Chaos in power can shatter markets. Sounds all too familiar? You’re right. Political factors causing stock market crash aren’t just headlines; they’re harsh realities influencing your investments. Let’s cut through the noise. In “Political Mayhem: Unveiling the Factors Crashing the Stock Market,” we peel back the layers of government action and global events unnerving stocks. Stay with me as we dissect the laws, elections, and trade spats upending your portfolio’s peace. Your financial savvy depends on it.

Understanding Government Policies and Stock Market Reactions

The Ripple Effect of Legislative Changes on Investments

When the government tweaks laws, your wallet feels it. New rules can make markets jump or crash. Say the government decides to change how much tax companies pay. Companies might then earn more or less. Their stock prices change to show this new money flow. So, if you own stocks, you could earn more or maybe lose cash. That’s a big deal for anyone who’s saving up or making money from stocks.

But how much can these laws really shake things up? A lot, trust me. I’ve seen it. A new law can change how much it costs to make things, move stuff around, or pay people. Businesses feeling this pinch may cut costs, sometimes by laying off workers. Fewer jobs can scare folks, making them spend less. That can make businesses earn less, and like a line of dominoes, one thing leads to another.

Tax Reforms and Their Direct Hit on Stock Performance

Taxes can be a headache, right? Well, imagine that for big businesses. Taxes are a huge slice of their costs. When taxes go up, they keep less money. When taxes fall, they keep more. Simple, isn’t it? If a business pays less tax, they might have more to spend. They can buy new machines, offer more products, or even hire more people.

Stocks get happy when taxes get cut and might drop when taxes rise. Let’s say the government chops business taxes. People think, “Hey, companies will have more dough!” So, everyone wants to buy their stocks. More buyers push stock prices up. On the flip side, if taxes hike up, people might think, “Companies are going to earn less.” Then, they might sell stocks. When more folks sell than buy, stock prices tumble down.

These changes don’t just hit one company. They ripple through the whole stock market. So, even if you don’t own stocks, this stuff can still touch your life. It can change how many jobs are around or how much stuff costs in stores. That’s why when I study the market, I keep a sharp eye on what laws might be coming.

Figuring out these moves can help you guess where the stock market’s heading. It’s like trying to predict the weather. You look at the clouds and feel the wind to guess if you need an umbrella. In the stock world, you watch the government to guess if you need to guard your cash.

Now, let’s get real. No one has a crystal ball. Stocks can be wacky, and even experts can get it wrong. But knowing how laws play with money can give you a head start. It’s all about being ready and smart with your stock choices. That way, you can dance to the beat of the market’s drum, even when it’s playing a wild tune.

Elections, Geopolitics, and Their Economic Shockwaves

Election Results and the Sensitive Pulse of Investor Confidence

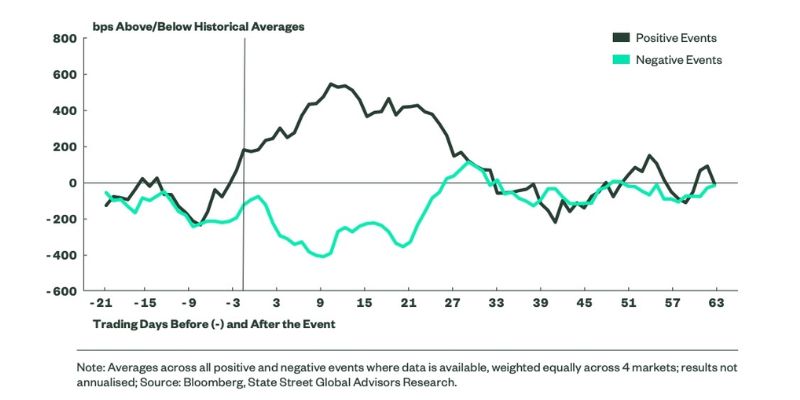

Elections can shake or settle stock markets. How exactly do elections scare or cheer investors? Here’s the simple truth: investors fear the unknown. New leaders bring new rules. Markets thrive on stability. When election results surprise us, stocks often tumble. In short, investors trust a predictable future; elections can upset this trust.

Let’s dive in. After a vote, if policy shifts look likely, investors get nervous. If the incoming party promises big changes in taxes or trade, for example, that can stir up trouble in the market. Sometimes, just not knowing what’s next can cause worry. Nervous investors might sell their stocks, causing prices to drop.

In turn, a sudden drop in stock prices shakes everyone’s confidence. This can start a chain reaction. More people sell, prices fall further, and fear spreads. However, if results match predictions and policies look steady, markets generally react well. Stocks could rise with investor morale on election night.

Navigating Through Geopolitical Instability and Its Impact on Stock Values

Conflicts between countries affect stocks, too. When nations argue or fight, markets respond. But how does turmoil between countries impact the stocks you own? Simple – it hurts trust and trade. If countries are in a spat, they may not trade well together. This can hurt companies that do business overseas, dragging their stocks down with them.

Sanctions are a big deal. They can block trade, hurting a company’s sales abroad. This, of course, can lower stock prices. Investors always watch for these signs of trouble. If they see risk, they might decide to sell, leading to lower stock values.

Then there’s the fear of war. Talk of tanks and troops can frighten investors. War means chaos, and the market hates chaos. So, stocks can fall if investors fear a conflict might break out.

But it’s not all bad news. Sometimes, the signs point to peace or trade deals. This can make stocks soar. Hopeful news can bring back trust, and trust is key in the market. When countries settle their differences, stocks often rebound.

In summary, elections and geopolitics play a huge part in how confident investors feel. And that confidence, or lack of it, shows up in stock prices. Change can scare markets, but calm can lead to gains. It’s a wild ride, but knowing how these forces move the market can help you steer through the storm.

Trade Tensions and Protectionism: Market Shocks Unfolded

Deciphering Trade War Consequences on Global Markets

Let’s cut straight to the chase: trade wars are bad news for markets. When countries fight over trade, stocks take a hit. Think of it like a tug-of-war; both sides pull hard. If one side lets go, or a new rule changes the game, everyone stumbles. That’s what happens when big countries throw tariffs at each other. Prices go up, people buy less, and companies make less money, which scares investors.

Can trade wars really crash markets? Yes, big time. Markets love calm and trade wars are the opposite. They make costs unpredictable for businesses that trade a lot with other countries. When companies can’t plan well, their stocks suffer. Investors then sell, not knowing what will happen next.

Let’s make it more real. Say the US and China slap taxes on each other’s goods. Products become pricier, so people buy less. Companies like Apple or Walmart, that get lots or sell lots in both places, might see their stock prices fall.

The Long Arm of Sanctions and Protectionist Policies on Trading Dynamics

Now, onto sanctions and protectionism. Governments sometimes punish others by not trading with them. Or they protect their own businesses by making foreign goods more costly. This can mess up how and where we trade. Jobs can disappear, and that hits stocks hard.

Why do sanctions matter to stock markets? They shake up trade ties, push up prices, and limit where companies can do business. This can spook folks holding stocks, causing sell-offs.

For instance, if the US stops buying oil from a country, that country makes less money. Then, its businesses and the global oil market get jittery. Stocks linked to that market could then tumble.

Protectionist policies can also throw a wrench in things. If a country makes it hard to buy stuff from abroad, it’s not just about more jobs at home. It can mean higher costs for making things, which can slash profits and upset investors.

Ever heard of the policy uncertainty index? It measures how much people worry about this stuff. If it’s high, expect bumpy times for stocks. Investors hate not knowing what’s coming next. Policies can change quick, leaving them with losses.

During trade tensions, one smart move is to keep an eye on key industries. They often get the roughest ride. Auto, tech, and agriculture can swing high or low depending on the latest trade news.

In the end, trade wars and protectionist moves shake up the calm that markets love. They bring uncertainty that can hit your wallet. Understanding this helps us see why markets trip when countries bicker. It reminds us that behind those stock tickers are real moves by real people, reacting to the big world of global trade.

Crisis and Confidence: How Political Turbulence Sways Markets

The Impact of Political Unrest and Scandals on Financial Stability

When countries face political unrest, it’s like big waves hitting a small boat in the ocean. Markets act like that small boat, shaking a lot. Investors in stocks get scared fast when leaders fight, laws change quick, or when big news hits about someone important doing something bad. They worry they could lose money. If a scandal comes out, even more worry spreads. Stocks can fall because trust drops. Low trust in a place means higher risks for money.

Central Bank Decisions in Times of Political Mayhem and Their Effects on Equity Values

When politics go wild, central banks must often make a move. They act to keep money value steady and help the economy. Their choices can make stocks go up or down a lot. If a central bank cuts rates, it’s often good for stocks. They can borrow cheap, and it helps them grow. But if the bank raises rates, especially if politics is messy, it can cause stocks to drop. This is because it costs more for companies to get money, and that can slow growth.

Now, let me break this down for you even more:

When leaders don’t get along, or there are fights in the streets, investors take notice. They start to think, “Is my money safe here?” They might decide to pull their cash out. When that happens, stock prices can fall. It’s like a row of dominoes starting to tumble.

Scandals are another big problem. When news breaks that someone in power has broken the rules, trust takes a hit. People start to question. Can we trust what’s going on in this country? This doubt makes stocks less attractive.

Central banks have tools to steady things. Do you know how, in crazy times, a small calm voice can make us feel better? Central banks try to be that voice for markets. They change interest rates to make money loose or tight. If they cut rates, it’s a green light for businesses to spend and grow. Stocks usually cheer up with rate cuts. But if rates go up, it’s like a red light. It warns of rough roads ahead. Stocks may then sulk because growing gets tougher.

So, what happens when a central bank acts while there’s also a lot of political noise? It’s tricky, kind of like driving a car on a stormy night. If the bank’s moves match what investors expect, the ride can be smooth. But if the bank surprises everyone during tense times, it can cause a crash.

Every move in politics and decisions by banks sends signals to the stock market. Investors watch these like hawks. They need to predict what will happen next. Whether it’s political fighting or central bank choices, both can mean big changes for stocks. And when change comes, it can make waves in our wallets.

Understanding these waves helps you see why stocks move the way they do. It’s not just numbers; it’s about people, decisions, and trust. It’s about keeping an eye on the horizon for the next big shake-up.

We’ve looked at how laws and power plays shape the stock world. New rules can shake up your investments, and taxes can make stocks dive or soar. When leaders clash or elections flip, your portfolio feels the heat. Trade fights and closed borders can also toss the markets into chaos.

Think of politics like a big game where your money’s on the line. When crisis hits, banks step in, but stocks can still roller coaster. So, stay sharp. Watch the news and think about how big decisions can juggle your cash. Keep these tips in hand, and you’ll ride the waves like a pro.

Q&A :

What political events can lead to a stock market crash?

The fluctuation of stock markets can often be linked to various political events, such as changes in government policies, geopolitical tensions, or unexpected election outcomes. For instance, the introduction of new regulations that affect key industries, sanctions against specific countries, or declarations of war can instigate significant uncertainty among investors, potentially causing a market downturn.

How do political decisions impact investor confidence and market stability?

Investor confidence can be heavily influenced by political decisions, as these can alter the economic landscape in which businesses operate. Decisions that create fiscal instability, lead to inflation, or disrupt international trade can unsettle markets. When investors anticipate that political actions may result in negative business outcomes, this can lead to a sell-off in stocks, contributing to market crashes.

Can government interventions prevent or exacerbate stock market crashes?

Government interventions, such as monetary policy changes by central banks, fiscal stimulus packages, or regulatory reforms, can be designed to stabilize or stimulate the economy. However, if these interventions are viewed as inadequate or misdirected, they can exacerbate market woes by either failing to provide enough support or by adding to the operational challenges of businesses. It’s a delicate balance, and the market’s perception of government action is critical.

What role do international political relations play in stock market fluctuations?

International political relations play a significant role in global economic stability. Disputes between countries can lead to tariffs, trade wars, and embargoes, which can distort global supply chains and affect multinational companies’ revenues and costs. Stock markets are highly sensitive to such international tensions, and a negative outlook can precipitate a broad market sell-off, leading to a crash.

How have past political factors contributed to historical stock market crashes?

Historical stock market crashes have frequently been intertwined with political factors. The Great Depression was exacerbated by protectionist trade policies like the Smoot-Hawley Tariff Act. More recently, political events such as the Brexit referendum and the 2008 financial crisis, which was partly due to deregulation in the financial industry, show that political decisions and their effects on economic policies can have a direct impact on stock market performance.