ESG in Mainstream Investment Strategies: Unlocking Sustainable Profits

ESG in Mainstream Investment Strategies: Unlocking Sustainable Profits

Imagine your money working for both profit and the planet. That’s ESG in Mainstream Investment Strategies for you. We’re stepping into a world where investing meets caring for the environment, supporting social justice, and pushing for better company leadership. Now, you can back businesses that do good and see strong returns. Let’s dive in and uncover how you can join the movement that’s reshaping the future of investments.

Understanding the Core of ESG Investing

Defining ESG Investing Principles

What is ESG investing? It’s a way to invest that takes care of the planet, people, and company rules. It’s not just about money. It’s about making sure our Earth and everyone on it can do well for a long time.

ESG stands for three big ideas: 1) the environment, where we look at how green a company is; 2) social stuff, where we think about how a company treats people; and 3) governance, which is about how fair and honest a company is.

When we pick stocks or funds, we don’t just look at money. We check if a company is doing good or bad things for our world. The better a company does in ESG, the more we like it.

The Rise of Sustainable and Socially Responsible Investing

Years ago, few people thought about the planet or being fair when they put money in stocks. Now, many do. This change is called sustainable and socially responsible investing. Why? Because now we know that a company’s actions can change the world, for better or worse.

We all want to live on a clean Earth, with people treated nicely, and companies that play fair. So, smart investors put their cash in companies that care about these things too. This kind of investing is growing fast, and it’s changing how big funds think about their money.

When you hear “impact investing” or “green finance,” this is what they mean. Folks are using their money to push for a greener and kinder world. And guess what? It turns out doing good can also mean doing well with your investments.

Investing with a heart is not only nice; it’s smart. Look at the numbers. Lots of studies show that companies good at ESG often make more money in the long run. People trust them more, and they can be better prepared for tough times.

So, when asset managers talk about ESG in equity research or when a company follows ESG reporting standards, they’re not just being trendy. They’re making sure their money is doing good things and is ready for the future.

Now, it’s not just about the feel-good part. There’s real data behind this. ESG data providers help investors see how companies score in ESG. This helps them pick where to put their money. By putting ESG in asset allocation, they hope to make profits that last and help the world too.

And we haven’t even talked about how all this helps with climate change. When companies cut down on pollution or use less power, it helps stop the Earth from getting too hot. This is a must if we want to keep Earth cool enough for us all. Plus, smart companies dodging climate risks can end up ahead in the game.

So what’s in it for you? When you put your money into ESG-themed investments, you’re part of something huge. You’re saying that you want a future where the Earth wins, people are happy, and companies play nice.

It feels great, right? But it’s not just about feeling good — it’s about making sure that future generations have a world worth living in, and perhaps, making some money along the way.

Incorporating ESG Factors into Investment Strategies

Ethical Investment Strategies and Portfolio Composition

When you think about making money and doing good, they can go hand in hand. As someone who’s worked in this exciting world of finance and responsibility, I’ve seen firsthand how ESG factors shape portfolios.

To start, let me explain what we mean by ESG. It stands for environmental, social, and governance. These are keys to making smart moves with money that also help the world. Now, how do these factors change how we invest? Let me give you a real breakdown.

First up is “E” for environmental. Here we think about how companies treat our planet. Do they recycle? Do they cut down pollution? These actions matter and can affect how well a company does.

Next is “S” for social. This is all about how companies handle people. Do they have good working conditions? Do they support the community? Getting this right means people support them back.

Last is “G” for governance. It’s about the rules and how fair a company plays the game. Honest business draws more investors and keeps trouble away.

Mixing these into money choices isn’t just nice; it’s smart. Companies that score well on ESG often do better in the long run. This means thinking about these factors can lead to smarter money moves.

ESG Risk Management and Reporting Standards

Managing risk is crucial in investing. And including ESG factors helps a lot here. It makes you think about risks you might not see at first. Like, will a new law about clean air hurt a company’s profits? It’s all about looking further to protect your money.

Understanding ESG risks means needing good info. That’s where ESG reporting standards come into play. These are like rules that say how companies should tell us about their ESG moves. They help everyone know just how well a company is doing.

Investors use this info to make cool charts and maps of where their money is going. This helps to pick the best spots and avoid the risky ones.

And here’s a kicker, ESG can actually lead to better returns. How? Because taking care of these factors tends to dodge big problems down the road. It’s like fixing a small leak before it floods your house.

So, we’ve got ethical investment strategies that aim to do right by the world and our wallets. We’ve got risk management that’s about being smart before the storm hits. And we’ve got reporting standards that keep it all clear and open.

With this mix, you see ESG isn’t just good talk; it shapes how money grows in a way that can make you proud. It’s true – money can work wonders and still wear the good guy’s hat. That’s the heart of ESG in investment strategies. It’s money with a mission, profits with a purpose, and I’m stoked to be part of it.

Measuring the Impact of ESG on Financial Performance

ESG Metrics in Portfolio Analysis

Let’s dive right into how ESG changes the game for making money. First off, ESG stands for three big ideas: Environment, Social stuff, and how companies are run—Governance. When we talk about ESG, we’re mixing these into picking where to invest. Think of it as checking a car’s health before a race. But it’s not just about being good folks; it’s about making sure the money grows.

Now, we don’t guess how ESG stuff affects cash. We use metrics, like rulers for money. These rulers help us see which companies care about the planet and people, and also make good profits. So, what’s cool about these ESG rulers? They let us see which companies are less risky to invest in because they think long term.

Firms that score high on ESG often cost less to keep up. They handle their money wisely and treat people well. They also stay out of trouble more—big plus for keeping money safe. With these numbers, making money with a good heart isn’t a fairy tale.

Benchmarking with ESG Investment Funds

Want to know who’s leading the run with ESG? Check out ESG investment funds. These are groups of investments picked by ESG rules. They’re like a team your coach would pick, hoping each player scores high at being good and winning games.

When we compare our money picks to these ESG stars, it’s called benchmarking. It’s like having a map to see if we’re heading to the treasure or the desert. If the fund does well, it tells us that caring for Earth and people can pay off. Over time, these team players can really bring the gold.

And guess what? Lots of folks want their money to do good now. So, these ESG funds are getting more popular, and they’re proving rich doesn’t have to mean greedy. In fact, cash put into ESG funds has grown a lot.

Put simply, using ESG isn’t just nice, it’s smart. By checking ESG scores and looking at funds that use them, we can make money and sleep well at night. That’s a win for us, the planet, and our kid’s future. Who wouldn’t want that?

Navigating the Future of ESG in Investments

Aligning Investments with Climate Change Strategies

Let’s talk about your future and your money. You want them both to last, right? Putting money in companies that think about climate change does just that. It’s like choosing a long road trip buddy who knows how to read a map and won’t get you lost. Working out which companies care about our planet helps us all.

So, how do we pick these companies? Look for those who set clear goals to lower pollution and grow without hurting the earth. They’re leading the pack and often dodge big costs from climate rules down the line. This helps your investments stay strong over time.

Taking care of the earth while making money is smart. You get the best of both worlds. By picking stocks that match up with climate tactics, you’re steering your cash into a future that shines bright.

ESG Disclosures and Compliance in the Investment Process

Now, let’s get the facts straight before you part with your hard-earned cash. Getting the full scoop on a company’s ESG game is key. This means making sure they’re not just talking a big game, but actually walking the walk. And there’s a push for folks to tell us what’s what with their ESG moves, in clear terms.

Governments and big money minds are calling for rules so you know if a company is doing ESG right. They should share their ESG reports just like they do with their money talks. This keeps them in line and keeps you in the know.

Wrap your head around this idea: It’s not just about making money now, but also about making sure our kids and their kids have a good shot later. That’s where ESG shines. You’re aligned with companies that plan for risers in the sea and more heat waves, so they last long and do good.

By the way, be sure to partner with investment pros who get the ESG world. They can spot the good apples who mean business about our planet and people. This isn’t just chatter; it’s about your future cash, the world we live in, and doing right by both.

To bring it home, diving deep into a company’s ESG talk can save you from wishy-washy investments. It’s all about real actions, not just promises. You’re looking for the folks who avoid nasty shocks and build up a solid investment that won’t bail when things get hot (literally).

In the long run, weaving ESG into where you put your dough can make it grow and let you sleep well, knowing you’re backing up a good cause. That’s a win-win, my friends. So next time you’re thinking about where to invest, remember the big picture. You’ve got the power to back a better future and watch your wallet swell up while you’re at it.

In this blog post, we dove deep into ESG investing, showing you what it means and why it’s booming. We talked about how to bring ESG factors into choosing where you put your money and the way these choices can actually play into your investment returns. We also looked at ways to use ESG scores to see how investments are doing and compared them with ESG-focused funds.

Our trip didn’t stop there. We explored how ESG ties into the big picture—like climate actions—and what rules are in place for investors to keep things clear and honest. What sticks with me, and should for you too, is how much ESG investing is about the future. It’s smart investing with a heart. It’s about making money work in a way that protects and improves our world. The key takeaway? Investing with ESG in mind isn’t just good for the planet and people, it’s good for your pocket too. Keep that in mind as you pick your next investment and be part of a change that’s here to stay.

Q&A :

How is ESG integrated into mainstream investment strategies?

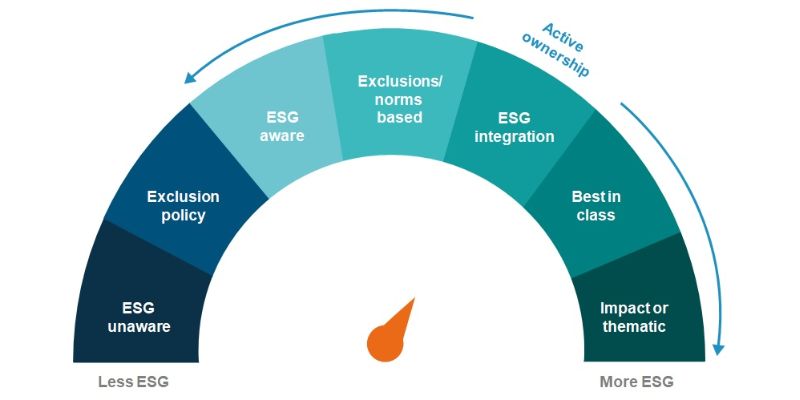

ESG integration in mainstream investment strategies involves the systematic and explicit inclusion of environmental, social, and governance factors into financial analysis and investment decision-making. This process can help investors identify potential risks and opportunities beyond traditional financial metrics that could impact the long-term performance of their investment portfolios.

What are the benefits of including ESG factors in investment decisions?

Incorporating ESG factors into investment decisions brings several benefits. It can potentially lead to better risk management as it can highlight issues that are not visible through traditional financial analysis. Furthermore, it can generate sustainable, long-term returns, and align investments with personal or institutional values. Investors may also contribute to societal goals such as climate change mitigation or improved labor practices through ESG investing.

How do investors measure the impact of ESG in their portfolios?

Investors measure the impact of ESG in their portfolios using a variety of metrics and frameworks. Common methods include ESG scoring and ratings provided by third-party agencies, which assess companies based on their ESG practices. Additionally, reporting frameworks like the Global Reporting Initiative (GRI) or the Sustainable Accounting Standards Board (SASB) help investors track and compare ESG performance across companies and industries.

Can ESG investing lead to better financial performance?

The relationship between ESG investing and financial performance is a topic of ongoing research. Some studies suggest that strong ESG practices may be correlated with better financial performance, reduced risk, and lower cost of capital. However, the financial impact of ESG investing can depend on various factors such as industry, company size, and the specific ESG measures in question.

Are mainstream investors actively seeking to implement ESG criteria?

Mainstream investors are increasingly seeking to implement ESG criteria into their investment strategies. This shift is driven by a growing recognition that ESG factors can materially affect a company’s performance and risk profile, as well as a rising demand from clients and stakeholders for more responsible investment practices. Institutional investors, in particular, are taking the lead on integrating ESG considerations into their investment analysis and portfolio construction.