Evaluating the Success of ESG Investing: everyone’s talking about it. But is it the gold mine it’s pegged to be? As an expert, I’ve seen buzzwords fly by. Few stick. ESG seems different. It promises profits and keeps your moral compass in check. So, let’s slice through the noise. How do we measure if it’s really hitting its marks? I’ll guide you through the facts—no fluff, just clear-cut insight. We’ll dig into performance metrics, compare strategies, and explore the real impact of ESG on both wallets and the world. Get ready to know if it’s the real deal or just good PR.

Understanding ESG Investment Performance Metrics

Identifying Key Criteria for ESG Success

Do you wonder if ESG investing really pays off? You’re not alone. People ask, “Does being good lead to good returns?” I’m here to show that the answer can be a solid “Yes”. Let’s break it down.

First, what’s key for ESG success? We look at three things: People, planet, and profit. We want our investments to help not harm. We seek companies that take care of their workers and our world. They should still make money though. That’s where the “profit” part comes in.

Knowing what makes ESG work helps us pick better. We want solid ESG ratings and good returns. It’s like checking a car’s fuel efficiency and speed. Both matter. ESG investing is not just about being nice. It’s about being smart with our money, too.

Comparing ESG Investment Strategies and Their Outcomes

Now, why does this matter? Picking where to put our money is a big deal. We all want our cash to grow. We don’t want it to hurt others or our planet. We’re now getting much better at measuring how green or how good a company really is. This helps us see who’s just talking and who’s doing.

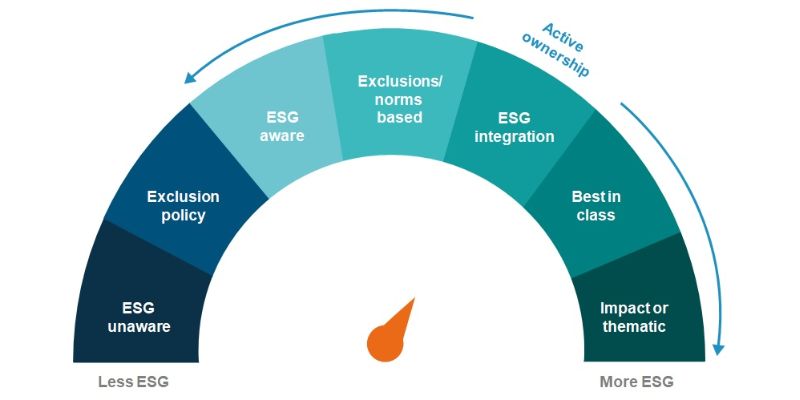

We also look at different ESG strategies. Some bet big on green tech. Others focus on worker rights or keeping water clean. By comparing these, we can see which do best. If more money goes into these good-doing firms, they can do more good. It’s that simple.

And don’t forget the money side. Firms that score high on ESG do well often. When companies care about more than just profit, they can last longer and do better. They can avoid fines, keep their workers happy, and have customers who love them. That’s good for the wallet!

In short, measuring ESG isn’t just about being ethical. It’s about making sure that being good also means doing well financially. With the right picks, we can smile all the way to the bank and make the world a better place while we’re at it. That’s smart investing.

The Relationship Between Sustainability and Long-Term Financial Returns

Analyzing the Long-Term Impact of ESG Integration on Investments

Do you know if adding ESG to investing really helps you make more money over time? The answer is often yes. The reason lies in how we pick companies to invest in. When they care for the planet, people, and how they run, they tend to do well. They can dodge lawsuits, keep loyal workers, and plan better for the future.

We look at ESG investing performance metrics to see this in action. They show us if companies with high ESG scores perform better than those without. But it’s not just about scores. We must see the whole picture. We look at their history with the planet and people, their plans, and how they lead.

Some will ask how we tell if ESG investing is doing its job. It’s not just about more cash. Success has many sides. It’s also about causing good change, right? For ESG success, we see how a company moves us towards a world that’s good for all. This is key: good for earth, good for people, and yes, good for wallets too.

To find out, we dig deep. We check how their work fits with caring for the planet. We see if they truly treat workers and other people well. Lastly, we look at how they lead. Are they open about what they do? Do they make smart choices for the long haul? When all these match, it often leads to a win all around.

Real-world Case Studies: Financial Benefits and Ethical Dimensions

Now, let’s get real. How does this work in the real world? Case studies give us the proof. Let’s talk about one company that took the ESG road. It made changes to hurt the planet less. It made sure its workers were happy and it ran right and true. And guess what? It started to earn more. Investors took note. The company grew.

Another key point is green investing outcomes. They’re proof that putting your money where it helps the planet can bring returns. We’re seeing more social governance investing results that tell the same story.

But how do we track ethical investment? It’s about more than just money. We follow what’s known as the triple bottom line. It counts planet care, people care, and yes, making money, too. It shows us that doing right by the earth and people can also lead to cash wins.

Then there’s ESG fund performance comparison. It’s how we spot which funds do what they say. By checking these, we can pick where to put our money with confidence. This is how we mix making money with doing good.

In the end, we can’t just hope our investments do well. We must pick them smart and check that they keep to their word on ESG. This way, we help the world get better and we can still aim for a nice profit. That’s how ESG investing makes sense in both the wallet and the heart.

Navigating ESG Investment Benchmarks and Ratings

Understanding the Significance of ESG Ratings and Performance Tracking

To win at ESG investing, we need great tools. Think of ESG ratings like a compass. They guide us to make sure our money does good in the world. They tell us how planet-friendly, fair, and well-run companies are. Firms with high ESG scores often do better over time. They face fewer lawsuits, attract top talent, and have loyal customers.

But what’s behind these ESG scores? Experts look at lots of data, like pollution levels, worker treatment, and how bosses make decisions. They score each part, then add it up. This tells us if a company thinks about more than just money.

Now, why do these ratings matter? They help us see who’s really walking the talk. Don’t be fooled, though. Some companies may look green outside but aren’t really. We call this “greenwashing.” It’s like wearing a superhero costume but not saving the day. ESG ratings help us spot these fakes.

To sum up, ESG ratings are our superpower. They help us pick stocks that are not only good for our wallets. They’re good for people and our planet too.

Utilizing ESG Benchmarks for Portfolio Evaluation and Risk Management

Next up, let’s talk about ESG benchmarks. Benchmarks are like race tracks for investments. They help us see if our ESG choices are winning or need a tune-up. These tracks show us the best path to take our money further.

We’ve got different tracks, or benchmarks, for different goals. There are ones for clean energy, gender equality, and many more. Using these, we can compare our investments to others and see who’s ahead.

Why does this matter? Well, just like in racing, you want a car that’s fast but also safe. With ESG benchmarks, we find investments that grow fast and last long. They help us dodge those big money holes like scandals or disasters that can slow us down.

By checking these benchmarks, we can also tell if our investments match what we care about. They also show us if we’ve put too many eggs in one basket. That could be risky.

In simple words, ESG benchmarks are our race guides. They help us stay on track, go fast but safe, and cross the finish line as winners. They show us how to invest with our heads, but also our hearts.

To wrap it up, ESG ratings and benchmarks together are like our investment super team. They give us the power to pick winners, dodge risks, and do good for the world. That’s smart money at its best.

Trends and Results in ESG Investment Vehicles

Growth and Performance of ESG Index Funds and Asset Classes

Let’s dive right into ESG index funds. These funds mirror a set of stocks focused on environmental, social, and governance values. They’ve been growing fast. More people want their money to do good while it grows. Now, what are the returns like? ESG index funds often match or beat other funds. Why? Companies that focus on ESG can be better run and less risky.

We’ve seen ESG-focused asset classes rise, from stocks to bonds. They cover tons of areas, like clean energy or fair labor. This growth shows investors and companies care about more than just cash. It’s about health, people, and our world. Is this growth a trend or the new normal? Many signs point to ESG being here to stay. Big investment firms are not just joining in; they’re leading the way.

Another cool point is that these funds help spread out risks. If one area hits trouble, you’ve got others to lean on. Smart, right?

The Role of Shareholder Activism in Influencing Corporate ESG Initiatives

Now, let’s talk about shareholders sparking change. You might wonder, how do investors influence companies? They buy stocks and get a voice. They use this voice to push for changes inside companies, like cutting pollution.

Shareholder activism makes real waves in corporate behavior. It’s not just talk; it’s about action that leads to a better world. These actions set examples and shine a light on good and bad corporate deeds.

When a big investor like a pension fund steps up, it’s a big deal. They can vote at big meetings and push for better ESG practices. They also make companies think hard about their choices and the planet. For example, if a company’s not green enough, it risks losing investors’ support. This can shake things up to create positive change.

Activism can lead to better company results and a cleaner, fairer world. It’s a win-win. With these tools, we see not just what companies say but what they do about ESG values.

Each ESG fund has its own goals. Some focus on the environment more than others. But they all aim to make money while doing right by the planet and people. Choices might seem complex, but they line up profits with our values. It’s not just about doing good; it’s also about smart investing.

Are these strategies effective? By and large, yes. Many ESG funds and actions lead to success on two fronts: our wallet and our values. We get to support what’s right while securing our future. It’s a way to ensure our money talks and walks the path we believe in.

The bottom line is, ESG is no longer just a nice-to-have. It’s a must for those who want to invest responsibly. And it’s proving to be good for returns as well. The key is to keep our eyes on the ball and invest in ways that can help the world and our own futures.

In this post, we looked at how smart ESG investment can pay off. We explored key criteria for ESG success and checked out different strategies. It turns out, thinking about sustainability often leads to better cash in the long run. Real stories showed us the good that comes from mixing money with morals.

We also dove into how to use ESG scores and benchmarks to spot great investments and dodge risk. Last, we saw how ESG funds are growing fast and how investors can push companies to do right by the planet.

Here’s the bottom line: ESG investing is about more than money. It’s smart, it’s growing, and it can help shape a world we’re all proud to live in. Keep these ideas in mind as you plan your next smart move in the investing game.

Q&A :

How is ESG investing performance measured?

The performance of ESG investing is typically measured using standard financial metrics integrated with ESG-specific factors such as sustainability reports, ESG scores, and ratings from third-party agencies. Additionally, ESG benchmarks and indices like the MSCI ESG Leaders Index may be used to compare the performance of ESG-driven investments against conventional portfolios.

What are some common ways to evaluate the success of ESG initiatives within an investment?

To evaluate the success of ESG initiatives, investors may look at the change in ESG scores over time, the direct impact on environmental practices, or improvements in social governance matters. Furthermore, the alignment of investment outcomes with the Sustainable Development Goals (SDGs) and positive shifts in stakeholder perception can be indicators of ESG success.

Can ESG investments perform as well as traditional investments?

Yes, ESG investments can perform as well as or even outperform traditional investments. Studies have shown that ESG investments often have similar or better risk-adjusted returns compared to their conventional counterparts. One reason could be that ESG practices can lead to better risk management and more sustainable long-term growth.

What challenges are there in evaluating the success of ESG investing?

Evaluating the success of ESG investing presents challenges, such as a lack of standardized metrics, varying definitions of what constitutes an ESG investment, potential greenwashing, and the need for more consistent reporting practices. Furthermore, the long-term nature of ESG benefits may not be captured in short-term financial analysis.

Why is ESG investing becoming increasingly popular?

ESG investing is gaining popularity due to a growing recognition that sustainable business practices can contribute to long-term financial performance. Investors are also showing a greater interest in aligning their investments with their personal values and societal goals. Additionally, the increasing awareness of climate change and social inequalities is driving more investors towards ESG-focused strategies.