War and Economic Sanctions: they shape our world, upend markets, and shift the political chessboard. Think you grasp their reach? Not so fast. Our global economy interlinks in complex ways, and when nations opt for these financial weapons, the fallout spans from Wall Street to your street. I dive into the grit, from the squeeze on trade to the tough choices in international corridors. Here’s the real deal on how sanctions toss economies and lives into turmoil, and what it means for everyone, bar none—including you. Strap in; we’re unraveling the global financial entanglement of War and Economic Sanctions.

The Mechanics and Motives Behind Economic Sanctions

Understanding the Impact of Trade Embargoes on Global Trade

Trade embargoes hit hard. They close doors between countries. When one country stops trading with another, goods can’t flow like before. Prices go up. People can’t get what they need. This is the impact of trade embargoes. Countries use embargoes to force change. They can be about stopping wars or making peace. Sometimes, they’re a loud call for a country to respect rights or laws.

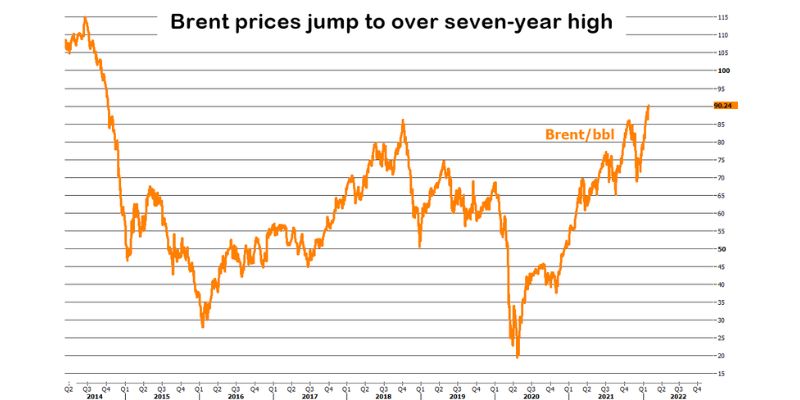

Still, not all embargoes work the same. Some aim at specific goods, like oil or tech items. These blocks cause big shifts in global markets. For example, when a big oil producer faces an embargo, gas prices can leap worldwide. This makes travel and shipping cost more. This leads to everyday items costing more too.

Now, people get creative to cope. They may trade with new partners or find other sources. But the change takes time. And during that time, lives and jobs can be on the line. Farmers may lose out when they can’t sell their crops abroad. Factories might shut down if they can’t get parts. It’s all part of the trade barriers due to warfare.

Analyzing Economic Sanction Lists and Export Controls

Let’s talk about sanction lists. These are lists of rules that say who can’t trade. It includes people, companies, and countries. Being on this list is tough. It means banks might not let you move money. It can stop you from using your assets, like your money or property. This is what we call an economic sanction list. It’s serious business.

Export controls are rules about what you can send out of a country. They stop sensitive goods from reaching the wrong hands. Think about high-tech weapons or stuff to make them. Countries don’t want these to cause more fighting or hurt innocent folks. So, they use export controls to keep a tight grip on these items.

These lists and controls can change fast. Countries and groups like the United Nations keep them updated. It’s to stay on top of global situations. That’s why businesses and people must always check the rules. No one wants to break them by mistake. And that’s where sanction compliance comes in. It’s all about playing by the rules. It’s complex but key to keeping peace and order around the world.

To wrap it up, war shakes up economies and lives. Economic sanctions and trade embargoes are tools that countries use in these tough times. They aim to change bad behavior. But they also lead to new trade paths and creative solutions. It’s about finding balance in the midst of global chaos. And it’s about making choices that are tough but aim to make things better for everyone.

The Ripple Effects of Sanctions on International Relations and Trade

Evaluating the Diplomatic Consequences of Sanctions

Economic sanctions aim to force change. But they shake global trust too. Allies may frown or walk away when one nation strikes another with trade bans. Sanctions spark a chain of distrust in global ties. Strain rises as nations question each other’s motives. Trust is hard to rebuild.

Sanctions change pals to foes. A country hit with bans may turn to new partners. These shifts can last long and change global power lanes. Old allies might not mend fences for years. This game of friends and enemies affects everyone’s safety. Sanctions thus are more than a money tool – they test friendships on the world stage.

Assessing Financial Sanctions Effects and Asset Freezes

Money rules the world’s game. Locking a nation’s money assets is like a sudden brake on their trade car. They can’t pay or get paid. Trade barriers due to warfare wreak trade flow havoc. Money freezes hit like a wall. A country can’t act or react in trade, causing a crash in their money health.

Let’s sift through this money mess. Global sanctions and conflict often mean lost jobs and cash flow stops. This hurts folks at home and abroad. Asset freezes trap funds. Imagine your piggy bank locked up, far from reach. That’s what nations face, but with billions at stake.

Embargoed countries can’t sell their goods like oil or crops. Oil embargoes and war push gas prices up globally. A ripple that starts in one place spreads wide. Export controls stop tech and tools from moving across borders. This hinders growth and traps innovation.

But it’s not just about what’s stuck inside. Sanction compliance is a tough dance for outside traders too. Mistakes can cost them big. Firms must check an economic sanction list often. One slip and they face huge fines or bans themselves.

When countries can’t trade well, their money loses power. Currency devaluation in sanctioned nations stirs up more economic pain. This pushes prices up, making life harder for everyday folks. People can’t buy what they need. This leads some to the black market during sanctions to get by.

The wider world feels the shock too. Financial market volatility and war make investors nervous. They pull back funds, causing a dip in cash from abroad. Foreign investment decline due to sanctions can choke progress.

Sanctions pack a punch, no doubt. They can pressure leaders to change. But this power move comes with risks and costs all around. Sanctions are thorny tools, twisting through the garden of global diplomacy and trade. As we tread these paths, we must tread with care. The impacts we leave can last far beyond our steps.

Exploring the Humanitarian and Financial Challenges of Sanctions

Delving into the Humanitarian Impact of Sanctions

When countries clash, sanctions can follow. They aim to press a nation to change. But they can hurt regular folks too. Food, medicine, and other vital needs may become scarce. Prices might skyrocket, and people struggle more. It’s tough when aid can’t get through. This leads to more suffering.

Sanctions can make goods cost too much. Kids and the sick feel this the most. It forces families to make hard choices. Some might skip meals or stop buying medicine. This is how hardship grows in sanctioned lands. It’s a big problem that cries out for a fix.

Addressing the Enforcement Challenges and Compliance with Sanction Policies

Making sure sanctions work as planned is not easy. Countries and businesses must know the rules and follow them. Avoiding support for bad actions is key. Even banks and companies can slip up if not careful. They might face fines or other penalties if they do.

Trade rules change and can confuse. Law experts and advisors help avoid these risks. They teach businesses how to stay careful and clean. When all play fair, sanctions stand a better chance. But when rules break, it’s hard for sanctions to hit their mark.

The truth is, keeping up with sanctions is tough. But it’s needed to try and keep peace in our world. We make these efforts to steer away from the harm of war. It’s all about finding that balance – being tough but fair. If we can do that, sanctions may just do more good than harm.

Strategies and Responses to Sanctions in the International Arena

The Role of Sanction Relief Strategies and International Monetary Funds

When countries face sanctions, they seek ways to lessen the blow. This is where sanction relief strategies come in. For instance, the International Monetary Fund (IMF) provides help. The IMF lends money to countries hit by war or sanctions. This aid can keep a country’s economy afloat.

What does the International Monetary Fund do? The IMF lends money to countries to help stabilize economies. It supports nations under stress from sanctions. This aid can range from loans to policy advice. With this help, countries may avoid total economic crash. They can use the money for trade, or to keep prices stable.

Sanction relief strategies are key. They help countries to manage the impact of trade embargoes. Countries work on other ways to trade. They try to keep goods flowing in and out. This is crucial. It eases the pain on business and on ordinary people.

We can’t forget how global sanctions and conflict make things hard. Trade barriers due to warfare can stop goods and hurt economies. But countries work on getting around these barriers.

How do they do this? Through things like new trade routes. Maybe they trade more with friendly countries. Or, they find new goods to sell. They may also work on making more of what they need at home. These steps help countries to stand strong against sanctions.

Navigating Sectoral Sanctions and Economic Coercion in Diplomacy

Sectoral sanctions target key parts of an economy. Take the energy sector, for example. Oil embargoes and war can hit it hard. Limiting the sale of oil can weaken a country.

What are sectoral sanctions? They are sanctions that only hit specific parts of an economy. This can be energy, like oil, or finance, and other key areas. They aim to put pressure on a nation without total embargoes.

Diplomats must talk and use wisdom in these cases. They work with sanction enforcement challenges. Countries may need to comply with sanctions. But they want to keep good relations too. This means finding ways to follow rules while working on peace.

Economic coercion can be tough. This is when nations use trade sanctions to push for change. Yet, there’s a risk. It can lead to more geopolitical tension and trade problems.

In this dance of power, sanction policy analysis becomes vital. It helps us understand the rules and how to follow them. It tells us about the impact of actions on global trade. This way, countries can move forward without more trouble.

Sanction relief strategies and smart diplomacy help nations adapt. These tools support them as they face tough times. They work to keep trade alive, even when times are hard. They show us how countries fight back in the face of sanctions. And through it all, they work on keeping peace and making deals to end the hardship.

In this post, we took a hard look at the engine and aims of economic sanctions. These tools can strain global markets and stunt trade, but their purpose is often to nudge countries toward change. The effects ripple out, touching diplomacy and freezing assets, which reshapes international relations.

Yet, sanctions come at a cost. They can hit everyday people hard, creating humanitarian crises. Even so, countries must stick to these rules or face tough penalties. It’s complex, and every country manages it differently, seeking relief or pushing back through diplomacy.

Remember, sanctions aren’t just about clashing powers. They’re about seeking peace, even if the path is rocky. Surely, nations must weigh these heavy choices with care so that a balance between pressure and support is struck. Let’s keep watching how this high-stakes game of global influence unfolds.

Q&A :

How do War and Economic Sanctions impact global markets?

The ripple effect of war and economic sanctions on global markets is substantial. Often, they lead to disruptions in supply chains, fluctuations in commodity prices, and changes in investor confidence. This question examines the specific impacts on trade, stock markets, and international investments, offering insights into how businesses and economies adapt to these geopolitical shifts.

What are the short-term and long-term effects of Economic Sanctions on a country’s economy?

Economic sanctions can have varying effects on a country’s economy based on their duration and severity. In the short term, sanctions may cause immediate disruptions in trade and finance. Over the long term, they can lead to deeper economic isolation and potential changes in political relationships. This analysis explores both immediate and enduring consequences, shedding light on how nations cope with economic pressures from sanctions.

Can Economic Sanctions lead to war?

While economic sanctions are typically seen as diplomatic tools to avoid military conflict, in some instances, they can exacerbate tensions and contribute to the likelihood of war. By delving into historical precedents and current geopolitical landscapes, we can understand under what circumstances sanctions may inadvertently edge nations closer to armed conflict.

What strategies do countries use to mitigate the effects of War and Economic Sanctions?

Countries employ various strategies to cushion the blow of war and economic sanctions. These can include seeking alternative trade partners, ramping up domestic production, or leveraging diplomatic channels to negotiate lesser sanctions. This query provides a detailed examination of the effectiveness of different mitigation tactics in preserving a nation’s economic stability.

How do international laws regulate the use of Economic Sanctions and actions during a war?

International laws, such as those framed by the United Nations and other global organizations, play a critical role in regulating economic sanctions and ensuring humanitarian standards are upheld during warfare. This question explores the legal frameworks governing sanctions imposition, enforcement mechanisms, and their implications on international relations and compliance during conflict scenarios.