How CBDC Revolutionizes Banking: Impacts and Insights

How CBDC Revolutionizes Banking: Impacts and Insights

Digital cash is not a new idea. But when central banks step in, game rules change. As we usher in this high-tech money era, you’re probably wondering how CBDC will affect banks. It’s more than just a new payment method; it reshapes how banks operate, stay stable, and even make their profits. Dive in with me, and let’s explore the seismic shifts CBDCs are triggering, from the ground up in banking’s traditional ways to the bold new paths they carve out. It’s a banking makeover, and here’s the insider scoop on what that means for our bucks!

The Transformation of Traditional Banking by CBDCs

Redefining Bank Stability and Profitability

Banks are in for a big change with central bank digital currency, or CBDC. This new kind of money from the central bank shakes up how banks work. Banks used to be the only ones that could hold and move our money. But now, with CBDC, things are shifting.

Imagine you have a digital wallet for CBDC. You don’t need a bank account for it. This will change the game for banks. Banks make money by handling our cash. They take our deposits and lend them out. But if we all start using CBDC, banks might see less cash. This means they might have to think of new ways to stay strong and make money.

Banks are also looking at the risks. With everything online, there are big concerns about keeping money safe. To stay ahead, banks are working hard on their tech skills. They want to make sure CBDCs are safe in their hands.

New Avenues in Financial Intermediation

With CBDC, banks are exploring fresh paths to help us with our money. They could offer services that blend nicely with CBDCs. Banks are experts at this, after all. With digital currency, they can make paying across borders much smoother. This could make things like buying from another country easier.

Banks are also looking at CBDC to fix some old problems. For example, sending money from one bank to another can be slow. CBDC could speed this up a lot. This helps banks, businesses, and even families.

But it’s not just about speed. CBDC could mean new products for customers. Think loans and savings plans that work well with a digital dollar. Banks are thinking creatively to find ways to keep us happy customers.

As banks join the CBDC trend, they’re mixing the best of both worlds. They use their know-how in handling our cash with the new perks of digital money. They’re learning as they go, just like us. The plan is to make sure that as CBDC becomes a big thing, our trust in banks stays strong.

Central banks are keen on this digital step too. They see CBDC as a way to keep an eye on money in the digital age. But, they have to make sure it’s a smooth move. They don’t want any shaky surprises. As that happens, we can expect banks to keep changing. They’ll need to rethink how they do business to fit this new digital money world.

CBDC Adoption: Operational and Regulatory Challenges

Cybersecurity and Digital Currency Risks

When banks start using CBDCs, they face big risks online. Bad guys are all over the internet, so banks must keep money safe from hackers. CBDCs are like cash but digital, so if someone steals them, it’s a major problem. Hacks can mean lost money for people and banks, shaking trust in the whole system.

Banks need strong cyber walls to keep digital dollars safe. They have to check and double-check their defenses all the time. If banks slip up, the whole system could come crashing down. So, every step of the way, from making a CBDC to using it, needs top-notch protection. Banks must also teach people about secure ways to use their digital wallets. Sound tricky, right? Well, banks are putting their smartest minds to work to solve these puzzles.

Establishing Regulatory Frameworks for Safe CBDC Integration

Once we sort out online safety, there’s another hurdle: rules for CBDCs. Without good rules, things can get messy fast. Picture people using digital money with no clear guidelines — it would be like the Wild West! We need clear rules so everyone plays fair.

Governments and banks are working together to make these rules. They’re thinking hard about how to keep CBDCs safe but also easy to use. The goal is to let people buy and send money without worry. But with new tech, new problems can pop up, so rules might change as we learn more.

Banks must stick to these rules to keep our trust. If they do, we could see easier shopping, cheaper ways to send money abroad, and faster payments. It’s not just about keeping money safe — it’s about making things better for everyone.

In a nutshell, CBDCs can change banking in big ways. But banks have to jump over some big hurdles first. They must make their online forts unbreakable and play by the new rule book. It’s a lot to handle, but get this right, and digital money could make our lives a whole lot easier.

Impact of CBDCs on Bank Operations and Revenue Models

From Lending Practices to Liquidity Management

Central bank digital currency is here, and it’s shaking up the financial scene. But what does this mean for our trusty banks? The way they lend money is set for a big change. You see, with digital currency in play, banks might start to lean less on deposits for lending out cash. This might make you wonder, “Will banks still hold my money?” Well, yes, but the game’s changing. They’re learning new tricks on how to manage money that flows in and out.

Digital currency makes moving money easy as pie. This means banks need to be on their toes with how much cash they keep ready to use each day. If they keep too little, they might not meet all withdrawal demands. Too much, and they’re missing out on making money through loans. It’s a fine line to walk.

Disruption in Retail Banking and Fee Structures

Now, let’s chat about the money we pay for banking services. Those could take a hit too. Why, you ask? Because central bank digital currency cuts out the middleman. That’s right, when we can zap money straight to someone else’s digital wallet, banks lose out on fees from card payments and transfers.

What’s the result? Banks have to rethink how they make their bucks. They might start charging for new things, or maybe find different ways to attract us, like offering cooler services. It’s like your bank’s turning into a gadget shop, always trying to sell you the latest tech toy to help manage your money.

And hold on to your hats, folks, because cross-border payments are revving up their engines. No more waiting days for a payment to clear. CBDCs could make it as quick as sending a text message. Banks are looking at how they can get a slice of this pie, too, but they’re not the only ones at the table anymore.

We could chat all day about the nuts and bolts of CBDCs, but the bottom line is crystal clear. Banks are reworking their playbooks because of digital currency. Lending, keeping cash on hand, and our fees are all getting a digital-age makeover. Sure, it’s going to be a wild ride, but banks are smart. They’ve seen revolutions before, and they’ll adapt to this one too. After all, they’ve been counting money since money became a thing, and that’s not stopping anytime soon.

Strategic Integration and Innovation Opportunities with CBDCs

Revolutionizing Cross-Border Payments and Settlement Systems

Central bank digital currency makes sending money abroad a breeze. It’s faster and cheaper than what banks use today. Cross-border payments and CBDC go hand in hand. They allow you to transfer funds in seconds, not days. Banks are now seeing a clear path forward. They spot how CBDCs are changing the game for international trade.

CBDC impact on traditional banking here is profound. It’s all thanks to digital currency and financial institutions working together. Central bank cryptocurrency implications reach far and wide. With a CBDC, there’s no need for the old exchange process. This speeds things up a lot. Banks won’t have to wait for transactions to clear through middlemen. This is big news for anyone who has family abroad or businesses across borders.

Embracing Blockchain Technology for Competitive Advantage

Blockchain is not just a buzzword; it’s a leap forward. Banks are seeing the light. By using blockchain, they can improve in ways we never thought possible. Embracing blockchain technology for a competitive advantage is smart. It helps keep track of money without errors. It is not about jumping on a trend. It’s about making bank operations and blockchain work together.

Commercial banks and CBDC adoption can transform how money moves. The effect of CBDC on lending can also be huge. Banks might lend out digital currency just as they do with physical cash. This could change things like interest rates and loan approval times. We could see banking sector transformation unlike anything before. Digital currency integration in banks may soon be the standard.

For the customer, digital wallets and banking industry moves toward a merge. Your money will be safe but also easier to use and move. Central banking and digital innovation are leading us to a new age. Digital currency won’t just live in our phones. It will be in our daily coffee runs, our big home buys, and our savings for the future.

The path is set for banks to rewrite the rules. Central bank digital currency is here. It invites banks to step up. To play with new tech. To make sure money is safe but also free to move like the wind. The future with CBDC is bright and full of promise. With smart moves, banks will not just stay in the game. They will win it.

In this post, we delved into how central bank digital currencies (CBDCs) are changing banking from the ground up. We explored CBDCs’ potential to make banks more stable and profitable and how they might open new doors in managing money.

Yet, it’s not all smooth sailing. We must tackle tough issues like cyber threats and the need for clear rules to make CBDCs work well and safely.

We also looked at how CBDCs will shake up the way banks earn money and run day to day, from giving out loans to managing their cash. There’s a big shift in how we all bank, especially with the fees we pay.

Lastly, we can’t ignore the exciting chances CBDCs bring. They can speed up money moving across borders and put banks ahead if they get on board with blockchain tech.

My final thought? CBDCs are more than just a new kind of money – they’re a chance for banks to step up, innovate, and stay ahead in a digital world. Let’s stay sharp, embrace the changes, and use them to make banking better for everyone.

Q&A :

How will Central Bank Digital Currencies (CBDCs) impact traditional banking systems?

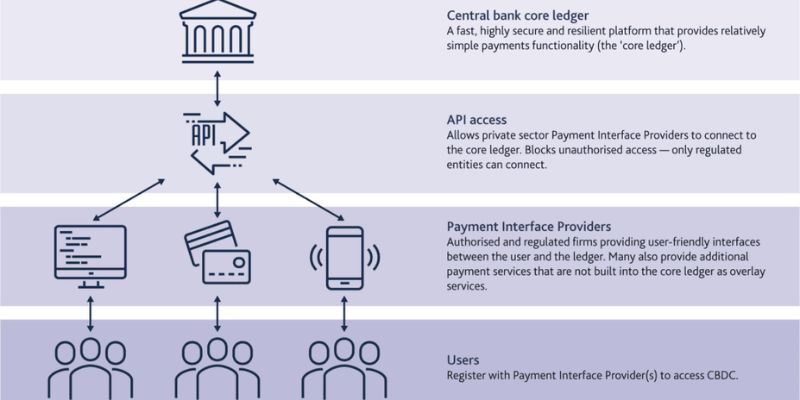

With the inception of CBDCs, traditional banking systems may face a transformation in their operational models. CBDCs are designed to streamline payments and reduce transaction costs, leading to a more efficient banking experience. However, banks may also encounter challenges in maintaining their roles as intermediaries in the financial ecosystem and could potentially see a shift in customer preferences towards these digital alternatives.

What changes can consumers expect in banking services due to CBDCs?

Consumers can anticipate several changes, including faster and potentially cheaper transactions, improved accessibility to financial services, and enhanced security features associated with digital currencies. Moreover, CBDCs could foster greater financial inclusion by ensuring that banking services are available to unbanked or underbanked populations who have access to mobile technology.

Can CBDCs lead to increased competition in the banking sector?

Yes, the introduction of a CBDC could intensify competition in the banking sector. It might encourage traditional banks to innovate and adopt new technologies to enhance their services. Additionally, non-bank entities could leverage the digital currency infrastructure to offer banking-like services, pressuring traditional banks to differentiate their offerings and improve customer value propositions.

Will the role of commercial banks diminish with the rise of CBDCs?

While CBDCs have the potential to alter certain functions of commercial banks, it is unlikely that they will entirely replace these institutions. Commercial banks offer a suite of services beyond transactions, including loans, credit facilities, and investments that CBDCs do not directly address. However, banks might have to adapt by focusing more on these value-added services and diversify their revenue sources, as CBDCs could take over some of the more basic banking functions.

How might CBDCs affect international banking and cross-border transactions?

CBDCs could revolutionize international banking by simplifying cross-border transactions. They have the potential to reduce the time and cost associated with transferring money internationally by bypassing traditional correspondent banking channels. This could open up more efficient trading partnerships and financial relationships between countries, although it would also require international regulatory coordination and robust cybersecurity measures.