Historical stock market crashes are not just footnotes in textbooks—they are stark lessons wrapped in chaos. Like a skilled detective pores over a crime scene, we must dissect these financial avalanches to unearth the truth. Understanding the underlying reasons for these crashes offers us a blueprint for prevention and reaction. Think of each meltdown as a story where clues were missed, and warnings ignored. In the roaring echoes of Black Tuesday and the painful memories of 2008, there are whispers of wisdom waiting for us. Let’s uncover these stories together and grow wiser in the face of uncertainty. It’s not just about survival; it’s about building the acumen to thrive when the next storm hits.

Understanding the Underlying Causes of Market Crashes

Analyzing the Warning Signs and Triggers

Market crashes scare us. They eat up wealth fast. But they don’t pop up without warning. I’ve seen patterns that hint trouble is coming. For example, before the Wall Street Crash of 1929, the market soared. People ignored the fact that the prices were much higher than the actual value of the stocks. That was a big sign.

In 1987, a similar thing happened on Black Monday. Computers, new trading programs, and panic selling mixed into a nasty drop. It was a bad day, with a lot riding on systems not ready for huge sells.

The dot-com bubble burst because of too much cash chasing too few profits. And in 2008, before the huge crisis, houses sold like hotcakes. Bad loans got wrapped up in fancy finance stuff. Then it all fell apart. Lehman Brothers collapsed, and it was like a wakeup call for everyone.

Stock market crash history tells us to watch for these signs. It shows us that big crashes often come after times when things look too good to be true. If folks borrow a lot, and prices go wild, trouble might be brewing.

Comparing Historic and Modern Economic Indicators

Now, let’s talk about yesterday versus today. The triggers might look the same, like sudden drops and quick sells. But the reasons for market crashes have changed a bit. These days, the world’s more connected. A problem in one country can hit markets worldwide.

Back in the day, like during the Great Depression, the world was different. It was harder to get news fast. Modern economic indicators, like job numbers or factory stuff, help us guess what might happen next in the market.

Modern tech tells us quicker when we hit market crash warning signs. Now we have things like circuit breakers in the stock market. They hit pause on trading to stop panic selling. This wasn’t around for the Great Depression or even Black Monday 1987.

Investment strategies for a recession now use this tech and data. We look at economic indicators to make better calls. It helps us avoid a bad tumble or to ride it out better.

Learning from the past, I say smart investing counts on good plans and cool heads. Diversify. Don’t put all the eggs in one basket. And watch those warning signs! Crashes hit hard, but they also teach us tons. Flash Crash 2010 showed high-speed trading can mess up trade and trigger big drops fast.

In the end, every crash, from the 1929 Black Tuesday to the Subprime mortgage crisis, tells a story. They show us what to look for and how to protect our money. History’s lessons are gold if we just pay attention.

Deconstructing Major Financial Meltdowns

The Devastation of Black Tuesday and the Onset of the Great Depression

Let’s explore the dark day of Black Tuesday. It hit Wall Street hard on October 29, 1929. This day sparked the Great Depression. Stocks fell like leaves from trees. Banks closed. People lost homes and jobs. It was a mess that took years to fix. Why did this happen? The 1920s saw stock prices soar. Too high, way too fast. People used loans to buy stocks, hoping to get rich quick. This setup was not stable.

Then, prices dipped. Folks rushed to sell their stocks. No buyers, only sellers. Fear spread. Prices crashed. This was a snowball effect. Investors lost cash. Many were broke. No one knew what to do. Money got tight. Businesses failed. It was the start of a hard time. Everyone felt it.

Lessons from the 2008 Financial Crisis and Lehman Brothers’ Collapse

The year 2008 saw another big market crash. This one shook the world over. Homes lost half their value. Big banks were in trouble. Lehman Brothers, a huge bank, fell. It was big news. Many lost savings. How did this happen? We blame bad home loans. These were given to people who could not pay them back. Big banks bought these risky loans. They hoped to make more money. Earlier, house prices went up, up, up. Everyone thought they would keep rising. They did not.

So, what can we learn from these events? A lot about being careful with money. Banks should not play fast and loose with loans. People also need to think twice before borrowing. Don’t buy pricey homes you can’t afford. It’s risky. Diversify. This means spread your investments. Don’t put all your cash in one spot.

Crashes can teach us. We watch for signs to dodge future tumbles. The market has crashed before, and it will do it again. History repeats. But knowing the past helps us brace for the next fall. We stay alert, watchful, and wise.

Final Thoughts

Not every dip means doom. Sometimes, markets just adjust. They do this after prices soar too much. This is called a correction. A crash is way worse. It hits hard and fast. Knowing this helps us stay calm during dips. We keep our eyes on the long game. Stocks rise, fall, but often climb back.

Remember, markets can recover. After the falls, they have bounced back. It takes time. But prices can return and even grow. To weather the storm, spread your investments. Keep some in stocks, some in bonds, others in cash. This mix can shield you from heavy losses.

We can’t see the future. But history gives us hints. Understand the past. Study it close. It can guide us through the rocky ways of the market. Investing is not just about making a quick buck. It’s about building for the long haul through the ups and downs. Take the lessons from those big crashes. Use them to make smarter choices today.

Strategies to Navigate the Bear and Prepare for the Bull

Importance of Portfolio Diversification During Volatility

In a stormy market, think of diversification as your umbrella—it’s crucial. When stock prices fall, it’s like rain pouring down. Keeping just one type of stock is like having only one shoe—you’ll get wet and cold. Spread out to different stocks, bonds, and cash. This way, when the stock market dances up and down, you don’t lose it all. Having bits in many pots can handle drops better than having all in one.

Diversification doesn’t mean putting your eggs in more baskets; it means choosing different types of baskets. Think of the Wall Street Crash of 1929. Many folks had all their money in a few stocks. When those crashed, they lost it all. Learn from that. Mix it up! Add tech, health, international, and many more sectors. Think wide, not just high. Now, even if tech falls, health might rise, keeping your money safer.

Risk Management and Protective Investment Measures

Risk management is like having a safety net when you walk a tightrope. When stock prices dip, don’t panic. Instead, have a plan. Use stop-loss orders which sell your stock if the price drops too fast. It’s like saying “if it gets too bad, get me out!” This can save you from bigger losses if the stock falls a lot.

Always check your stocks. Know why you bought them and what can make them weak. Let’s talk about Black Monday 1987. Stocks fell hard because computers went wild selling. Now, we can set rules to stop trades if it gets too wild. Think about the stock bubble. It’s when prices go way up, not because they’re worth it, but because people are too excited. Just like a bubble, it can pop. When it does, prices tumble down.

Keep an eye on “market correction vs crash.” A correction is when stocks dip a bit to match their true value. A crash is a big, painful drop. Knowing the difference helps. Save cash for when stocks are cheap. After a crash, they can be like a sale – when everyone is scared and selling, a brave buyer gets a deal.

Remember, markets have always had ups and downs. After the Great Depression or the 2008 financial crisis, they climbed up again. It takes time, but stocks can come back. Your job is to hang on, stay calm, and think ahead. Control what you can, learn from the past, and prepare for the future. With smart steps and steady hands, you can walk through bear markets and be ready to run with the bulls.

Post-Crash Analysis: Recovery and Future Predictions

The Role of Federal Reserve in Economic Recovery

After a stock market crash, all eyes turn to the Federal Reserve. It has a big job. It needs to fix the money flow and bring back confidence. After the Great Depression, the Fed learned a lot. It now steps in fast to help banks and the whole economy.

When the 2008 crisis hit, the Fed slashed interest rates. This made borrowing cheaper. They also bought a lot of assets. This move is called “quantitative easing.” It pumps money into the system to get things moving again.

The Fed’s job doesn’t end there. It watches over banks to keep them in line. It tries hard to stop another crash from happening. By doing all this, it steadies the markets and supports a bounce-back.

Investor Psychology and Market Behavior Post-Crash

Market crashes can scare investors a lot. After Black Monday in 1987, people were very fearful. But markets can bounce back. It’s all about how investors think and feel.

When panic hits, many sell their stocks fast. This is panic selling. Afterward, they might regret it. Why? Because markets can and do recover over time. History shows us that after the fall, stocks often climb back up.

Smart investors keep a cool head. They know that crashes are part of the game. These investors spread their money out. That’s called portfolio diversification. It’s like not putting all your eggs in one basket.

Even if the market drops, they don’t sell in fear. They think long-term. They might even buy more stocks when they’re cheap. When the market recovers, they could make a profit.

In the end, crashes teach us to be better investors. By understanding the market and not giving up, we can come out stronger.

We’ve dug deep into market crashes, from causes to fallout. We looked at the signs and triggers, compared past and present economic clues, and learned from historic financial mess-ups like Black Tuesday and the 2008 crash. Key takeaways? Spread your bets and manage risks to stay afloat. When the market dips, smart moves can help you ride out the storm and even come out ahead.

The Federal Reserve and investor feelings play big roles in bouncing back after a crash. Remember these insights and keep your eyes peeled for warning signs. Stay sharp and you’ll be ready for the good times and the tough ones. You’ve got the smarts now; use them well!

Q&A :

What are the common causes of historical stock market crashes?

Historical stock market crashes are often the result of a complex interplay between economic factors, market sentiment, and external events. Common causes include speculative bubbles, where the prices of stocks rise far higher than their real value; sudden economic downturns or crises; overvaluation of stocks; and panic selling, which can exacerbate a market decline. Changes in regulatory environments and unexpected geopolitical events can also trigger significant market corrections or crashes.

How have historical stock market crashes impacted the global economy?

The impact of historical stock market crashes on the global economy has varied in scale and duration, but they can lead to prolonged periods of economic recession. When stock values plummet, it can reduce household wealth and erode consumer and business confidence, which in turn can decrease spending and investment. The resulting slowdown in economic activity can lead to increased unemployment, lower productivity, and sometimes deflationary pressures. These effects can ripple through the global economy, affecting international trade and investment.

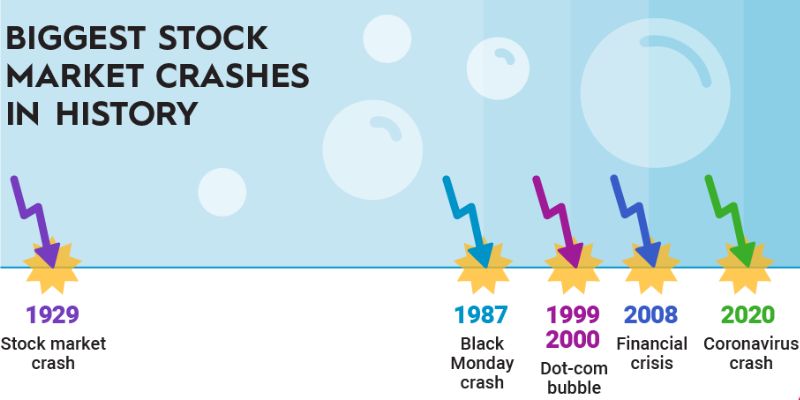

What were some of the most significant stock market crashes in history?

Some of the most significant stock market crashes in history include the Wall Street Crash of 1929, which precipitated the Great Depression; Black Monday in 1987, where major stock markets around the world crashed; the dot-com bubble burst in the early 2000s; and the financial crisis of 2007-2008, which was followed by a global recession. Each of these events had a profound impact on the economy and the stock market, leading to regulatory changes and new financial safeguards.

How do stock market crashes differ from corrections?

Stock market crashes and corrections are both characterized by declines in stock prices, but they differ greatly in magnitude and duration. A market correction is typically a short-term decline of 10% to 20% from recent highs and is considered a normal part of market fluctuations. In contrast, a stock market crash is a rapid and often unforeseen drop in stock prices, usually by more than 20%, and can signal the onset of a bear market or economic downturn.

Can we predict future stock market crashes?

Predicting future stock market crashes is extremely challenging because they often result from unforeseen economic shocks and complex interactions between multiple factors. While economists and financial analysts may identify overvalued market conditions or accumulating risks, the timing and triggers of a crash are difficult to forecast accurately. Nevertheless, investors and regulators often monitor economic indicators and market trends to try to anticipate and mitigate the effects of potential market downturns.