The Rise of Fintech in developing economies is changing how people handle their cash. Now, folks can tap their phones to send money or get loans without the stuffy bank lines. These tools aren’t just handy; they’re flipping the script on traditional banking. This shift has thrown open the door to managing money in new ways, and everyone’s taking notice. Dive into the heart of this financial shake-up with me, and let’s explore how tech is rewriting the rules of the economic game for millions.

Understanding the Fintech Landscape in Developing Economies

Mobile Banking and Digital Payments: Paving the Way for Accessibility

Mobile banking is changing lives in low-income countries. It lets folks without a bank still move money safely. It’s like a bank in your pocket. People can send cash, pay bills, and buy goods with just a few taps. They no longer need to travel far to a bank or carry lots of cash.

We see more digital payment systems now. This means less time spent in lines and more safety from theft. Even small shops can use these systems, making life easier for everyone.

Financial inclusion initiatives aim to get everyone banking services. No matter how much money they have. These plans create tools that work well even in remote places. Places where banks are miles away.

Mobile money services have spread fast in many countries. These services let people without banks join the money world. It also helps them find new chances to grow money-wise. This is big news for the unbanked population.

These tools are not just handy. They also help make the economy stronger. When more people can manage money well, they can start businesses, which means more jobs and growth. It’s like planting seeds that grow into a strong money forest.

The Interplay between Microfinance and Emerging Financial Technologies

Microfinance means small loans for people who can’t use regular banks. It helps them start tiny businesses. This can change lives and help whole communities grow.

But how does tech come into play?

Fintech, or financial tech, makes microfinance even better. With new tech, people can get loans right from their phones. This cuts down costs and saves time. It’s a huge help, especially in places where it’s hard to find a bank.

Tech also keeps track of loans better. This means fewer mistakes and more trust. People know they won’t be charged for money they didn’t borrow.

Peer-to-peer lending platforms are also shaking things up. They connect people who want to borrow with those who want to lend. No need for a bank in the middle. This makes getting credit through fintech easier.

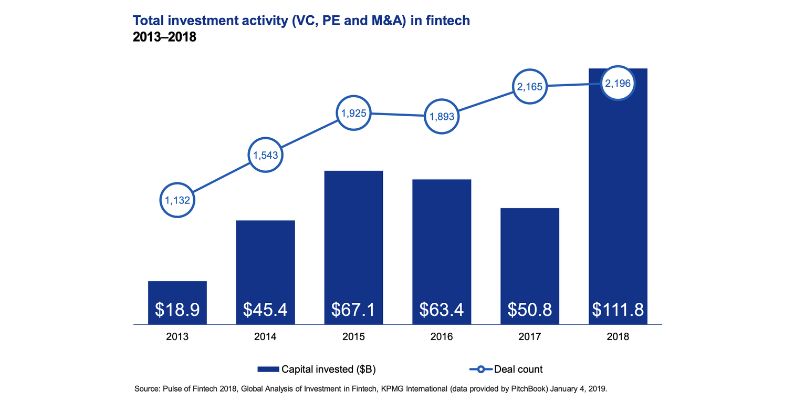

Fintech startups in Africa and Asia are on the rise. They come up with cool new tools that fix local money issues. They are also drawing lots of fintech investment trends. It shows that people believe these young companies can make a difference.

In summary, mobile banking and digital payments are opening doors. More folks can now take care of money matters with ease and safety. At the same time, fintech meets microfinance to build a bridge to better futures. It’s giving people new ways to lift themselves out of tough spots. And when they rise, so does the economy. It’s a win for everyone.

The Impact of Fintech on Traditional Banking and Economic Growth

Fostering Financial Inclusion Through Innovative Platforms

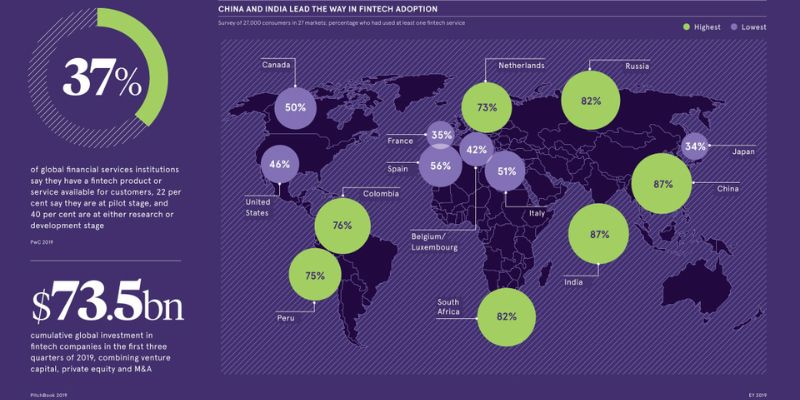

In many low-income countries, people struggle to use banks. Fintech is changing that fast. It lets people manage money through their phones. Digital payment systems help even in remote places. Mobile money services are booming. Now, someone in a small village can save, send, or get money easily. This change is huge.

Fintech also helps folks who never had bank accounts before. With digital wallets, they join the money world safely. More people can now start businesses or invest in their future. With fintech, everyone gets a chance.

Evaluating the Influence of Fintech Startups on Local Economies

Fintech startups are making waves in Africa and Asia. They bring fresh ideas and new tech. They make getting loans easier through peer-to-peer lending platforms. These loans can help small farms or shops grow.

Fintech brings more than loans and accounts. It brings hope and tools so people can build a better life. With mobile banking, a shop owner can track sales and supplies on their phone. People in the city or the countryside find it easier to buy and sell.

Startups in fintech mean more smart jobs in tech and business. They inspire people to learn new things. They show that everyone can have a part in the economy. It’s like planting seeds that grow into strong trees. These trees are the local businesses that help towns and cities thrive.

The growth of fintech is like a rising tide. It lifts up people, business, and the whole economy. It’s a game-changer that opens doors to a world where everyone has a chance to prosper. Fintech is not just apps and screens — it’s a key to a better, fairer world. And that’s a world we all want to live in.

Navigating Regulatory Challenges and Promoting Fintech Adoption

Overcoming Barriers to Serve the Unbanked with Digital Wallets

Many folks still don’t use banks in places like Africa and Asia. Digital wallets are changing this fast. They let you use money on a phone, any place, any time. Think of it like a bank that fits in your pocket! Banks are hard to find in many small towns. But phones are everywhere. This means even folks in far places can keep and use their money safely.

With more people using mobile wallets, money moves around easier. This helps people start businesses and pay for stuff like school and food. Sometimes rules can slow down how fast these wallets spread. I work to understand these rules. And I help make them better so more people can use these great tools.

Advancing Cryptocurrency and Blockchain Solutions in Banking

Now, let’s talk about crypto and blockchain. I bet you’ve heard of Bitcoin, right? Well, these are what we call “digital cash”. And the way they’re kept safe is super cool. Imagine a huge puzzle that lots of computers work on. Once they solve it, we know no one messed with the money. That’s blockchain.

Crypto cuts out the middleman. So, if you live in one country and want to send money to family in another, it’s much quicker. No waiting for the bank to open or for a person to help you out. Crypto never sleeps. It’s always ready to move your money.

Banks look at this and think, “We need to get in on this too.” So, they start using blockchain. It makes things safer and faster. But just like with mobile wallets, they face hurdles. Some rules aren’t clear or they’re really strict. Sometimes it’s hard just to understand them.

My job involves talking to rule-makers. I explain how these tools can help. We look for happy middles. Ways to keep the money safe but also let people use these new techs. It’s all about balance.

By tackling these challenges, we make sure fintech helps everyone. Both the folks who’ve never had a bank and those who need a better way to deal with money. We’re on a path that makes managing money easier for people in far places and small towns. And that’s a path I’m proud to walk on.

Strengthening Fintech Growth through Education and Collaboration

Enhancing Financial Literacy and Women Empowerment via Fintech Initiatives

In developing nations, many people still lack basic money skills. Fintech is changing that. It’s making it easier to learn and grow. Especially for women. Here’s how. By offering simple apps and services, fintech helps users understand saving, spending, and investing. Through games and videos, complex ideas become easy.

Mobile money services and digital payment systems are real game-changers. They let people manage money without a bank. For many, this is their first step into finance. Fintech firms host workshops, too. They focus on money skills. When women learn these skills, they gain power. They can start a business or better support their family. With this, families and communities flourish.

The Role of Partnerships in Spurring Fintech Innovations

Partnerships are key to fintech growth. They unite ideas, skills, and resources. When banks and startups work together, they create new solutions. This makes money tasks simpler and faster for everyone.

Take mobile banking expansion, for instance. When banks partner with fintech firms, they reach more people. Even those in far-off places. They offer peer-to-peer lending platforms. These platforms make it easier to borrow and lend money without middlemen.

Fintech startups in Africa and Asia are growing fast. They often team up with bigger companies. This way, they get advice and funding. They learn from each other. They face regulatory challenges together. They brainstorm. They build better services.

Partnerships also link fintech with schools and nonprofits. Together they teach people about finance. Banks learn from tech firms. They adopt mobile financial services. They improve the user experience. They make banking more fun and less of a chore.

Peer-to-peer lending, mobile money, and more. All get better with teamwork. Fintech growth in low-income countries depends on it. As these partnerships strengthen, they change lives. They help the unbanked. They push for financial inclusion. They boost fintech and economic development.

In all, fintech’s rise is not just about tech. It’s about people working together. It’s about making sure everyone can manage money smartly. No matter where they are. This brings us all closer to a world where no one is left out of finance. And that is something truly worth working for.

In this blog, we explored how fintech shapes up in places where banks are few. We saw mobile banking break down walls, making money matters simple for all. Fintech isn’t just cool tech—it’s a buddy to small money lenders and a booster for local markets. It’s true, fintech faces tough rules, but it still finds ways to reach those without bank accounts.

We drilled down on how digital cash and new tech like blockchain can change the game. But it’s not just about the tools. Teaching people about finance and teaming up are key to fintech’s win. Every step we take toward understanding and adopting fintech doesn’t just help us—it grows our whole economy.

I believe fintech is not just a trend. It’s the future, crafting a world where everyone gets a shot at growing their money. It reminds us that when we join hands, and gear up with knowledge, we can make waves that lift all boats. Here’s to forging ahead, learning, and linking up for a brighter economic tomorrow.

Q&A :

How is the rise of fintech impacting developing economies?

Fintech, or financial technology, is rapidly transforming the financial landscape in developing economies by providing innovative services that were once out of reach for many individuals and businesses. These advancements are facilitating more inclusive financial systems, improved access to credit, and more efficient payment and remittance channels, which in turn are fueling entrepreneurship and economic growth.

What role does fintech play in financial inclusion in developing countries?

Fintech plays a crucial role in bridging the gap between the underserved populations and the financial services they need. Through mobile banking, digital wallets, and peer-to-peer lending platforms, fintech is helping to overcome traditional barriers to financial inclusion such as lack of infrastructure, documentation, or collateral.

Can fintech help reduce poverty in developing economies?

Fintech has the potential to significantly reduce poverty by providing access to financial services that enable individuals to save, invest, and protect their assets. By leveraging technologies like blockchain and mobile money, fintech firms are also offering cheaper and more transparent remittance services, thus enabling individuals to securely receive funds from abroad.

What challenges do fintech companies face in developing economies?

While fintech is promising for economic growth, companies in developing economies face challenges such as regulatory hurdles, cybersecurity threats, and a lack of consumer trust or understanding of the technology. Additionally, the digital divide – the gap between those with and without access to digital technology – can also pose a significant barrier to fintech adoption.

How does fintech foster entrepreneurship in developing economies?

Fintech fosters entrepreneurship by democratizing access to finance for small and medium-sized enterprises (SMEs), which are often the backbone of developing economies. Innovative lending platforms enable entrepreneurs to secure capital without the stringent requirements of traditional banks. Digital payment services also allow SMEs to conduct transactions more efficiently and expand their market reach locally and internationally.