Have you ever wondered how Central bank interest rates impact on monetary policy? These rates are key to our economy’s health, like a captain steering a ship. High rates may slow things down, while low rates can speed things up. Think of interest rates as tools. They control money flow, affect your pocket, and shape businesses’ futures. Dive in with me, as we explore this vital link between central bank decisions and our everyday economic life. Let’s demystify this complex process, and see how a single number can ripple through our entire financial system. Buckle up, we’re about to unravel the powerful influence of central bank interest rates!

The Dynamic Role of Central Bank Interest Rates in Monetary Policy

Understanding How Central Bank Interest Rates Shape Monetary Policy Adjustments

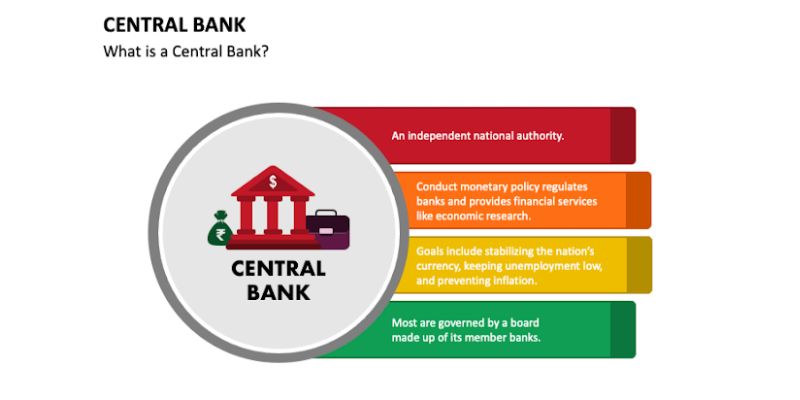

Central bank interest rates lead the way for our money’s health. These rates decide how much it costs banks to get money. They help keep prices stable and grow our economy. Picture the rate as a car’s gas pedal. Press down, the economy speeds up; lift your foot, it slows down.

Central banks, like the Federal Reserve, change rates to control inflation. If prices rise too fast, they hike rates. This makes loans cost more, so people and businesses think twice about spending. If the economy is slow, they cut rates to make borrowing cheap. Then people buy more and companies grow.

The Relationship Between Federal Funds Rate and Discount Rates

The federal funds rate is what banks charge each other for loans they make overnight. The discount rate is what banks pay when they borrow direct from the central bank. They’re like two tracks on the same road. If the federal funds rate goes up, so does the discount rate, making it costlier for banks to get money. This filters down to you and me. Loans for homes or starting a business get more expensive.

When banks can’t lend to each other, they use the discount rate. It’s the backup plan. These rates move together to guide how much cash is in the economy. If there’s too much, we run into inflation; if there’s too little, growth stalls.

By fiddling with these two rates, central banks can nudge the economy in the right direction. It’s a neat trick, but it’s not perfect. They watch how things play out in real life and adjust as needed. Too hot or too cold, they try for just right.

Keeping these rates in balance is key to a stable economy. It’s like keeping your bike upright. Lean too far one way or the other, and you might crash. But get it just right, and you can have a smooth ride. Central banks aim for that balance to keep our money safe and growing.

In simple terms, central banks use interest rates to make sure we’re not overspending or undersaving. They keep an eye on prices and try to make sure the money we earn today will be worth about the same tomorrow. It’s pretty important stuff because it affects everything from the price of milk to how much you earn.

Central banks have a big job. They have to watch the whole economy and make calls on interest rates. They use all sorts of tools, like the federal funds rate and the discount rate, to steer the ship. It’s not always smooth sailing, but getting it right means we all do better. Next time you hear about interest rates in the news, remember, it’s a big piece of the puzzle in keeping our economy on track.

Central Bank Interest Rates and Inflation: A Balancing Act

Mechanisms of Inflation Control Through Interest Rates

Ever wonder how a central bank keeps prices stable? It’s like using a thermostat. When the economy gets too hot, prices rise fast; this is inflation. To cool things down, the central bank raises rates. Think about it like this: higher interest rates make borrowing money cost more. So, people and businesses slow down on spending. When less money chases goods, prices tend to stop rising so fast. This helps keep the balance between what things cost and what money is worth.

The Impact of Interest Rate Fluctuations on Currency Value and Inflation Targeting

Interest rates can feel like a secret power of central banks. They go up or down, and it’s like they send a wave through the whole economy. When rates go up, it can mean your currency is worth more. Why’s that? Well, investors like places where they get more for their money. So, they’ll bring their money where interest rates are higher. This can be good, but only up to a point. If a currency is too strong, it can hurt sales abroad. Central banks aim for a sweet spot, called inflation targeting. It’s like aiming for a small, steady rise in prices over time. By targeting this, banks try to stop prices from going wild and help the economy grow just right.

But these choices aren’t easy. A change in rates takes time to work through the system. It’s a bit like guessing how much to turn the steering wheel before you even see the curve in the road. And when they do make a move, it’s not just one street that feels it; it’s like the whole town gets a shake-up. Rates can sway everything from your savings account to how much a home costs. Knowing how this works helps us see why those rate changes in the news are such a big deal.

Central banks walk a tightrope, carefully setting interest rates to keep inflation on target. It’s not just about today’s prices. It’s about keeping our money’s value in check so we can plan for tomorrow. It’s a job full of tough calls, high stakes, and all with an eye on keeping our economy on course.

Central Bank Interest Rates and Their Economic Implications

Quantitative Easing Impact and the Cash Reserve Ratio’s Influence on Borrowing Costs

Central banks use tools that affect how much it costs to borrow money. One major tool is quantitative easing. This is when a bank buys assets to pump cash into the market. It’s like pouring water on a thirsty plant; it helps things grow. This buying can lead to banks having more money to lend. This can make loans cheaper.

But there’s more to this story. The cash reserve ratio also plays a big part. This ratio sets how much money banks must keep and not lend out. When this ratio is high, banks can lend less money. This means loans can cost more. Lowering the ratio makes loans cheaper, as banks have more to lend.

The Ripple Effect of Interest Rates: From Consumer Spending to Business Investment

Interest rates are like a big switch for the economy. When rates go up, people and businesses may cut back on spending. High rates make loans, like for a house or car, cost more. This can slow down buying and investing.

When rates drop, it can work like a green light. Lower rates make loans cheaper. So, people may buy more, and businesses might invest in new things. This can help the economy grow. But it’s tricky. If everyone spends too much, prices could go up too fast. This is why central banks must be careful with the interest rates.

Central bank interest rate effects reach far and wide. They shape how much we all spend and save, and so the whole economy. These rates control the flow of money. They decide if it is easy or hard to borrow and spend. With smart adjustments, central banks can steer the economy in good directions. But it’s like driving a big ship. Changes take time to show, and the water can be rough. A wrong turn can take a while to fix.

International Perspectives on Central Bank Interest Rate Policies

Consequences of Rate Hikes and Cuts on Global Economic Stability

When central banks change interest rates, the whole world feels it. A rate hike means a central bank is lifting the cost to borrow money. They do this to cool down an economy that’s too hot. Think of it as gently tapping the brakes on a car speeding down a hill. Making loans costlier helps keep inflation in check. That’s because pricier borrowing can make people and businesses slow down on spending.

But what happens when rates get cut? That’s like stepping on the gas pedal. It makes it cheaper to borrow money. This can boost spending and help a slow economy pick up speed. It’s a tool central banks use with care. Too much borrowing can make prices rise quicker than we want, which hurts buying power.

Both rate hikes and cuts can shake up economic stability across the globe. Countries tied together by trade can feel ripples from these changes. A rate hike in one country can mean less investment from abroad. Higher rates can offer better returns on savings, so money might flow out of one nation and into another. That’s why central banks must act wisely. They keep an eye on the world scene when moving rates up or down to keep us on a steady path.

How Policy Rate Decisions Affect Exchange Rates and Cross-border Trade

The price to swap one currency for another can wiggle around when central banks tweak interest rates. If a central bank boosts its rates, holding on to that country’s currency gets more attractive. It pays more to save in that currency, so its value can climb. This makes stuff sold in that currency cost more for other countries to buy, which can slow down trade.

On the flip side, when a central bank lowers rates, its currency may lose a bit of shine. It doesn’t pay as much to save in that currency, so its value against others can slip. This can make its goods cheaper for other countries to snap up. So, what’s the big deal? Well, if a currency falls a lot, it can make things messy. It can make imports costly and lead to a spending crunch at home.

Central banks must think about how rate changes can sway exchange rates and trade. Shifting rates too much or too fast might disturb the balance. Keeping trade moving smoothly matters a lot for a healthy world economy.

In the dance of international finance, central bank interest rate moves are key. They influence not just the price of borrowing but how countries trade and grow together. It’s a big deal that keeps experts like me always alert, ready to understand and explain the latest slide or leap in the complex tango of global economics.

In this post, we explored central bank interest rates and their crucial role in steering the economy. We covered how these rates shape monetary policy and interact with the federal funds and discount rates. Interest rates are key to controlling inflation and managing the economy’s overall health.

We saw how tweaking interest rates affects everyone, from big banks to our own wallet. It’s like a domino effect. Lower rates can boost spending and investing, but they can also spark inflation. Higher rates do the opposite. They can cool down an overheated market but may slow down growth.

Globally, these rates can shake up trade and affect how much money is worth across borders. It’s a complex game with high stakes.

Think of central bank interest rates as the economy’s thermostat. Set it right, and we can enjoy a comfy financial climate. Get it wrong, and we’re either shivering in recession or sweating in inflation.

It’s clear that these rates are not just some obscure figures. They impact your life and mine. Stay informed, stay smart, and let’s navigate these economic waves together.

Q&A :

How do Central Bank interest rates influence monetary policy?

Central Bank interest rates are a crucial tool used to influence the economy. When a central bank decides to raise interest rates, it aims to cool down an overheating economy and reduce inflation. Conversely, when interest rates are lowered, the goal is usually to stimulate economic activity by making borrowing cheaper, thus encouraging spending and investment. These rate adjustments directly affect monetary policy, as they help to control the overall levels of liquidity and consumer demand within an economy.

What are the effects of an increase in Central Bank interest rates on the economy?

An increase in Central Bank interest rates typically leads to higher borrowing costs for individuals and businesses. This can result in reduced consumer spending and business investment, which may slow economic growth. Higher rates also generally lead to an appreciation of the country’s currency, which can affect exports by making them more expensive for foreign buyers. Additionally, an interest rate hike can help to curb inflation by decreasing the amount of money in circulation.

How do lower Central Bank interest rates encourage economic growth?

Lower Central Bank interest rates decrease the cost of borrowing for consumers and businesses. This encourages them to take loans for various purposes like buying homes, expanding business operations, or financing other spending activities. Such economic behavior increases demand for goods and services, creating a ripple effect that can lead to job creation, higher production levels, and overall economic growth. Additionally, lower interest rates can lead to a depreciation of the local currency, potentially boosting exports by making them cheaper abroad.

What is the role of Central Bank interest rates in managing inflation?

Central Bank interest rates play a pivotal role in managing inflation. By adjusting these rates, central banks can influence the amount of money circulating in the economy. Higher interest rates can help reduce the money supply, ultimately leading to lower consumer prices, as there is less cash chasing the same amount of goods and services. In contrast, lower interest rates increase the money supply and can lead to higher inflation if the economy is near full capacity.

Can Central Bank interest rate changes impact employment rates?

Yes, Central Bank interest rate changes can impact employment rates. When a central bank lowers interest rates, it becomes cheaper for businesses to borrow money, which can lead to capital investments and expansion. This potentially increases the need for labor, thereby reducing unemployment. On the other hand, if a central bank raises interest rates to combat inflation, borrowing costs increase, potentially leading to a slowdown in economic activity and higher unemployment if businesses cut back on spending and lay off workers.