When the central bank pushes rates up, your cash takes the hit. It’s a move that cools down spending and borrowing. But what does a central bank interest rates hike truly do to your wallet? Whether it’s your home loan, your shopping habits, or your savings account, every dollar you have sits up and takes notice. I’ll guide you through what puffed-up interest rates mean for your personal finances, your investments, and the bigger picture of the economy. Stay sharp because these changes are not just numbers in the news—they are signals that steer where your money moves next.

Understanding the Impact of Central Bank Interest Rates Hikes on the Economy

Effects on Inflation and Economic Growth

When central banks raise rates, they aim to control inflation. Higher rates can make stuff cost more to buy on credit. But this also can cool down how much we all spend. Less spending means businesses don’t sell as much. Then, growth can slow. It’s like hitting the brakes on a fast car.

Think of your last trip to the store. If you buy less because things are pricey, the store might lower prices. This is what the bank wants – less inflation. But if we all buy less, stores sell less. They might cut jobs if this goes on. Jobs can get harder to find and growth can dip.

Federal Reserve and Global Central Bank Trends

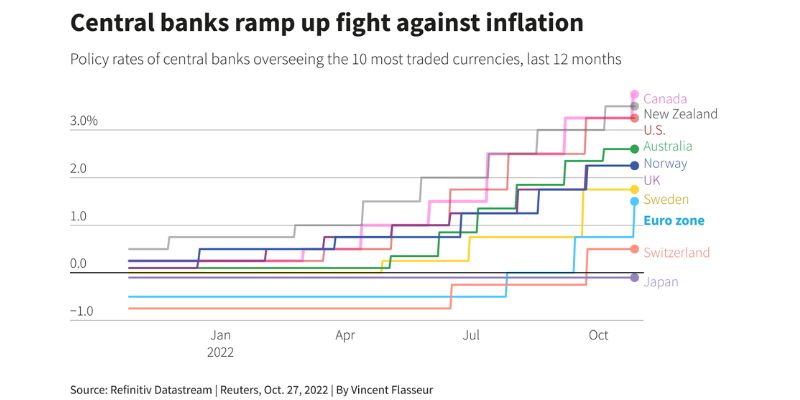

Banks around the world, like the Federal Reserve, set trends with rates. They watch prices and decide how to act. If prices fly up, they might hike rates. This makes it pricier to borrow cash. It’s their way to keep things stable. We can feel this in our wallets when it costs more to get a loan.

Banks in Europe and England do this too. They set their own rates to manage how their money is worth. When prices rise, they might lift their rates as well. This keeps their money from losing value too fast. When lots of banks do this, it sets a global trend. It’s like a big team working to keep money in check.

Every move these banks make, we feel it. It can change how much you pay for a home loan, for example. Or what you earn if you save money in the bank. It’s a big deal because it touches everything – from how much you spend to how much you can save.

So, when you hear about rates going up, think about how it hits your cash. It might mean saving might earn you more. But borrowing will cost more too. It’s a trade-off. The bank’s goal is to keep our money worth something and our economy on the right track. And that’s something we all have a stake in.

How Higher Interest Rates Affect Personal Finance

Mortgage and Loan Interest Adjustments

When central banks raise rates, the cost of borrowing goes up. This means your mortgage or car loan might cost you more each month. The rate banks charge each other for loans sets the tone for what you pay. So, if the Fed or another central bank hikes rates, your interest payments might climb.

Higher mortgage rates can make owning a home pricier. If you have a variable rate mortgage, your payments can change with rate moves. Fixed-rate loans stay the same until you refi or the term ends. But getting a new house gets harder as loans cost more and buying power drops.

Say you took out a loan to grow your business. If rates go up, your loan costs more, eating into your profits. The impact of raising interest rates can hold back company growth due to increased borrowing costs. However, it’s not all bad. Banks often pay more on what you have in savings when rates climb.

Changes in Credit Card APR and Deposit Savings Rates

Credit cards usually have a variable APR, tied to the prime rate. This prime rate moves with the central bank’s moves, like the Federal Reserve’s. So when they up their rates, your credit card costs can jump too.

This means you could pay more interest on what you owe. It can take longer to pay off balances and can cost more over time. Smart move? Pay down big balances before any rate hikes hit.

But not all news is sour with rate lifts. Your savings and CDs could grow faster. That’s because banks may offer better interest on what you save. While loans and credit card costs go up, savers enjoy more earnings on their accounts. It’s a plus for those stashing cash.

Squads to Central Bank Rate Changes:

- Central banks upping rates can make your loans cost more.

- Credit card interest might rise with these rate hikes.

- Savings rates could also go up, helping savers earn more.

The Response of Financial Markets to Central Bank Rate Decisions

Stock Market and Fixed Income Investment Dynamics

When central banks hike rates, the stock market often takes a hit. Why? Well, it costs more for businesses to borrow money. This can slow down growth and profit. Plus, higher rates make bonds more appealing compared to stocks. This tug-of-war between stocks and bonds creates a seesaw effect in the market.

What happens to bonds? As rates go up, new bonds pay more, so existing ones with lower rates aren’t as valuable. This causes their prices to fall. The overall tug-of-war between return and risk shapes where investors put their cash.

Impact on Bond Yields and Currency Valuation

Higher interest rates from central banks can lead to stronger currencies. This means a country’s money can buy more foreign goods. It’s great for travelers and for buying overseas goods. Yet, it can hurt exports, as foreign buyers find our stuff pricier.

Also, bond yields jump up with rate hikes. Why? Because new bonds must offer more to attract buyers in a higher-rate world. Existing bonds with lower rates lag behind, so their prices drop. For regular people, this means your bond investments can lose value in the short run.

In all, rate moves by central banks like the Federal Reserve have wide ripples. These affect your stocks, your bonds, and even the dollars in your wallet. And with other big banks globally following suit, these effects go beyond our borders, touching economies all around the world.

Assessing the Broader Implications of Monetary Policy Changes

Recession Risk and Unemployment Rates Correlation

When central banks raise rates, they often aim to cool a hot economy. High rates can limit how much people borrow and spend. This can slow down the economy too much and lead to a recession. A recession means less demand for workers, so jobless rates can go up. People worry about losing jobs, and businesses pause their plans to grow. When fewer people have jobs, they spend less. This makes the economy weak, and we call this a bad cycle.

Fiscal Policy Influence and Monetary Stimulus Withdrawal

Fiscal policy involves government spending and taxing. When central banks stop boosting the economy with easy money, it’s often up to the government to step in. If they spend more or tax less, it can help keep the economy stable. But if they can’t or won’t act, tough times could get even tougher. It’s a delicate balance, and getting it wrong can hurt our wallets.

Raising interest rates has big effects, like making loans cost more. This matters for anyone with a mortgage or credit cards. It’s like when you have less money to spend because you are paying more each month on your debts.

What happens when rates go up? First, it costs more for banks to get money. So they charge us more for loans, like for houses or businesses. This can slow things down in the market. People may wait to buy homes or cars. Businesses might hold off on making new things or hiring.

The cost of borrowing goes up right away after a rate hike. For things like mortgages, this means bigger monthly payments. It’s a direct hit to your budget. When money is tight, we might not eat out as much or buy new clothes. This means less cash going into shops and restaurants.

Also, when rates rise, banks give better interest on savings. If you’re saving money in the bank, you might get more back now. But if you’re borrowing, like with a mortgage, you’ll pay more. It’s a give and take.

On the big picture side, higher rates can slow down inflation. Inflation means when things cost more. If money costs more to borrow, less of it is spent, so prices can level out. But if central banks hike rates too much, the economy can stop growing. This is a delicate dance and central banks must be careful.

For businesses, more expensive loans can mean less money for new ideas and jobs. If a company can’t afford to grow, they might not hire new people. Or worse, they might have to let go of some workers. This is how rising rates can affect jobs across the country.

Finally, stocks and bonds react to higher rates too. Generally, when rates go up, bond prices go down. This is because new bonds pay more interest than old ones. So, people sell the old ones for less. Stocks can also go down. This is because higher loan costs can mean less profit for companies.

Talking about money isn’t always fun. But it’s super important to understand how these big decisions by banks can change our daily lives. By keeping an eye on rate changes and adjusting your budget and plans, you can stay ahead in the finance game.

In this blog, we looked at how central banks raising interest rates impacts our wallets and the world. We saw it’s a big deal for inflation, growth, and borrowing costs. For everyday folks, this means higher payments on mortgages and loans, plus changes in how much we earn from our savings.

We also explored how these interest rate hikes shake things up in the stock and bond markets. As rates go up, the value of bonds can drop, and stocks might do a roller coaster move. These changes reach far, even affecting the risk of a recession and job numbers.

As you think on this topic, remember high rates can slow down spending and cool off an overheated economy. But there’s a balance to strike. We don’t want growth to stop or jobs to vanish. Central banks have a tough job, and their choices touch everything from our paychecks to our investments. Keep an eye on these trends – they’re key for making smart money moves.

Q&A :

Why do central banks raise interest rates?

Central banks may decide to raise interest rates as a measure to combat inflation. By increasing the cost of borrowing, it can help cool down an overheating economy by reducing consumer spending and investment, thereby helping to control inflationary pressures.

How does a central bank interest rate hike affect the economy?

A central bank interest rate hike typically results in higher borrowing costs for individuals and businesses. This can lead to a reduction in consumer spending and business investment, which can slow down economic growth. Higher interest rates can also strengthen the currency, affecting exports and imports.

What are the signs that a central bank might hike interest rates?

Signals that a central bank is considering a rate hike often include consistent economic growth, high inflation rates, and a robust labor market. Central banks may give forward guidance in their statements or release data that indicates their posture towards potential rate increases.

How can individuals and businesses prepare for central bank interest rate hikes?

To prepare for interest rate hikes, individuals might lock in low mortgage rates, pay down variable-interest debt, or refinance existing debt. Businesses can also manage their exposure by securing fixed-rate loans, hedging interest rate risk, and reassessing their budget to account for increased borrowing costs.

How often do central banks change interest rates?

Central banks typically adjust interest rates periodically, but not on a predefined schedule. They assess economic data and monetary policy goals regularly, often on a quarterly or monthly basis, to decide whether to change interest rates. Major central banks announce their interest rate decisions after scheduled policy meetings.