Understanding the central bank role in economy is like learning how to steer a vast ship through rough waters. Like a captain at the helm during a squall, the central bank guides our economic journey. Whether calming inflation, nudging interest rates or ensuring financial health, it tackles waves from all sides. You might not see its crew working, but every move they make keeps us afloat. With the tools of monetary policy in hand, they aim to steady the ship for smooth sailing ahead. Our shared voyage depends on their skill to navigate through the stormy seas of economic uncertainty. Let’s dive into how their decisions affect your wallet and the world.

Central Bank Fundamentals: Navigating Monetary Policy and Economic Stability

The Dual Role of Money Supply Regulation and Interest Rate Adjustments

The central bank has two big jobs. First, it handles the money supply. Second, it changes interest rates. Let’s dive into why these matter so much.

The money supply is all about how much money is out and about in the economy. If too much money chases too few goods, prices rise. That’s inflation, and nobody likes that, right? The central bank pumps money into the economy or pulls it back to keep things stable. It’s like a DJ turning the volume up or down at a party.

Interest rate adjustments are the central bank’s way of making borrowing cheaper or pricey. Lower rates mean you can borrow money for less. Businesses and people spend more, and the economy can grow. Higher rates do the opposite, they put the brakes on spending.

These tools are key. They help a central bank lead the country towards a healthy economy. Imagine trying to sail a boat in stormy weather. That’s what central bankers do – steer the economy through ups and downs.

Inflation Control and Its Impact on Economic Growth

How does the central bank control inflation? With a neat trick called interest rate adjustments. When prices start climbing too fast, the central bank may hike interest rates. By making loans more expensive, they can slow down the economy’s engine. People spend less, demand drops, and so do prices.

But it’s not all about keeping a tight leash. Sometimes, the economy needs a boost. Then the central bank might lower interest rates. This fires up spending and can help the economy grow. It’s a delicate balance, like walking a tightrope.

Inflation control is like keeping a campfire steady. You don’t want it to burn out or to start a forest fire. The central bank’s job is to add logs carefully or splash water when needed.

Both money supply regulations and interest rate tweaks aim to keep the economy humming. They are not perfect, but they get the job done most of the time. With these tools, the central bank tries to hit two birds with one stone: Keep prices stable and help everyone who wants a job get one.

No one said it’s easy to steer a giant ship like the economy. But that’s what central bankers sign up for. They wake up every day to keep the economy sailing smooth. So next time you hear about central banking or monetary policy in the news, you’ll know exactly what’s going on behind the scenes.

Advanced Monetary Tools: Quantitative Easing and Open Market Operations

The Mechanics and Effects of Quantitative Easing on the Economy

Imagine a ship in rough seas. Central banks work like skilled captains. They guide the ship to calm waters. One tool they use is called quantitative easing.

Quantitative easing is quite simple. Central banks buy lots of government or other assets. They do this to put more money into banks. This makes it easier for people to borrow and spend. The goal is to speed up economic growth.

When central banks buy these assets, they create new bank money. This might sound like magic. But it’s just part of their economic toolkit. They use this to help when the economy slows down. This can lead to more jobs and sales. It boosts the economy when it needs a push.

Still, some folks worry. They fear this could cause too much inflation. Inflation means prices go up and money buys less. Central banks watch this closely. They aim to keep inflation just right. Not too high, not too low, but stable.

Open Market Operations as a Pillar of Central Banking Strategy

Now let’s think about open market operations. These are day-to-day moves. Central banks buy or sell government bonds. This affects how much money banks can lend.

If a central bank wants to lower interest rates, they buy bonds. This adds money to the economy. It’s like giving more wind to the ship’s sails.

When they sell bonds, the opposite happens. They take money out of the economy. This can help keep inflation in check. It’s like pulling in the sails to slow the ship down.

Why do these moves matter? Central banks aim to keep money flowing just right. Too much, and we get inflation. Too little, and the economy might stall. Imagine a garden hose. You want enough water to flow to keep the garden green. But if you open it too much, you flood the garden. If you open it too little, plants dry up.

Central banks use open market operations to find that balance. They ensure money flows smoothly through the economy. This helps make sure prices stay stable and people have jobs.

Both tools help central banks steer the economy. They’re like dials and gauges on the ship’s control panel. Central banks watch the economy’s horizon. They adjust these tools to sail smoothly through stormy economic seas. They keep our ship on course, aiming for a future of steady growth and jobs for all.

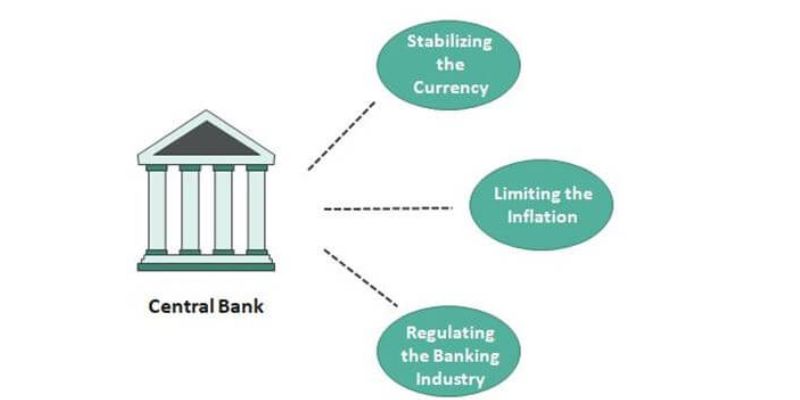

Central Bank as Guardian and Regulator: Ensuring Financial System Health

Lender of Last Resort: Preventing Financial Crisis and Providing Liquidity

When banks face rough times, the central bank stands tall, like a sturdy lighthouse. It is there for banks when they need money fast to keep running smoothly. This crucial job is known as the lender of last resort. When other banks can’t help, the central bank jumps in to lend a helping hand.

Just like a doctor rushes to stop the bleeding, the central bank quickly provides money or liquidity to stop a bank from failing. This act is like a bandage, stopping worse problems like spreading fear and stopping cash flow in our economy. It’s a big, important job that keeps banks from going under and makes sure cash keeps moving around.

When you hear “open market operations,” think of a central bank as a captain steering the economy ship. With a steady hand, it buys or sells government debt. This buying or selling controls how much money is out in the world. The goal? To make the journey smooth, even when the economy faces big waves. This precise control helps us all reach our jobs: smooth sailing and avoiding the stormy seas of recession.

Banking Oversight and the Importance of Financial Supervision

The central bank also acts like the economy’s guardian. It watches over banks to make sure they stay healthy and play fair. This job is banking oversight. It is super important for making sure our money is safe. When a bank looks after your money, you want to trust it will be there when you need it. The central bank sets rules to make sure that happens. These rules, like seat belts in a car, protect you and your money.

Financial supervision is another way the central bank shields the economy. It’s just like a teacher who looks over a class, making sure everyone is doing what they should. The central bank checks banks for any funny business and teaches them how to be better. This helps prevent crashes before they happen. No one likes a surprise, especially when it comes to the safety of their money.

The health of the financial system is super key and it’s the central bank’s job to keep it strong. It can adjust the reserve requirements. This means changing how much money banks must keep on hand. If the economy is slow, it can lower the amount to kick-start lending and help things grow. If things are too fast and prices rise too much, it can tell banks to hold more money back. This helps cool things down and keeps prices steady.

A central bank’s role in managing the economy is big and complicated, but these are the basics. Think of it as the heart of the financial system, pumping life through the economy with each decision.

They always aim for price stability and solid job numbers. To do it, they keep their eyes on money moving around and the cost of borrowing. But it’s not a solo gig. How they work with the government’s spending and tax choices matters too.

In the end, they work hard to make sure our money is worth the same tomorrow as it is today. And that, my friends, is what keeps the economy ship afloat in stormy and sunny weather alike.

Steering the Economic Ship: Monetary Policy Decisions in Challenging Times

Expansionary vs. Contractionary Monetary Policy in Response to Economic Signals

Imagine a ship in a storm. Like a captain, a central bank guides the economy. It uses monetary policy like a wheel, to keep the ship steady. Steering involves two main moves: expansionary and contractionary policy. Expansionary policy is like a push forward. When the economy slows, the central bank cuts interest rates. It makes borrowing cheaper. Businesses invest, hire more, and growth kicks in.

Now, what if prices soar too high? That’s where contractionary policy comes in. It’s like pulling back on the reins. The central bank raises interest rates, making loans pricier. This slows spending and cools down inflation. Keeping the right balance is tough, but central banks aim to do just that. They want stable prices and lots of jobs.

Sometimes, like in a big storm, a regular push isn’t enough. Here, central banks may opt for quantitative easing. They buy government debt or other financial assets. This pours more money into banks. Banks then lend more easily, helping the economy on its way. But this is a big move, saved for tough times.

Central banks also control how much money banks must hold – these are called reserves. They influence how much cash banks can lend out. More reserves mean tighter control, fewer loans, and a slower economy. Fewer reserves have the opposite effect, revving the economy up.

Coordinating with Fiscal Policy and Central Bank Independence Concerns

There’s another player in this game – the government. It controls fiscal policy – that’s how it spends and taxes. Fiscal policy works hand in hand with monetary policy. But they must play well together to sail the ship smoothly.

Central bank independence is key. It means central banks can make choices without political pressure. This lets them focus on long-term goals like stable prices and steady work for people. But they must talk with the government to align their strategies.

Central banks also keep an eye on financial systems. They watch over banks, making sure they’re safe places for people’s money. If a big bank struggles, the central bank helps out. It acts as a lender of last resort, giving loans when others won’t. This helps stop bigger money problems in the economy.

So, the central bank’s role is vast and vital. They tweak interest rates, manage the money supply, and help banks in crisis. By doing all this, they aim for a healthy economy with good jobs and steady prices. It’s like guiding a ship through calm and stormy seas alike. The central bank’s hands on the wheel keep us sailing forward.

In this post, we’ve unpacked how central banks play a vital role in our economies. From handling money supply and interest rates to keeping inflation in check, they help ensure growth and stability. We explored sophisticated tools like quantitative easing and open market operations, seeing how they influence financial health.

Beyond that, central banks stand as financial system guardians, ready to step in during crises. Their oversight maintains order in banking and the broader financial arena. In tough times, they must decide between expansionary and contractionary approaches, weighing their independence against fiscal policy ties.

My final thought is this: the central bank’s steering of our economic ship is complex but crucial. Their actions resonate through our lives, shaping the health and future of our economy. Understanding their role can help us all grasp the bigger financial picture that affects us daily.

Q&A :

What is the primary function of a central bank in an economy?

The central bank plays a pivotal role in managing a nation’s currency, money supply, and interest rates. It oversees the financial system’s stability and acts as a lender of last resort to the banking sector during times of financial distress. In many countries, the central bank also formulates and executes monetary policy to control inflation and maintain price stability, contributing to economic growth.

How does a central bank influence the country’s economy?

A central bank influences a country’s economy by setting key interest rates, regulating the money supply through open market operations, and maintaining the stability of the financial system. By adjusting interest rates, a central bank can either encourage spending and investment during economic downturns or curb inflation during periods of rapid economic growth. These actions directly impact employment, consumer spending, and the overall health of the economy.

Can the central bank control inflation, and if so, how?

Yes, the central bank can control inflation by using various monetary policy tools, such as adjusting the benchmark interest rate and altering reserve requirements for commercial banks. By raising interest rates, the central bank can reduce the availability of credit, thus lowering consumer spending and business investment, which in turn slows down inflation. Conversely, lowering interest rates can stimulate the economy and increase inflation if it is below the target level.

What role does the central bank have in regulating banks?

The central bank has a significant role in the regulation and supervision of banks. It ensures that commercial banks operate under sound financial practices, follow minimum capital requirements, and are adequately supervised. The central bank also conducts stress tests to ascertain the resilience of banks to financial shocks. In providing regulation, the central bank aims to maintain the safety and soundness of the banking system and protect the interests of depositors.

How does central bank policy affect employment and wages in an economy?

Central bank policy can affect employment and wages through its influence on economic activity. By managing interest rates and the money supply, the central bank can stimulate or slow down the economy. For example, lower interest rates tend to reduce the cost of borrowing, leading to more investment and hiring, which can, in turn, increase demand for labor and potentially push up wages. Conversely, when the central bank raises rates to cool down an overheated economy, employment and wage growth may slow down as businesses reduce spending on expansion and hiring.