On December 3, 2024, South Korean President Yoon Suk Yeol shocked the nation by declaring a state of emergency martial law for the first time in 44 years. This decision has not only sparked a strong political reaction within South Korea but has also had far-reaching effects on financial markets, particularly the cryptocurrency sector. Let’s explore the impacts of this event on Bitcoin, XRP, and investors both domestically and internationally.

Martial law in South Korea

On the evening of December 3, 2024, President Yoon Suk Yeol announced the emergency declaration of martial law, an unprecedented move in South Korea for over four decades. This decision has deeply affected the political landscape and generated significant consequences in the economic and financial sectors, especially the cryptocurrency market.

Reasons for declaring martial law

President Yoon explained that the martial law was necessary to “eliminate pro-North Korean forces” and to protect South Korea’s democratic order. The main reason for this action stems from political disagreements between Yoon’s government and the opposition, particularly as the opposition party holds a majority in the National Assembly. Yoon has accused political opponents of undermining South Korea’s democracy through actions such as pushing for the impeachment of top prosecutors and blocking the passage of the national budget.

The imposition of martial law in South Korea is seen as an extreme measure, as it is the first time in 44 years that the government has used the military to replace civilian governance. In this context, the military not only has the authority to control government agencies but can also suspend fundamental freedoms such as freedom of speech, assembly, and the right to hold protests.

Political implications and national assembly dynamics

President Yoon’s actions quickly met with strong opposition from the opposition parties, particularly the Democratic Party, which holds a majority in the National Assembly. The discord between the government and the National Assembly has further intensified political tensions in South Korea. The Democratic Party declared it would strive to revoke the martial law, fearing that military intervention in political matters could destabilize the country.

Although this decision has sparked widespread opposition among citizens and politicians, President Yoon maintains that his actions are necessary to prevent “internal and external threats” and to safeguard the country’s democratic order.

The political significance of the event

The declaration of martial law carries major political implications not only for South Korea but also for its international relations, especially with countries involved in the North Korean situation. The military’s involvement in political matters could raise concerns about the stability of democracy in South Korea, potentially eroding investor confidence and alarming international trade partners.

Impact on the cryptocurrency market

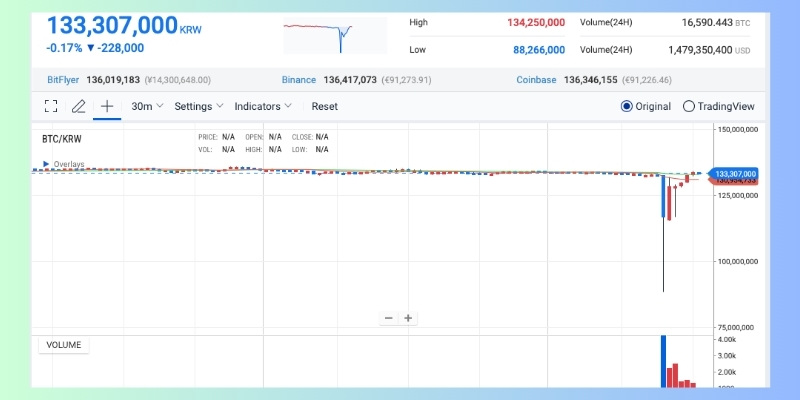

Following the announcement of martial law, South Korea’s cryptocurrency market saw a dramatic downturn. Bitcoin (BTC) and XRP, two major cryptocurrencies, both experienced significant losses on domestic exchanges.

Bitcoin: A sharp decline

On Upbit, one of South Korea’s largest cryptocurrency exchanges, Bitcoin’s price plummeted from 132 million KRW (approximately 92,000 USD) to 88 million KRW (about 62,000 USD). This sharp 33% drop within a short period caused widespread panic among domestic investors, leading many to rush to sell off their assets. This was one of the most significant shocks to South Korean cryptocurrency investors in recent times.

This decline stemmed not only from macroeconomic factors like political instability but also from investor anxiety about the uncertainty of the future. Many investors chose to withdraw from the market to minimize risk, causing the cryptocurrency market in South Korea to dive.

XRP: An unbelievable drop

XRP, known for its goal of providing fast and efficient payment solutions for banks, also saw a dramatic price decline. On Upbit, XRP’s price dropped from 4,000 KRW to just 1,623 KRW, a nearly 60% decrease. Although XRP recovered somewhat afterward, this volatility highlights the impact of South Korea’s political turmoil on both financial and cryptocurrency markets.

Psychological impact on investors

The political crisis and the declaration of martial law triggered panic among investors. Those without a long-term strategy rushed to exit the market to protect their assets. The situation grew more tense with the announcement of military measures, amplifying the political and economic instability.

However, cryptocurrency markets do not always react in predictable ways. Although Bitcoin and XRP prices plummeted immediately, they quickly rebounded once news broke of the martial law being lifted. This indicates that while politics can cause significant volatility, cryptocurrency markets can quickly adjust in response to positive signals.

South Korea’s national assembly revokes martial law

After the martial law declaration, South Korea’s National Assembly moved swiftly to revoke the decision, thanks to strong opposition from the opposition parties and civil groups.

- Political situation after the revocation: Following the revocation of martial law, political stability in South Korea began to improve. Public protests and opposition subsided, and market sentiment shifted positively. Investors began returning to the cryptocurrency market, particularly Bitcoin and XRP.

- Cryptocurrency market recovery: As soon as the news of the martial law revocation spread, South Korea’s cryptocurrency market experienced a rapid recovery. Bitcoin’s price returned to 133 million KRW, while XRP also showed signs of recovery. This demonstrates that market recovery is a natural response when political stability is restored.

The martial law event in South Korea caused significant disruptions in the financial and cryptocurrency markets. However, with the revocation of the martial law and market recovery, investors can feel more reassured about the future. While politics can profoundly impact the economy, financial markets, especially cryptocurrencies, can bounce back quickly when political stability is regained. Therefore, investors need to monitor political developments closely and make cautious investment decisions.

Don’t forget to follow Forex Trend News for the latest updates from the finance and investment markets every day!