Integration of ESG into Traditional Investing: The Responsible Profit Boost?

Ready to make money and do good at the same time? It’s not a dream. By folding ESG into your classic investing mix, you might just hit that sweet spot. Think of ESG as your compass for picking stocks that pack a powerful good-for-the-world punch, while still aiming for those juicy returns. But how does it stack up? Does weaving environmental, social, and governance (ESG) criteria into your investment strategy really lead to a fatter wallet? Let’s cut through the noise. Here, we dive deep into what ESG investing brings to your table and how it spices up the old-school approach. We’ll unwrap the solid facts behind ESG’s impact on your returns and blueprint strategies for aligning ESG goals with long-term financial growth. Plus, I’ll guide you through smoothly blending ESG into your portfolio and climbing over any hurdles you might bump into. Ready for a responsible profit boost? Let’s roll.

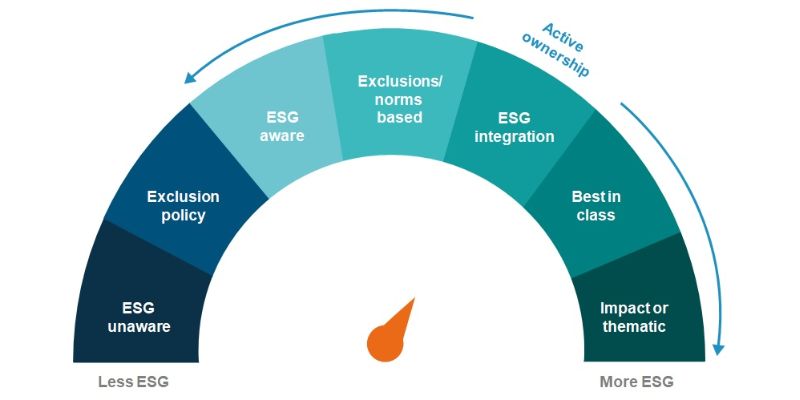

Understanding the Basics of ESG and Traditional Investing

The Rise of ESG Investing Principles: An Overview

Imagine investing in a way that helps the planet and people while making money. Sounds cool, right? That’s what using ESG investing principles is all about. It stands for Environment, Social, and Governance. This means we look at a company’s care for the environment, how it treats people, and how it runs itself. By doing this, we pick stocks that not only grow our money but also do good in the world.

People are getting more into this smart way of investing. It’s because they want to make a difference. More trees, cleaner air, and happier people. It’s not just a trend; it’s a powerful move that’s changing the game. Investors and big money managers are seeing that good choices can lead to good profits.

Traditional Investment Strategies: Adapting to New Dynamics

Now, let’s talk about usual investing — like owning a piece of a company by buying stocks. Most of the time, people only looked at money stuff, like profits. They didn’t think about the planet or how companies treat their workers. But things are changing. We’re now bringing in ESG criteria when we decide where to put our money. It’s like adding a new flavor to an old recipe.

Some folks worry ESG might mean less cash in return. But wait, let’s get this straight. Can ESG factors in portfolio management actually make us more money? Yes, they can! Companies that care about the environment, their people, and have good bosses often do really well. So by caring, we’re not just being nice; we’re being smart.

We do something called an ESG risk assessment to pick the best stocks. It’s like detective work. We search for anything that might hurt the company because of bad ESG stuff. And guess what? We’ve found that sometimes ESG can even protect us from bumpy rides in the stock market!

When we add ESG into asset allocation, it’s not just about doing good. It’s also about spreading out risks. So if one area gets shaky, not everything goes down. Plus, investing in things like green bonds can be like planting seeds for money trees that will grow in a cleaner world.

What’s cool is that this whole ESG thing is backed by big names like the United Nations. They have these rules called the Principles for Responsible Investment, and they tell us that mixing money with good deeds works out.

The bottom line? Traditional investing and ESG can be best friends. They can team up to make our world better and our wallets thicker. And the fun part is, as we learn to blend them well, we can have a big smile knowing our cash is fighting the good fight.

How ESG Factors Enhance Financial Performance

ESG Impact on Returns: Myths and Realities

Do environmental, social, and governance (ESG) factors boost returns? Yes, they can. Studies show that firms with strong ESG records can outperform others. When I dig into a company’s ESG practices, it’s like looking under the hood of a car. I check how it runs on the inside. Are they treating workers well? Do they care for the environment? Are their leaders playing by the rules? Good scores in these areas often mean fewer risks and more stable returns.

Companies ignoring ESG can face damage – both in reputation and in their pockets. Imagine a company hurting the environment. They might get fines, or people might stop buying their products. Now, think about one that’s doing it right. They are likely to stay ahead. By focusing on ESG, they meet a growing demand from folks like you and me who want to invest without harming our planet.

Aligning ESG with Financial Goals for Long-Term Growth

Mixing ESG and financial goals takes skill, but it’s worth it. It’s not just about the good we do – it’s also about smart money moves. When I look at building wealth, I think long-term. And that’s where ESG shines. Let’s say you invest in a green bond. You lend money to a project that’s good for the planet, and you make a tidy profit over time. It’s a win-win.

Businesses with strong ESG practices are often better prepared for tomorrow’s world. They’re thinking ahead about things like climate change. So they adapt faster than firms that don’t. This means in a changing market; they can come out on top. Also, when I craft an investment plan, I make sure ESG factors are part of the mix. They help manage risks and can lead to better results over the years.

Think about social issues too. Companies that treat workers well tend to have a happier, more devoted crew. This can mean better work and more profits. For investors, this spells more growth and less worry.

Blending ESG with money goals is like a chef making a fine meal. You need the right ingredients. This means finding firms that score high on ESG and match your money goals. I’ve helped many clients do this. It’s a powerful way to make sure your cash works hard – for you and the world.

Using ESG isn’t just about being good; it’s about wise investing. It lets us look after our cash, our planet, and each other. With ESG, everybody has more chances to win.

Executing ESG Integration in Investment Portfolios

The ESG Risk Assessment Process: Identifying Opportunities and Threats

Investing today is not just about money. It’s about values and impact. When I dive into a company’s ESG practices, I’m searching for unseen opportunities and threats. How? Through detailed ESG risk assessment. This is the heart where smart choices begin.

We start by checking how a business works with nature. They misuse resources? That’s a red flag. Then, we watch how they treat folks inside and outside the company. Bad acts can hurt their rep and our cash. Last, we look at the bosses in charge. If they play fair (and smart), we know they’re good for a long run. Finding companies that pass this triple-test often leads to cashing in with a clean conscience.

Incorporating ESG into Asset Allocation and Portfolio Diversification

Once we’ve nailed the risk checkup, it’s time to mix it up in our investment spread. We blend different types of stocks and bonds so our nest egg can handle bumpy roads. Here’s where ESG shines. Like adding steel to concrete, it makes our portfolio tough yet flexible.

I make sure we’re not putting all our eggs in one basket. Sustainable investing helps us reach for more than just money – it stands for a safer planet and fair play, too. Let’s think about green bonds for a sec. These bonds help the earth, and they’re like a life jacket for our funds when storms hit the market. By folding in ESG, we don’t just aim for the now but for a lush future too.

So here’s the rundown: we hunt for companies that care for the world, its people, and are run by upright leaders. Then, we craft a mix of investments that keeps our money rolling, even when the market takes a wild ride. And trust me, when we do good, it often leads to doing well too. That’s the savvy way to fold ESG into the traditional investing fabric. It’s about being smart with our money, and making sure our investments help build a world we’re proud to pass on.

Overcoming Challenges and Reporting on ESG Investments

Navigating ESG Integration Challenges: A Strategic Approach

Investing with an eye on ESG is smart but not simple. It can be tricky to mix ESG with old school investing. You need a plan. First, know your ESG investing principles. These are rules that guide you in picking the right mix for your green portfolio. Next, understand how to spot and measure ESG criteria. This helps you know which companies are doing good for the planet and people.

Now, let’s dive into ESG factors in portfolio management. They can change the game for your bucks. But how do you put them in your plan and still make money? Start with an ESG risk assessment. It shows you risks you might face with ESG in your pocket. Spot the risks, then manage them. This will help keep your money safe and sound.

ESG analysis for investors is key. It’s how you make sense of the green numbers. You’ll see if doing good is also doing well for your money. Don’t miss out. ESG due diligence process is next. It’s like your homework before you send your money to work. Check if the company really does what it says about ESG. Once you’ve done this, you can mix ESG into your traditional investment strategies.

ESG Reporting Standards: Transparency for Stakeholders and Investors

With ESG, telling others clear and true stories about how you’re doing is vital. That’s where ESG reporting standards step in. They’re like rules for showing off your ESG scores. You tell folks how you’re helping the planet and making cash at the same time.

Why are ESG metrics and performance buddies? Metrics are like a scoreboard for ESG. They tell you if your green game plan is winning. Plus, they show if your ESG investments are giving your wallet a high five. This builds trust with folks who gave you their money to grow. They need to know that their cash does good and grows.

Finally, keep your eyes on the long run with ESG. Green bonds, ESG and shareholder value, ESG portfolio diversification—stash these in your toolkit. They’re paths to make sure your green grows over time. By playing the long game, you bank on the world being better tomorrow. You help the earth and your bank account too.

In the end, mixing ESG in with traditional cash plays isn’t just trendy. It’s about making money with meaning. Pro tip: Stick to the United Nations Principles for Responsible Investment. It helps keep your investing on the green road. Plus, it’s a promise to look after people’s money—and the world they live in. Keep these tips in your pocket, and let’s make investing good for today and better for tomorrow.

To wrap it up, let’s look back at what we’ve covered. First, we explored ESG investing, how it’s growing, and what it means for the money world. Then we dug into old-school ways to invest and how they’re changing.

Next, we talked about how caring for the earth, people, and company rules can actually help us make more cash. We broke down the big talk about ESG and returns and looked at how to mix doing good with smart money moves for the future.

After that, we got into the nitty-gritty of ESG in our investment bags. We learned to spot the good and bad and how to spread out our bets with ESG in mind.

Lastly, we tackled the rough spots in making ESG work and how to show what we’re doing in clear reports for everyone watching our money moves.

So, here’s my final say: ESG isn’t just a buzzword; it’s a solid way to invest with a heart and still see our cash grow. Let’s use this know-how to make better choices and set up for wins that count for our wallets and the world.

Q&A :

What is ESG and how is it integrated into traditional investing?

Environmental, Social, and Governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. The integration of ESG into traditional investing involves evaluating these criteria alongside financial metrics to make investment decisions that reflect ethical values and long-term risk management. Investors may use ESG scores, provided by various firms, to assess a company’s relative risk and performance in these areas.

Why is ESG integration important for investors?

The integration of ESG factors is important for investors because it helps in identifying companies that are not only financially stable but also responsible in their operations, potentially leading to sustainable long-term performance. ESG integration can potentially mitigate risks that could have a negative impact on the assets’ value, such as regulatory risks, reputational risks, and environmental liabilities. Further, many investors are increasingly driven by personal values and societal impact, thus aligning their portfolios with their beliefs.

How does ESG integration affect investment performance?

The effect of ESG integration on investment performance can vary, but studies have shown that integrating ESG factors can potentially lead to better risk-adjusted returns over the long term. Companies with strong ESG practices may be better positioned to handle operational, financial, and reputational challenges, and thus may offer more stability and less volatility. However, the impact can also depend on the individual ESG factors considered and the specific industries or companies in question.

Can ESG integration lead to positive societal impacts?

ESG investing often aims to produce positive societal impacts by allocating capital towards companies that lead in environmental stewardship, social responsibility, and good governance practices. Successful ESG integration can encourage companies to improve their business practices in these areas. This can lead to wider positive outcomes such as reduced carbon emissions, improved labour standards, and better corporate governance and accountability.

What challenges do investors face when integrating ESG into traditional investing?

One of the main challenges of integrating ESG into investment practices is the lack of standardized reporting and measurements for ESG performance. This can make it difficult to compare companies and accurately assess risk. Additionally, there can be a perceived trade-off between ESG alignment and financial returns, though this perception is increasingly being proven unfounded. Furthermore, investors may face difficulties in accessing reliable and timely ESG-related data, as well as interpreting its relevance within the context of their investment strategies.