Leading e-commerce payment platforms are your golden key to a seamless online checkout. No one likes clunky, slow sales steps that turn easy buys into digital drags. You’re not just selling products; you’re crafting experiences. That’s why understanding how these platforms work is crucial for your success. Whether you’re a start-up or a seasoned online vendor, choosing the right payment gateway isn’t just about transactions—it’s about ensuring your customers glide through checkout with a smile. Let’s dive into the world of e-commerce payment solutions, compare methods, and make sure your site isn’t where easy shopping goes to die.

Understanding the Dynamics of E-commerce Payment Solutions

The Evolution of Online Payment Systems

Let’s take a trip back in time. Long ago, buying online was tough. We had to type out lots of numbers. It was slow, and boy, it was not fun. But good news, folks! Times have changed. Now, we tap our phones and – bam – shopping done. Smooth, right?

Kids, guess what older folks used only? It was called “cash on delivery.” Yep, cash! Then, along came credit cards. But here’s the cool part – we got smart. We made computer ways to pay that are safe and fast. Today, top e-commerce payment solutions make buying online a breeze. We use PayPal, Stripe, and Square because we trust them. No more writing long card numbers each time.

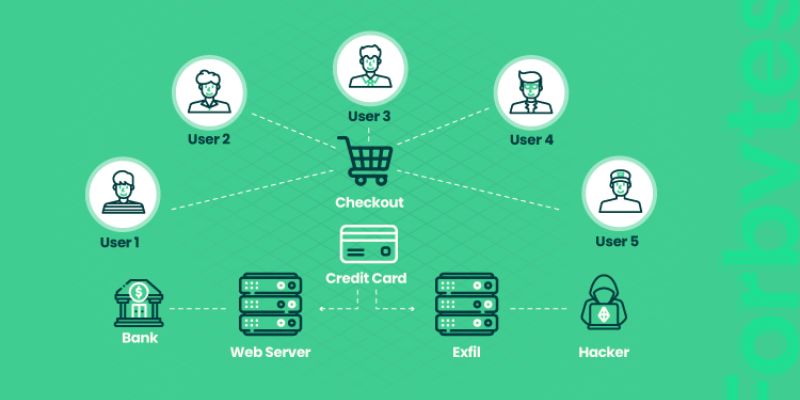

See, secure online transactions really matter. We share money info with trust. Our card details or a quick login, and we’re set. Plus, shops now take care of us. They watch for bad guys trying to steal. That means more play for us and less worry about our piggy banks.

And hey, you know what else is neat? We can pay from anywhere. Got a cool toy from a shop across the ocean? No sweat. International payment services for retailers make it super easy. Dollars or Euros, they sort it out. It’s like magic money moving around.

So, what did we learn? We learned that paying online got way, way better.

A Comparison of E-commerce Payment Methods

Now, let’s line things up and look close. When picking how to pay, you’ve got choices. Lots of them. But which one is your superhero?

Credit cards are the old-school cool. They work. But hold on, there’s more. Have you heard of digital wallets? Apple Pay on webshops or Google Pay checkout – tap your phone and you’re through. No card swiping needed.

But wait, have you seen people pay with Bitcoin? That’s the new kid on the block – cryptocurrency payment adoption is growing fast. Some folks really dig it. You might too!

And what about when you buy the same thing every month? Like your favorite snack box. Recurring payment systems for e-commerce make sure you never run out. It’s like magic – your treats just show up.

Want to buy with just one click? Yep, that’s a thing too. One-click payment convenience means more playtime for you. Less typing, more chilling.

Alright, we looked at how you can pay when you shop online. Old school or new tech, all have their special superpower.

We need to be minding the rules too. That’s PCI compliance for e-commerce. It’s like the rulebook for safe paying. And those shopkeepers work hard to follow those rules. So we can keep having fun shopping.

Now, go forth with this wisdom and find your perfect way to pay. Happy shopping!

Selecting the Ideal Payment Gateway for Your Business

Identifying the Best E-commerce Payment Gateways

Picking the right payment gateway is like choosing a key for a lock. It must fit well to work. Look for gateways that match your sales volume, target audience, and type of products. The top e-commerce payment solutions make paying easy and safe. They should let customers pay how they want, whether by credit card or digital wallet. The best e-commerce payment gateways will offer options like PayPal, Stripe, and Square.

PayPal is a go-to for many online stores. It’s well-known and trusted. PayPal e-commerce advantages include a vast user base and familiarity. Stripe is great for developers who want custom solutions. It features easy-to-use tools for building the ideal checkout. Square is superb for small businesses, offering a simple fee structure.

For international sales, look for services that handle different currencies. Multi-currency payment platforms help you reach buyers around the world. Mobile payment options for online stores are essential too. More folks shop on phones now, so you need to support Apple Pay and Google Pay.

Security matters a lot. Pick gateways that follow payment security standards in e-commerce. Look for PCI compliance to protect card data. Also, find out how they fight fraud. Good gateways offer tools to stop dodgy deals and manage chargebacks, which are refunds made after disputes.

The Integration Journey: Payment Systems for Shopping Carts

Once you choose a payment gateway, you need to add it to your store. This is called integration. Payment integration for shopping carts should be smooth. Many e-commerce platforms, like Shopify, Magento, and WooCommerce, come with built-in options for this. They often have plugins or modules that make setting it up a breeze.

For custom online stores, you might need more work. You could need to code or hire a developer. But remember, simple and quick checkouts keep customers happy. With one-click payment convenience, they can buy without hassle. This can bump up your sales.

To sum it up, picking your payment gateway needs thought. Consider what matters for your business. Think about your customers, where they come from, and how they like to pay. Go for secure, well-known gateways with strong support for issues like fraud. Make sure they work well on mobile as many shop with their phones. A seamless checkout will keep customers coming back, which is good for your business.

Taking time to get your payment process right pays off. It’s not just about getting the sale. It’s also about creating trust. A smooth payment process shows you value your customers. It can help make your online store a go-to spot for them to shop.

Enhancing Transaction Security and Compliance in E-commerce

Navigating Payment Security Standards and PCI Compliance

When you run an online store, keeping customer info safe is a must. Do you know what’s key to this? It’s following payment security standards and PCI compliance. These rules protect credit card info and make sure it’s all handled right.

To stay in line with PCI rules, you first need to know what data is sensitive. Credit card numbers, expiry dates, and security codes top this list. You must keep this info safe both when it’s stored and during a sale.

But how do you protect this data? Use encryption, strong passwords, and access control. Encrypting data turns it into a secret code that only the right person can read. Strong passwords and access control mean only trusted folks can see the data.

Make sure to scan your systems regularly for any weak spots. This helps you find and fix any open doors that hackers might try to sneak through. It’s like checking all the locks in your house before you leave. And don’t stop there – keep your eyes open for new PCI rules and follow them.

Implementing Effective Fraud Protection Strategies

Now, let’s talk about fighting fraud. Scammers are always finding sneaky ways to steal. So, you must have good fraud protection to guard your store.

Start by screening orders. Watch for anything that seems off, like big orders that come out of nowhere. Also, use tools that check the address and security code of the credit card.

Next up, keep an eye out for chargebacks. A chargeback happens when a customer says they didn’t make a buy and asks for their money back. Too many of these can cost you big time. So, track them and look for patterns. Maybe there’s a hole in your store’s defenses you didn’t spot.

Be ready to ask for more info if a buy doesn’t seem right. It might be a hassle for some customers, but it’s better than letting a fraudster through. It’s like asking for ID when someone looks too young to buy a video game. Better safe than sorry, right?

Lastly, use tech like device fingerprinting and behavior analysis. These look at how and from where people are shopping. It can flag if something’s fishy. Maybe someone’s trying to buy stuff from a country far away, too fast, or late at night.

Remember, consumers trust stores that keep their info safe. You must work hard to build and keep that trust. Use secure online transactions, fight fraud, and follow PCI rules. Then customers will feel good about shopping with you. Happy customers mean good business, and that’s the goal, isn’t it?

Leveraging Advanced Payment Features to Boost Sales

One-Click Payment Convenience and Subscription Billing

These days, folks want quick and easy shopping. That’s where one-click payments shine. They let customers buy with a single tap. No need to enter card info every time. This means they check out fast, which they love.

Subscription billing is another super tool. It helps you sell products or services over time. Customers sign up once. Then they get billed regularly, like every month. It’s great for things they need often. And it makes your cash flow steady.

By using these features, you’re making sure that your shop is as easy as pie to use. And when your store is easy to shop in, folks keep coming back. That’s more sales in your pocket. So, smart payment options are key. They help customers say yes to buying, over and over.

Adopting Emerging Payment Technologies for a Competitive Edge

Staying ahead is a big deal in online sales. So, it pays to know the latest in payment tech. Let’s talk about mobile payments. Options like Apple Pay and Google Pay make buying on phones a breeze. They’re secure and fast. Plus, people can pay without their wallets!

Cryptocurrency is another hot topic. More businesses are starting to accept it. It gives customers more ways to pay. And it can set you apart from others.

Don’t forget about global shoppers. Offering international payment services can open up whole new markets. They let you accept different currencies. So, customers from anywhere can buy your stuff.

To keep up, you’ll want to choose payment systems that are easy to add to your online store. And they should grow with your business. They need to be safe for you and your customers too.

When you get these things right, your store can stand out. You’ll be ready to wow shoppers from all over the world. Your checkout will be a snap. And everyone will want to buy what you’re selling. It’s all about giving folks that smooth, safe, and modern payment experience.

In this post, we’ve broken down the key parts of e-commerce payment solutions, from how they’ve grown to what to choose for your business. We compared different payment methods and looked at the top gateways for a smooth checkout process. We also covered how to keep payments safe and stick to rules. Plus, we showed how one-click pay and new tech can ramp up sales.

To wrap up, picking the right payment system is vital for your online shop. You need one that’s easy for customers, follows security rules, and has features that can help you sell more. Keep your eye on the latest tech to stay ahead. Remember, a good choice today can lead to better sales and happier customers tomorrow. Choose smart, and good luck with your e-commerce journey!

Q&A :

What are the most popular e-commerce payment platforms in 2023?

The landscape of e-commerce payment platforms is ever-evolving with new technologies and players entering the market. As of 2023, some of the leading platforms include PayPal, Stripe, and Square. These platforms are known for their robust features, security measures, and ease of integration with various e-commerce systems. Other contenders such as Shopify Payments, Amazon Pay, and Adyen also offer competitive services tailored to online merchants, providing a range of options depending on the specific needs of the business.

How do leading e-commerce payment platforms enhance online security?

Online security is a paramount concern for e-commerce payment platforms. Leading services incorporate multiple layers of security to protect both merchants and customers. Technologies like encryption, tokenization, and Secure Sockets Layer (SSL) certificates are commonly employed. Additionally, many platforms comply with Payment Card Industry Data Security Standard (PCI DSS) and offer fraud detection tools to help prevent unauthorized transactions. These features reassure customers and merchants that their financial data is handled safely.

Can small businesses benefit from the same e-commerce payment platforms as larger corporations?

Absolutely, small businesses can take advantage of the same e-commerce payment platforms that larger corporations use. In fact, many platforms are designed with scalability in mind, allowing them to cater to businesses of all sizes. Features like easy integration with shopping carts, customizable checkout experiences, and various payment methods make these platforms versatile for businesses at different stages of growth. Moreover, competitive pricing and pay-as-you-go models allow small businesses to access high-quality payment solutions without prohibitive costs.

What are the key features to look for in an e-commerce payment platform?

When selecting an e-commerce payment platform, businesses should look for key features that align with their operational needs. Important features include a variety of payment methods (credit/debit cards, digital wallets, bank transfers), multi-currency support for international sales, mobile payment capabilities, and straightforward integration with e-commerce platforms. Additionally, transparent pricing, reliable customer support, and robust security measures are crucial for a seamless and secure transaction experience. Strong analytics and reporting tools can also provide valuable insights into sales and customer behavior.

How do e-commerce payment platforms integrate with online stores?

E-commerce payment platforms typically offer a range of integration options to ensure smooth and efficient transactions within online stores. These include API (Application Programming Interface) integrations that allow for custom checkout experiences, pre-built plugins or extensions for popular e-commerce platforms like WooCommerce, Magento, and Shopify, and even hosted payment pages that can redirect customers to secure payment environments. The goal is to streamline the payment process for both the merchant and the customer, minimizing cart abandonment and maximizing conversion rates.