Sustainable Investing Takes Off: What’s the Future Hold?

Just a few years ago, the term “sustainable investing” might have brought puzzled looks. Now, it’s the buzzword on Wall Street and Main Street alike. Investors are no longer asking why, but What’s Next for Sustainable Investing? They dive in, eager to match their dollars with their values. We see money pour into funds that honor the planet while seeking profit. I’m here to tell you that this isn’t a fad or a phase; it’s the future. Let’s break down what’s fueling this green fire and spot the investments that promise both impact and returns.

The Driving Forces Behind the Surge in Sustainable Investing

Exploring Environmental, Social, and Governance (ESG) Criteria

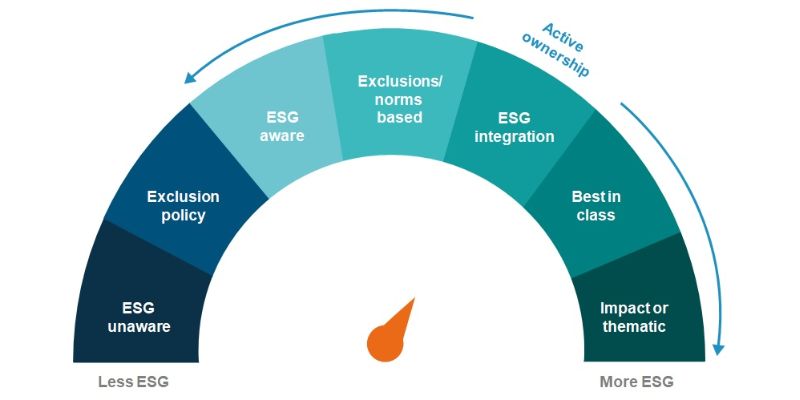

These days, everyone is talking about ESG. At its core, ESG includes how companies help the planet, care for people, and run their business right. Investors now want more than just profits. They want to make the world better too. This is pushing lots of money into funds that score high on ESG.

An Analysis of Current Green Investment Trends and Future Predictions

Green trends are booming. From climate change funds to investments in clean tech, more dollars are chasing eco-friendly options. This growth isn’t slowing down anytime soon. We see investors demanding more ESG options. Why? Because they know that good planet choices can also mean good money.

The future? Expect a big push for renewable energy and cutting carbon. Firms are also getting smart about how they use stuff. They call this the circular economy, where waste gets reused. This creates lots of new chances to invest and make a difference.

Investing isn’t just about cash anymore, it’s about our kids’ future. So we watch for the best ESG scores and green bonds to put our money in. These choices help push companies to do better for our planet. And when they do better, we all win.

What about farms and cities? Now, there’s more money going into clean farming and building better places to live. All so we can eat, work, and play without harming our home, Earth.

Investor demand for ESG keeps growing. They want companies to tell us clearly how they’re helping—this is called sustainability reporting. When they report well, they get more investors. It’s a cycle that lifts everyone.

Governments are starting to set rules for all this too. These ESG regulations mean serious business. Companies must show they care for the Earth, or they’ll miss out.

Companies that show true heart in their work will top the charts. It’s clear, my friends, the train to ESG town is moving fast. You coming aboard?

Assessing the Impact and Performance of ESG Investments

Breakdown of ESG Scoring Methods and Their Effectiveness

How do we measure if a company is kind to the earth or cares for its people? We use ESG scoring methods. They are like report cards for companies that show how well they do in things like taking care of the environment and treating people fairly.

What makes one ESG scoring method better than another? It depends on how much it looks at. It should consider lots of data and be clear in its ratings. This way, investors can pick the best companies that match their values.

Some might ask, do these ESG scores really tell us if a company is doing the right thing? Yes, but only if the scores are made well. They must be based on true data and not just what companies say they do. This way, they can help us choose where to put our money to do some good.

Sustainable Financial Products: A Look into Renewable Energy Portfolio Growth

What about the money we put into funds that help the earth? Let’s talk about funds like those that focus on renewable energy. These funds have grown a lot because more people want to help fight climate change.

Are renewable energy funds doing well? Yes, many are, because the world is moving toward clean energy. This means these funds often make more money as more people invest in them.

Can we expect more growth in these funds? Absolutely. As the world works harder to cut down on pollution, these funds have a strong future. They’re a way to make money while also helping our planet.

These funds don’t just have stocks, but sometimes they have green bonds too. These are special, as they let people lend money to projects that are good for the environment. Schools or hospitals can use this money to become more eco-friendly, which helps them and the earth.

In conclusion, ESG scores help us know which companies are doing the right thing. Renewable energy funds give us a chance to invest in a cleaner world. Together, they show the bright future of using our money for good.

The Role of Regulatory Developments in Shaping Sustainable Investing

The Evolution of Corporate Sustainability Reporting

Back then, companies barely shared how green they were. We just hoped they cared. Now, it’s a must. All over, companies must tell us how they’re helping our planet. It started slow. But rules grew.

Just a few years back, reports on how companies help the Earth were rare. Now, they’re the norm. Why the shift? People! Investors like you and me asked for it. We wanted to know not just about profits but also about the planet. This push led to rules.

How ESG Regulatory Developments Are Influencing Investor Decisions

Imagine picking a team. Would you pick someone without knowing their skills? Never, right? It’s the same with investing. We need to know companies’ environmental, social, and governance (ESG) scores. These tell us who’s really playing for the green team.

Regulations are making all the difference. They’re making these scores clear. Now, when I advise on where to put your money, it’s not a wild guess. Thanks to rules, we know who’s true to their word on being green. This helps you and me make smart choices. We’re all in this together, looking for a greener future.

Here’s how it goes. New laws come in. They say, “Tell us how you’re green!” Companies listen. They report on good (and not so good) things they do. It’s a scorecard, see? This scorecard changes the game. It tells us who’s good for our money and our world.

Think about climate change funds and renewable energy, for example. These used to be niche – just a few people got it. Now, they’re big news. And because of better rules, we see their worth. It shows right there in the clear numbers. Clean air and profits can be friends.

The growth of sustainable financial products is off the charts, too. They’re like plants in good soil – they just keep sprouting! All thanks to rules telling us which funds are green, not just in name, but deep down. That’s what I help folks like you figure out.

With all these new rules, we get to make better bets on the future. Will green bonds keep rising? I think yes. And sustainable ETFs, they’re just warming up. Watch them go!

As for shareholder activism, it’s more than a buzzword. It’s power. Power for you to push companies into the green light, with actions, not just words. We’re seeing this push grow, cutting through the noise, making real change.

So, look around. The future of eco-friendly investments looks bright. It’s no longer just a ‘nice-to-have’. It’s crucial. It’s how we all win – profit in the wallet, peace in the heart, and a cool breeze for the earth.

Remember those big words, ‘decarbonization strategies’, and ‘circular economy’? They’re not so scary. They’re just about looping good stuff back in and keeping the bad stuff out. Rules make sure everyone’s on track. And we’re here to help you pick the greenest, cleanest superstars to back.

ESG scoring? It used to be foggy. Now, it’s clear as day. Thanks to evolving laws, we know who’s truly green. From soil to buildings, we’re weaving the planet into our choices. It’s not just good vibes – it’s smart money.

So, there’s our future, painted in every shade of green. More reports, clearer choices, better Earth – count me in!

Forecasting the Next Wave of Sustainable Investment Opportunities

The Potential of Circular Economy and Clean Tech Investments

The future of eco-friendly investments looks bright, especially when we look at clean tech and the circular economy. These sectors aim to produce goods in ways that use fewer resources and create less waste. It’s a big shift from the “take, make, waste” way most industries work today. What’s great about the circular economy is how it can make and use things that are good for the planet.

Let me explain. Circular economy investment opportunities grow as more companies aim to reduce waste. They design products to last longer and to be recycled at the end of their lives. It means more value from what we use and less harm to our world. Clean tech investment potential is also getting a lot of buzz. This covers stuff like energy-saving tech and cleaner production methods.

Now, think solar panels, wind turbines, and electric cars. We need these to fight climate change, and they’re getting more common and cheaper every year. Impact investing outlook shows that putting money into these can help the planet and bring good returns. Investors are catching on fast. The future of ESG integration is leaning heavily toward these areas.

Navigating the Transition: Fossil Fuel Divestment and Carbon Offset Strategies

Fossil fuel divestment strategies mean taking money out of coal, oil, and gas. It’s a way for investors to say no to the old, polluting ways. They instead put their cash into things that don’t harm the air we breathe. It’s not just about being nice either. It’s smart. Big changes like global warming can make fossil fuels a risky bet.

Carbon offset investment strategies are also part of the change. Companies or funds invest in projects that cut carbon, like reforestation or clean energy. These help balance out the greenhouse gases they can’t avoid yet. It’s like saying, “I can’t cut all my emissions today, but I’ll make sure to undo some of it by helping the planet in other ways.”

It’s all part of a big change. We’re moving to investing that’s smart for both our wallets and our world. And it’s not slowing down. Climate change funds, sustainable financial products, and renewable energy portfolio growth are rising. More and more, we see that doing good and making money can go hand in hand. I’m excited to see where it leads and how it will shape a better future for everyone.

In this post, we explored the big push for sustainable investing. We dug into ESG criteria and saw how green investments are doing now and what might come next. We looked at how well ESG scores tell us about real-world impact and peeked at the growth in clean money products.

We also touched on how rules and reports on sustainability change the game for investors. Plus, we tackled what’s up ahead, like investing in a circular economy and clean tech, and moving money away from fossil fuels.

It’s clear that smart investment choices can make our world better and also make sense for your wallet. Every step forward in ESG investing could mean a win for both your finances and the planet. The path ahead looks bright for those ready to invest in a more sustainable future. Let’s make money count for more than just profit; let’s invest in our world’s health and wealth.

Q&A :

What are the emerging trends in sustainable investing?

With increasing awareness about climate change and social issues, sustainable investing is expected to evolve further. Investors are looking closer at the impacts of their investments and seeking out opportunities in renewable energy, circular economy, and clean technologies. Integration of ESG (environmental, social, governance) factors into investment strategies is becoming more sophisticated, with focus on impact investing and shareholder activism for sustainability. Advances in data analytics also allow for better tracking of the sustainability outcomes related to investments.

How will regulation affect the future of sustainable investing?

Regulatory frameworks around the world are beginning to catch up with the sustainable investing movement. Governments and financial regulatory bodies are introducing guidelines and requirements for better disclosure on ESG practices and risks. The European Union’s Sustainable Finance Disclosure Regulation (SFDR) and the U.S. SEC’s increasing interest in ESG disclosures are examples. As these regulations become more stringent, they are likely to drive more transparency and standardization in sustainable investing which can help attract more investors to this field.

Are technologies playing a role in the advancement of sustainable investing?

Definitely. Technology is a significant facilitator in the development of sustainable investing. Fintech innovations, including artificial intelligence and blockchain, are enabling better ESG data collection, reporting, and real-time tracking of investment impacts. These technologies also help in creating sustainable investment products and platforms that cater to a broader range of investors. Additionally, tech companies focusing on sustainable solutions are becoming attractive investment opportunities themselves.

How does sustainable investing performance compare to traditional investing?

Recent studies have debunked the myth that sustainable investments underperform compared to traditional investments. In fact, many ESG funds have been shown to perform as well as, if not better than traditional funds particularly over the long term. This is attributed to the fact that sustainable companies can often be more resilient and better prepared for future challenges, making them potentially less risky and more profitable in the long run.

Will sustainable investing become the new standard in the future?

While it’s difficult to predict the future precisely, sustainable investing is rapidly moving from a niche approach to a mainstream strategy. With a growing recognition that sustainability factors can materially influence financial outcomes, along with rising consumer demand and regulatory pressures, it is quite possible that sustainable investing will become the new norm in the investment world. As traditional investors increasingly embrace sustainability criteria, these practices are expected to be integrated into the core of investment decision-making processes.