make deals people trust, without a middleman saying “yes.” Think of it like a digital handshake that no one can break.

Direct Access to Investment and Insurance Products

Now, let’s talk about growing your cash. Remember investing without brokers? It’s a game-changer. Direct stock plans let you buy shares without the extra cost. Your returns could bloom because you’re saving on fees.

Insurance works the same. Direct plans have no salesperson. That keeps more money in your pocket. And greater control means more power to you. You choose the best plan for you, not what someone else sells you.

Crowdfunding’s another big win here. It lets you back what you believe in. Plus, you can even launch your own dreams for others to fund.

With all this power, you can see why cutting out the middleman matters. Your money works for you, not for the fees of someone else. And that’s the heart of financial freedom.

These tools aren’t just good for savings. They let you get loans and invest in ways that once weren’t possible. They bring down walls and let us all have a chance at growing our wealth.

This shift to taking charge isn’t just handy. It’s a move toward a system that works for everyone. A system where your hard-earned cash is truly yours to command.

Broadening Access: The Democratization of Finance

Harnessing the Power of Direct Lending and Stock Purchase Plans

Imagine a world where you are the bank. You pick who gets a loan, and you reap the direct rewards. This is the power of peer-to-peer (P2P) lending. It links you to those who need loans without a bank in the middle. You cut out middlemen and gain more from your money. Loans are more personal and tailored to those who need them.

Stock purchase plans also let you buy shares straight from a company. You pay no broker fees. You get to invest in businesses you believe in, often with small amounts of money. This direct tie can also mean you get info and perks straight from the company. You’re more than an investor; you’re a valued part of the business.

Fostering Inclusion Through Financial Technology Advancements

Tech is changing the game in finance. It lets us handle our money with just a few taps on our phones. People can now use fintech tools no matter where they are or how much they have. Apps and platforms give you the power to send, save, and invest your cash with ease. They open doors for those who banks may have left out. They do this by offering a way in for folks who just need simple tools to start with.

Blockchain tech makes all this safe and sound. It creates a secure way to do deals right between people. This means less risk of fraud and no need for a bank to say it’s okay. It’s a trusty system that’s all yours.

In this digital age, finance is no longer just for a select few with lots of money or know-how. It’s for you and me – for all of us. It hands the reins of finance back to the people where it belongs.

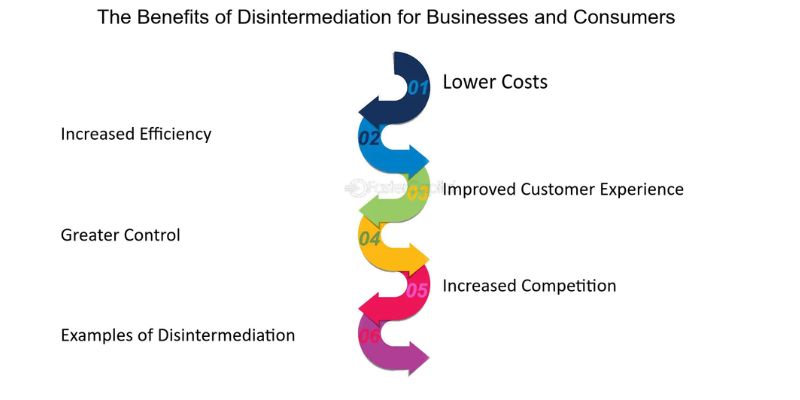

In this blog, we explored how cutting out the middleman changes money matters. We talked about peer-to-peer lending, and how fintech and blockchain shake up finance. We saw how disintermediation slashes fees, boosts savings, and beefs up investment returns. It means more power to you, offering direct ways to invest and protect cash. We also covered how finance is now for everyone. New tech lets more folks borrow, save, and invest.

My final take? Direct finance puts you in the driver’s seat. You save money, gain control, and it’s fair for all. It’s smart to get on board with these savvy financial moves.

Q&A :

What are the main benefits of financial disintermediation for consumers?

Financial disintermediation can offer consumers a range of benefits, key among them being lower transaction costs since middlemen or intermediaries are cut out. This direct dealing can also result in better interest rates for savers and borrowers. Additionally, consumers can enjoy more control over their investments and the potential for higher returns due to a direct connection with financial markets.

How does financial disintermediation impact consumer access to financial services?

By bypassing traditional financial institutions, financial disintermediation often allows for more inclusive access to financial services. Innovative technologies and platforms enable consumers who may have been underserved by conventional banks to connect with funding sources directly—like peer-to-peer lending and crowdfunding platforms, enhancing financial inclusion.

Can financial disintermediation lead to more personalized financial services for consumers?

Yes, financial disintermediation can lead to more personalized services. With the use of technology and the removal of traditional financial institutions from the process, services can be tailored to individual consumer needs. This can result in a more customized investment strategy and a more personal relationship with financial service providers.

Does financial disintermediation pose any risks to consumers?

While there are benefits, financial disintermediation does pose some risks to consumers. Without the regulatory framework and protection that traditional banks offer, consumers may be at increased risk of fraud. Additionally, they may lack the financial advice and support that traditional banks provide, which could lead to less informed decision-making.

In what ways does financial disintermediation improve market efficiency?

Financial disintermediation can improve market efficiency by reducing the spread between what savers earn and what borrowers pay. The direct connection between these two groups can lead to a more efficient allocation of capital. This, in turn, promotes competition and innovation within the financial services sector, often resulting in better products and services for consumers.