Welcome to the ultimate financial face-off: Growth vs. Value Investing Showdown: Which Packs the Bigger Risk Punch? In this corner, we have growth investing, the aggressive contender known for its swing-for-the-fences attitude. Across the ring stands value investing, the seasoned strategist betting on undervalued stocks to clinch the win. You’ve likely pondered, “Growth vs value investing: which is more risky?” Let me tell you, it’s not just about picking sides. It’s about understanding where each throws its hardest punches and how it fits into your money-making game plan. Strap in as we dive deep into the traits and traits that set them apart and gauge which one truly tips the risk scale.

Understanding the Landscape: Growth and Value Investing Defined

Key Characteristics of Growth Investing

Growth investing is like hunting for hidden treasure. You look for companies that grow fast. These young or tech firms often reinvest their profits. They do this instead of paying them out to investors. Because they aim to grow quick, they often don’t give dividends early on. Their stock prices can shoot up fast, though. But they can also drop just as quick. This makes growth stocks like roller coasters, thrilling but not for the faint of heart.

Let’s talk risk factors in growth investing. There are about three to five big ones. First, growth stock prices swing a lot—this is called volatility. Second, these stocks can get overvalued easy. When investors get too excited, they might pay too much. Third, you have interest rates. If rates go up, growth stocks might not look so good anymore. That’s because borrowing costs more, which can slow down growth.

Defining Value Investing and Its Core Principles

Now, value investing is a different story. Think of it as bargain hunting. Value investors look for stocks that seem cheaper than they should be. They find firms that the market has overlooked. These companies might not be growing like crazy. But they often have solid stuff going for them. They might have strong sales, good assets, or nice dividends.

With value investment strategies, we aim for steady returns. There’s about three to five key moves to do this. One, we search for blue-chip companies—big, well-known firms with a history of doing well. Two, we check the dividends. A steady dividend is a sign of a solid company. Three, we look at the price-to-earnings ratio. This tells us how much we pay for every dollar the company earns. Lower is better.

Value investing is seen as safe, or safer than growth investing. It’s about protecting what you have while still trying to make a bit of money. This style fits people who don’t like shocks in their portfolio. It suits those looking for a long-term investment horizon. Here, market cycles impact these stocks less. That’s because we bet on the company’s value, not just its price tag.

We can say value investing has a defensive nature. It holds up better in hard times, like a bear market. When things get tough, folks tend to cling to what’s known to last. And that’s often the kind of stuff value investors already have. These firms might not make you rich quick. But they aim to make you richer, slowly and more dependably.

As an expert, I’ve kept an eye on stocks for years. I’ve seen growth stocks race up and crash down. I’ve watched value stocks chug along, sturdy and more predictable. Both have their place, and both can play a part in reaching your money goals. It all comes down to how much risk you’re up for and what you want your cash to do for you. Choose wisely and don’t put all your eggs in one basket!

Measuring Risk in Growth vs. Value Stocks

Volatility and Risk in Growth Stocks

Growth stocks are the wild kids at the party. They shoot up fast and can drop just as quick. The risk factors in growth investing are higher, for sure. Why? Growth stocks bet on potential. They are about what could be, not what is. Think about tech startups or big dreamers like Tesla in its early days. High chance for big money, but also a high chance to lose.

Growth stock volatility is a roller coaster. Market mood swings can send their prices flying or crashing. It’s thrilling but not for the faint-hearted. In a bull market, they can lead the charge. But if a bear growls, they might fall the hardest. When you’re picking growth stocks, think long-term. Don’t get scared off by each bump. But do watch out for overvalued stocks. Paying too much for a “maybe” is a big risk.

The Steady Nature of Value Stocks and Inherent Safety

Now let’s chat about the steady folks, value stocks. They are like old friends. Reliable, maybe a bit dull, but they’ve got your back. Does this mean they’re risk-free? No, but they are safer. With value investment strategies, you look for deals. You want solid companies that folks have overlooked. Blue-chip companies often fall into this family.

Value stocks earn their stripes through steady returns. They aren’t showy, but they keep chugging along, even when the market’s moody. Their secret is the defensive nature of value investing. They are recession-resistant. Think of them like a sturdy ship in a storm. They might rock a bit, but they won’t flip over.

Ready for a pro tip from Warren Buffett? He loves value stocks because they mean quality at a good price. And here’s a thought: combining value investing safety with diversification in investing? That’s a strong move. You’re spreading out your risk, not putting all your trust in one play.

Analyzing risk in your portfolio, remember this: growth stocks give you highs and lows. Value stocks offer comfort and less worry. Both have their place. It depends on your goals, your gut for risk, and your patience. Always think about the market cycles impact. It changes what’s hot and what’s not.

For my friends who love details: check out price-to-earnings ratios. They tell you if you’re getting a good deal. Historic returns give you a clue about past performance. But don’t cling to those numbers. Instead, focus on the here and now. Look at company fundamentals and economic conditions. That’s how you pick winners.

In the end, ask yourself: what’s my style? Do I go for the big win with growth stocks? Or do I prefer the quiet climb with value ones? As you ponder, don’t forget the balance. Your mix should reflect who you are as an investor and where you want to go. Choose wisely, and watch your investments closely. That’s the best way to play this game.

Market Conditions and Investment Performance

How Economic Cycles Influence Growth and Value Stocks

Economic ups and downs shape how much money we can make from stocks. Think of the economy like a giant wave. Sometimes it’s high, sometimes it’s low. Growth stocks shine when the wave is high. It’s because they earn more as people spend more. They do stuff like tech and new ideas. Yet when the wave crashes, these stocks often fall hard. That’s the risk we take for a chance at big wins.

On the flip side, value stocks are like sturdy boats. They ride out the stormy waters of a bad economy better than growth stocks. They’re usually well-known companies. They’ve been around for a long time and sell things we always need, like toothpaste or electricity. Even when money is tight, they tend to offer stable returns. That’s their safety net.

The Impact of Market Volatility on Both Investment Strategies

Now, not all shakes and jolts in stock prices are the same. Some stocks wiggle like crazy, we call this growth stock volatility. Others barely move—that’s steady returns with value stocks. If you can handle the wiggles, growth investing might suit you. It can be like a wild roller coaster. But remember, big ups can mean big downs.

On the other hand, value investment strategies focus on keeping your money safer. It’s like picking the calm pony on the merry-go-round, not the wild horse. Why? Because those companies have been around. They’ve weathered storms before. They may not jump in value overnight, but they usually won’t crash fast either. They provide a defense, a shield from market shakes.

Making money from stocks takes more than luck. It’s about knowing the game. It’s about seeing the signs. When stocks cost too much, we call them overvalued. It’s like paying $10 for a lemonade worth $2. Recognizing overvalued stocks is key. It keeps us from bad buys. Price-to-earnings ratio helps with this. It’s a number that shows if a stock’s price makes sense compared to its earnings.

Interest rates matter too. They can make borrowing money cheap or pricey. Cheap means more spending and often higher stock prices. Pricey means the opposite.

Let’s wrap it up. Growth and value stocks dance to different tunes. Growth stocks sprint ahead when times are good. They might stumble when the music stops. Value stocks take it slow and steady. They might not win the race, but they stay on track. It’s all about matching your groove to the beat of the market cycles. Each style has its risks and rewards. It’s like picking between a fast motorbike and a durable car. What’s right for you?

Remember, throwing all your money at one stock is like betting on one horse. Don’t do it. Mix it up. That’s diversification. It spreads out the risk. It’s like having a foot in two different boats. One might wobble, but you won’t fall in.

Strategy Application and Risk Management

Adopting Warren Buffett’s Principles for Risk Assessment

Let’s dive into Warren Buffett’s world, shall we? I’m sure you know him—the investment wizard who loves value stocks. His secret sauce? He looks for hidden gems: unloved or overlooked companies priced less than they’re worth. It’s like treasure hunting but with stocks, and it works!

Now, here’s the deal: Warren says “Risk comes from not knowing what you’re doing.” So I say, avoid risk by doing your homework. Check out a company’s health like Warren does. Is it strong? Does it make money? Sometimes, you need to act like a detective to really get the lowdown.

Diversification and Its Role in Balancing Risk in Your Portfolio

Alright, folks, let’s get real about diversification. Think of your investments like a soccer team. You can’t win with all forwards, right? You need defenders, midfielders – a balanced team to tackle the ups and downs. So mix it up with growth and value stocks, tech giants and steady blue-chips, to defend against market swings.

Growth stocks? They’re your high-fliers, like shiny tech startups. They can score big but might also miss when things get rough. Value stocks are your reliable players, offering steady returns even if they’re not making headlines.

Remember, you’re the coach of your investment team. So, pick a squad that can handle sunny and stormy days. By spreading out your risks, you’re playing both offense and defense. That’s how you stay in the game no matter what the market throws at you.

Keep this in mind: don’t put all your eggs in one basket. Or, like my grandma used to say, “Don’t bet the farm on one horse.” Investing in different types of companies means you don’t rely on just one to win. It’s all about balance.

Alright, that’s our play-by-play on managing risk with some Buffett wisdom and smart team strategies. Remember, the game plan is knowing your moves and keeping your team diverse. Play it right, and you could have a championship portfolio!

In this post, we dug into growth and value investing, exploring each strategy’s features and risks. We saw that growth stocks are often more volatile, while value stocks tend to be steadier. Economic cycles affect both, but in different ways. By looking at legends like Warren Buffett, we learned practical ways to assess risk and saw how mixing investments can protect our money.

To wrap it up, both growth and value investing can work, but it really comes down to what makes sense for you. Do you like fast movers or prefer steady winners? It’s about your goals, your gut for risk, and how you manage your mix of stocks. Smart investing is not just picking winners; it’s also about playing it safe and smart. Keep these tips in mind, and you’ll be onto a solid start. Let’s invest with confidence and smarts!

Q&A :

What are the main differences between growth and value investing?

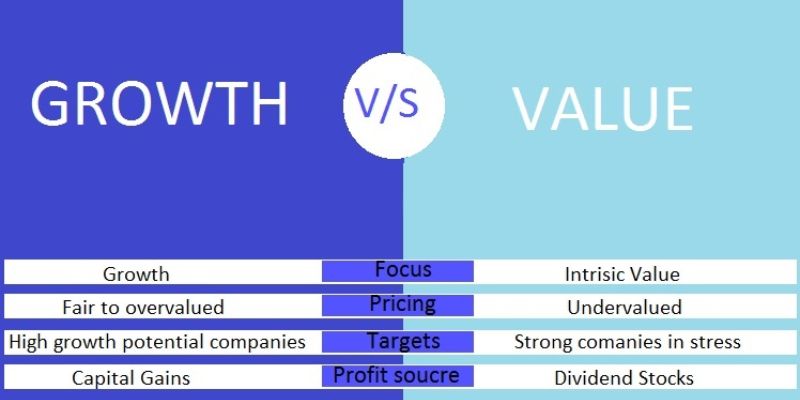

Growth investing focuses on companies that exhibit signs of above-average growth, even if the share price appears expensive in terms of metrics such as price-to-earnings or price-to-book ratios. Value investing, on the other hand, is about finding undervalued companies with strong fundamentals that are selling at a discount to their intrinsic value. The risk profile of growth stocks can be higher, as they are expected to generate high returns, which may not materialize, while value stocks tend to be more stable and less sensitive to market swings.

Which investment strategy is better for long-term investors, growth or value?

For long-term investors, the decision between growth and value investing should align with their risk tolerance, investment goals, and time horizon. Historically, both strategies have had periods of outperformance. Growth stocks may offer higher potential returns but come with increased volatility and risk. Value stocks may provide steady growth and dividends but may not have the same high growth potential. Diversifying across both growth and value stocks can be a balanced approach for long-term investment.

Can value investing outperform growth investing in a bear market?

Value investing has the potential to outperform growth investing in bear markets due to the defensive nature of value stocks. These companies are typically well-established and financially sound, which can help them withstand economic downturns better than high-growth companies, which may still be developing their business models and could be more susceptible to adverse market conditions. However, individual performance can vary, and there are no guarantees in investing.

How does market volatility impact growth and value investing strategies?

Market volatility can have differing impacts on growth and value investing strategies. Growth stocks, with their higher valuations and expectations for future earnings, may be more vulnerable to market downturns and can experience larger fluctuations in price. Value stocks are often considered to be less volatile due to their lower valuations and focus on current earnings and dividends. During high volatility, some investors may prefer the relative safety of value stocks.

Is growth or value investing more suitable for risk-averse investors?

Risk-averse investors may gravitate towards value investing because it typically involves buying stocks that are considered undervalued in relation to their intrinsic value and may offer dividends, resulting in a potential cushion during market dips. Growth stocks are often seen as riskier, as they rely on future potential, which may or may not be realized. These stocks can be more sensitive to market sentiment and can experience sharp price movements.