How long does a stock market recovery take? It’s the million-dollar question plaguing investors’ minds after a market tumble. The journey back to prosperity can feel like a maze without a map. Let’s dive into the data and decode the mysteries of economic bounce-back timelines. From understanding patterns carved in history to sizing up the indicators flashing today’s market moods, we’ll break it all down. With a focus on the factors that fuel a financial market rebound and strategies to harness post-recession growth, I’m here to guide you through the market’s ebb and flow. Ready to unleash the secrets behind the stock market’s rise from the ashes? Let’s get started.

Understanding the Historical Market Recovery Periods

Analyzing Past Stock Market Recoveries

Let’s dig into the past. When stocks fall, they often climb back up. The big question is: how long does that take? Looking back, stock market recoveries have varied a lot. Some have been quick; others, not so much.

For instance, the recession recovery time frame can take several months to years. Yet, average time for market correction generally spans a few months. It’s critical to remember, not every dip means a long wait ahead. We’ve seen short-lived stock market crash rebounds. This shows us that the duration of stock market dips does not have a one-size-fits-all answer.

Don’t get me wrong, understanding these timelines takes work. I look at patterns from before. I see how stocks have bounced back after tough times. I check numbers a lot. They can tell us stories about what might happen next.

Key things like economic indicators for market recovery help us guess the future. They hint at how the market might do. We get clues from job reports, housing, and more. This leads us to make smarter choices about money.

Bear Market Length Versus Bull Market Returns

Now, let’s talk about the ups and downs. A bear market is when stocks go down for a while. A bull market follows when they go up again. The historical bear market length usually lasts shorter than the good times after. That’s an uplift for those who stay steady through the storm.

The bull market return after crash often brings strong gains. This part is exciting. After a dip, stocks can shoot up higher than before. People in the know call these market downturns and subsequent rallies. And they can be a big deal for your money.

But how much time does it take to shift from bear to bull? History helps tell this story. Often, the S&P 500 recovery rates give solid hints. They show us how stocks have done after past falls. These rates have been all over the place, but on average, bull runs last longer than bear drops.

It’s about balance. Good days come more than bad ones, but you need patience in market recovery. When stocks fall, don’t grow cold feet too quick. Wait it out. Look close at historical market recovery periods. They show that all is not lost when prices dip.

Bottom line: every market mess has a clean-up. It might be short. It might test your grit. But stick to smart moves. Keep an eye out for recovery stocks to watch and rely on analysis of stock market cycles to guide you. Trust the trend, not the panic, when timing the market post-crash. And never forget, your future self will thank you for the patience you muster today!

Key Economic Indicators for Predicting Market Recovery

Gauging Recovery Through Economic Indicators

Let’s talk recovery! When markets trip and fall, we all want to know one thing: how soon will they stand tall again? Let’s look at some signs that shout recovery time. Job numbers, for instance. When more people nail jobs, it means our market’s health may get a boost.

Then, there’s factory action. If factories buzz more, they make more goods. More goods? More sales, and yes, that can mean our stocks may soon zip up. Keep an eye on houses, too. When folks buy more homes, it usually means good news for the stock market’s comeback.

So, you ask how these signs tell us about recovery. Well, when jobs, factories, and home sales pick up, it shows people and businesses are spending. And spending is like a vitamin shot for the market’s health.

Historical Bear to Bull Market Transitions

Now, let’s dig into history. Markets are like seasons. They chill in the bear cold, then warm up to bull sun. Bear markets can last a while, sure. But history whispers a secret: good times come back. It’s a cycle, friends!

Bear markets? They’ve stayed around for one to three years. That’s before the bull market charges back in. Some lasted just a few months; others, way longer. The average time for markets to swing from sad to happy? Roughly one and a half years. That’s the pattern history shows us.

But the bull stick around longer, folks. Once they’re in, they savor the play. It can be several years of market highs. Good news for everyone’s wallets, right?

Keep this in mind. Past playbacks don’t write the future, but they teach us lots. Watch the signs, learn the history, and you’ll be on track to spot the next market springtime. Trust the process, but stay sharp!

Factors Affecting the Speed of Financial Market Rebound

Influences on Market Recovery Times

When the stock market falls, everyone asks, “How fast will it bounce back?” It can take months or even years. It’s not easy to say. Many things can speed up or slow down a recovery. Let’s dig into these factors.

The first big factor is how the economy is doing. If it’s strong, the market may perk up faster. This means looking at jobs, how much stuff is made, and what people spend. Good numbers in these areas can mean a swift recovery.

Sometimes, what the big money folks do matters a lot. If they start buying, others often join in. Then prices can rise. Confidence is catchy, and it can give the market a much-needed lift.

Global events also play a part. If there’s peace and calm abroad, that’s good news for the market. But if there’s trouble or a crisis, that can make a rebound take longer.

Policies from the government and central banks are crucial, too. They can cut taxes or set lower interest rates. This makes it cheaper to borrow money. It can be just what’s needed to kick-start a recovery.

Lastly, sometimes the market just needs time to heal. That’s normal after a big drop. Patience is key here. Jumping in too soon could be a mistake.

Analysis of Stock Market Cycles and Downturn Rallies

Now, looking at stock market cycles can help us guess how long a dip will last. History shows us cycles of ups and downs – bull and bear markets. Knowing this pattern helps us see where we might be headed.

A bear market happens when the market drops by 20% or more. On average, these tough times can last over a year. But all hope is not lost. A bull market starts when prices rise by 20% after a drop. This rise can go on for years.

To get it right, we look at the past. Take the S&P 500, a group of 500 big U.S. companies. By studying its ups and downs, we can learn a lot. The S&P 500 has bounced back from every drop in its history. That’s a powerful fact.

Looking at when downturns happen can also help. Is it after a quick jump in prices? Then the drop might also be brief. But if it follows a long period of rising, the fall could last longer.

Understanding these bits and pieces of the market is like putting together a puzzle. Each part – economy data, investor moves, world happenings, policy choices – fits with the others to form the full picture. Together, they help us see how fast the market might recover.

In the end, patience wins. Rushing can lead to wrong moves. By knowing these factors, you can better plan for the next rise. Remember, a rebound will come, it just needs time.

Strategies for Navigating Post-Recession Market Conditions

Portfolio Recovery Strategies in Wake of Market Crash

Bouncing back from a market crash needs a solid plan. You need to look at your current portfolio and see what’s down, but not out. Some stocks might be down because of panic, not poor health. Those are the recovery stocks – the ones that can bounce back strong in a bull market.

Start by checking the balance of your investments. Too much in one sector can spell trouble. Diversify your assets across different areas. This spreads out your risk and can help your portfolio recover faster. You also want to eye historical market recovery periods. They tell you how long past downturns lasted and how quick the recovery was.

Patience is key. You can’t rush a market correction. On average, it takes a few months to a couple of years for things to turn around. Keep calm and think long term. Remember, market dips are normal. They’ve happened before and will happen again. But history shows markets have a pattern of coming back over time.

Identifying and Timing Recovery Stocks for Long-Term Growth

Want to know when to jump back in after a crash? Look for recovery stocks. These are the stocks set to grow over the long haul. But how do you find them? You start with research. Look at the company’s health. Check if it’s got good cash flow, a strong market position, and a product or service that’s still in demand.

The S&P 500 recovery rates can guide you. They show how this big group of stocks has done after past crashes. It can give you an idea of what might happen next. If you invest too early, you might catch a falling knife. Wait too long, and you might miss the upswing.

Another tip is to keep an eye on economic indicators for market recovery. These can signal when things might be getting better. This includes stuff like job numbers, consumer spending, and manufacturing stats. When these start looking up, it could mean the market is on the mend.

Always remember, no one can time the market perfectly. Buying a little at a time can be smarter than going all in. This is called dollar-cost averaging. Even pros use this approach to spread out risk and catch the up and down swings.

In a nutshell, recovering from a market crash takes careful planning, diversification, and staying clued into the economy. Keep an eye on recovery stocks and don’t get tripped up by trying to time the market. Slow and steady wins the race. With the right strategy, you can set your investments up for success in the long run.

In this post, we’ve looked at how historical market recoveries work. We saw that no two stock market rebounds are alike. By studying past patterns, we understand the play between bear and bull markets. We learned to spot key signs that predict a market comeback.

Economic indicators also give clues about when markets might recover. We discussed how changes from bear to bull markets can signal new growth. The factors that speed up or slow down market rebounds are complex. Yet, knowing them helps us make smarter investment choices.

Finally, we talked about strategies to heal your portfolio after a crash. And we learned to pick stocks that have potential when things look up. Remember, knowledge can lead to smart decisions in tough economic times. Here’s to making your next move with confidence!

Q&A :

How long can it typically take for the stock market to recover after a crash?

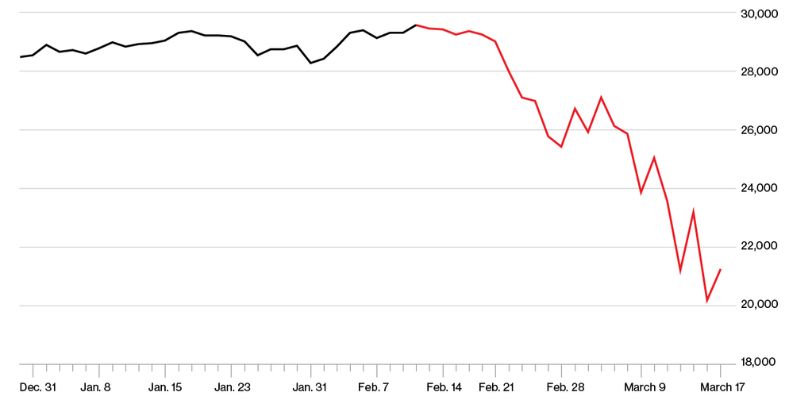

While the length of time for the stock market to recover after a crash can vary greatly, historical data suggests that it can take from a few months to several years. For example, the market rebound following the 2008 financial crisis took about four years to reach prior levels. However, shorter recoveries have also occurred, as seen after the 2020 market drop due to the COVID-19 pandemic, which saw a swift rebound within a few months.

What factors influence the duration of a stock market recovery?

The duration of a stock market recovery can be influenced by a multitude of factors, including the underlying cause of the crash, government and central bank interventions, investor confidence, economic indicators, and global economic conditions. A coordinated policy response and robust economic fundamentals can expedite recovery, while prolonged uncertainty or additional economic shocks can extend the timeline.

Is the rate of recovery consistent across different market sectors?

The rate of recovery in the stock market is not consistent across all sectors. Some sectors may bounce back quickly because they are less affected by the conditions that caused the market downturn or because they benefit from the recovery environment. Conversely, other sectors that are more directly impacted or slower to adapt to new conditions may take a longer time to recover.

What historical stock market recoveries can provide insight into recovery times?

Studying historical recoveries can provide insight into potential recovery timelines. Notable recoveries include the bounce-back after the Great Depression, the recovery following the dot-com bubble burst, and the rebound from the 2008 global financial crisis. Each of these events offers lessons on factors that can impact the recovery duration, such as economic policy changes and shifts in investor sentiment.

Can investors do anything to mitigate the effects of a market downturn?

While investors cannot control the market, they can take steps to mitigate the effects of a market downturn. These include diversifying their investment portfolios, considering long-term investment strategies, remaining calm during volatility, and avoiding panic selling. Additionally, some investors might see market downturns as opportunities to invest in quality stocks at lower prices, potentially setting the stage for gains during the recovery.