Investments During Geopolitical Turmoil: Times like these test our nerves and our portfolios. It feels like news headlines shake the markets daily. But here’s the deal: volatility can be a gateway to opportunity. You just need to know where to look. I’ll walk you through safe havens that can protect your cash when the political climate gets rough. Think gold and bricks—classic, right? But that’s not the full picture. We also need to talk about hedging your bets and finding recession-proof sectors that won’t buckle under pressure. Ever considered cybersecurity or green energy? These could be your golden tickets. And let’s not forget how global conflicts twist market trends, especially in commodities and defense. Ready to turn uncertainty into gain? Let’s dive in.

Understanding Geopolitical Risks and Safe Haven Assets

Identifying Safe Havens During Political Conflict

What counts as safe havens during political conflict? Gold, real estate, and treasury bonds often top the list. They hold value when trouble hits. That’s key to keep wealth safe when markets shake. You might ask, why do these assets stay firm? They’re not tied to one country’s economy or its currency. That’s good to know when currency values drop because of war or unrest.

Gold has been a wealth go-to for ages. It doesn’t rust, and folks trust its worth all over. Real estate is another solid pick. People will always need places to stay, no matter what happens in the world. Bonds from stable governments, too, are like snug harbors in the storm of market chaos.

During unease, moving cash to these safe spots can guard the money you’ve worked hard for. But keep in mind, all assets can go up or down. It’s about odds and playing them to your favor in a rough game.

The Role of Gold and Real Estate in Uncertain Times

When talking investments, folks get that gold shines in tough times. Think panic hits: stocks fall, but gold stands tall. Its price can climb when fear grips the market, making it a fortress for your funds. Even when currency devaluation and investment risks loom, gold glitters as a guard against loss.

Real estate joins as a stout shield, too. Land and buildings often skip the worst of a dive that hits stocks or bonds. Land won’t vanish, after all. It’s a steady hand for money growth. Over time, rent and land values can rise, beating cost spikes we call inflation. That’s a win for folks with foresight.

Both gold and realty can give peace of mind. With gold, you hold a piece of history, stable through ages. With land, you gain a slice of Earth, never making more of that! Both can give a sense of control when the world’s in a spin. But remember, even these face threats – no gain comes without a hitch.

So, gold and real estate stand as kings in the game of safe investing. They’re like hefty anchors, keeping your wealth from drifting when geopolitical waves crash. Masters at this know how to mix it up, having a bit of both gold and good land. This way, your cash can grow even as world events shake the money tree.

To sum it up, solid safe havens are like sturdy boats in a storm. They can help you ride out the tough tides of political conflict. With the right blend, your investments can not only survive but also thrive, all while the winds of uncertainty howl outside.

Hedging Strategies and Recession-Proof Investments

Crafting Hedging Approaches in Volatile Markets

In shaky times, we must protect our cash. Think of hedging as a safety net. It’s a way to shield your money from sudden market drops. You can hedge by using different investments that usually don’t fall at the same time.

So how do we hedge? Start with diverse investments. Don’t just own one kind of stock. Mix it up with bonds, real estate, and gold. These often hold up better when stock prices fall. Also, look at options like currency devaluation and investment. When a country’s money value dips, some investments, like gold, often go up.

Another tool is investing in defense sector stocks. They can stay stable or even rise during global conflict. When nations boost defense spending, these companies can benefit.

Sectors That Thrive During Economic Turmoil

Not all is doom and gloom in a crisis. Some sectors can do well when others struggle. Take the energy sector during political crises. Oil prices often jump when there’s fear of supply cuts.

Another winner can be the agriculture sector. Food is always in demand, crisis or not. So investing in agriculture can be smart.

Pharmaceutical stocks often stay steady too. No matter what, people need their meds.

Tech can be hit or miss. But, cybersecurity thrives as conflicts today involve the digital realm. Being safe online is vital. So, cybersecurity firms can see a bump during conflicts.

Lastly, consider solar energy. Despite chaos, the push for clean energy goes on. Conflict can even boost it as countries look for oil alternatives.

Think about what does well in tough times. That’s your target for recession-proof investments.

Remember, always balance your risks. Diversify and keep a close eye on the news. That’s how you stay ahead in this game.

Looking for more advice on where to put your money during these times? Keep a tab on geopolitical volatility and ETFs. They offer a way to invest in diverse sectors without buying many different stocks.

This is just the start, friends. There’s a world of tactics for smart investing, no matter the climate. Stay curious and keep learning. Your future self will thank you for it.

Impact of Global Conflict on Markets and Commodities

Defense Sector Dynamics Amidst International Tensions

When world conflicts heat up, defense stocks often do the same. Companies that make military gear see more demand. More countries want to stock up to keep safe. Firms in the defense sector can get busy and their stocks might rise. Money flows here when fear of war grows.

If you hold stocks in defense, watch the news. Big events can make stock prices jump fast. It’s a time to stay alert. You may see quick gains, but risks are also high. Be smart and keep an eye on global hot spots. Quick moves in defense stocks can happen when tensions rise.

Commodity Prices: Effects of War and Political Unrest

War and political fights can shake up commodity prices. Think oil, gas, and wheat. Their prices can soar when trouble hits. Countries at war might not ship goods like they used to. This leaves less for the rest. Prices go up as things get scarce.

Investing in commodities during unrest takes guts. Prices can jump, but they can also fall. When peace talks start, prices might drop. If you invest here, you should watch the news daily. And know the field well. It’s not for everyone.

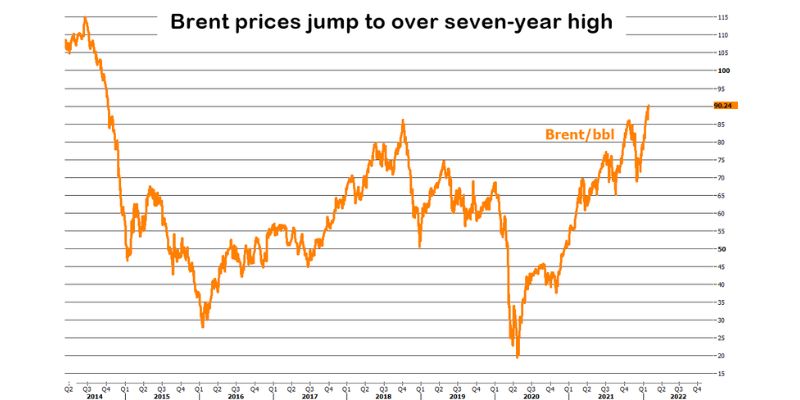

Oil prices are a big deal. They touch every part of the economy. Gas for cars, jets, and heating homes can all cost more. This can push inflation up. That means your cash buys less. A rise in oil prices can hit stocks too. It can lower what companies earn. This could make their stocks drop.

During unrest, focus on the basics: food, energy, and safety. They will always be in need. This can make some commodities a solid choice. But, twists and turns in world events can lead to price swings. So, make sure to stay sharp. Keep track of the news. And work to understand how war can impact trade, transport, and prices.

In times of tension, think about what people will always need. Energy to warm homes, food to eat, and ways to stay safe. These areas might give clues on where to invest. But always remember, in the world of investing, nothing is sure. It’s about playing the odds and staying informed.

So, when you think about your money during times of conflict, look at the big picture. Ask how these events might shape demand for goods. And find out which sectors might win or lose. The defense industry and commodities like oil and gas could be key players. But there’s more to the story. Peek into the details before you dive in.

Diversification and Sector-Specific Opportunities

The Rise of Cybersecurity Investments During Conflict

When countries clash, cyber threats climb. Staying safe online gets tough. This lights up chances to put money in firms that shield against cyberattacks. Why now? Hackers often pounce during unrest, aiming to disrupt. Companies and governments must guard their digital doors.

Putting cash in cybersecurity means betting on companies that fight hackers. They work to keep data safe, detect threats, and block attacks. This niche booms as threats loom. It’s not tied down to one land or sector. Every business and nation needs it. This spreads out the risk.

Look at the news. Hacks make headlines. Big firms to small shops hunt for cyber shields. This push hikes demand for cybersecurity services. Stocks in this space can jump, even as markets dip. Yes, the stock market shakes when strife stirs. But cybersecurity stands firm, growing nonstop.

Think long-term, not just quick gain. When peace returns, cyber defense stays vital. So does the need for new tech to block future hacks. It’s smart to have cybersecurity in your mix for growth that lasts.

Exploring Renewable Energy Investments in Times of Crisis

Now, let’s talk sun and wind, where crisis meets chances. Renewable energy takes the stage when turmoil hits oil and gas. Why is that? Oil lines might close or get hit during fights. Nations may slap bans on trade. This makes oil prices soar and dive without warning.

Renewables like solar and wind don’t depend on shaky supply chains. The sun won’t stop shining, the wind won’t quit blowing. Investing in renewables is a way to bet on a stable, homegrown power source. It’s clean, it’s steady, and it’s getting cheaper to make.

As the globe heats up, so does the push for clean energy. Laws may shift, pushing for less coal, more breeze and rays. This opens doors for investors. Sun and wind could win big. Beyond stocks, think of stuff related to energy—like batteries or tech to manage power use.

In tense times, folks look to stuff that keeps its worth. Renewables fit the bill. They offer a hedge against chaos. They give back two ways: steady gains and a better planet. That’s a win-win. Plus, following a green path can bring rewards from governments as well.

So what’s the smart play? Keep an eye on firms in sun, wind, and related tech. Think about their plans and how they handle tough times. Are they making moves that pay off long after today’s headlines? That’s the key.

In a shake-up, we all aim for safer bets. Both cyber and green energy offer that. They grow no matter the global mood. They serve needs that just get bigger. Crises pass, yet these sectors can still set you up for gain.

In this blog, we broke down how to stay safe when the world is not. We talked about safe places for your money when war or fights pop up. Gold and houses can be like shields when things get shaky. Then, we looked at smart moves you can make to protect your cash from big market jumps. Some areas of business can still win, even when money is tight. We also saw that fights and unease can twist market prices, especially for stuff that armies use and goods like oil and metals. Lastly, we talked about how not to put all your eggs in one basket and where you might find bright spots, like in guarding against hackers and investing in clean energy, even when times are hard.

Here’s my last bit of advice: keeping your investments safe is a mix of know-how, timing, and guts. Markets will jump around, but with the right plan, you stay standing. Aim to understand, prepare, and maybe even grow when the world is full of surprises.

Q&A :

How can geopolitical turmoil affect investment markets?

Geopolitical turmoil often brings about uncertainty and volatility in the investment markets. During times of political strife, economic sanctions, or military conflicts, investor confidence can wane, and risk-averse behavior may increase. This can lead to significant fluctuations in stock prices, commodities, and currency values. Investors may seek safe-haven assets such as gold or government bonds, which can impact the performance of various market sectors differently.

What are safe-haven investments during times of geopolitical conflict?

Safe-haven investments are assets expected to hold or increase in value during times of turbulence. During geopolitical turmoil, traditional safe-havens include gold, U.S. Treasury bonds, Swiss Franc, and Japanese Yen, among others. These assets are sought after for their stability and the fact that they are not directly tied to the performance of the broader market. Real estate and certain currencies can also act as safe-havens, depending on the conflict’s nature and location.

How should one adjust their investment strategy in response to geopolitical turmoil?

In response to geopolitical turmoil, it’s crucial to reassess your investment strategy to ensure it aligns with your risk tolerance and investment horizon. Some investors might adjust their portfolios to include more safe-haven assets or defensive stocks that are less sensitive to market downturns. Diversification across different asset classes and geographical regions can also help mitigate risk. Consulting a financial advisor to navigate these situations and make informed decisions is advisable.

Can geopolitical turmoil offer investment opportunities?

Yes, while geopolitical turmoil generally fosters a risk-off atmosphere in markets, it can also present unique investment opportunities. For instance, certain commodities like oil and natural gas can see price surges if their supply is affected by political unrest. Additionally, market dips might provide chances to buy undervalued assets with the potential for recovery post-conflict. However, capitalizing on these opportunities requires careful analysis and an understanding of how the geopolitical event may unfold.

What are the risks of investing during geopolitical turmoil?

Investing during times of geopolitical turmoil carries heightened risks such as market volatility, liquidity issues, and unpredictable economic impacts. The instability can cause rapid and severe market movements, leading to potential losses. Moreover, the turmoil may affect global trade, supply chains, and commodity prices, further complicating investment decisions. Investors must be vigilant and prepared for sharp and sudden changes in their investments’ value.