Geopolitics and Oil Price Fluctuations: they shape our world in ways you may not see at first glance. Imagine the globe as a complex web; when one strand vibrates, the tremors are felt across the entire network. This is especially true for the oil market. As an expert immersed in the ebbs and flows of energy politics, I decode the omnipresent ripples that stem from the power plays of nations and conglomerates. Whether it’s a sharp tweet that sends shockwaves through trading floors, or covert meetings leading to sudden shifts in supply, you can bet it touches your life, from the gas pump to your energy bill. Keep your eyes peeled here as I journey through the murky intersection where global power struggles meet your wallet. Let’s dive in and harness clarity in a world where clarity seems like a scarce resource.

Understanding the Impact of International Relations and OPEC Decisions on Oil Prices

Analyzing Current International Tensions and Their Direct Effects on Crude Markets

International spats often shake oil prices. Why? They can slow or stop oil flow. For example, Middle East tensions might cut off oil supply routes. High tensions can mean higher oil prices. Lower tensions can mean the opposite. It’s a big deal because oil fuels our world. When its flow changes, economies feel it. Oil prices change with the news. A small event can cause big price jumps.

Countries know this power. They can use oil as a tool in global talks. Take the US and Iran. Their relations can swing oil markets. Good talks might bring prices down. Bad talks? Prices go up. It’s like a seesaw that responds to every move they make.

The Role of OPEC in Shaping Global Energy Dynamics

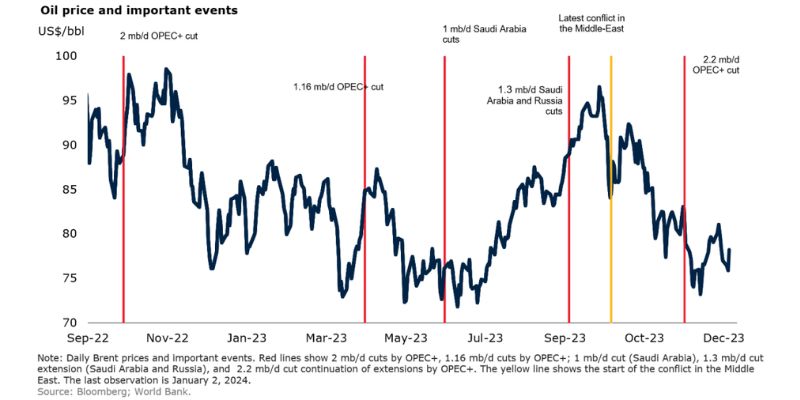

What about OPEC? They’re like a club of oil-producing nations. This club makes big decisions. When they decide to pump more oil, prices can drop. If they hold back, prices might rise. It’s all about balance. They try to keep oil markets stable. But it’s not easy. Each country has its own needs.

Global energy demand moves OPEC’s decisions too. If the world needs more energy, OPEC might increase supply. But if the world uses less, like with COVID-19, OPEC might cut back. These cuts can surprise markets. Suddenly, there’s less oil around. Prices can leap up. And that affects everything, from gas in your car to the cost of flying.

OPEC’s moves often depend on how much oil is stored worldwide. These are called strategic petroleum reserves. They’re like a rainy-day fund of oil. If there’s lots of oil saved up, OPEC might feel okay to cut production. But if stores are low, they might pump more to help out.

OPEC also thinks about renewable energy. As wind and solar grow, we might need less oil. But for now, oil remains king. How long that lasts is a big question. OPEC must plan for a future where oil might not be as important.

We also can’t forget places like Russia and China. Russia supplies a lot of Europe’s oil. Trouble there can mean trouble for oil prices. And China uses lots of energy. If they need more, it can push prices up worldwide.

In the end, oil prices are like a web. They connect countries, policies, and even the sun and wind. A pull here or a snap there can send shakes through that web. And those shakes hit our wallets. It’s a big game of action and reaction. One we all play, even if we don’t see it. Understanding that game helps us know what might happen next with our energy and our money.

Assessing the Global Energy Framework Amidst Fluctuating Demand and Supply Disruptions

The Ripple Effect of Middle East Tensions on Petroleum Economics

Think of the world’s oil flow like water in your house’s pipes. Now, imagine a big freeze hits—pipes burst, water stops. Something a bit like this happens when tensions rise in the Middle East. This region is a huge oil “tap” for the world. So, when something goes wrong there, it can send oil prices up or down like a yo-yo.

Why does it matter to us? Well, we use oil for fuel, making plastics, and more. When those Middle East issues crop up, it’s not just a far-off problem. It means the gas in your car might cost you more. Or the plastic used in toys and tools can get spendier too.

Surviving Supply Chain Shocks: Oil Market Resilience and Responses

Now, let’s chat about those oil supply chain hiccups. They’re like roadblocks in the journey from oil wells to our homes. These can happen because of storms, accidents, or political fights. But don’t worry too much. Countries use something called strategic petroleum reserves. Think of them as big oil savings accounts to help keep things steady when supply gets shakey.

OPEC, a group that some oil countries belong to, also plays a part. They make decisions on how much oil to pull out of the ground. So, they help keep a balance between having too much or too little oil. This way, even when the going gets tough, the oil keeps flowing, and life goes on without big hiccups in prices.

Things get trickier with sanctions. These are like penalties one country can give another. If a country misbehaves, others might say, “We won’t buy your oil.” This can make oil scarcer, pushing prices up. And that hits everyone’s wallets.

As for trades, countries often make deals to buy and sell oil. These agreements help make sure enough oil gets around. This is important because oil is a big piece of how countries work together. Or don’t, at times.

Let’s not forget about those savvy energy traders. They watch all this like hawks. They try to guess where oil prices will go next. They look at everything – wars, weather, even rumors. Then they bet on oil prices, and this guessing game can make prices bounce too.

So, when you hear news about tensions or trouble in oil places, remember: it might mean more than just headlines. It could mean a change at the gas pump, in your heating bill, or even your next flight’s price. And as for us in the energy biz, we keep an eye out and our ears open. We try to read the signs, make smart guesses, and help everyone ride out those waves without wiping out.

Navigating Through Turbulence: Sanctions, Military Conflicts, and Energy Security Strategies

Evaluating the Potency of Sanctions and Their Reverberations on the Oil Sector

When countries clash, oil markets shake. Powerful nations often use sanctions to push their goals without waging war. These penalties target a nation’s economy, hoping to force a change by cutting it off from vital cash flows. For oil-producing countries, this means a big hit.

What happens when a country famous for its oil gets hit with sanctions? First, its oil can’t reach markets it used to serve. This causes a supply drop. Since oil is so needed around the world, other nations must think fast. Where will they get their oil now? Prices may jump, as there’s less oil for everyone to buy.

Sanctions hit places like Russia and Iran and their effects on oil are clear. Russia, rich in oil, faced sanctions, and global oil prices felt the heat. Buyers from Europe and the US had to find new sources. Sanctions like these shape the oil we buy and how much we pay.

Energy Security in the Crossfire: How Military Conflicts Redefine Market Equilibrium

Oil flows like the lifeblood of our world. A pump gets clogged, we all notice. Military conflicts are one of the worst clogs. They can shut down oil from whole regions in a snap. Think about Middle East tensions. When fights flare up, oil prices often spike up too. How does this happen?

Oil’s path from ground to gas tank is long and tricky. It crosses countries and oceans. So, any military clash along this path can halt the flow. This means less oil gets to where it needs to go. Then comes the law of supply and demand. Less supply with steady demand? Prices rise.

Prices of oil swing with the news of war or peace. So, smart energy security strategies are vital. Countries store oil for rainy days, called strategic petroleum reserves. Why? To keep the lights on when oil supplies are cut off due to conflicts.

This is real life, not just numbers on a graph. When you fill up your car and see high prices, remember this dance of supply and demand. Conflicts far away, where oil flows, affect our wallets right here, right now. So, watching these global events helps us prepare and maybe even avoid a big hit when we least expect it.

Strategic Petroleum Reserves and Renewable Energy: Pivotal Points in Modern Energy Markets

The Strategic Use of Petroleum Reserves in Stabilizing Global Markets

Now, let’s chat about oil and how we keep prices from going wild. We have something called strategic petroleum reserves. These big oil stashes are held by countries to tackle any sudden supply cuts. For instance, when things get heated in oil countries, leaders can release some oil from these reserves to cool down prices. It’s like having an extra can of gas in your garage, just in case. This way, they keep oil flows steady and stop prices from jumping too high.

Countries use these reserves very carefully. Their goal is to make sure we all have enough oil without causing price crashes. Prices should stay just right: not too high for buyers or too low for sellers. It’s a tough balance but super important for everyone’s wallet and for keeping businesses running smooth.

Balancing Act: The Growing Influence of Renewable Energy on Traditional Oil Dynamics

So, what about clean energy like wind and sun power? Well, they’re becoming big players in the energy game. As we use more of these, we rely less on oil. That means oil prices can go down when everyone’s excited about going green. Countries are now trying to use both: they keep oil for when we need it, but they’re also adding more clean energy to the mix.

This switch to renewables shakes things up. Oil was king, but now it’s sharing the crown. Oil countries have to think hard about this change. They know that sooner or later, the world will need less oil. So they’re preparing by looking into new ways to make money and to keep their people happy.

Wind and solar power are gaining steam as they get cheaper and better. People like them because they help us fight global warming. They also give us more energy choices. This is awesome because it means we’re not stuck if there are problems with oil.

So there you have it, oil prices jump around for lots of reasons. Countries use their oil stash to keep markets steady. Meanwhile, clean energy is stepping up, changing how we think about oil. It’s not just about what’s happening now, but about planning for a future where the air’s cleaner, and energy comes from the sky and the sea, not just from under our feet.

In this post, we explored how global events affect oil prices. We saw how international tensions impact crude markets and how OPEC shapes energy dynamics. We also looked into the energy framework’s reaction to changing demands and supply disruptions, including the Middle East’s influence and the oil market’s ability to bounce back.

We discussed how sanctions and military conflicts test energy security, changing how markets work. Lastly, we talked about using strategic petroleum reserves to steady the market and how renewable energy changes the oil scene.

All these factors play big roles in our energy market today. Understanding them helps us see where oil prices might go and prepares us for future shifts. It’s a complex mix, but staying informed means we can navigate these changes better.

Q&A :

How do geopolitics influence oil price fluctuations?

Geopolitical events play a significant role in the global oil market, as they can lead to uncertainties that may either disrupt oil supply or affect oil demand. For instance, conflicts in oil-producing regions can halt production, while trade agreements or sanctions can limit or expand the oil trade. These situations often result in volatility in oil prices, reflecting the market’s reaction to potential changes in oil availability.

What are some examples of geopolitical events that have affected oil prices?

Historical events such as wars, embargoes, and tensions in the Middle East have had significant impacts on oil prices. The Arab Oil Embargo of 1973, the Iran-Iraq War in the 1980s, and the more recent U.S. sanctions on countries like Iran and Venezuela have all led to shifts in oil prices due to changes in oil supply and demand dynamics.

Can changes in leadership or government policies in oil-rich countries impact global oil prices?

Yes, changes in leadership or policies in oil-rich countries can have immediate effects on global oil markets. New governments may alter their approach to oil exports, engage in international agreements, or decide to change production levels, all of which can influence global oil prices.

How does geopolitical stability in oil-producing regions affect the oil market?

Geopolitical stability in oil-producing regions is crucial for steady oil production and supply. Stability encourages investment in oil infrastructure and ensures that oil can flow uninterrupted to the market. Conversely, instability can lead to production shutdowns, create fears of supply shortages, and thereby drive up oil prices due to supply-side concerns.

What roles do organizations like OPEC play in geopolitics and oil price determination?

Organizations like the Organization of the Petroleum Exporting Countries (OPEC) are influential in the oil market because they can collectively decide on production targets and influence oil output levels of member countries. OPEC’s decisions are often swayed by the geopolitical interests and economic needs of its member states, which in turn can significantly impact global oil prices through managed supply levels.