Monetary Policy and Inflation: Taming the Dollar Dance – Who Wins?

Think of your money like a dance partner. Sometimes it dips, other times it soars. But when prices climb too high, the music stops. Who steps in? Monetary policy. It has its set moves to keep inflation in check and your wallet flexible. We’ll deep dive into this rhythm to see who truly leads on the economic dance floor. This dance impacts your life, so let’s break down the moves, measure the beats, and see how it all flows. Ready to master the dollar dance? Let’s go.

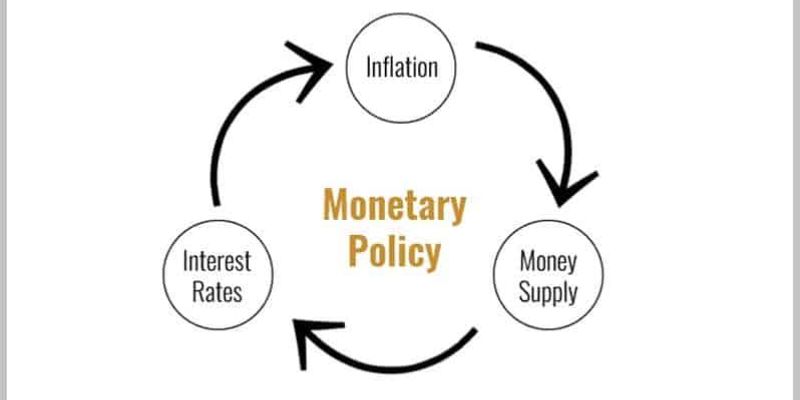

The Core Dynamics of Monetary Policy and Inflation

Understanding Central Bank Policies and Their Objectives

Central banks have one big goal: keep prices stable. To do that, they watch inflation like hawks. Inflation rates tell us how fast prices go up. When prices rise too fast, everyone gets nervous.

Central banks use tools like the federal funds rate to keep things in check. Think of the federal funds rate like a gas pedal for the economy. Push too hard, and inflation zooms up. Let up too much, and growth slows.

The Interplay between Monetary Tools and Inflation Rates

Now, let’s talk about central bank tools and inflation. Central banks can buy or sell government bonds. This is called open market operations. It’s like turning a knob to adjust money flow in the economy.

When a central bank buys lots of bonds, it’s called quantitative easing. It’s like pouring water on a thirsty plant—the plant being our economy. But too much water and the plant’s roots, our prices, can get soggy and rise too much. That’s bad inflation.

Central banks also set the discount rate. This rate tells us how much banks pay to borrow money from the central bank. A low discount rate means borrowing is cheap. This can help the economy grow, but again, watch out for too much inflation!

Inflation measurement tools like the consumer price index, or CPI, show us how prices change for everyday stuff. Think milk, bread, cars, and more. The producer price index, or PPI, shows what factories and farms charge.

Both the CPI and PPI help central banks nail down inflation rates. They don’t want runaway inflation like a horse without reins. That’s called hyperinflation, and it’s as scary as it sounds.

On the flip side, central banks must dodge deflationary spirals. That’s when prices drop too much. It sounds good, right? But it can actually harm the economy, like a bike losing its momentum.

Let’s not forget stagflation. That’s when the economy doesn’t grow but prices go up. Imagine trying to run through mud. Not fun, right?

So, central banks have to balance things just right. They want a little inflation, but not too much. They must be careful with tools like interest rates to keep our economy dancing smoothly to that perfect beat.

Demystifying the Metrics: Measuring Inflation Accurately

The Role of Consumer and Producer Price Indexes

Inflation can feel like a mystery. But with the right tools, we can unravel it. Central bank policies aim to manage inflation. They watch the prices of goods and services closely. This is where the consumer price index, or CPI, comes into play. CPI tracks what families pay for everyday items. It’s like a shopping list that shows how prices change over time.

We also have the producer price index, or PPI. PPI checks the cost of goods right as they leave the factory. It shows how much more or less it costs to make things. Think of CPI as the price for you, and PPI for the maker of what you buy.

Both indexes are big clues in the inflation puzzle. They tell us if life is getting more expensive, and by how much. Through CPI and PPI, we see inflation’s true colors. We can tell if our money is losing its stretch to buy what we need.

Advantages and Limitations of Various Inflation Measurement Tools

Now, every tool has its strengths and its flaws. CPI and PPI are both really good at tracking prices over time. But they don’t catch everything. For example, CPI may not show how changes in rent or health care affect us all. And PPI can’t predict if higher costs for makers will mean higher prices for us.

Then there’s the big topic of housing costs. CPI includes them, but the way it’s done makes a debate. Some say it doesn’t reflect true home prices. Others think it’s close enough.

We also use different tools for different jobs. CPI is great for figuring out cost of living raises. When it goes up, so should wages. But PPI is a step ahead in showing where inflation might go next.

We keep digging with more measures, like the federal funds rate. That’s the interest rate banks use with each other. It sets the beat for other rates. Think loan and mortgage rates. When it goes up or down, the dance of dollars across the economy changes pace.

Open market operations are another key move. This is when the central bank buys or sells government bonds. It’s like adding or taking away money in the system. This can either fan or cool down inflation.

Inflation targeting strategy means setting a goal for how high prices should climb each year. If prices rise too fast or too slow, the central bank steps in. They use tools like the discount rate influence. That’s the interest rate banks get for loans from the central bank.

These measures help shoot for price stability goals. But they’re not perfect. They can’t catch every whiff of change in the air. Still, they guide us well. They’re like a compass for safe sailing on the sea of spending.

That’s our sneak peek into measuring inflation. It’s not just numbers, but stories of what we make, buy, and need. These tools, like CPI and PPI, help us see if we’re winning the dollar dance or if it’s time to change our steps.

The Real-world Impact of Monetary Decisions

How Interest Rates Shape Economic Activity and Inflation

Picture this: Interest rates are like the heart’s pace for our money’s health. They go up, borrowing gets pricier. They go down, and folks find it easier to borrow. It’s all set by a group we call the central bank. When interest rates are low, people like to spend more. That can drive prices up, which we call inflation.

But it’s not just about buying things; it’s about jobs and businesses too. If it costs less to borrow, companies might take out loans to grow or make new jobs. This is the central bank walking a tightrope, making sure their moves help our money stay steady but still keep things growing.

Why does this matter? Well, your money should buy the same basket of stuff tomorrow as it does today. But if prices jump too high or too fast, it can’t. That’s a big problem. That’s why these interest rate decisions are super important.

Quantitative Easing and Open Market Operations: A Deeper Look

Now, let’s dive deeper into some big words: quantitative easing and open market operations. These are like the tools in a central bank’s toolbox. They use them to make sure there’s just enough money flowing in the economy. Not too much to cause crazy high prices but not too little so nobody can buy or sell stuff.

Quantitative easing is when the central bank creates money to buy things like government bonds. This can make interest rates fall even more. It’s like giving the economy a big glass of juice when it’s feeling tired.

Open market operations are another tool they use every day. It’s like the central bank’s daily workout for the economy. They buy or sell government securities to control how much money is out there. When they buy, they pump money into the economy. When they sell, they take money out. This helps keep inflation just right, not too hot and not too cold.

Both of these can help keep our money dance smooth. Whether it’s tweaking interest rates or using these fancier tools, it’s all about keeping our dollars from tripping over their own feet.

So there we have it. Interest rates and these big central bank tools shape everything – from what you pay for groceries to whether a business can hire more people. And getting it right is a big deal for everyone’s wallet.

Striving for Economic Stability: Strategies and Challenges

Inflation Targeting and Price Stability: Central Bank’s Balancing Act

Let me paint a picture of a tightrope walker. This is our central bank. It aims for a clear goal: the ground is price stability and the pole for balance is monetary policy. Imagine inflation like a gust of wind, trying to knock our walker off the path. Central bank policies are the moves made to stay steady.

Interest rates impact this balance. Think of these rates as the rope’s tension. If it’s too loose (low rates), the walker wobbles – spending rises, prices inflate. Too tight (high rates), and growth slows. Getting that tension just right keeps the economy steady.

What are inflation rates? It’s how fast prices for stuff we buy go up. When they climb too fast, things get tough – our money buys less. The central bank’s job is to keep this climb slow and steady. It uses inflation measurement tools like a weather vane. They show which way the wind – or inflation – is blowing. One tool is the consumer price index (CPI), tracking prices over time. The producer price index (PPI) tracks it for sellers. Together, they guide the bank’s steps on that tightrope.

Now, central banks have a bag of tools. Quantitative easing is like a net. It’s there to catch a falling economy by pumping money into it. Open market operations are the carefully planned steps. Here, the bank buys or sells government bonds to control how much money is out there.

Then there’s the federal funds rate. This one’s key. It’s the rope’s anchor. Banks charge each other this rate for loans. It influences all other rates. By adjusting it, the central bank signals to everyone whether to spend more or hold back. This helps in aiming for that inflation targeting strategy – like keeping an eye on a fixed point to stay balanced.

So, what’s this all for? Price stability goals. It means making sure prices don’t jump or drop too quick. A sudden jump can hurt buying power. If too slow, it might signal a weak economy. Both can trip up our walker – the economy.

Sometimes, despite tools and skills, there’s a strong wind – inflationary pressure. Prices might start rising fast due to more demand or higher costs to make things. It’s challenging, but not impossible, to tackle.

Forecasting Tools and Techniques for Managing Inflation Expectations

Central banks don’t just react; they also predict. It’s like checking the weather before a walk. They use economic indicators – signals that suggest where inflation might go next.

Managing inflation expectations keeps everyone calm. It’s like telling people, “Don’t worry, the tightrope walker has practiced.” This belief helps keep the economy stable. If people think prices will hold steady, they act in a way that makes it true. So, predicting right matters a lot.

How do they make these calls? They watch lots of numbers. They see how much money folks spend, how many things factories make, and even compare prices in different countries.

Central bank independence is crucial here. It’s the walker focusing without a crowd yelling. The bank makes decisions best for the economy without political noise.

Remember, it’s a dance. One where balance, foresight, and quick steps are key to not stumbling. The central bank leads, holding inflation’s hand, swaying to the rhythm of the economy.

In this post, we’ve unpacked the big ideas behind money stuff like inflation and central bank moves. We learned how banks use special tools to make sure prices don’t jump too high or dip too low. It’s tricky, but they keep an eye on different price tags to measure inflation right. They want us all to afford things we need, without the costs going wild.

We also saw how the bank’s choices about interest rates can make a big difference. They can make money cheap or costly, and that changes how much folks spend or save. Sometimes banks buy stuff to give the economy a little push – that’s called ‘quantitative easing.’ Yup, it’s a mouthful, but it’s a key move in their playbook.

Finally, we talked about how banks work to keep everything steady. They use cool tricks and tools to guess what prices might do next. This helps them get ready for whatever comes up, aiming for prices that don’t change too much.

All these things matter a lot because they touch our lives every day. Whether we’re buying a snack or saving for a bike, money rules mean a lot. Thanks for sticking with me through the nitty-gritty of bank talk and cash chatter!

Q&A :

How does monetary policy affect inflation?

Monetary policy, primarily enacted by a country’s central bank, influences inflation through the adjustment of interest rates and control of the money supply. By raising interest rates, the central bank can decrease borrowing and spending, which cools down economic activity and hence reduces inflation. Conversely, lowering interest rates can stimulate borrowing and spending, potentially leading to increased inflation if the economy overheats.

What tools do central banks use to control inflation?

Central banks have several tools at their disposal to control inflation, including:

- Open Market Operations (OMOs): The buying and selling of government securities to influence the level of bank reserves and the overall money supply.

- Interest Rate Adjustments: Setting the benchmark for short-term interest rates that affect borrowing costs for individuals and businesses.

- Reserve Requirements: Dictating the amount of funds banks must hold in reserve, which impacts the amount of money available for lending.

- Discount Window Lending: Providing loans to banks, which can alter the reserve levels and influence the money supply and inflation.

Can monetary policy lead to deflation?

Yes, when monetary policy is overly restrictive, it may lead to deflation. If a central bank raises interest rates too high or reduces the money supply excessively, it can cause a decrease in consumer spending and investment, leading to a reduction in demand for goods and services. This can trigger a deflationary spiral where prices continue to fall, potentially hampering economic growth.

What is the relationship between expansionary monetary policy and inflation?

Expansionary monetary policy involves lowering interest rates and increasing the money supply to stimulate economic growth. While this policy can reduce unemployment and boost economic activity, it can also result in increased inflation if the supply of money grows faster than the economy’s capacity to produce goods and services. Over time, if not carefully managed, this excess liquidity can lead to a sustained rise in prices.

How do inflation targets influence monetary policy decisions?

Inflation targeting is a framework used by central banks to achieve price stability. By setting a specific inflation rate as a target—often around 2%—central banks can shape monetary policy decisions to either stimulate the economy or cool it down, depending on whether actual inflation is below or above the target. Interest rates, reserve requirements, and other monetary tools are adjusted accordingly to steer inflation toward the desired rate.