As we stare down the barrel of 2024, whispers of fastest growing emerging economies 2024 turn into roars. You’re not just thinking about where to clock the next big boom, are you? No, you’re itching to lead the pack—to know which emerging economies will skyrocket, and why their stars are shooting so high. Here’s the deal: I’ve dug deep into the trends, dynamics, and forecasts that will define tomorrow’s power players. From Asia’s tech hubs crafting the future, to Latin America’s markets pulsing with potential, I’m giving you a front row seat to the action—as long as you’re up for the ride. Buckle in—we’re about to see which countries are ready to sprint ahead, and what it all means for you and your wallet.

Understanding the Surge in Emerging Market Growth 2024

Key Drivers Behind Rapid Economic Expansion

Let’s dive straight into what’s making some countries grow so fast right now. Good policies, smart tech use, and loads of young workers all matter a lot. Money from outside also helps. When a country does these things right, they can grow super quick.

Now, these places are not rich already. But they are working hard to get there. They make more stuff and start new businesses. More trade with other countries helps too. This is all great for their money, called GDP, to go up.

Projected High-Growth Regions and Their Unique Traits

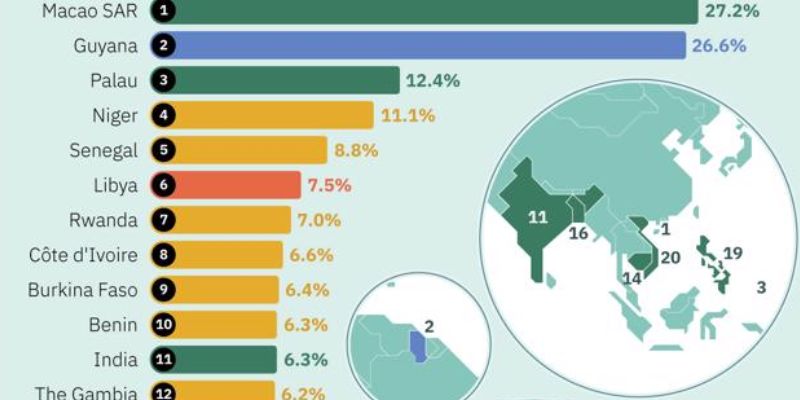

Ever wonder which countries will grow the most in 2024? Let’s find out. Africa, Asia, and Latin America are on the list. They are very different but share something special: big promise for more money and jobs.

These places have lots of room to grow. Some countries, like Vietnam and Bangladesh, make a lot of things to sell to other countries. This makes them strong and able to grow extra fast.

Now let’s think about Latin America. It’s got a mix of big and small countries, each with exciting chances for growth. Mexico and Brazil, for example, have huge industries and rich natural stuff like oil and metals.

Africa has its own story. From Nigeria to Kenya, many people do business on their phones. This is huge. It makes things like banking way easier for many people. It’s a big reason why they can grow so much.

So, what’s this all mean for you? If you have some money to invest, these places could be good bets. But remember, sometimes they can be a bit risky too. It’s smart to learn as much as you can before you dive in.

Hey, it’s not just about money. A better life for people in these countries matters too. When jobs are easy to find and businesses do well, everyone wins. It’s cool to see people getting what they need to live happier lives.

As for me, I keep a close eye on these hot spots. We’re seeing history happen right now! Places that were quiet before are now making some serious noise on the world stage. It’s not just interesting — it’s a huge chance for them to shine.

Every day, I see new data and stories that make me excited for these emerging markets. We’re talking about a major shift that could change the future for millions. And I’m all for being part of that, aren’t you?

Deciphering High-Growth Countries 2024: Asia, Latin America, and Africa

Asia’s Fastest Growing Economies and Contributing Factors

Let’s dive into what’s shaking things up in Asia’s dynamic economies. We’re seeing nations like Vietnam and Bangladesh steaming ahead with growth rates that leave others in the dust. What’s driving this surge? It’s a mix of tech upgrades, a growing middle class, and clever trade moves. Smart investment is also key. Building roads and factories creates jobs and fuels more trade.

These hot spots are not just about cheap labor anymore. They are rocketing forward by making stuff the whole world wants. From smartphones to solar panels, they’re climbing up the value ladder. You’ve got a population eager to work, learn, and earn more. And guess what? This hunger is turbo-charging their economies.

Now, don’t forget India. This giant is sprinting ahead as its tech scene explodes. They’ve got a bunch of young people coming online and a government that’s getting serious about digital life. All these bits add up to a big leap in growth.

Latin America’s Economic Rise and Africa’s Surging Economies

So what’s the buzz in Latin America and Africa these days? Places like Chile and Panama are pulling ahead. They’re picking up speed with smart business laws and solid money management. Over in Africa, nations like Ethiopia and Rwanda are on the rise. They’re building like crazy and hooking up more people to power and the net.

Here’s the cool part. They’re not just digging stuff out of the ground anymore. They’re making their own goods and selling ideas. This shift is what’s putting them on the fast track to riches. The secret sauce? Leaders with brains and plans for the long game.

Now, these regions aren’t just growing fast. They’re becoming magnets for cash from investors who smell opportunity. The deal is simple. They’re young, they’re plucky, and they’re hungry for success. That’s a mix that could pay off big for those willing to take the leap.

All these regions, each with their own recipe for growth, share something special. They’re hungry for success, ready to adapt, and open for business. What’s not to love?

Look, I get it. Diving into emerging markets might feel like a gamble. But take it from me, betting on these high-growth countries in 2024 could be the smartest move you make. With the right info and a dash of daring, you can join the growth party and maybe even grab a slice of the pie.

For investors, this means keeping a close eye on these rising GDP countries. If you pick the right horse, you’re in for a thrilling ride. And for those of us watching and crunching the numbers, it’s a wild world full of promise.

In these lands of tomorrow, they’re not just dreaming of a brighter future. They’re building it, one innovation, one policy, and one investment at a time. So, strap in, because these emerging economies are outpacing the old guards and rewriting the rule book on success.

Investment Opportunities in Emerging Markets During 2024

Identifying Top Performing Emerging Markets for Potential Investors

Look! 2024 is a year of hot spots for smart money moves. Let’s find the stars.

Emerging market growth? It’s buzzing. We’re talking places on the move, economies kicking up dust and saying, “Watch us soar!” I dig deep, and I see certain lands outshining others. Yes, top performing emerging markets demand our gaze.

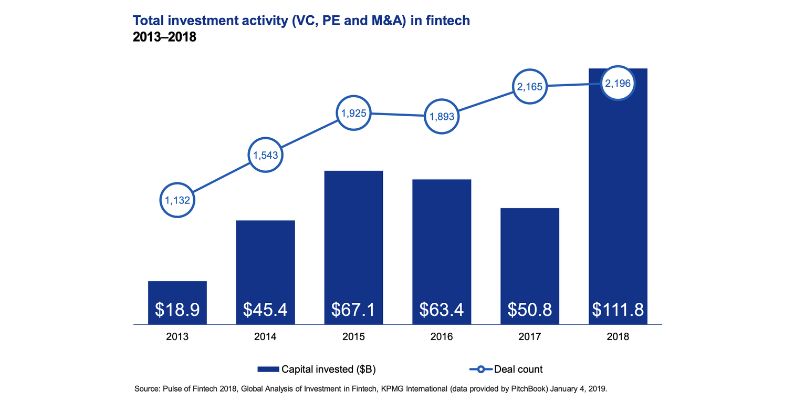

We grab our money maps and scout. Asia calls with whispers of growth, new tech, and fresh ideas making waves. Latin America? It thrums with energy, reform, and steps forward. Don’t sleep on Africa, where tech and resources spark bright fires of progress.

These are not your grandpa’s investment tales. They’re fresh, live with colors of culture, need, and ripe chances. Now, you ask, “What are these high-flying lands?” Data shouts the names: think Asia’s fastest growing economies—Vietnam, India. Look at Latin America economic rise moments, with Colombia and Brazil. Then, boots-on-ground in Africa, watch folks like Ghana and Ethiopia.

“Which are the best emerging markets for investors?” you think. Precision matters, so first up: India. Tech booms, young folks flood the labor pool, and reform keeps rolling. Next? Vietnam. It’s a mix of low costs and bold moves in trade, pulling firms in. Then Colombia, with its peace and pockets open for business.

Peek at charts, dig into rising GDP countries 2024, and ask folks who watch dollars dance. Clear patterns shine – some places have the juice, others just the promise. These leaders? They’ve got both.

Analyzing High ROI Strategies in Frontier Markets

Rope in your best bet for cash that grows. Here’s how you cast a smart line for big fish in these frontier markets with high potential.

Step 1: Know the game. Markets up and coming swim fast. They ask for bold plays and an eye keen on change. Look hard at emerging markets economic forecast 2024. Check out trends, feel what moves the locals, know the law lay of the land.

Step 2: Variety’s your friend. A mix of picks—stocks, bonds, new ventures—makes for a bountiful basket. Spread those bets to tap the full dance of emerging economies outpacing developed ones.

Step 3: Be in on the ground floor, feel the beat. Find firms with roots deep in these soils. Local players get the scene, they pivot with poise. That’s where you find the high ROI in emerging markets.

Seek smart heads for tidbits, tips, and truth. Watch for soaring growth in developing nations. See, not all growth is the same. Some puff, some sizzle, others? They’re the main act.

In this game of 2024, the board is wide and wild. Your move? Play informed, play sharp, hook into the right spots. Silver-tongued guides yammer, but your best weapon is a clear eye and patient coin. Watch these fastest growing economies. They craft tomorrow’s cash stories, and you, friend, might just write the next chapter.

Emerging Market Trends 2024: What Analysts Predict

The Economic Forecast for Robust Economic Development in Emerging Economies

Here’s the scoop. In 2024, emerging markets are taking the world by storm. Experts are buzzing about these fast movers, and with good reason. They’re growing so fast! We’ve got countries where things are changing quick. Dollars and work are pouring in. This means more jobs, better lives, and happy faces.

These high-growth countries are where the action is. Think of it like this: if the world of money was a race, these guys are the speedy ones out in front. We’re looking at places in Asia, Latin America, and Africa that are set to wow us in 2024.

Financial Analysis Techniques for Evaluating Soaring Growth in Developing Nations

Let’s cut through the numbers game. When we’re talking about soaring growth, there’s more than meets the eye. To find the gems, we look at what each place is doing right. We want to know where the smart money goes. The trick is to spot the signs of a boom before it happens.

We’ve got fancy tools and sharp minds to help figure where the growth’s at. We look at what folks are buying and selling. We peek at the banks and what they’re up to. And we keep an eagle eye on the rules of the land because they can make or break the game.

For you, this means a clear map of where 2024’s big wins might be. And hey, who doesn’t want to know where to look for a goldmine, right?

Emerging markets in 2024 are the places full of promise and pluck. They are the ones shaking things up. These are the lands of future kings in the economy game. And I’ll tell you what, it’s a wild ride, but it’s one worth taking if you’re up for a dash of daring and a slice of smarts.

In this post, we explored why emerging markets are booming in 2024. We saw key growth factors, found fast climbers in Asia, Latin America, and Africa, and eyed top investment spots. I shared solid tips on making smart moves in these fresh markets.

Let’s wrap it up. We’re seeing a big leap in some world parts. Places like Asia, Latin America, and Africa are racing ahead. They’ve got special things working for them. For someone looking to invest, these spots could be gold. But it’s not just about where to put your money. It’s about how to pick wisely and grow your cash.

Here’s my final say: these markets are hot right now. If you’ve been with me so far, you know the drill. Find the right place, use your head, and you could do well. Always keep an eye out for new chances. That’s how you stay ahead! Remember, smart choices bring big wins. Let’s keep watching these markets as they change our world.

Q&A :

What are the fastest growing emerging economies projected for 2024?

There’s a lot of buzz around the emerging markets that are set to take the global economy by storm in 2024. Investors and analysts are keeping a close eye on nations that boast rapid economic expansion, with certain countries frequently making the cut thanks to their impressive GDP growth rates, expanding consumer bases, and increasingly liberalized economic policies.

Which emerging market economies are poised for significant growth in 2024?

When we look at the landscape for 2024, there are a few emerging market economies that analysts predict will demonstrate significant growth. Typically characterized by young populations, burgeoning tech sectors, and sweeping reforms, these nations may present favorable opportunities for investment and international trade.

What factors contribute to the rapid growth of the fastest growing emerging economies?

The pace at which an emerging economy grows can often hinge on a complex interplay of factors. Some of the most influential include progressive governmental policies, foreign direct investment, technological advancement, and the development of a skilled workforce. These elements can fuel an environment ripe for economic acceleration.

How can investors take advantage of the fastest growing emerging economies in 2024?

Investors looking to capitalize on the growth of emerging markets in 2024 should do their due diligence. This often means researching the political stability, market access, and sectoral performance of these economies. Additionally, they might consider diversifying across various asset classes, including equities, bonds, and commodities that are relevant to these burgeoning markets.

Are there any risks associated with investing in the fastest growing emerging economies?

As with any investment, stepping into the fastest growing emerging economies comes with its own set of risks. These can range from political instability and changes in currency value to issues of liquidity and regulatory uncertainties. It’s crucial for investors to weigh these potential risks against the prospective gains when considering their investment strategies.