Latest Developments in Global Financial Crisis: Navigating the New Economic Tides

As waves crash and storms brew, the finance world rocks to its very core. We’re sailing through a time of major stress, keen to grasp the latest shifts in our global money crisis. Here, I break it all down; from the roots of this economic chill to its spread across our world. Banks are on shaky ground, stocks bounce like rubber balls, and governments scramble to patch the leaks. Will we ride the waves to calm waters, or will we face a harsher storm ahead? We’ll look at cash plans that countries roll out, and central banks’ big moves that spin our cash value. Lastly, we’ll scout the horizon to see how our global money health might bloom or wilt, eyeing the IMF and World Bank’s part in mapping our comeback, and how new markets stand up to this tough test. Let’s chart the course together and make sense of this financial whirlpool.

Understanding the Current Economic Downturn Analysis

Tracing the Origins and Current State of the Economic Downturn

We must dig deep to understand the roots of the latest financial slump. It started with small cracks in banking systems, international debt, and rules on money use. Soon, these issues spread across the globe. Major banks found themselves on thin ice. Stocks tumbled down, taking wealth with them. Everywhere, folks lost jobs as companies scaled back or shut down.

Now, we face rising prices on goods, while our bucks buy less. Nations worldwide are deep in the red, owing more than they can pay back. Even mighty currencies aren’t standing as tall as before. The pain is real in our wallets and on Main Street.

Assessing the Impacts of Ongoing Global Recession Updates

Let’s look at the ripple effects of the downturn we’re in. As jobs leave, folks have less cash to spend. Businesses feel the pinch when sales drop. Worried investors watch as the value of their nest eggs wobble. Governments are stepping in, trying to light a fire under the chilly economy with cash injections. But these moves can be double-edged swords, sometimes stoking the very fires of price jumps they hope to quell.

And around the bend, there’s talk of change in the air. Some predict a bounce-back, while others caution of more tough times. We have to buckle up and steer through this financial storm with our eyes wide open.

It sure isn’t a walk in the park. But knowledge is power. To ride out this storm, we need to keep tabs on money movements, savings safety, and the winds of change in world markets. We’ll weather this together and come out wiser on the other side.

Examining Financial Market Trends During Uncertain Times

Insight into Banking Sector Stability Amid Economic Fluctuations

Banks are like the heart of our money world. When they’re strong, we all smile. If they shake, we get worried. Right now, banking big-shots are working hard to keep things stable. They check their cash, cut risks, and follow rules to stay solid. Less loans go bad, which is good news. But watch out, banks! Hard times aren’t over yet.

Money folks fear global slipping back into a big slowdown. This means banks might see more loans turn sour. They keep an eagle eye on job rates, debt woes, and people’s spending. When folks lose jobs or get scared to spend, banks brace for impact. The key? They need to be ready and have a plan. That way, they keep our money safe even when things look grim.

Navigating Stock Market Fluctuations and Investor Confidence Levels

Stock markets are like roller coasters – thrilling but shaky. Investors they’re riding this wild ride every day. They look for signs – good or bad, that could swing their cash up or down. When markets dip, some get scared. They pull out their cash and wait. But here’s a secret – smart ones stay cool. They know it’s part of the game.

These money pros look at stuff like trade, debt, and gold. They peep at oil and new tech cash like Bitcoin. All these can stir up the markets like a giant wave. When folks hear news, they feel brave or scared to invest. Too much back and forth and trust slips away. We need trust to keep markets going strong.

So, we’ve got to stay sharp and look out for changes. Bad news today doesn’t mean no hope tomorrow. Markets might bounce back, surprising us all. We keep learning, day by day. That’s how we get through the tough stuff and come out ahead.

Policy Responses to the Financial Crisis

Evaluating the Efficacy of Economic Stimulus Packages

Leaders worldwide use economic stimulus to fight downturns. Such packages aim to boost the economy by increasing jobs and spending. To evaluate their success, we look at jobs data and business health.

Easy-to-grasp signs can tell us if stimulus efforts are working. When more people have jobs and can buy goods, it’s a thumbs-up for the economy. Shops selling more and people spending cash are signs of a pick-up. If these are not happening, it could mean the plan’s not quite there yet.

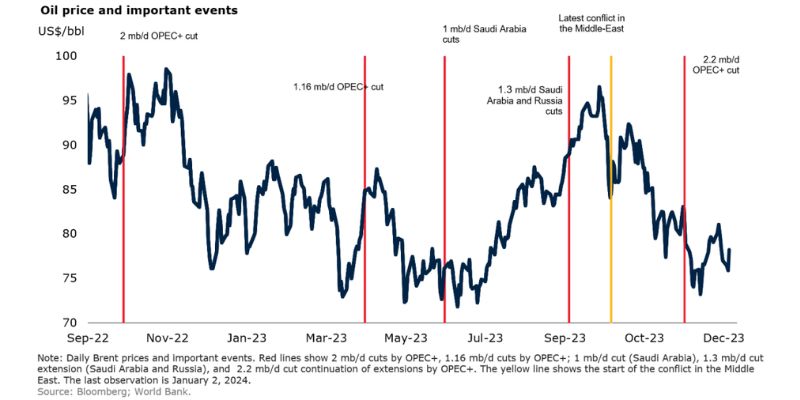

Global Central Bank Measures and Their Effects on Currency Devaluation

To assist economies, central banks play a big role. They change interest rates and buy government bonds. These actions impact the value of our money against other countries’. A weaker money value can help some businesses but can also make imports pricier.

Central banks aim to balance this money value change. They want a level that aids growth without too much harm. At times, changes can affect people’s pockets and change how much things cost. With care, these steps can steer us clear of deeper economic woes.

Prospects for Recovery and Long-Term Economic Health

The Role of International Monetary Fund and World Bank in Shaping Economic Recovery Predictions

Think of the International Monetary Fund and World Bank as doctors for the world’s cash flow. They help when a country’s money health is poor. These big groups lend cash and give advice to countries. This helps countries fix their cash problems and get stronger again.

How do they predict recovery?

The IMF and World Bank look at data. They check how money moves around the world. They watch what people buy and sell. Seeing this, they guess how fast countries can bounce back.

How good are their predictions?

They have lots of smart people and information. So, they can make pretty good guesses about the future.

The IMF and World Bank watch everything from how much stuff a country makes to the prices in the stores. They use this info to help us understand if a country’s economy will do well or face more trouble.

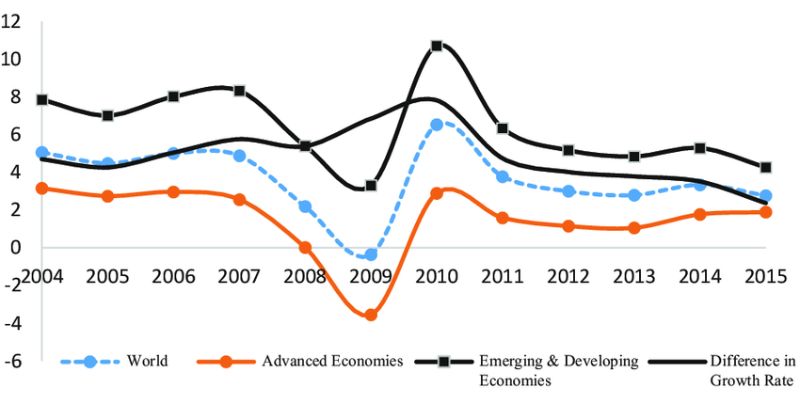

Emerging Markets: Vulnerability and Strategies for Resilience

Now, let’s talk about places in the world that are just starting to grow fast, like some countries in Africa or Asia. Experts call these “emerging markets.”

Why are emerging markets at risk?

They depend a lot on money from outside. When global cash flow hits a snag, these places feel it a lot. They might not have much saved up to help when times are tough.

What can emerging markets do to stay strong?

They need plans to handle less cash coming in. One idea is to have a safety net. This could be money saved or help from other countries. They also need to be careful with how they spend their money. Being smart about spending means they can stay stable when things are hard.

Are there any success stories?

Yes! Some have saved money for rainy days. Others have made rules to keep their banks safe. And some have found ways to sell more things to people in other countries.

Emerging markets can grow even in hard times. They do this by being smart about money and getting help from friends like the IMF and World Bank. These markets are like small boats in a big storm. With a good captain and a strong ship, they can make it through!

In this post, we’ve dived deep into our shaky economy. We started by looking at why things got bad and where we stand now. Then, we saw how banks and stock markets are trying to stay afloat during these hard times.

Next, we checked out what governments are doing to fix things. They’re giving out money and pulling financial levers to spark life back into our cash flow. Last, we looked ahead. We talked about big groups like the IMF and World Bank, and how they plan to get us back on track. We also thought about the countries just starting out and how they can stay strong.

Here’s the deal: Times are tough, but we’re not out for the count. The world’s got plans and so should you. Stay smart, stay informed, and let’s ride this out together. Keep your eyes on the news and your mind on your money. We’ll get through this.

Q&A :

What Are the Recent Key Events Shaping the Global Financial Crisis?

In addressing the consequences of the global financial crisis, recent key events include changes in interest rates by central banks, fluctuations in the stock market, and new policies aimed at stabilizing the economy. Political developments and trade negotiations can also significantly impact the crisis, potentially leading to broader economic implications.

How Is the Global Financial Response to the Latest Financial Crisis Evolving?

As the financial landscape shifts, global responses adapt through a mix of fiscal stimulus, monetary policy adjustments, and international cooperation. Governments and financial institutions might implement relief programs to support businesses and individuals, while regulators could introduce new measures to enhance financial stability.

What Are the Predictions for the Global Economy Following the Latest Developments in the Financial Crisis?

Economists often provide varied forecasts based on the latest financial crisis developments. Predicted outcomes can range from recessionary periods to slow economic recoveries. These predictions consider factors like consumer spending, industrial production, and the effectiveness of implemented financial strategies.

How Are the Latest Financial Crisis Developments Affecting Global Markets?

Stocks, bonds, and commodity markets react to the developments in the global financial crisis. Factors influencing these effects include investor confidence, currency valuations, and global trade. Market volatility can offer insights into the immediate impact of crisis-related news on different sectors and economies.

What Steps Are Governments Taking to Mitigate the Effects of the Latest Global Financial Crisis?

To mitigate the effects of the latest financial crisis, governments may employ various strategies, such as implementing stimulus packages, offering tax relief, and providing direct financial support to citizens and businesses. Central banks might also cut interest rates or purchase assets to increase liquidity in the financial system.