The Effect of Monetary Policy on Interest Rates: Unraveling the Economic Strings

Money talks, and nowhere is this clearer than in the subtle tug-of-war that the effect of monetary policy on interest rates plays out on the economy. Central banks, like puppeteers, pull strings to either cool down an overheated market or kick-start a sluggish one. It’s a power move that reaches into your wallet, affects your mortgage, your car payment, and even your savings. I’m here to break it down, to show you how these decisions are made and just what they mean for your financial future. Stick with me, and you’ll see how the gears turn in the vast machine of our economy, and learn to anticipate the moves before they happen. We’re about to peel back the curtain on this financial wizardry – let’s dive in!

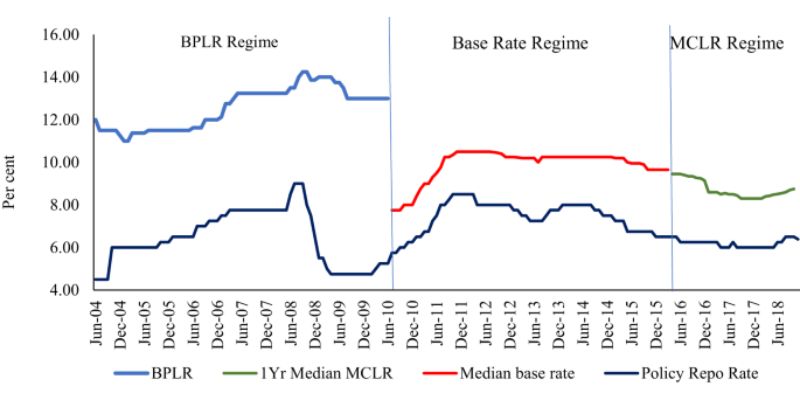

Understanding How Central Bank Policies Shape Interest Rate Trends

Federal Reserve Impact on Short-term Interest Rates

Let’s dig into how the Federal Reserve, or the Fed, makes a splash in short-term interest rates. When the Fed plays with the federal funds rate, it’s like a powerful magnet. It pulls short-term interest rates up or down. Think of interest rates as the cost to borrow money. If the Fed hikes this rate, borrowing gets pricey. On the flip side, if they cut it, borrowing is more like a hot deal.

The cost to borrow, or these interest rates, affect things like car loans and credit cards. When the Fed raises rates, people might say, “Eh, that new car can wait.” But, lower them, and suddenly that car looks mighty fine. The Fed’s decisions get banks buzzing too. They follow suit, changing their rates so you and I feel the impact.

The Role of Quantitative Easing and Discount Rate Changes

Now, onto something called quantitative easing. It’s a mouthful, I know, but stick with me. It’s when the Fed buys stuff – like government bonds – with freshly created cash. This flood of cash makes interest rates take a dive. The Fed uses this trick to kick-start the economy when it’s feeling sluggish.

Then there’s the discount rate. It’s the fee banks pay to borrow from the Fed when they’re short on cash. When the Fed raises the discount rate, banks often raise their own rates because, well, it costs them more to borrow. Drop the discount rate, and it’s like giving banks a break, which often means you get better rates on loans and credit.

So, the Fed’s toolbox for managing interest rates includes the super-important federal funds rate, plus quantitative easing, and the discount rate. Each tool works in a special way to steer the economy on the right track. When the economy needs to cool down, tightening monetary policy is the go-to move. And when it needs a boost, an expansionary monetary stance gets the job done.

Understanding how these dominoes fall isn’t just interesting; it’s key to knowing when that house you’ve been eying might have a sweeter mortgage rate or when your savings account might just start working harder for you. Plus, savvy folks can take hints from the Fed’s moves to plan their money moves.

So there you have it – a quick dive into the Fed’s influence on short-term interest rates and how big policies like quantitative easing and discount rate changes ripple through our wallets. While it can feel like economic magic, it’s really all about the Fed pulling the right levers to keep things steady.

The Mechanics of Interest Rate Setting: Tools at the Central Bank’s Disposal

Open Market Operations and Federal Funds Rate Dynamics

Let’s dive into how a central bank, like the Federal Reserve, moves interest rate trends. They have a big tool kit, but I’ll highlight a few key tools they use. Think of these as levers they can pull to speed up or slow down the economy. One major lever is open market operations. This is when the Fed buys or sells government bonds. By doing this, they control the federal funds rate—the rate banks charge each other for overnight loans.

If the Fed buys lots of bonds, banks have more money. They can lend more easily. This lowers the federal funds rate. When rates are low, people and businesses borrow and spend more. This can heat up the economy. But if the economy is too hot and inflation creeps up, the Fed may sell bonds. This takes money out of banks’ hands and pushes up the federal funds rate. Higher rates can cool things down because it costs more to borrow money.

The Influence of Cash Reserve Ratios and the Liquidity Adjustment Facility

Another control knob for the Fed is the cash reserve ratio. This is the chunk of cash banks must keep, not lend out. If the ratio is high, banks lend less. This can tighten the money flow, and you guessed it, interest rates might rise. Banks need to make the most of the cash they can lend. However, when the ratio is low, there’s more money to go around. Rates can then take a dip, encouraging loans and spending.

The liquidity adjustment facility is a lesser-known tool, yet very powerful. It helps banks have enough money day to day. They can borrow money through this facility using their assets as a pledge. The Fed sets the repo rate—the cost of borrowing for banks. A low repo rate means cheap borrowing for banks and can lead to lower interest rates for everyone else. A high repo rate can mean the opposite.

When we think about the impact of these tools on savings accounts and mortgage rates, we see the ripple effect. If the Fed decides to make borrowing cheaper, your savings interest might shrink. But, hey, it’s a good time to get a home loan. On the flip side, when rates climb, saving money gets more rewarding. But those looking to buy a house could face steeper costs.

Central bank policies are key to this balancing act they perform. They aim for that sweet spot—where the economy grows without prices skyrocketing. These moves influence whether we’re in a time of economic stimulus or tightening our belts. And each decision the Fed makes writes a new chapter in the story of our economy. Understanding these tools helps us predict how our own wallets will be affected. Are we saving more? Are mortgage costs shifting? It’s all tied to these complex yet crucial central banking decisions.

The Real-World Consequences of Interest Rate Fluctuations

Impact on Mortgage Rates and the Housing Market

When central banks tweak rates, home loans feel it first. For instance, if the Federal Reserve hikes the federal funds rate, borrowing gets pricier. Banks raise their own rates, and mortgages follow suit. A higher mortgage rate can scare off buyers. This cools down the housing market—a space where dreams are made and futures are planned.

In a hot market, any hike in interest rate can pour cold water on the fire. It might make you think twice before buying that four-bedroom colonial. But here’s the kicker: sometimes, this is exactly what the economy needs. It’s like a timeout in a game of tag. It helps prevent prices from getting too wild.

How Savings Accounts Adjust to New Interest Rate Environments

Savings accounts dance to the tune of interest rates. A bump up in rates, thanks to central bank policies, can mean more cash in your cookie jar. Why? Because banks will pay you more to keep your money there. It’s their way of saying, “Thanks for letting us borrow your funds!”

This might make you smile when you open your savings app. More interest means more ice cream for the kiddos, right? But it’s not just about treats. Higher savings rates encourage folks to save more dough. And saving money isn’t just smart—it’s essential for weathering rainy days.

Yet, it’s not all sunshine. If rates climb too high or too fast, loans can become too costly. This can make people and businesses less likely to spend. And if everyone zips their wallets shut, the economy can slow down. It’s a delicate balance, kind of like walking a tightrope. Central bankers have to be part circus performer, part scientist to get it right.

In the end, when central banks tighten or loosen the money reins, it affects us all. From that family home with the white picket fence to the piggy banks in our homes. Understanding how these decisions play out can help us make better choices. We can be ready for a turn in the road, whether we’re spending, saving, or just dreaming of a future home.

Forward-Looking: Anticipating Changes in Interest Rates

Utilizing Interest Rate Forecasts and Economic Indicators

Let’s talk about what might happen to interest rates. I keep an eye on patterns in these rates. They tell us a lot about cash we borrow or save. Central bank policies, like those from the Federal Reserve, guide these rates. They change rates to keep our economy on track.

Now, what is quantitative easing? It’s when a bank buys assets to boost money in the system. This can make rates drop, making loans cheaper. But when banks tighten up, rates can rise. This means we pay more on loans but earn more on savings.

Predicting interest rates needs a sharp look at many details. Bank rates shift as economies grow or slow down. So, watching these clues helps us guess where rates will go. How do central banks decide on interest rates? Well, they use special tools. One is the federal funds rate, what banks charge each other for overnight loans. This rate influences many other rates.

How does all this touch you and me? If a bank expects rates to rise, getting a loan could cost you more later. If they might fall, you could save by waiting to borrow. Being smart with these forecasts can help our wallets.

Monetary policy tools aren’t just for show. They have real power over our money. A central bank’s decision can change what we pay on loans and earn on savings. Changes in the federal reserve impact are a big deal. They shake up home loans, car loans and credit card rates.

Always, I look out for shifts in central bank policies. When they move, I ask, “How will this touch interest rates?” If you’ve got a loan or savings, these trends matter to you too.

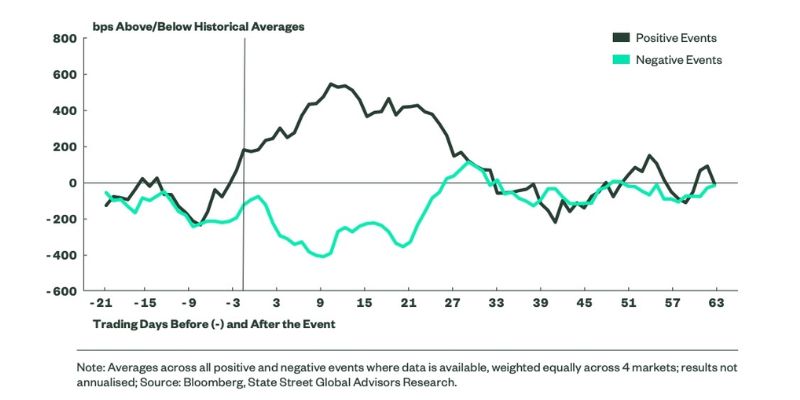

Assessing the Effects of Monetary Policy Announcements on Market Expectations

Next, let’s dive into how announcements from central banks stir things up. These big news moments can shake the entire economy. They can twist what we expect for future rates.

Imagine a room full of listeners waiting for a big speech. That’s like the market when a central bank speaks. People get ready for hints about rates. Will they go up, stay the same, or dip? Everyone has a guess. But the true impact shows in how banks set their rates.

How can we tell what banks will do? We study every word from the Federal Reserve. Tiny hints can spur big changes. Market players adjust their bets on future rates based on these talks. One word can tilt the market like a seesaw.

Banks and investors always listen hard. They know a slight rate change can mean big bucks. If a bank hints at higher rates, folks will act fast. They want the best deals on savings and loans.

Market folks call this the policy transmission mechanism. It’s how central bank plans move to our everyday money. This link shows how central bank policies touch loans and savings. The talk about rates isn’t just babble. It shapes how much we pay or earn on our money.

Announcements can trigger quick reactions. Let’s say a bank hints at interest rates rising. Lenders might hike rates quickly. But if the hint is a rate drop, we might see lower loan rates soon.

So, I keep my eyes peeled for these policy signals. They’re clues to how our future money moves might unfold. Understanding these signs can help you make smart money moves. Keep in mind, being ahead in this game can save you money on loans or grow your savings.

We’ve now peeled back the layers on how central banks guide interest rates. We saw that the Fed can drive short-term rates and how tools like quantitative easing shake things up. We also dug into the central bank’s toolkit, with tactics like open market moves and reserve rules. But it’s not just theory – these shifts hit home, shaping what we pay for homes and earn on savings.

Looking ahead, we can’t predict interest rates with certainty. However, by watching forecasts and the economy’s signs, we can make smart guesses and plan our money moves better.

So, let’s stay sharp and aware. The central bank’s next move could sway your wallet. Keep learning, and you’ll navigate the waves of change with ease.

Q&A :

How does monetary policy influence interest rates?

Monetary policy, typically set by a central bank, is a powerful tool used to control the money supply and interest rates within an economy. By changing policy rates, a central bank can either encourage borrowing and spending (expansionary policy) or restrict it (contractionary policy), in an effort to maintain economic stability. For instance, when a central bank lowers the policy rate, it usually leads to a decrease in interest rates throughout the economy, making loans cheaper and stimulating growth.

What are the main tools of monetary policy used to control interest rates?

The central bank employs several primary tools to manage monetary policy and adjust interest rates:

- Open Market Operations (OMO): These involve buying or selling government securities to influence the amount of money in the banking system.

- Discount Rate: This is the interest rate that banks pay to the central bank to borrow money. Adjusting this rate can make borrowing more or less expensive for banks.

- Reserve Requirements: Setting the minimum reserves each bank must hold impacts how much money they have available to lend, influencing interest rates and the money supply.

Can expansionary monetary policy lead to lower interest rates?

Yes, an expansionary monetary policy, which is often characterized by a central bank reducing its target interest rates, can lead to lower interest rates across the board. When a central bank lowers its rates, it reduces the cost of borrowing for commercial banks, which in turn usually lower the rates they offer to consumers and businesses. This drop in interest rates is aimed at promoting increased borrowing and spending to stimulate economic activity.

What is the relationship between monetary policy and inflation?

Monetary policy is closely related to inflation. When a central bank perceives that inflation is higher than desired, it may implement a contractionary policy, raising interest rates to cool off the economy. Conversely, if inflation is too low, it might employ an expansionary policy by lowering interest rates, aiming to encourage borrowing and spending. The goal is to achieve a balance where inflation is at a target level, often around 2%, which is considered conducive to a healthy economy.

How do changes in interest rates affect the overall economy?

Interest rate adjustments have far-reaching implications for the overall economy:

- Consumer Spending: Lower interest rates make loans and mortgages cheaper, which can boost consumer spending and home purchases.

- Business Investment: With cheaper borrowing costs, businesses may be more inclined to invest in expansion and capital improvements.

- Exchange Rates: Changes in interest rates can impact the currency’s strength, affecting exports and imports.

- Inflation: Lower interest rates can increase spending and demand, potentially leading to higher inflation if not carefully managed.