Central bank interest rates impact how we all live. Think about it. From the price of bread to the cost of a home loan, these rates touch every part of your finances. Experts always watch them, because they shape the economy. And not just yours, but the world’s. So, they influence your wallet more than you might think. Let’s dive deep into how these rates decide if you can afford that new car or how much you make on your savings. Get ready, because understanding central bank rates can truly change your financial future.

Understanding Central Bank Interest Rates and Your Economy

The influence of Federal Reserve interest rate decisions on daily life

Let’s dive deep into how the Federal Reserve’s interest rate moves touch your life. Imagine you’re planning to buy a home. The Fed hikes rates. Suddenly, you notice your dream home’s mortgage costs more each month. Why? Higher federal reserve interest rate decisions mean banks lift their own rates. So, loans for homes and cars cost more. It’s like a ripple in a pond. One big stone – the Fed’s decision – makes waves that reach your wallet.

When the Fed talks about raising rates, they hope to slow down how fast prices rise, which is called inflation. If you’ve noticed the price of your favorite snacks going up, that’s inflation in action. The Fed wants to keep it in check by making borrowing costlier. This way, people may think twice before buying costly things on credit.

The global economic impact of interest rates on overall financial health

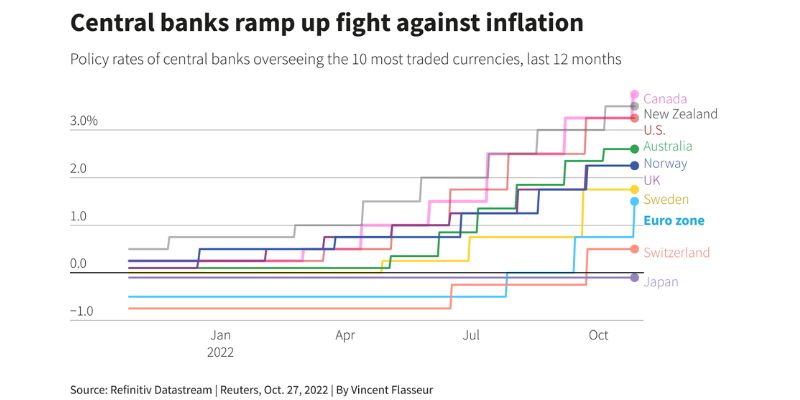

Rate changes don’t just affect one country. They’re like a global tug-of-war. When the U.S. adjusts interest rates, it can cause a stir around the world. For instance, countries with loans in dollars may find it harder to pay back when rates go up. Even businesses outside the U.S. can find it tough to invest as loans become pricier.

But why should you care about global effects? If companies worldwide face higher costs, you might see that reflected in the price of goods on store shelves. Also, if you’re keen on keeping savings in the bank, higher interest rates can be good news for you. Your bank might pay you more for saving with them.

Central banks across the world try to use rates like a tool. They aim to control how fast their economy grows and to keep money flowing smoothly. They want a balance, where businesses thrive and you, the consumer, can afford life’s essentials and extras without strain. It’s complex, yet it boils down to a simple truth: Interest rates matter, from the big picture right down to your pocketbook.

The Ripple Effect of Rate Changes on Inflation and Recession

How do interest rates affect inflation and spending habits?

When central banks tweak interest rates, they aim to control inflation. Higher rates mean loans cost more. People then spend less. This slows inflation. But if rates drop, people can borrow cheaply and spend more. This pushes prices up, possibly causing inflation.

Let’s dive deeper. Say the federal reserve hikes rates. Borrowing becomes pricey. Buying a car on loan might make you think twice. Businesses also feel this pinch. They may hold off on getting new equipment. Then, growth slows. Too much of this and inflation drops, sometimes too much. It’s a fine balance.

Assessing the risk of recession due to interest rate hikes

Higher interest rates can lead to a recession. How? If rates climb too quickly, spending slams on the brakes. Factories might cut shifts, and shops may see fewer customers. Soon, people could lose jobs. No job means less money to spend. This cycle can lead to a downturn in the economy.

That’s the recession risk. Central banks must be cautious. They use data and trends to decide on rate changes. They don’t want to cool down the economy too much. It’s like driving. You tap the brakes to slow down, not stop suddenly. A sudden stop in the economy can cause big problems.

So, central banks like the ECB or the Bank of England track everything. From jobs to home sales, they keep tabs. Their goal is to steer clear of inflation and dodge recessions. It’s a tough job. But it’s vital for keeping our financial future stable.

The International Perspective: ECB and Bank of England

Analyzing ECB rate adjustments and their wider implications

The European Central Bank (ECB) makes big choices about rates. Its decisions reach far beyond Europe’s own turf. So what happens when the ECB changes rates? Well, these moves steer the economy, affecting how much things cost and how businesses grow.

For example, a rate cut by the ECB often makes borrowing cheaper. This can lead people to spend more. But, if rates go too low, it can mean less saving. It’s a careful balance. Higher rates can slow down borrowing and spending but save more. The trick is to keep inflation in check without harming growth.

The significance of Bank of England policy rates in the current economy

Now, let’s chat about the Bank of England and its rates. It sets the cost to borrow money in the UK. These rates shape everything from what you pay for a loan to how much you earn on savings. The Bank of England aims to keep prices stable and avoid big swings in spending and saving. When it hikes rates, your mortgage could cost more, but your savings might grow faster. This can cool down a hot market or help fight rising costs.

Both banks work to prevent too much inflation without triggering a recession. They aim to make sure money keeps moving in the economy. And they work to keep your financial future secure. So, when you hear about the ECB or Bank of England changing rates, think about how it touches your wallet and the wider world.

Personal Finance in the Wake of Interest Rate Adjustments

Impact of interest rates on mortgages and consumer credit

When the federal reserve makes a move, everyone feels it. Take your home loan, for example. If the federal reserve lifts interest rates, your mortgage costs can go up. Why? Because the rate you pay is tied to those big federal moves.

What if you have credit cards or a car loan? Those get pricier too with high interest rates. It means you shell out more money just to cover the extra interest. It’s like a snowball. Costs go up, and you might hold off on buying things.

Central banking and liquidity: What it means for your savings and investments

Now, let’s talk savings and stocks. Central banks like the federal reserve decide on rates to keep the economy steady. When they cut rates, they’re saying, “Hey, spend and invest more – it’s cheap!” It’s like a sale at your favorite store; you want to buy more.

But when rates climb, that’s their way of hitting the brakes. They want to slow things down, make sure prices don’t go nuts. And for your savings? Higher rates can be good news – you earn more just by keeping money in the bank.

It’s all a big balancing act. Central banks change rates to manage how much cash flows in the economy. Too much, and inflation jumps up. Too little, and businesses might not invest. It’s a fine line they walk to keep things smooth.

Remember, when you hear about interest rate changes, think about how your wallet will feel it. It’s not just about the numbers; it’s about your money and your future.

In this post, we dove deep into how central bank rates touch our lives and wallet. We explored how the Fed’s calls on interest impact our day-to-day and the world’s money health. We saw how even small shifts in rates can nudge inflation and might lead to a recession.

We looked far too, at how Europe’s and the UK’s banks control their cash flow, and what that means for us globally. Then we drilled down to your personal cash matters – from home loans to your nest egg.

Here’s the bottom line: changes in interest rates shape our economies and personal finances alike. Staying in the know can help you make smart choices to keep your financial future secure. Keep an eye on those rate changes; they hold more power than you might think.

Q&A :

How do central bank interest rates affect my personal finances?

Central banks influence individual finances by setting the cost of borrowing. When interest rates rise, loans and credit become more expensive, affecting mortgage payments, car loans, and credit card interest rates. Conversely, lower rates can decrease borrowing costs, potentially freeing up more money for spending and investment, whilst impacting savings interest.

What is the relationship between central bank interest rates and inflation?

Central bank interest rates are a key tool to manage inflation. Higher rates can cool off an overheating economy by making borrowing more expensive, thus reducing spending and investment. Lowering rates aims to stimulate the economy, boosting spending and investment but potentially leading to higher inflation if conducted excessively.

Can central bank interest rate decisions predict economic trends?

Decisions on interest rates by central banks can provide insights into economic health. If rates increase, it might suggest efforts to curtail inflation amid strong economic growth. Rate cuts often signal attempts to stimulate a slowing economy. However, myriad factors affect the economy, making predictions solely based on interest rate changes difficult.

How do changes in central bank interest rates impact the stock market?

Stock markets often react to central bank interest rate changes due to their effect on corporate borrowing costs and consumer spending. Higher rates can dampen profits and reduce risk appetite, potentially leading to stock price declines. Conversely, lower rates may lower the cost of capital and stimulate spending, which can buoy stock prices.

Why do central banks change interest rates?

Central banks adjust interest rates to manage economic stability and growth, keeping inflation within target ranges and maintaining employment levels. Decisions are based on several economic indicators, including GDP growth, employment rates, and inflation trends, aiming to balance the economy’s expansion with price stability.