Diving headfirst into investing can make your head spin. Which investment strategy is better for beginners growth or value? This burning question haunts many new players in the stock market. Some rave about the fast-paced world of growth investing, while others swear by the steady approach of value investing. Both paths glitter with potential but carry their own risks and rewards. Let’s break it down, clear the fog, and help you plant your feet firmly on the ground of investing. As a beginner, you need the inside scoop to make a choice that aligns with your goals without losing your shirt. Ready to find out which strategy will be your stepping stone to financial success? Keep reading!

Understanding the Investment Landscape: Growth vs. Value

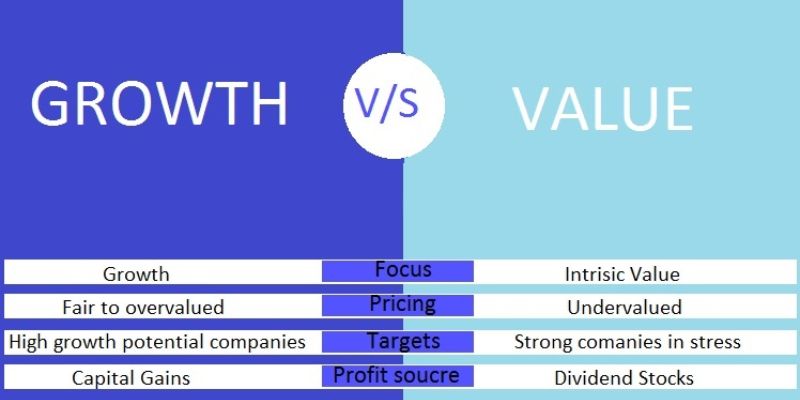

Introduction to Growth Investing

Think of growth investing like planting a seed. You pick plants—or growth stocks—that you think will get big. These are companies that grow fast. They don’t pay dividends but can make your money grow more. Investing in growth is betting on the future. It’s like saying, “I believe this small plant will become a huge tree.” A good place to learn more about this is on an introduction to growth investing.

Value Investing Basics

Now, let’s talk about value investing. Imagine finding a toy at a yard sale that’s worth a lot but selling for a little. That’s value investing. You find companies that cost less than what they’re really worth. They’re like hidden treasures waiting for folks to see their true value. This strategy loves stable companies that pay dividends. It’s more patient and steady. Want to understand the nitty-gritty? Dive into value investing basics.

Think about what fits you best as you start your investing journey. Are you excited about finding the next big thing? Or do you like searching for hidden gems? Your choice matters a lot. In growth investing, you’re hoping your stock gets more expensive so you can sell it for a profit. But with value investing, you might make money from dividends even if the stock price doesn’t change much.

Here’s a key point: Growth stocks can go up and down a lot. It’s a bit of a ride. If that sounds scary, value stocks are more like a gentle stroll. They don’t swing as much. But remember, just because a stock is steady doesn’t mean it can’t lose value. Every investment has risks.

So which is better for beginners? Well, that depends on your style and patience. Some start with growth because they dream of fast gains. Others like the steadiness of value stocks. But what if you could have both? Yep, mixing growth and value is like having a balanced meal. It can be wise to start with a bit of each, so your money is spread out.

Building an investment portfolio takes time and thought. Think of it like a recipe. What goes in it—stocks, bonds, cash—makes it yours. Your mix should fit your life, goals, and how you feel about risk. Start by asking, what’s my goal? When do I need the money? How do I feel about my money going up and down?

Great investing isn’t just about picking stocks. It’s about knowing yourself. It’s about building a basket of investments that fit you like a glove. It’s about learning every day so you can watch your money grow over time.

If you’re a newbie, start by learning and practicing. You can play with fake money on investing apps to see how it all works. When you’re ready, start small. Use money you can afford to lose. Over time, as you learn and earn, you’ll find your way. Happy investing!

Assessing Risk and Time Horizon in Investing

Risk Tolerance in Investing

When you start investing, knowing your risk tolerance is key. This means how much risk can you handle. High risk can lead to high rewards. But, it can also bring big losses. One’s comfort with risk often guides their choice between growth and value investing.

Growth investing is about buying stocks that may jump in price. Think of it like planting a seed and waiting for it to grow. It can be thrilling to see these stocks soar. But, they can also fall just as quickly. Risk is higher here.

Value investing is like finding hidden gems at a yard sale. It involves buying stocks that seem to cost less than their true worth. These stocks may not shoot up fast, but they often come with less worry. The risk is lower as they tend to be more stable.

Investment Time Horizon for Starters

Your investment time horizon is about how long you plan to keep your money invested. It’s a big deal for choosing between growth and value stocks.

If you’re young or can wait a long time, growth stocks might fit you well. They often need time to show their full potential. You have to leave them to grow, like waiting for a tree to get tall.

On the other hand, if you’d rather not wait so long, or you’re a bit older, value investing could be a better match. This way, you might see steady gains over a shorter period. Plus, value stocks sometimes pay dividends. That’s extra cash in your pocket while you hold the stock.

Understanding your own risk level and time frame is essential. It helps you pick the right path. So take a moment to think. How do you react to ups and downs in the market? How long can you leave your money to work for you? Your answers to these questions shape the foundation of your investment strategy. They influence whether you lean towards fast-growing companies or steady, undervalued ones. Remember, investing is personal. There’s no one-size-fits-all.

Each strategy has pros and cons. Growth investing could rocket your money to new heights. Value investing might offer a smoother, yet slower, climb. Which road you take depends on your personal financial goals, how much market sway makes you nervous, and how long you want to invest.

A good first step is to learn the basics. Know what growth and value really mean. Look into how they have done in the past. Then, link this back to your own comfort with risk and your time goals. This way, you set yourself up for winning in the investment game.

Pulling from the wisdom of seasoned investors, you’ll understand that the stock market is not a one-day match. It’s more of a season-long sport. Whether you choose growth or value investing or a mix, you start the journey to potentially thriving financial health.

Remember, the market can swing, and patience pays off. Armed with knowledge about risk tolerance and investment time horizon, start your journey with confidence. The right path is the one that aligns best with who you are, your dreams, and your timeline.

Building a Solid Foundation: Asset Allocation and Diversification for New Investors

Asset Allocation for New Investors

So, you’re ready to start your journey in the world of investing. Good move! First, let’s talk about asset allocation. Think of it as your investment recipe. It’s how you mix different types of investments to cook up success. Starting with a good mix can help you handle the dips and dives of the market. Stocks, bonds, and cash are the main ingredients. A pinch of each shapes your risk factor and can affect your money growth.

Young investors often go heavier on stocks. Why? They have time to ride out market storms. With years ahead, taking some extra risk now may lead to more payoff later. But let’s keep it real. No single mix suits everyone. It’s all about your comfort with risk and your cash needs soon. Your perfect balance may shift as your life does too.

Diversification in Investing for Beginners

Now, diversification. Imagine eating only apples every day. Boring, right? Plus, if there’s an apple shortage, you’re out of luck. This is where diversification shines in investing. Don’t just buy one company’s stock. Spread your bets across various sectors and investment styles. This way, if one part of your portfolio hits a bump, the rest might smooth it out.

Mix it with big company stocks, small ones, some international shares, and sprinkle in bonds for good measure. This can protect your hard-earned cash from too much bumpiness. Like a sports team with star players in every position, a diversified portfolio won’t depend on one “player” to score big.

Heads up – diversification isn’t just about having lots of stocks. It’s about having different kinds that don’t all move the same way at the same time. A mix of growth and value stocks, for instance. Growth stocks are like the hare, aiming for fast wins. Value stocks, the tortoise, may not race ahead but can give steady gains and often pay dividends. Both have their merits, and having a bit of each can be a smart move.

Asset allocation and diversification are not a get-rich-quick trick. They are the steps to build a resilient foundation for your investment house. A well-thought-out plan takes you closer to your money goals, while also helping you sleep at night. Remember, starting off solid makes the ride smoother and more likely to reach the destination you have in mind. It’s like strapping on a seatbelt before hitting the road. It’s about safety and smarts – and it works.

By spreading your investments, assessing your risk comfort, and revisiting your plan as life changes, you’re setting yourself up for a better shot at success. And hey, as you grow more confident, you can finesse your strategy. But for now, nailing these basics can open doors to a more secure and potentially richer future. Investing isn’t just about picking stocks – it’s about picking the right strategy for you.

Investment Strategies in Practice: Real-World Application for Beginners

Passive vs Active Investing

When you start investing, you have two paths. You can be hands-on or hands-off. Active investing means you buy and sell often. You aim to beat the stock market. It takes lots of work and skill. The costs can add up too. You pay more fees. You might also pay more taxes.

Then there’s passive investing. This is more laid-back. You invest in funds that track a market index. These funds don’t change much. The goal is to match the market, not beat it. It’s easier for beginners. It costs less too. You pay lower fees. You have fewer taxes.

Now let’s talk about which method works better. For most new investors, passive wins. Here’s why. Active investing is tough. Even pros can’t always beat the market. As a beginner, you probably won’t either. But with passive investing, you can still see your money grow. It mirrors the broad market, and over time, that market tends to go up.

Also, there’s less stress with passive investing. You don’t chase the next big thing. You don’t fret over short-term losses. Your focus is on the long haul, and history shows that’s a smart bet.

Low-Cost Index Funds for Beginners

So, what’s a great way to start passive investing? Enter low-cost index funds. These funds are easy to buy. They let you own lots of stocks or bonds at once. This spreads your risk. If one stock dips, you have others to cushion the fall.

Index funds also save you money. They have low fees. Every penny saved on fees is one more you invest. Over years, that can add up to a lot.

Beginners love index funds for their simplicity too. You don’t need to pick winning stocks. You don’t have to watch the market daily. You just ride the wave of the whole market.

And here’s the kicker – many pros use index funds too. Why? They know it’s a solid bet for the long term. They favor low cost and broad market access.

When you’re starting out, think about your goals. How much risk can you handle? How long will you invest? Low-cost index funds can be a great start. They offer a mix of stocks. They’re good for building wealth over time.

Remember, no single strategy fits all. But for many beginners, the slow and steady pace of passive investing, especially with index funds, is a wise choice. It could lead you to a stable financial future without the ups and downs of active trading.

As you gain confidence, you can always explore more. But for now, keep it simple. Lower your costs. Think long-term. And watch your investments grow with the market. It’s a strategy even investment legends like Warren Buffet endorse. And that’s a good company to keep as you set out on your investment journey.

In this guide, we’ve tackled the big ideas in investing, from growth versus value to risk and time. We kicked off with growth and value investing – two paths you can take depending on how you see the stock game. Then we looked at how much risk you can handle and how long you plan to invest, because it’s super important to match your investments with your comfort level and goals.

We also learned about splitting your money into different types of investments, a process called asset allocation, and why spreading your bets across different assets – yeah, that’s diversification – can be a game-changer. Lastly, we dug into investing strategies that work in the real world and why going for a low-cost index fund could be a smart move, especially if you’re just starting out.

Bottom line: investing can be simple or complex, but knowing the basics sets you on the right path. With a solid plan and some smart choices, you’re ready to hit the ground running in the investment world. Aim for steady growth, keep risks in check, and play the long game. You’ve got this!