Market plunges catch many by surprise, but you don’t have to be one of them. Knowing how to protect yourself in a stock market crash can be a life vest for your finances when waves hit. I’m here to guide you. You’ll learn the signs that trouble is brewing and how to brace your investments. With a smart plan, you can defend your dough and even set the stage for future growth. Ready to become unshakeable even when markets quake? Let’s dive right in.

How to Shield Your Finances During a Stock Market Crash

Recognizing Stock Market Crash Indicators

Can we see a stock market crash coming? Sometimes, yes. A big drop in stock prices is a key sign. Often, when investors feel unsure, stocks will swing wildly. This shows in the “volatility index,” or VIX, a fear gauge for the market. If it rises fast, buckle up.

High loan amounts can also warn us. If borrowers or businesses owe too much, they’re more at risk. Rising interest rates can be another hint. They make loans costlier, tightening the grip on both spenders and savers.

A Bad job report? This suggests folks aren’t working or earning well. It can hint at trouble. So can a dip in manufacturing activity. Think of it as the heart of an economy. If it’s not strong, the body falters. And if houses start costing less, this could point to a crash. It often means people aren’t buying or can’t afford to.

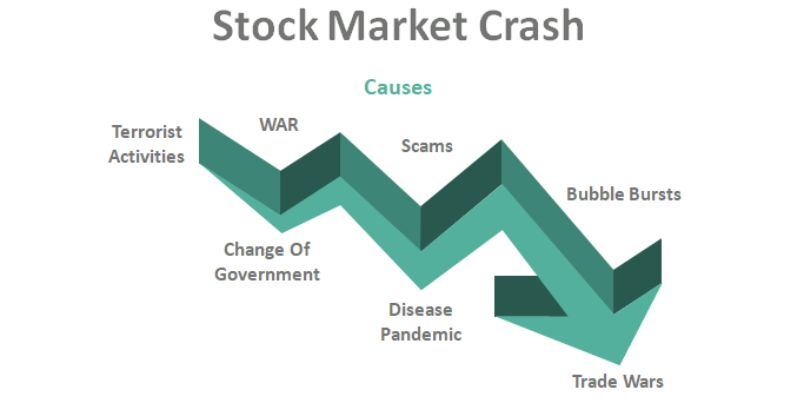

Historical Stock Market Crash Patterns

Looking back helps us brace for what’s next. In history, crashes often sneak up after a long climb in stock prices. This lures more people to invest, sometimes too late. Before a fall, watch if stocks are way pricier than company earnings justify.

Companies cutting costs is a clue. Layoffs and less spending can ring alarm bells. Trends outside the US matter, too. A tough time abroad can hit markets at home.

Each time is different, but patterns help us prepare. When stocks fall hard and fast, it’s called a “correction” if it’s short-term. If that slide goes on and drops deep, that’s a crash.

Now, let’s talk safety nets. ‘Safe haven’ assets, like gold or some bonds, endure storms well. They can add a calm spot in your mix of investments. Risk management is about balancing – not just hunting for wins.

For your portfolio, think diverse. A mix of stocks, bonds, and other kinds can absorb shocks. An “emergency fund” is a stash of cash for rough patches. It’s key to have, so you’re not forced to sell stocks when prices are low.

Lastly, ask: What’s your plan if stocks dive? If you have one, you’re a step ahead. You’ll fight the urge to sell in panic. Instead, you’ll buy more wisely or sit tight until the air clears.

Before any crash looms, it’s wise to review where you stand. Are your investments set to weather a hit? Are you ready to act, not just react? Keeping cool and focused is half the battle when markets shake. And remember, crashes don’t last forever. Growth and recovery are always on the horizon. Stay informed and steady, and you’ll navigate through it.

Preparing Your Portfolio Before the Crash

Diversification Investment Strategy

A smart move is to spread out your bets. This is called diversifying. It’s like not putting all your eggs in one basket. You buy different kinds of stocks and bonds. You pick from many sectors. This helps you when some stocks go down. Others might not, so you lose less. Think about adding some bonds, too. They often do better when stocks are down. This mix can keep your money safer.

One thing to think about is gold. It often holds its value when stocks fall. Some put money in high-yield savings accounts. This keeps it safe and earns some interest. Remember to switch up your mix as the market changes. What worked before might not work now. Ask a financial advisor for help if you need it. They know lots about this stuff. They can guide you to choose right.

Asset Allocation During Recession

When times get tough, it’s key to look where your money is. Some stocks are safer in a recession, like utilities or health care. They are called defensive stocks. People always need power and health care, no matter the economy. So, these might not drop as much.

You should also think about how much to put in stocks. Less might be better when a recession hits. Keep some cash or cash-like assets. These are things you can turn into cash fast. They give you options if things get rough. Always have an emergency fund. This is money you save for hard times. It helps you stay calm and not sell in a panic.

It’s tough to know when a crash will come. But signs can help you guess. If stocks have been going up a lot, be careful. It might be close to a drop. Keep learning about market cycles. This means watching how stocks go up and down over time. This can help you plan better.

When the market drops, it’s not always a crash. A small drop is a correction. A big one is a crash. Knowing this helps you act right. If you know it’s a small drop, you might not worry so much.

In a bear market, that’s when stocks are down a lot, change your mix. This helps you keep your money safe. It might mean having less in stocks and more in bonds or other safe places. Stick to your plan, even when it’s scary. This means not selling everything in a panic. It’s part of smart risk management.

In short, start preparing before trouble comes. Choose a mix of safe and risky assets. Keep an eye on the market. Have a plan for if a crash happens. This way, you can rest easy knowing you did your best to keep your money safe.

Navigating the Crash: Defensive Strategies to Adopt

Hedging Against Market Volatility with Safe Haven Assets

When stocks drop hard, it’s time for smart moves. Safe haven assets are your best friends here. Think of them as your financial bunker. They hold strong when storms hit the market.

The best safe havens? Gold shines bright. It doesn’t rust or fade when stocks tumble. Bonds too, they are like a cushion. But not all bonds, you want the ones from strong governments. They pay you back come rain or shine. So, mix them into your money plan. You’ll be glad you did when stocks dive.

Preserving Capital with Stop-Loss Orders and Dollar-Cost Averaging

Now, let’s talk about keeping what you’ve earned, even when stock prices fall. Stop-loss orders are a big deal. They are like a safety net for your stocks. You set a price, the stock hits it, they sell. Simple, right? It stops a drop from wiping you out.

Another neat trick is dollar-cost averaging. This means buying stocks bit by bit, over time. Not all at once. The cool part? You buy more shares when prices are low and fewer when they’re high. That can lead to saving cash in the long haul. And who doesn’t love saving cash?

Stick to these moves, and you’ll stand stronger when the market gets wild.

Post-Crash Recovery: Rebuilding Your Financial Security

Portfolio Rebalancing in Bear Market

After a market crash, your first job is setting your portfolio right. This means looking at your stocks, bonds, and other assets and figuring out if you still have the right mix. The goal is to keep your investments spread out. This way, you don’t have all your eggs in one basket. It’s time to sell some things and buy others to keep your risk low and your chances for making money better.

Imagine your portfolio like a boat in a storm. A good mix of investments keeps it stable. Too much of one thing can tip it over. By moving things around after a market drop, your boat stays steady. This also sets you up to do well when the market gets better.

The Role of High-Yield Savings Accounts and Emergency Funds in Recovery

Think of high-yield savings accounts and emergency funds as your safety nets. They catch you when things go bad in the stock market. A high-yield savings account is like a strong savings spot. It helps you earn more than a regular savings account, especially in tough times. It’s safe and steady. An emergency fund is money set aside for big surprises. You don’t touch it unless you really need it. Like when times are hard, and you need money fast without selling your investments at a loss.

Having these funds means you can face hard times without fear. You know you have the cash you need. This keeps you from making quick, scared choices. Like selling your stocks when prices are low. This smarts. It can hurt your chances to make money later when the market goes up.

Both rebalancing your portfolio and having safety funds are ways to protect yourself. They keep you ready for what comes next in the stock market. Remember, crashes happen, but they always pass. Staying wise with your money means you can get through them and come out ready for the next upswing.

In this post, we talked about spotting signs before a market crashes. We learned about stock red flags and past crash patterns. It’s key to get your portfolio ready ahead of time. Mixing up your investments and choosing the right assets can help. If a crash hits, you want strong plans to keep your money safe. Using safe havens, stop-loss orders, and smart investing can protect your cash. After a crash, it’s about bouncing back. Fixing up your portfolio and saving cash wisely will rebuild your security. Markets go up and down, but with these tips, you can stand strong and even grow your wealth. Stick to the plan, stay calm, and you can weather any financial storm.

Q&A :

What are some strategies to safeguard your investments during a stock market downturn?

Implementing a diverse portfolio strategy is one of the most effective ways to protect your investments when the stock market shows signs of instability. This means investing in a variety of asset classes to avoid excessive risk in any single area. Additionally, it’s wise to consider defensive stocks with a history of stable performance during economic downturns, and possibly look into alternative investments such as bonds or real estate that may behave differently from stocks.

How can you minimize losses when the stock market crashes?

To minimize losses during a stock market crash, consider setting stop-loss orders to automatically sell securities at a pre-set price limit, mitigating significant declines in your holdings. Another strategy is to maintain a reserve of cash or cash equivalents, which enables investors to ride out the volatility without being forced to sell at low prices. Rebalancing your portfolio to align with your risk tolerance and investment goals can also help in safeguarding your assets in tumultuous times.

What role does a long-term investment perspective play in facing a stock market crash?

A long-term investment perspective is crucial during market downturns, as it focuses on the bigger picture, rather than short-term losses. Historically, the stock market has recovered from crashes and continued to grow over time. Investors who maintain a long-term approach are more likely to avoid panic selling and can potentially benefit from buying opportunities when prices are low. It’s important to review and adjust your investment plan regularly to ensure it reflects long-term objectives and risk tolerance.

Is it advisable to shift your portfolio towards bonds during a market crash?

Shifting your portfolio towards bonds can be a strategic move during a market crash, especially if you’re looking for more stability. Bonds are often seen as a safer investment compared to stocks, as they generally offer fixed interest payments and return of principal upon maturity. However, this shift should be made with consideration of your investment goals, time horizon, and risk tolerance, as bonds may offer lower growth potential compared to stocks over the long term.

Can dollar-cost averaging benefit investors in a volatile stock market?

Dollar-cost averaging involves consistently investing a set amount of money over time, regardless of market conditions. This strategy can indeed benefit investors amid a volatile stock market by reducing the impact of timing the market. When prices are low, the fixed-dollar investment buys more shares, and when prices are high, it buys fewer, potentially lowering the average cost per share over time. Consistent investing through dollar-cost averaging can also help investors stay disciplined and focused on long-term goals.