Security of e-commerce payment platforms is on everyone’s mind. You buy, you sell, and behind every swipe, a question lingers: Is your money truly safe? We’re diving deep to unpack the truth about online payment protections. From encryption to compliance, I’ve explored how your transactions stay secure. Trust is key in digital buying and selling. Get ready for a clear-eyed look at how e-commerce sites guard your cash against cyber threats. Let’s bust myths and lay out facts. Your financial peace of mind? That’s the goal.

Assessing the Robustness of Secure Online Transactions

Deploying Advanced Encryption for Payments

Let’s talk money and safety. When you buy online, your payment must go through secure ways. This keeps your money safe. Encryption is a superhero here. It scrambles your card details into code. Bad guys can’t read this code. So, when you pay for that cool toy or new gadget, encryption is keeping watch.

Think of encryption like a secret code. Only the right people can understand it. Each time you check out, this code changes. Even if someone gets it, they can’t use it again. It’s a one-time deal. Smart, right?

Complying with PCI DSS Standards

But there’s more to keep you safe. Ever heard of PCI DSS? It’s a bunch of rules that stores must follow. They make sure stores handle your card details safely. It’s like a promise that they’re doing their best to keep your info out of the wrong hands.

Here’s how they do it:

- Stores must build and keep a safe network.

- They must protect your card details.

- Checking systems often is a must.

- They need a plan in case bad things happen.

It’s super important to obey these rules. You want to feel good about where you shop. Stores that follow PCI DSS signs mean they’re working hard to protect you.

Each time you type your card number, think safety first. These steps we talked about are like a goalie. They block the shots that hackers try to make. So you keep scoring, and they don’t. That’s how we win the game against bad guys.

And remember, you’re a part of the team too. Keep an eye on where and how you shop. Safer shops mean safer buys. Together, we can make sure our online shopping trips are fun and free from worry.

Enhancing Payment Gateway Protection and Fraud Prevention

Implementing SSL Certificates and Tokenization

When you shop online, you want your money safe, right? Here’s the scoop on making that happen. First, websites use SSL certificates to keep your payment info hidden from bad guys. It’s like sealing a letter in an envelope before mailing it. Shops put this SSL seal on their site to show you they’re serious about safety. Think of tokenization as swapping your card number for a secret code. Even if someone sneaky sees this code, they can’t use it to take your money.

SSL certificates for websites are a big deal for protecting your card info. The complex part of SSL – the secure sockets layer – is just tech talk for something that keeps your data safe. When you check out and see “https” in the web address, that ‘s’ means secure. It means an SSL certificate is at work.

Tokenization in payments takes your card number and changes it into random numbers and letters. This code is hard to crack. Even if hackers get this code, they won’t get your card number.

Refining E-commerce Fraud Detection Mechanisms

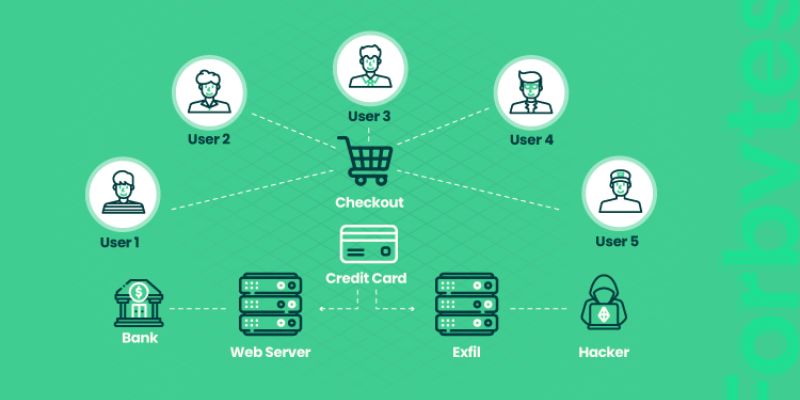

Okay, so how do shops check for fraud? They’ve got smart systems to catch fishy activity fast. Imagine a security guard looking at video feeds to spot thieves. E-commerce sites do this with software. This fraud detection watches for weird behavior with your account. Like someone trying to buy something expensive far from where you live.

Fraud prevention techniques keep getting better, too. Shops are always looking to be one step ahead of cheats. They study patterns, so if someone’s buying fifty TVs, that’s a red flag. They aren’t psychic, but it’s close!

Building a secure checkout process is also key. You enter your details, and boom, they’re locked down. Only the right people at the shop can see them. Credit card security measures mean your card details get a shield. This stops folks who shouldn’t see your info from peeking.

Digital payment vulnerabilities are like weak spots where trouble can get in. Shops work hard to patch these up. They’re like digital handymen, always fixing things up. Risk management in e-payments means looking at what could go wrong and guarding against it – like putting a helmet on before you ride a bike.

Cybersecurity best practices are the rules that shops follow to keep you safe. They’re like guidelines for crossing the street safely – look both ways, then proceed. Anti-fraud systems for online merchants are their secret weapons. These systems work in the background, hushing threats to your shopping spree.

Remember, secure online transactions are the goal. So next time you’re buying those cool sneakers online, think about all the tech keeping your cash safe. And that’s a big reason to feel good about clicking ‘Buy Now’.

The Critical Role of Multi-Factor Authentication and Risk Management

Tailoring Cybersecurity Best Practices in E-Payments

In e-payments, we leave nothing to chance. We build trust with secure payment methods. Our goal is simple yet bold: your money must be safe. How do we do this? We start with multi-factor authentication (MFA). It’s like a double-check system where more than one proof is needed from you to prove it’s really you. This can be something you know, like a password, something you have, like your phone, or something you are, like your fingerprint.

Now, you might ask, “What is multi-factor authentication?” It’s a security step to double-check that it’s really you trying to get to your money or account. When you log in, the system might ask for your password and then send a code to your phone. You need both to get in. This stops bad guys even if they have your password because they don’t have your phone.

Risk management in e-payments is also key. We look at where things could go wrong and make plans to stop them before they happen. Every step of taking or sending money online is checked. We look for anything out of place. If we spot a risk, we deal with it fast to keep your money safe.

You might wonder, “What does risk management in e-payments involve?” It means keeping an eye on all the money that moves in and out. We look for signs of fraud or strange behavior. If we see something odd, we take steps right away to check it out and fix it.

Overseeing Multi-layered Defense Against Data Breaches and Vulnerabilities

We layer our defenses just like onions have layers. First is encrypted payment processing. When you pay for something, we scramble the details. It’s like turning them into a secret code that only the right computer can read.

Someone might ask, “What is encrypted payment processing?” This is when we mix up your payment info into a code as it moves across the internet. It keeps your data safe from sneaky people trying to grab it. They can’t use what they can’t understand.

Then there’s tokenization in payments. We swap out your card details for a unique code. This way, if someone does get their hands on this code, it’s useless elsewhere.

And what is tokenization in payments? Imagine replacing your payment card number with a random code for each transaction. Even if hackers find this code, they can’t do anything with it because it’s a one-time deal.

We follow PCI DSS compliance too. It’s a set of rules that make sure all businesses that handle card payments do so safely. We stick to them like glue to protect your money.

What is PCI DSS compliance? It’s like a big rule book for anyone dealing with credit card info. Breaking these rules can result in huge fines and a bad reputation, which is a no-go for us.

By mixing multi-factor authentication with risk management and these solid tech tools, we fight to keep cyber threats away. This is how we make sure your money stays right where it should be – safe with you.

Building a Trustworthy E-Commerce Environment

Securing Transactions with 3D Secure Protocol and Biometric Systems

When you shop online, you want to know your money is safe. That’s where 3D Secure Protocol comes in. It gives an extra check to make sure it’s really you using your card. Now, some sites also use your fingerprint or face scan to keep your details safe. This is called biometric verification. It’s like a super-secure lock that only your body can open.

These days, every click and swipe might mean a risk. But with tools like these in place, thieves have a hard time stealing your info. It’s not just about one secure method. It’s about layers. The more layers, like passwords and biometrics, the harder it is for bad guys to get through.

Now, 3D Secure Protocol is a safety net for your bank and you. It checks with you before letting any money move. You might get a text with a code or need to give a thumbprint. It’s there to stop anyone who isn’t you from spending your cash.

Biometric systems sound high-tech, and they are. They measure things only you have, like your eyes or how you talk. They can be on your phone or at checkout when you pay. This tech makes sure no one can pretend to be you. No one has your unique features. So, when you use them to check out, it’s like saying, “Yes, it’s really me.”

Imagine you’re buying the latest gadget online. You type in your card info and then—a pause. The site asks for your face or thumb. You’re in charge and safe to go ahead.

These systems are very smart too. They often learn by looking at lots of scans of your fingerprint or face. So even if you get a cut on your thumb or a new haircut, they’ll know it’s still you.

Establishing Compliance and Chargeback Prevention Tactics

But there’s more to keeping your money safe. Sellers have rules they need to follow. These are called PCI DSS compliance standards. They help protect your card details when you buy something. If stores follow these rules, your info is safer. You can spot sites taking good care of your details by looking for trust seals. Think of them like a badge that says, “We’ve got your back.”

Even with all this, sometimes things go wrong. Maybe you get charged for something you didn’t buy. That’s called a chargeback. Stores don’t like chargebacks. They lose money and trust when they happen. So, they work hard to stop them before they start.

They use special programs to spot strange buying patterns. If they see something odd, like a bunch of pricey items all at once, they might check in with you first. This is good for you and good for them. It means fewer headaches later over who bought what.

They also keep a keen eye on the card number, date, and code on the back. If these don’t match up, they’ll know something’s up. They’re like detectives looking for clues to keep your money from being taken by someone else.

To sum it up, online shopping is getting safer every day. With smart tech like 3D Secure and biometrics, plus rules and badges to look for, you can click “buy” with much more peace of mind.

In this post, we dived into making online payments safe. We looked at how to use tough codes for payments and meet important safety rules. We also talked about making sure payment gateways are tight and spotting fraud better. Keeping buyers’ info safe is a big deal. We covered how extra checks and good risk plans can help a lot. Lastly, we saw the value of trust in online shops. This means using smart tools like 3D Secure and knowing how to avoid payment disputes.

These steps keep your money and info away from the wrong hands. Every part, from codes to several checks, matters. With the right moves, you can shop without worries. Remember: a safe web is better for everyone. Let’s keep our online world secure!

Q&A :

How do e-commerce payment platforms ensure transaction security?

E-commerce payment platforms employ a variety of security measures to ensure that each transaction is secure. These include encryption technologies like Secure Sockets Layer (SSL) and Transport Layer Security (TLS) to secure data in transit. Furthermore, they implement Payment Card Industry Data Security Standard (PCI DSS) compliance to safeguard payment card information. Advanced methods such as two-factor authentication (2FA), anti-fraud algorithms, and risk management systems are also utilized to detect and prevent unauthorized access or fraudulent activities.

What are the common security features found in e-commerce payment systems?

Most e-commerce payment systems come equipped with a series of robust security features to protect both merchants and customers. These features often include data encryption, tokenization to replace sensitive payment details with unique identifiers, SSL certification, and compliance with PCI DSS standards. Additionally, regular security audits, real-time monitoring tools, and the use of firewalls and anti-virus software help to maintain the integrity of the payment environment.

Can customers trust e-commerce payment platforms with their personal data?

Customers can generally trust e-commerce payment platforms with their personal and payment data as long as these platforms adhere to standard security protocols and regulations. It’s crucial for customers to look for signs that the platform is secure, such as the presence of HTTPS in the website’s URL and security badges from verified third parties. Reputable platforms will have robust data protection measures in place, comply with international security standards, and transparently communicate their privacy policies and practices to users.

How to identify a secure e-commerce payment gateway?

To identify a secure e-commerce payment gateway, check for the following signs: the presence of HTTPS and a padlock symbol in the browser address bar, valid SSL certification, PCI DSS compliance, and visible trust seals or security badges. A secure gateway should also provide detailed information about its security practices and allow for secure user authentication methods like two-factor authentication. Read reviews and check for any known security breaches associated with the gateway to further ensure its reliability and security.

What should a consumer do if they suspect a security issue with an e-commerce payment platform?

If a consumer suspects a security issue with an e-commerce payment platform, they should immediately cease any transaction and report the concern to the customer service of the platform. It is advisable to monitor bank statements and credit card activity for unauthorized transactions, and to change passwords on the potentially compromised platform. If fraud is detected, consumers should contact their bank or card issuer to dispute the charges and may also need to report the issue to relevant authorities for investigation.