How are ESG Funds Performing? Unlocking the Mystery of Sustainable Investing’s Success

How are ESG Funds Performing? Investors around the globe are turning their attention to one burning question: How are ESG Funds Performing? The push for sustainable investing is no longer a niche trend—it’s a key player in the financial market, reshaping how we think about the impact of our money. But does going green mean more green in your pocket, or is it merely a feel-good factor? This critical dive peels back the layers of ESG investment performance, pits sustainability funds against traditional ones, and decodes the real score on ESG growth and returns. You’re in the right place to uncover the mystery of ESG investing’s success. Let’s get our hands dirty and see if sustainable investing truly stands up to the hype.

Analyzing ESG Investment Performance: A Deep Dive into Sustainability

Current Trends in ESG Fund Growth and Returns

ESG funds are on a roll. More people want their money to do good. They want it to grow too. That’s where ESG funds shine. They mix profit with purpose. But how well do they really do? Let’s dig in and find out about these heroes of investment.

First off, ESG fund growth is strong. Very strong. Year after year, more cash flows in. Why? People care about where they put their money. And the results? They’re promising too. Many ESG funds stand tall next to their old-school peers. But it’s not just about the returns. It’s about investing with a heart.

Benchmarks and Comparisons: Sustainability Funds vs. Traditional Funds

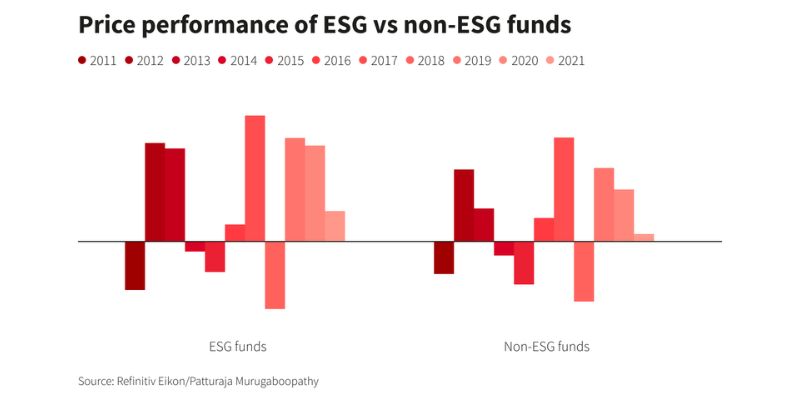

Now, let’s talk benchmarks. ESG vs traditional funds – who wins? It’s a tight race. We compare them a lot, but it’s tough. Each has its own goals. However, ESG funds have a secret weapon. Their focus on social good and the earth can lead to smart choices. These can pay off in the long run.

We experts look at ESG investment strategies. We need to get it right for our futures. It turns out, good ESG fund ratings often mean solid plans behind them. It’s like a good recipe leading to a tasty meal.

And don’t forget about risk. ESG fund risk assessment is key. It’s not just about the green. It’s about keeping your money safe while doing good. That’s important, and ESG funds are at your side, watching your back.

So, are ESG funds the golden ticket? No, not always. But they are a bright choice for many. They make your wallet and your heart feel full. Keep your eyes on sustainability funds’ results and green fund returns. They show us that doing good can mean good profits too.

Remember, these funds help fight climate change and boost fair work. They’re all about a better tomorrow. Investing in ESG is not just about now. It’s about crafting a future we can all look forward to.

That’s our dive into ESG investment performance. It’s more than numbers. It’s hope, boldly stamped onto the world of finance. And that’s a journey well worth the investment.

The Impact of ESG Factors on Fund Ratings and Risk Assessment

Understanding the Influence of ESG Scoring on Investment Decisions

Today’s investors want to know how green a fund is before they buy. ESG scores help them decide. High ESG scores can make a fund look good. They show how a fund does with things like clean air and fair work. This helps funds stand out and get chosen by buyers.

But what does ESG scoring really mean for money-making? More and more, folks see that these scores can lead to smart moves in the money world. Companies with good ESG scores often face fewer risks. This is because they try to avoid harm to the planet and care for their people.

Assessing Environmental Fund Performance and ESG Dividend Potential

Let’s talk about the green money pieces — environmental funds. These funds put money in places that are good for Earth. They often aim for long-term wins, not just quick cash. So, how well do these funds do? Many times, they do quite well indeed. They offer a chance at solid profits while doing right by the planet.

Next, there’s talk about these funds giving out dividends. ESG dividends come from profits earned by these feel-good funds. When companies in the fund do well, they might share some of their extra cash with you. That feels nice, right? But remember, not all funds can give out steady dividends. It depends on how well the companies in the fund are doing.

So, when you mix ESG scores and how a fund does, you get a clearer picture. You see if a fund is just talking big or really walking the walk with Earth and its people. Looking at these things closely, like a detective, can help you be smart with your money. And who doesn’t want that for our world’s future?

When money talks, ESG ratings shout. They are changing how we think about success in investing. Good ESG ratings often mean a fund is looking ahead. They tell us a fund is taking care not to hurt the future. They also help buyers make choices that feel good and do well.

Remember, these scores and how the environment does are tied together. They shape how we spot risks and find chances to do more good. These ESG insights are like a beacon, guiding the way to make money with meaning. So when we think about putting our money to work, we should keep these green scores in mind. They could be what sets a fund apart from the rest. And that’s something to really think about.

Portfolio Strategies: Integrating ESG for a Sustainable Future

ESG Investment Strategies and Portfolio Analysis

You might wonder how your money can work for you and the planet. Here’s how. ESG investment strategies mix regular investing with a focus on companies that care about the environment, treat people well, and have strong leadership.

Let’s say you love clean air and plan to make money. You look for companies that reduce pollution. You put them in your investment mix. Green fund returns show that doing good can also mean good profits.

ESG fund growth isn’t a secret. It’s really about picking companies that plan for the future. These businesses often do better because they think ahead. They deal with social issues and climate risks before they grow too large.

ESG investing trends prove people want more than profit. They want their investments to reflect their values. ESG benchmarks help you compare how these funds do against others.

The Role of ESG ETFs and Indexed Funds in a Diversified Portfolio

Now think about spreading your risks in investing. This matters a lot. ESG ETFs and indexed funds help you spread your cash across different good companies. So if one has trouble, you don’t lose everything.

Diversified portfolios with ESG focus aim for balance. Social responsibility funds can offer solid outcomes. They take care not to harm people or our planet.

But don’t just go for any ESG fund. Some talk big but don’t walk the talk. You check ESG fund ratings to see who’s actually doing things right.

So, when you put money down on ESG-focused funds, you’re betting on a better future. And with the way the world’s waking up, it seems like a smart bet. More and more investors are catching on that being good can be good for your wallet too.

Paying attention to ESG can also be about managing risk. It’s like having a safety net. Funds that score high in ESG are often safer. They’re prepared for things like new laws on pollution, or issues with workers.

To wrap it up, ESG needs to be part of smart money moves today. It can help your savings grow. At the same time, it brings some good into the world. It’s like adding green to your greenbacks, as they say. And who doesn’t want that?

Measuring the Success of Socially Responsible Investing

The Rise of Corporate Governance Investing and Its Success Rates

Corporate governance investing looks at how firms manage themselves. It’s part of ESG which stands for Environment, Social, and Governance. This matters because firms that run well may do better in the long run. It’s like picking a soccer team where the players work well together. You’d bet on that team, right? That’s what corporate governance investing is – picking companies that follow good rules and treat people fairly.

This kind of investing is doing well. How well? Let’s look at some numbers. Some reports say companies that follow good governance rules give investors more money back in the long run than companies that don’t. It seems companies that play fair also pay fair. And that’s good for your wallet.

Forecasting the Market: ESG Fund Market Share and Profitability Trends

Now, let’s talk about ESG funds. An ESG fund is a group of investments that are chosen for being kind to the planet, fair to people, and well-managed. It’s like a grocery bag filled with good food that’s also good for nature and society.

These funds are gaining ground. More and more people want to invest in them. Why? Because they often do as well or better than other funds without ESG rules. Think about it – if you have two ice cream cones, one regular and one that’s good for the earth, which one would you pick? Many would choose the earth-friendly one, especially if it tastes just as good or better.

Market share is just how much of the pie these ESG funds have. The slice is getting bigger. Why does that matter? It means these funds are becoming popular, and people believe they’re a good choice.

Profits – that’s what investors get out of it. ESG funds can be profitable, and that’s a big deal. When people make money from them, they tell their friends, and more people want in.

In short, ESG funds are like a rising star in the world of investing. They show us that doing good can also mean good business. This bodes well for our wallets and our world. That’s a win-win if I ever saw one.

In this blog, we explored ESG investing from many angles. We saw ESG funds grow and learned how they match up to traditional ones. We dug into how ESG scores shape investment choices and looked at the wins and risks. ESG factors matter not only for our planet but also for our wallets.

We then checked out smart ways to mix ESG into your investments. ESG ETFs and index funds can spread out your risks and keep your future green. The final piece of the puzzle was seeing how these choices pay off. Companies with strong governance are doing well, and the market shows ESG funds can make money.

So here’s the scoop: Mixing ESG into your portfolio seems smart. It’s about looking out for the world and your cash. The move to ESG is strong and it seems like this trend is here to stay. Let’s invest not just for today, but for the world we want to live in tomorrow.

Q&A :

How do ESG Funds compare to traditional investments in terms of performance?

Environmental, Social, and Governance (ESG) funds are designed not only to provide financial gains to investors but also to contribute to responsible and sustainable business practices. When it comes to performance, numerous studies suggest that ESG funds can compete with traditional funds. In fact, some ESG funds have outperformed their conventional counterparts, particularly over the long term. Investors should consider that ESG investing strategies may lead to a more resilient portfolio, especially as the global economy increasingly factors in sustainability.

What factors contribute to the performance of ESG Funds?

The performance of ESG funds can be attributed to various factors including strong corporate governance, sustainable resource management, and ethical business practices. These factors may reduce a company’s exposure to environmental liabilities, regulatory fines, and other risks, potentially leading to more stable and predictable financial performance. Additionally, ESG compliance can improve a company’s reputation and lead to better customer loyalty, employee satisfaction, and operational efficiencies—all of which can contribute positively to a fund’s performance.

Are there any specific market trends affecting ESG Funds’ performance?

Yes, market trends significantly influence ESG funds’ performance. An increasing awareness of climate change, social justice issues, and corporate governance is driving investor interest towards companies with strong ESG credentials. Governments and regulatory bodies worldwide are also pressing companies for greater transparency and responsibility, which in turn drives innovation and can improve long-term returns. Technological advances in renewable energy and sustainable practices also shape market trends, opening up new investment opportunities within the ESG space.

How can I track the performance of ESG Funds?

Investors can track ESG fund performance through several means, such as fund fact sheets, annual reports, financial news, and investment platforms that offer specialized ESG ratings and analysis. It’s critical to look at performance over an appropriate timeframe to understand the full picture and to compare ESG funds with similar investment strategies. Investors can also consult indexes that specifically track the performance of ESG-compliant companies, like the MSCI ESG Leaders Index or the FTSE4Good Index.

What should an investor consider before investing in ESG Funds?

Before investing in ESG funds, an investor should consider their personal investment goals, risk tolerance, and the specific ESG criteria of the fund. It’s important to assess how the fund managers incorporate ESG factors into their investment process and the level of transparency they offer about their holdings and shareholder engagement practices. Fees and performance track record are also crucial when comparing ESG funds with traditional investments. Finally, investors should consider how well the fund’s ESG philosophy aligns with their values.