Combining technical and fundamental analysis isn’t just a strategy; it’s an art. You’ve probably heard all the buzz about one or the other, but it’s when you fuse them that the real magic starts. Think of it this way: it’s like having a superhero duo instead of a lone ranger to tackle the investing world. While technical analysis lets you read the market’s pulse through charts and patterns, fundamental analysis dives into a company’s very heartbeat — its financial health and market position. As your trusty guide, I’ll walk you through how leveraging both can sharpen your trading edge. Ready to boost your trades with a dual approach? Let’s dive in and unlock the power of this ultimate investing fusion.

Understanding the Synergy of Technical and Fundamental Analysis

The Intersection of Chart Patterns and Economic Indicators

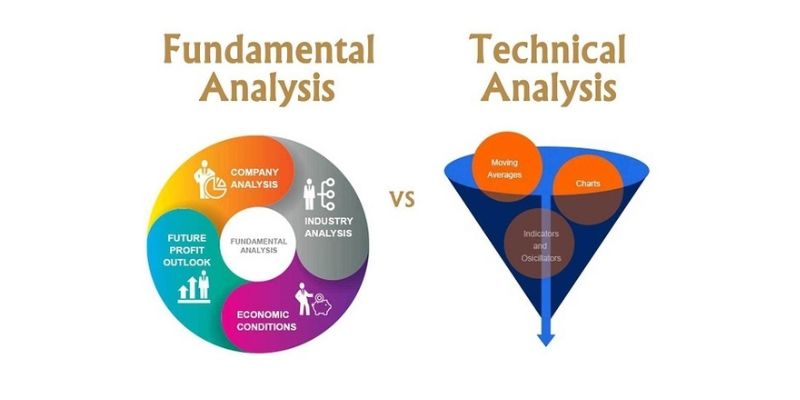

When I look at charts and crunch numbers, it feels like solving a puzzle. Combining market analysis strategies gives me a clear picture. I use technical analysis principles every day. They help me see the direction a stock might move. Knowing about chart patterns and economic indicators is key. They tell us how companies do within the bigger economy.

Integrating technical with fundamental indicators seems tough, but it’s not. It’s like playing two instruments at once to make great music. Market analysis dual approach helps me a lot. It tells me when both the company and the market look good. This is when I know it’s a good time to act.

Synergistic trading methods are like a secret weapon. They help me outsmart others in the stock game. I blend analysis types in trading every chance I get. It’s like making a smoothie with the best fruits to get a health kick. Enhancing trading strategy this way means smarter moves and better chances at winning.

Enhancing Trading Strategy with a Dual Approach

Moving on, I love to talk about mixing it up with advanced investment analysis. It’s like putting together a team where each player has a unique skill. Incorporating fundamental data with technical charts is smart. It shows if a stock is not just looking good on paper but also in the market.

Price action combined with company health helps me pick the best stocks. Think of it as choosing players for a basketball team based on skills and fitness. Mixed analysis for stock selection is my go-to play. It makes me feel like a coach with a top team.

Investment analysis hybrid methods have another perk. They help figure out the real value behind stocks. Asset valuation cross-analysis is like knowing both the recipe and the taste of a cake. It tells me if the stock is as good as it seems.

Imagine trading signals and financial performance holding hands. That’s what I do. Marrying chart trends with income statements gives me the full story. I get to see the health of a business and how others feel about it in the market.

Macroeconomic factors with technical signals give me a heads-up on a stock’s future. It’s like having a crystal ball which shows how things might turn out. It guides me to tell if the stock will rise or fall.

In short, when I mix it all up, I aim for harmony. I look for ways that both technical indicators and financial ratios sing together. Risk assessment with technical and fundamental makes dealing with ups and downs easier. Stocks often move before earnings reports even come out.

Using a combo like this for my trading strategy is fun. It feels like both scouting the terrain and having the best map. I hope more traders hitch a ride on this method. It’s like using a super-powered GPS for trading success.

Diving into the Mechanics of a Combined Analytical Method

Technical Analysis Principles and Their Application

When trading, I use a map called technical analysis. Think of each stock chart as a map that shows past price moves. Patterns on these maps can hint where prices might head next. Some common patterns include triangles and “head and shoulders.” They are like landmarks, helping to track where we are.

To apply these principles, I often use price action. This is a fancy term for changes in stock prices over time. I look for trends like an uptrend, where prices are climbing, or a downtrend, where they’re falling. With these tools, I get strong clues about future market moves.

But I don’t stop there. I blend these chart clues with financial health checks, such as how much money a company makes or owes. This helps me know if the stock deserves its chart’s story. For example, if a stock’s price is jumping but the company is losing money, this signals a risky buy.

Incorporating Fundamental Data within Technical Charts

Mixing chart patterns with money facts is key. This means using both technical analysis and company reports. Fundamental data includes sales, profits, and how much debt a company has.

When these two ways of looking at stocks join hands, it’s powerful. For instance, if the chart shows an uptrend and the company has good sales, it’s a strong signal. The opposite is also true. A good-looking chart can’t hide poor company performance for long.

Once, I found a stock with a pattern that suggested it was about to rise. But its sales were falling, and debt was high. I held on buying. Sure enough, the stock fell soon after. Chart patterns and financial facts told me that something was not right.

This blend, or synergy, of market analysis is crucial for picking stocks. It considers both the mood of traders and the actual company performance. Together, they form my map for trading. They guide me when to buy or sell, enhancing my chances for success. If the chart and the financials agree, I’m more confident in my choice.

Integrating market analysis strategies is like a dance between numbers and patterns. Marrying chart trends with income statements is an art. It helps me see the long-term picture and keep my money safe. By respecting both technical signals and macroeconomic factors, I can avoid quick losses and aim for long-term gains.

Just like a seasoned explorer trusts their compass and map while respecting the terrain, I trust my mix of analysis when choosing my trading path. It’s a full-circle view of every stock, where I assess risk and look deep into a company’s story. It turns trading into a well-thought-out journey rather than a wild guess. And in the world of investing, being prepared with the right tools – a mix of analysis types – can make all the difference.

Practical Insights: Applying Mixed Analysis for Sound Investment Choices

Marrying Chart Trends with Income Statements for Long-Term Trends

When we talk about making smart money moves, combining market analysis strategies is key. Imagine charts and numbers getting married. They form a pair that’s hard to beat. Chart patterns show us the price moves. Income statements tell us if a company’s making money. Together, they light the way for long-term investing.

Let’s say I see a stock price going up on the chart. That’s a good sign, right? But, if the company’s income is down, that could mean trouble. This mix warns me to think twice before buying. We blend both views to see the big picture. We check if a company is healthy and if other buyers like it too.

Risk Assessment Through the Lens of Technical and Fundamental Data

Risk is like weather for investors. We want sunny days, not storms. By combining technical analysis principles with info from balance sheets, we can often see risk before it hits. This is like having a good weather forecast.

When prices on charts move a certain way, we call these “trading signals.” We then ask, “What do the company’s money details say?” If a chart shows a stock dropping and the company owes lots of money, then watch out! Risk might be knocking on the door.

Now let’s consider the whole market. Economic news can push prices around. Interest rates, jobs, and sales numbers all make waves. Technical charts and company reports together tell us if these waves can shake our stocks.

In short, when you mix analysis types, you’re armed with more info. This can make you a better stock picker. You can see if a stock price is fair and if a company can weather storms. You step into trades with your eyes wide open.

By looking at earnings reports and charts together, we learn a lot. We see how news changes what traders think. This can move prices in a flash. Stock picking using combined analyses gives us an edge. It guards our cash and helps us grow it.

Being right about the market feels great. Making money from that bet is even better. Combining technical with fundamental indicators can turn guesses into smart bets. It’s like turning your gut feeling into a game plan.

So next time you look at stocks, think marriage. Let charts and numbers tie the knot. It’s a match that could make your investments live happily ever after. It shows us not just when to get in, but also when it’s time to step back. This way, we won’t get caught in those nasty storms. We’ll stick around for the sunny days, that’s where the money grows.

Mastering Market Timing: Integrating Macro and Micro Analytical Tools

Leveraging Financial News with Chart Trends for Optimal Entry and Exit

Have you ever wondered how to pick the best time to buy or sell stocks? It’s like finding the right time to jump onto a moving train. Not too early, and never too late. As an investor, you must watch the market like a hawk.

So, how do we do it? We mix two secret sauces – breaking news and chart analysis. This blend helps us pinpoint those sweet moments to enter or exit a trade. Think of it as matching what you see on the news with what the charts are whispering.

When a big company event hits the news, it can shake up stock prices. This news could be about new products, earnings reports, or big deals. We keep an eye out for these news bits.

Then, we dash over to the stock charts. We look for patterns that tell us what might happen next. Using both news and charts, we make smarter choices on when to get in or out. It’s like holding a map and a compass on a treasure hunt.

Portfolio Diversification and Volatility Patterns with a Comprehensive Analysis Blend

“Diversify.” That’s the golden rule of investing. It means spreading your money into different types of investments. This is so you don’t put all your eggs in one basket. It’s a shield against the wild swings of the market.

Now, let’s talk about being smooth in a bumpy market. Volatility patterns. These are like the mood swings of the stock market. Sometimes happy, sometimes mad. We must keep calm and carry on.

How does combining market analysis strategies help? It’s like having both a weatherman and a farmer’s almanac. One tells you today’s weather, the other predicts the season’s patterns. By mixing technical analysis principles with chart patterns and economic indicators, we get a clear picture.

We track things like how often stock prices jump around. We also watch the big picture – the economy, interest rates, and more. This way, we can guess how rough or calm the market sea will be.

Advanced investment analysis ties this all together. It’s more than just connecting the dots. It’s like weaving a net to catch the right fish – or in our case, the right stocks.

Now, let’s get real. This kind of work is not a walk in the park. It takes skill and patience. But for those who master it, the payoff is big. You can make better picks, avoid nasty surprises and sail smoother through rough market waters.

Here’s a handy tip for traders and investors. Always combine technical indicators with financial ratios. Look for candlestick patterns and check the balance sheet too. This way, you’re armed with the best tools.

Remember, good investing is about being smart and ready. It’s a mix of art, science, and a little bit of magic. So keep your eyes peeled on both the news and the charts. They’re your compass to successful investing.

We’ve covered a lot about blending technical and fundamental analysis to make smarter trades. By understanding how chart patterns work with economic indicators, you can improve your trading strategies. Remember, it’s about using both methods — not just one.

In our deep dive, we discussed how technical analysis principles work and how you can include key financial data within those charts. This helps you see the full picture and make better choices.

Practical insights help too. For example, when you combine chart trends with income statements, you can spot long-term changes more clearly. And, by looking at risks through both technical and fundamental data, you keep surprises to a minimum.

Finally, we looked at how we can use big financial news and small chart changes together to choose the best times to buy or sell. When you mix these tools right, you can diversify your portfolio and manage the ups and downs of the market well.

Using both technical and fundamental analysis isn’t just smart; it’s essential for staying ahead. So, let’s take these insights and make choices that can help us thrive in the markets!

Q&A :

Can you combine technical and fundamental analysis for better investment results?

Combining technical and fundamental analysis can potentially lead to better investment results as it allows investors to evaluate stocks from different perspectives. Fundamental analysis looks at a company’s financial health, management, and market position, while technical analysis focuses on price movements and trading volumes to identify patterns and trends. By using both, investors gain a more comprehensive understanding of both the company’s value and market sentiments.

How do technical and fundamental analysis complement each other?

Technical and fundamental analysis can complement each other in several ways. For instance, while fundamental analysis can help identify which companies are financially strong and have growth potential, technical analysis can pinpoint the optimal times to enter or exit a position in those companies based on market trends and investor behavior. Together, they can help refine an investor’s strategy for when to buy and sell, in addition to what to invest in.

What are the benefits of using both technical and fundamental analysis?

The benefits of using both technical and fundamental analysis include a more holistic approach to investing, improved timing for transactions, and the potential for reduced risk. By considering both the intrinsic value of a security and the market’s price movements, investors can make more informed decisions that align with both long-term business performance and short-term market opportunities.

Are there any drawbacks to combining technical and fundamental analysis?

One potential drawback is the complexity and time requirement of mastering both analysis methods. Additionally, conflicting signals can sometimes arise between technical and fundamental readings, making it challenging to decide on a definitive investment strategy. However, many investors believe that the benefits of a combined approach outweigh these challenges.

Which should I learn first: technical or fundamental analysis?

The choice of which analysis to learn first largely depends on your investment goals and style. If you are interested in understanding a company’s intrinsic value and long-term growth potential, you may prefer to start with fundamental analysis. Conversely, if you’re more focused on short-term trading and price patterns, technical analysis might be your preferred starting point. It’s beneficial to have an understanding of both to create a balanced investment approach.