Oil Prices and Geopolitical Tensions are words you’ve seen splashed across headlines. The harmony of global markets is under threat, shaking the ground beneath our feet as oil prices shoot up. Each tick upwards spells out a message loud and clear: tensions on the world stage tug hard on the strings of our wallets. Do you feel the pinch when filling up your tank? I know I do, and I’m here to shed light on the ‘whys’ behind this uptick. From the simmering sands of the Middle East to the boardrooms where sanctions are signed, every action ripples through to what you pay at the pump. Let’s dive into the heart of the matter, dissect the role of conflicts and sanctions, and explore how nations respond when oil, the lifeblood of modern economy, becomes a pawn in a game of geopolitical chess. Strap in – we’re about to navigate the turbulent waters of a market on edge.

Understanding the Spike in Oil Prices Amidst Recent Geopolitical Events

The Role of Middle East Conflicts in Shaping Current Oil Market Dynamics

Middle East conflicts steer oil prices, no doubt about it. Wars hit oil hard. When battle cries ring, oil markets shake. It’s simple yet deep. Now the Middle East, that’s a region that’s central to oil. You see, it has a ton of it. When wars or tensions rise there, folks worry. They ask, will the oil flow stop? Will it slow? This fear can make crude oil’s price leap up.

Let me paint the picture. Imagine fighters near oil fields. Fear spreads. Will the oil still come out? People start to wager. They bet prices will rise. And often, they’re right. It’s a tough spot. Countries rely on that oil. If supply drops, it’s not good. Buyers scramble, prices soar. It’s like if suddenly there were half as many cookies but kids crave the same amount. Imagine how much they’d trade for a cookie then.

How Sanctions on Oil-Exporting Countries Affect Global Oil Supply

Now, let’s talk about sanctions. It’s when countries say to another, “You can’t play in our game.” For oil, this is big news. Countries hit with sanctions often sell a lot of oil. If they can’t sell, there’s less oil to go around. What happens then? You got it – prices climb.

Think of it like a lemonade stand. If the biggest stand shuts down, others can’t meet the thirst. Prices jump up. Sanctions can cause this in the oil world. They pinch the supply. That makes each barrel of oil more costly. Plus, people get worried. They think, will there be enough oil? This fear alone can boost prices. It’s not just about how much oil there is. It’s also about how calm or scared folks feel.

During these times, everyone’s eyes are on the news. They watch every move in these oil-rich places. A small event can seem huge. People’s reactions affect the market a lot. They’re watching, guessing, and sometimes panicking. This can send prices on a roller coaster ride. It’s a game of nerves.

Oil is more than just fuel. It’s power and safety for countries. When leaders play chess with oil, things get intense. Prices jump not just from what happens, but from what might happen. And there’s another layer. Businesses and countries use oil to make stuff or keep things running. So, when oil prices leap, everything else can get pricier too.

What we see here is a link. It’s between the rough and tumble of politics and the everyday price of fuel. Middle East conflicts and sanctions reach far. They touch us at the gas station and in our wallets. We all feel the ripple when these events stir the oil markets. It’s a big, wide world. But on the ground, it boils down to simple things we all use every day. Like oil.

The Interplay Between Geopolitical Risks and Oil Market Speculation

Geopolitical Risk Premium on Oil: Evaluating the Impact

When armies clash or leaders spar, oil markets feel it too. For example, if there’s a hint of war, fear can drive up oil prices even before any actual supply drop happens. This is because traders bet on risks, not just present facts. They ask, “Will there be enough oil if things get worse?” This guessing game can make prices swing fast. It’s like when kids trade cards, betting on who will be the next big player. Fear of missing out can make a card’s price jump even before that player starts scoring big.

Now, let’s look closer at the Middle East, a hot zone for oil and fights. When conflicts rise here, the world watches because a lot of our oil comes from there. Any sign of trouble can make everyone nervous, and suddenly, oil costs more. It’s like if there was only one pizza place in town, and it might close. People would pay more for the pizza, just in case they couldn’t get it tomorrow.

Oil Futures and Speculation Amidst International Tensions

Speculation is like the game of musical chairs. Oil traders rush to grab a spot, betting where prices will go. They use “oil futures,” contracts you can think of as promises to buy or sell oil later at a set price. When countries argue or fight, traders start to worry that oil might run out. They then bet on future problems by getting these contracts, hoping to sell them for more later. It’s like buying lots of ice cream on a hot day, guessing others will want it later when it’s even hotter.

So, when things get tense between countries, like if one country says they’ll stop selling oil, the market reacts. Traders think, “This could mean less oil for all of us.” Prices then shoot up as a bet on future oil shortages. It’s like when you hear a storm is coming; people rush to buy candles, even though the power is still on. They’re betting the outage will happen.

What you should remember is that prices don’t just reflect what’s happening now. They’re also about what might happen next and how that scares or excites traders. It’s all very human – our hopes, fears, and guesses shaping today’s prices.

Strategic Responses to Oil Supply Disruptions

The Activation of Strategic Petroleum Reserves as a Mitigating Tool

When oil prices jump, it’s often a sign of trouble. Think about it like a fever. Just as a high temperature says something may be wrong in the body, so too can soaring oil prices reflect issues on a global scale. Recent conflicts have sent prices upward. Countries can’t control wars, but they have a big card to play – their Strategic Petroleum Reserves (SPRs). Let’s dive into SPRs and how they help us in tough times.

What are Strategic Petroleum Reserves? Well, SPRs are like our emergency savings of oil. When supplies tighten, due to say, a war, these reserves can be released to chill out rising oil costs. This action doesn’t fix the problem but gives us time to deal with the original cause.

In the past, we’ve seen countries tap into these oil savings in a pinch. For example, during the 2011 Libyan crisis, member countries of the International Energy Agency agreed to release 60 million barrels of oil into the market. Why did they do this? It was to lessen the impact of lost Libyan oil on the world market.

OPEC’s Strategies in Stabilizing the Oil Market During Turbulent Times

Now let’s look at the other big player: the Organization of Petroleum Exporting Countries, or OPEC. As a group of oil-producing nations, OPEC’s moves matter. They’re like the team captains of the oil world, setting the pace. Especially during rough patches, they can either tighten or relax oil flows.

What exactly does OPEC do when things get shaky? It’s a balancing act. They adjust their oil production to keep prices stable. Price too high? They might up production to bring it down. Too low? They could cut back to nudge prices up.

OPEC has been doing this dance for decades. Think of the oil embargo in the 1970s or when they held back production in the early 2000s. They’re keen on keeping prices at a sweet spot – not too high for buyers, and not too low for sellers.

As we face current tensions, OPEC’s role is as crucial as ever. They keep watch, ready to ease or tighten their supply taps in response to global events. So, while the world squabbles, OPEC works to keep the oil markets from spinning out of control.

In the energy game, it’s all connected. Wars can strain the supply, causing prices to spurt. SPRs offer quick relief, and OPEC sets the longer tempo. In such a complex world, these strategic moves are the effort to keep oil, our modern-day lifeblood, flowing smoothly.

Forecasting the Future: Oil Prices in the Context of Prolonged Geopolitical Strain

Projecting Oil Price Trends in Light of Geopolitical Risk

Oil futures are trades folks make to guess oil prices tomorrow. These futures react fast to world events, and boy, they can swing wildly with every hint of trouble! Think about recent times. We’ve seen big jumps in price when soldiers march or leaders argue. That’s because buyers fear there won’t be enough oil. Countries fight or have issues, and often, oil’s hard to get.

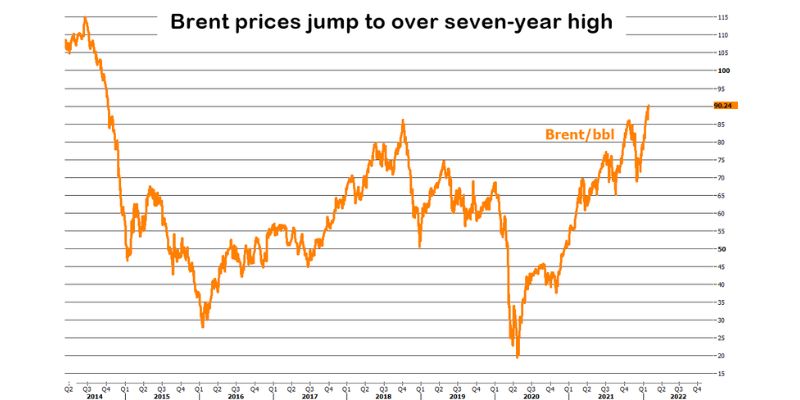

Some areas matter more for oil, like the Middle East. When conflicts rise there, the world holds its breath. That’s because lots of oil come from there. So, when tanks roll, prices can soar. And there’s Russia, another big name in oil. When sanctions hit them, it’s like a blockage in a pipe, slowing things down. Oil trade gets all messed up, and prices reflect that. Countries like Iran and Venezuela? Their political crises toss more fuel on this fire. That means more ups and downs in price for us all.

Then there’s OPEC, this group of countries that decides on making more or less oil. Their choices shape the market. They can open up the taps or keep them tight, affecting what we pay at the pump. OPEC watches the world, trying to keep things smooth, but it’s a tough job. Everyone’s watching them to see what they’ll do next.

What about those oil reserves nations have saved up? Well, they release some when times get tough. This helps to cool down high prices. It’s like having a backup gas can when your car runs dry. But these reserves aren’t endless. They need to last and be there for real emergencies, so using them has to be a careful choice.

Now, throw in the wild card of terrorism and how that scares markets. Imagine an attack near oil fields or tankers. Prices might jump, because getting oil becomes riskier. It’s all about how steady and safe we feel the supply is.

And then, there are events that make us stop and think hard about oil. Like when everyone stayed home a while back. Oil prices did a nosedive because no one was out driving or flying. The world changed fast, and the oil market had to catch up.

So when you ask me, “What’s next for oil prices?” I’m looking at all this – conflicts, sanctions, OPEC moves, reserves, and those sudden shocks we can’t see coming. It’s like trying to predict the weather; we know the seasons but not every storm. We do the best we can, watching the signs and drawing from past lessons.

Adapting Fuel Pricing Policies to Mitigate Economic Impact of Oil Shocks

Governments can tweak fuel policies to soften the blow when oil prices hit the roof. They tax less or help folks pay for their gas. They want to keep cars and businesses running. Adjusting these policies takes a fine balance. Aid too much, and the cash dries up. Do too little, and folks struggle.

Think about what happens when gas prices jump. People find it tough to fill up. It hurts going to work or taking kids to school. Everything costs more since trucks hauling goods need gas, too.

That’s where smart policies come in. They’re like levers governments pull to keep things fair. Help too much, and it can stop folks from saving energy or finding new ways to get around. Help too little, and the pain gets too much. It’s a dance, trying to find that middle ground where the economy runs well, but people don’t hurt.

In times of peace, it’s easier to plan. But when the world’s in a tizzy, every day can bring a new challenge. So, we keep an eye on the world stage, ready to turn those policy levers as needed to steady the ship.

Forecasting oil prices? It’s a blend of knowing the market, watching the world, and learning from what’s happened before. It’s never perfect, but we keep refining the craft, hoping to give the best guess and keep the wheels turning smoothly.

In this post, we’ve dug into the reasons behind rising oil prices. Wars in the Middle East affect oil big time. When countries can’t sell their oil due to sanctions, it hits supply hard.

We also looked at how fear of what might happen can make prices go up even more. Investors guess on prices, and when the world seems shaky, they guess high. To fight these jumps in price, countries have oil saved up just in case, and they use it to keep markets calm. The big oil group, OPEC, also has tricks to keep things steady when times get tough.

Thinking ahead, oil costs might stay high if these tough times last. We have to be smart with how we set prices for gas to help soften the blow.

I hope you’ve got a clearer picture of oil prices now. It’s a complex dance of supply, demand, and nerves. But by knowing the steps, we’re all better prepped for what may come. Keep this info in mind, and let’s ride out the oil waves together.

Q&A :

How do geopolitical tensions impact oil prices?

Geopolitical tensions often lead to uncertainty in the global oil markets as they can affect oil supply through disruptions, sanctions, or conflicts in key oil-producing regions. These tensions can also impact oil prices by causing speculators to predict changes in supply and demand, thus, driving market prices up or down.

What are the main geopolitical events that have historically affected oil prices?

Historically, events such as wars in the Middle East, OPEC’s oil embargoes, sanctions on oil-producing countries, and maritime disputes in key shipping routes have had significant impacts on oil prices. Such events can lead to either spikes or drops in prices, depending on how they influence the balance between supply and demand.

Can oil prices predict geopolitical tensions?

While oil prices themselves do not predict geopolitical tensions, they can reflect market participants’ expectations of future events, including geopolitical risks. A sudden increase in prices might indicate growing concerns among traders about potential disruptions in oil supply, which could be due to emerging geopolitical conflicts.

How do oil prices affect global economic stability during geopolitical tensions?

Oil prices have a direct impact on global economic stability because oil is a critical commodity in the global economy. High oil prices can lead to increased costs for transportation and manufacturing, which can contribute to higher inflation and slow economic growth. During geopolitical tensions, volatile oil prices can exacerbate economic instability, affecting both producers and consumers.

What strategies do countries use to mitigate the impact of oil price volatility due to geopolitical tensions?

Countries may employ various strategies to mitigate the effects of oil price volatility, including maintaining strategic petroleum reserves to buffer supply disruptions, diversifying energy sources, investing in renewable energy, and engaging in long-term contracts for oil supply at fixed prices. Additionally, they may participate in diplomatic efforts to resolve geopolitical conflicts that threaten oil supply stability.