Navigating the Green Legal Maze

Got your eye on Future Legislation for ESG Practices? You’re not alone. The rules are changing. Businesses and investors worldwide are prepping for a shake-up. What’s in store? Think tighter rules, more reports, and big shifts in how companies operate. The landscape of Environmental, Social, and Governance (ESG) is evolving, and it’s a maze we’re all learning to navigate. The stakes are high. Get it wrong, and you could be left behind. Ready to break it down and stay ahead of the curve? Let’s dive into the world of upcoming ESG legislation, where staying informed means staying on top.

The Current Landscape of ESG Legislation and Upcoming Changes

Understanding the Present ESG Regulation Framework

Right now, rules around ESG are like a big, tricky puzzle. We have some pieces, but the picture isn’t clear. In the puzzle are bits of the law that tell companies how to act nice to the earth, to people, and how they run themselves. You may wonder, “What are these rules all about?” Simply put, they make sure companies do what’s good for us all, not just what makes the most money.

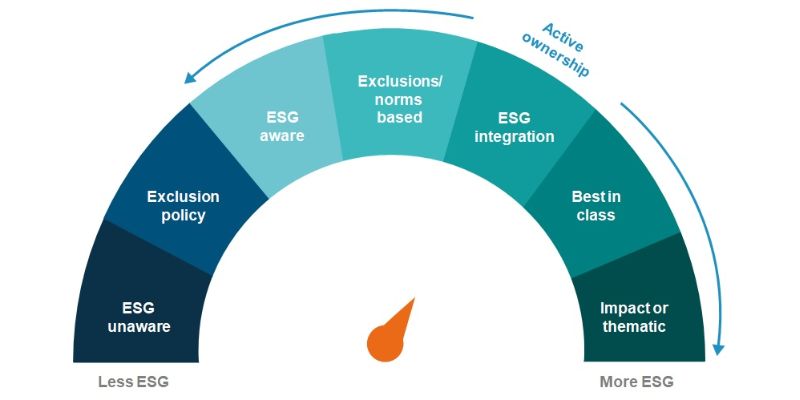

Companies need to show how green they are, how fair they treat people, and that they’re run well. This is ESG. The rules say “do good things,” and tell everyone about it. Now, this can be tough. It’s not always easy to know what “good” looks like. So, there are special ESG scorecards that can help. These cards give a thumbs up or thumbs down on how a company is doing.

This matters a bunch because when investors see a good scorecard, they might say, “Here’s my money, make more good stuff happen!” But if the scorecard is bad, they might walk away. This can shake things up in big money world.

Anticipating Shifts in Environmental, Social, and Governance Policies

Now, let’s talk about the future. Things are changing fast! New rules are coming that could make the ESG puzzle trickier. “What kind of changes?” you might ask. Well, for starters, folks who make these rules are thinking hard about climate change. They’re talking about cleaner air and less waste. This means laws might ask companies to cut down on making dirt in the air and use more clean energy.

Next up, people are a big deal too. This includes everyone: the people making your stuff, the ones buying it, and others living around where it’s made. Laws to make sure everyone is treated right and that no one is left out could come into play. It’s called social equity, and it’s getting a lot of attention.

And don’t forget, companies have to be led the right way. Leaders need to think about more than just cash. They have to care for our planet and people too. So, new laws may say, “Hey, think long-term. Care for tomorrow, not just today!”

What we’re seeing is a big move to cleaner, kinder, smarter ways of doing business. This is no flash in the pan. It’s here to stay. And those who get it right will be the stars of the show. They’ll win over hearts, minds, and wallets!

The times are flying, and laws are racing too. But don’t sweat it. I’m here to steer companies through this green legal maze, keeping them on top of their game. And remember, doing good for the world is not just nice, it’s smart business. The future is green, folks. Let’s get ready to flourish in it.

Preparing for Future ESG Reporting and Compliance Requirements

Navigating Upcoming ESG Disclosure Mandates

The world is changing, and so are the rules. We must get ready for new ESG mandates soon. Investors and the public now want more info on firms’ eco, social, and governance actions. This push is strong and reaches far. Governments are reacting with new ESG disclosure mandates. These rules will soon ask firms to share how they affect the world. The idea is to make the impact of companies clear to all.

Incorporating Anticipated ESG Benchmarks and Performance Standards

Let’s dive deeper into what’s coming. Think of future ESG reporting like a report card for firms. It will show how well a firm does on eco-friendly steps, fair worker treatment, and honest leadership. To shine, firms must meet the new ESG benchmarks. These are like goals every firm should aim for. They will say what makes a business good for the planet and its people. Hitting these targets will help firms succeed and do right by the world.

The stakes are high. Missing these marks may cost firms trust and money. Firms should start now. They should learn these coming rules and be ready to act. Here’s how: Firms must keep up with the latest ESG regulation forecast. They should also know what’s in store with upcoming ESG compliance laws. This is not just for show. It means making real changes that help the earth, care for workers, and keep leaders in check.

Firms must also be ready for new climate change legislation. This could mean rules about how much pollution firms can make. Or laws that support clean energy work. The same goes for social responsibility legal standards. These will tell firms how to treat people better, at work and in the community. Last, corporate sustainability law might change. It will say how firms should keep going without harming our future.

Firms must also keep an eye on what green finance regulation says. This deals with money matters. Like where a firm can get cash and what projects it can spend on. ESG data transparency laws play a key role too. These laws make sure that everyone can see and trust the ESG info firms share.

For firms that take money from people, knowing investor ESG expectation is key. Investors now want to back businesses that care for more than just profit. Firms must show they are such businesses – ones that look after the earth and its people. This is how to stay ahead and build trust. Firms that do this well will stand out.

In short, firms must keep their eyes open and be quick to act. Know what’s coming and get ready. You want to meet ESG performance standards and make both people and the planet proud. It’s not just about following rules. It’s about doing what’s right and making a better world for everyone.

Financial Implications of Emerging ESG Legal Frameworks

Assessing the Impact of New ESG Laws on Investment Decisions

New ESG laws change how we invest. Investors now look closely at how firms do good for the planet and people before they put their money down. This means we need to know what new rules are coming and how they will change things. Companies must meet new environmental, social, and governance policies to keep investors happy.

Firms with strong ESG practices often do well. They can get money at better rates and find more people to invest in them. But if they fall behind, they could lose money and support. This is why upcoming ESG compliance laws are key. Stay up to date with them!

Green finance regulation is also becoming a big thing. Money is going towards things that help the earth now more than ever. We will see new rules for this type of investing for sure. This includes stuff like green bonds standards legislation and renewable energy investment laws.

Investors now expect companies to have high ESG performance standards. You must show you’re doing things that help everyone, not just your bottom line. You need to have good ESG scores or else you may struggle to get people to invest in you.

In short, ESG stuff is now a must-have in your investment choices. Watch for new laws and be ready to show off your good ESG work.

Managing Risk with ESG Risk Management Legislation

Risk and ESG go hand in hand. Lawmakers know this and are making new rules to keep risks low. The upcoming ESG risk management legislation is all about this. It means companies have to check their ESG risks often and tell people about them.

Governments are stepping in too. They’re creating laws on social equity and climate change. This means firms need to treat people fairly and protect the earth. If they don’t, they could get in trouble or have to pay more money.

The EU taxonomy for sustainable activities is a big deal. It tells firms what counts as green work and what doesn’t. This helps them make sure they are really helping the earth. Companies must follow this or they might not get money or could get fined.

Firms are also watching for new carbon tax policies. If you make lots of greenhouse gases, you might have to pay more. So, it’s smart to invest in clean energy now before these rules come into play.

When you hear about mandatory ESG considerations, that’s what this is all about. Rules are getting tougher on how you report your non-financial stuff. This includes how green and fair you are. We will see more rules like this soon. Get ready now to keep risks low.

In all, ESG laws are big for risk management. Know what’s coming and get set to keep your firm safe and sound.

Strategies for Adapting to ESG Evolution in the Legal Arena

Corporate Governance Reform and Investor Expectations

We know ESG matters are big talk today. Soon, new laws will change how we do business. Investor demands are shifting. They want more than just profits. They care about how a company acts. Is it fair? Does it help the planet? These questions are key.

New regulations will touch on corporate actions. For sure, companies must adapt. They will have to show how they help society and nature. They might also have to change who makes decisions. Why? So more voices can help guide the firm. That’s what we mean by reform. This is no easy task. It needs a clear plan and good tools.

Firms should start now. Waiting is risky. New rules could come any day. The smart move is to learn fast. What are investors asking for? What might lawmakers demand next? We must get ready.

ESG Legal Compliance Strategies and Non-Financial Reporting Directives

Staying true to ESG is more than just talking. It means acting right. Soon, we will have to report more on ESG. This isn’t just about money. It’s about telling people how we really do things.

Here is where it gets real. There are things called non-financial reports. They show how a firm handles ESG issues. They can be about worker happiness, helping the community, or clean energy use.

In the future, there will be set rules. Firms will need to report certain things. And they must do it in a way that’s easy to check. What does this mean? It’s about being open and honest. People should see how a company really does. True data makes this possible. No tricks, just facts.

Keeping up with these laws is no joke. It takes work. And it’s not just about avoiding fines. It’s about trust. Customers, workers, and investors all want to trust the firm. They want to know the firm does good for the world.

To do this right, firms might need help. There are folks like me who know these rules well. We can show you the ropes. We help firms build strategies that last. And these strategies make sure firms keep doing well, even as rules change.

Remember, ESG is not a fad. It’s how we will do business now and in the future. If we start right and keep going, the law won’t scare us. It will just be part of how we win.

We dived into the ESG law scene, eyeing what’s now and what’s next. We saw the current rules and guessed future policy shifts. Then, we tackled how to get set for new ESG reports and rules. We weighed how evolving ESG laws shape our cash choices and risks. Lastly, we explored ways to stay ahead and meet what investors want and laws demand.

In final thoughts, ESG isn’t just a buzzword—it’s a must for smart business. Laws change, and so must we. With this guide, you’re ready to handle ESG’s next wave. Let’s lead with actions that count for our planet, people, and profit.

Q&A :

What Is ESG Legislation and How Will It Affect Future Business Practices?

Environmental, Social, and Governance (ESG) legislation refers to laws and regulations that are designed to ensure that companies adopt sustainable and ethical practices. Future ESG legislation is likely to have a significant impact on how businesses operate, pushing them to incorporate ESG metrics into their strategies, enhance transparency through reporting, and increase accountability for their social and environmental impact.

How Are Governments Planning to Enforce New ESG Regulations?

Governments may enforce new ESG regulations through mandatory reporting requirements, penalizing non-compliance, or offering incentives for adherence. Regulatory bodies could implement auditing mechanisms to ensure accuracy in ESG disclosures and may also require third-party verification of sustainability claims. Companies might also be expected to follow specific frameworks or standards to uniformly measure and report on ESG performance.

Can Companies Influence Future ESG Regulations?

Yes, companies can influence future ESG regulations by engaging in dialogue with lawmakers, participating in industry groups, and contributing to the development of standards. By proactive involvement in the legislative process and the public conversation, businesses can help shape policy that is both effective and feasible for implementation. It’s important for organizations to stay informed and adapt their strategies in anticipation of upcoming regulations.

What Are the Benefits of Complying With ESG Legislation for Companies?

Complying with ESG legislation can offer multiple benefits for companies, including enhanced reputation, increased investor trust, and potentially better financial performance. It can also lead to a competitive advantage as consumers and investors increasingly favor companies with strong ESG credentials. Furthermore, early compliance might reduce the risk of sanctions and ensure a smoother transition as regulations become more stringent.

How Can Companies Prepare for Upcoming ESG Legislation?

Companies can prepare for upcoming ESG legislation by conducting thorough assessments of their current practices and aligning them with ESG standards. Investing in sustainability initiatives, training staff on ESG matters, and improving data collection and analysis for ESG metrics are also critical steps. It’s advisable to engage with experts and consider integrating ESG criteria into governance structures to be well-prepared for future legislation.