The global foreign exchange market is the largest and most liquid financial market in the world, and at its core lie the banks. Understanding the role of banks in forex trading is crucial because they are not just major players; they are the market’s primary architects and operators. This article explores the multifaceted functions banks perform, from providing liquidity to influencing national monetary policy and enabling international trade for everyone.

The interbank market as the foundation of forex

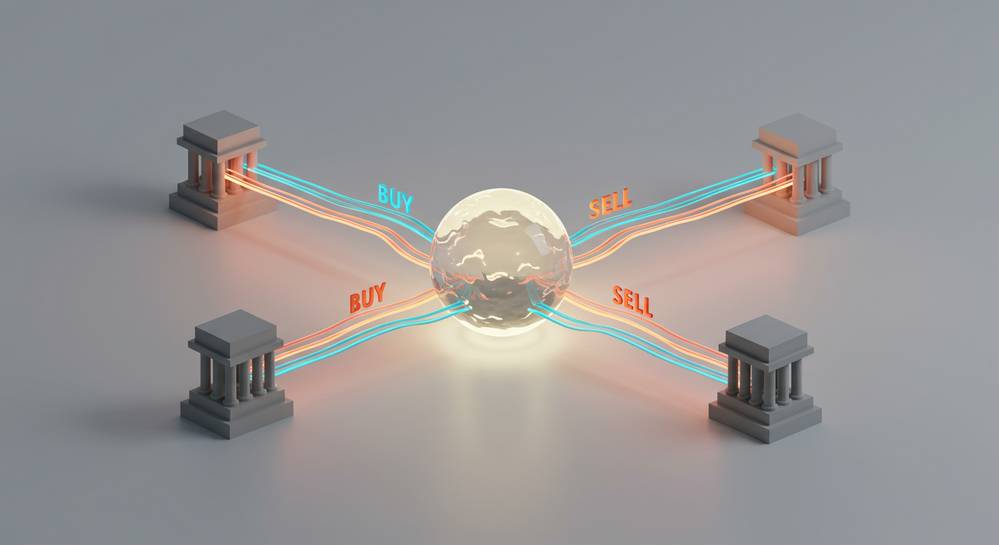

The fundamental role of banks in forex trading originates directly from the interbank market. This is not a physical place but a vast, decentralized global network. Within this system, major financial institutions like JPMorgan Chase and UBS trade currencies directly with one another. It forms the absolute top tier of the foreign exchange market, processing the overwhelming majority of daily transaction volume.

Core mechanics of the interbank system

- A wholesale environment where currencies are traded in large blocks, typically in the millions of units.

- Operates over-the-counter (OTC) through electronic networks, without a central clearinghouse like a stock market.

- Sets the benchmark exchange rates used globally, which form the basis for all retail and commercial transaction prices.

This framework firmly places major banks at the epicenter of global currency flows. Their position grants them unmatched influence over pricing and privileged access to market information. This advantage is a key factor for anyone conducting detailed financial market analysis.

Acting as liquidity providers and market makers

A critical role of banks in forex trading is to ensure market fluidity. They achieve this by acting as both liquidity providers and market makers. By always being willing to buy and sell currencies, they create a stable and efficient environment for transactions to occur smoothly at any scale. This function is the lifeblood of the foreign exchange ecosystem.

As liquidity providers, banks inject massive capital volumes, guaranteeing a deep pool of buyers and sellers. This high liquidity reduces transaction costs. As market makers, they perform several key actions to facilitate trading, often influenced by factors like undefined. These actions include:

- Quoting two-way prices by offering simultaneous bid and ask prices, profiting from the spread.

- Absorbing large orders from corporations and funds without causing major price shocks.

- Managing their own inventory of currency positions to balance risk and profit from market movements.

Without banks fulfilling these essential roles, the forex market would become significantly more volatile and expensive for everyone involved.

Facilitating international trade and capital flows

Beyond speculative trading, banks perform an indispensable function in the real economy. Their most practical role in forex trading is facilitating cross-border payments for international trade and investment. Every time a company imports goods or a firm invests overseas, a bank must execute the currency exchange, forming the backbone of global commerce.

Enabling global economic activity

This function is the financial plumbing that allows businesses to operate internationally. For instance, when a European company buys supplies from Asia, its bank converts euros to the required local currency. This process is vital for several key activities:

- Allowing businesses to seamlessly import raw materials and export finished products.

- Enabling Foreign Direct Investment (FDI) by helping companies acquire assets or build operations abroad.

- Offering hedging tools like forward contracts to protect firms from currency volatility, which can arise from undefined.

Through these essential services, banks provide the stability and mechanisms necessary for the global economy to function and grow.

The influence of central banks on monetary policy

While commercial banks drive daily volume, central banks are the most powerful actors influencing the forex market. Institutions like the US Federal Reserve or the European Central Bank do not trade for profit. Instead, their primary role is to manage national economic stability through monetary policy. This unique mandate gives them unparalleled power to shift currency valuations globally.

Central banks utilize several powerful tools to achieve their objectives. Their decisions create significant ripples that all other market participants must watch closely. The main instruments include:

- Interest Rate Adjustments: This is their most potent tool. Raising rates can attract foreign capital and strengthen a currency, while cutting rates may have the opposite effect. This is a core component of undefined.

- Direct Market Intervention: A central bank can directly buy or sell its own currency on the open market to influence its value.

- Quantitative Easing (QE): In times of economic stress, they can inject liquidity by buying assets, which often devalues the currency.

Therefore, the announcements and actions of central banks are among the most critical events for any forex trader to monitor.

Banks are not merely participants in the forex market; they are its fundamental infrastructure. From providing the liquidity that enables trading to facilitating global commerce and executing national monetary policy, their influence is unmatched. Understanding their functions is key to grasping how the world’s largest financial market operates. For more expert analysis on market dynamics, visit Forex Trend News.