What causes stock market crash? It’s a question that hits home for anyone with even a penny in the game. There’s no single answer—like a puzzle, many pieces fit together to show the big picture. From shaky economic signs to too much guesswork on prices, the triggers are often hidden right in plain sight. I’ve seen how investor trust and cold, hard numbers paint a risky scene. And let’s not forget the buzz from people guessing prices will go up forever—this hype can push a healthy market off a cliff. Let’s pull back the curtain and spot these sneak attacks before they hit your wallet.

Understanding the Anatomy of a Stock Market Crash

Economic Indicators and Investor Confidence

Why do stocks fall so fast? A big part is how people feel. Let’s say lots of folks start to think the economy is in trouble. Maybe they’re scared of losing jobs or prices going up. What they feel can change how they act with money. This can start a stock market crash. When folks are worried, they might want to sell their stocks. If enough people sell, prices can drop a lot!

Now, think about things like the cost to borrow money. If it goes up, people might buy less stuff. Then companies could make less money. This might make the stock market go down. What if it’s hard to get a loan? Same deal. It’s like what happened before the big stock market crash over a hundred years ago and in 2008.

But wait, there’s more! Prices can be sneaky. They go up over time, which is called inflation. If prices go up too fast, buying stuff can be hard. This makes many people sell stocks. It’s a thing that can make the market fall too.

The Role of Market Speculation and Overvaluation

Now, let’s chat about market guessing games. Imagine you see a toy you really, really want. You think it’s the coolest and everyone will want one too. You’re willing to pay a lot for it. But what if you’re wrong and no one else wants it that much? You paid too much! That’s kind of what happens in the stock market too.

People sometimes pay more for a stock than it’s really worth. They just think it’ll keep going up. But if they’re wrong, the price can fall. That’s called a bubble, like blowing a big bubble with gum. If it pops, people might panic and sell. This can make the market crash hard.

And here’s a fun fact. Long ago, people could take their time buying or selling stocks. But now, computers can trade super fast. That’s called high-frequency trading. These computers can make prices jump all over the place. When everyone tries to sell at once, it’s like a super-fast slide downhill.

So, remember, a stock market crash can happen when folks are scared about the future or make wild guesses. It’s a bit like a row of dominoes. If one tips over, they might all go down. If we watch the signs carefully, like smart detectives, we can understand why it happens. And knowing why means we can try to stop it before it gets too bad. That’s our goal, keeping those dominoes standing tall!

The Ripple Effects of Systemic Factors and Global Events

High-Frequency Trading and Systemic Risk

You may have heard about fast trading done by computers. This is high-frequency trading. It moves stocks very quickly. It can make a lot of money, but also big crashes. The computers buy and sell so fast, it’s like a blur. If something starts to go wrong, they can all start selling at once. This can cause the price of stocks to fall fast.

Imagine everyone running to one exit. It gets crowded, right? Now picture a stock market like this, where computers rush to sell. This is what we call systemic risk. It’s a danger that can spread in the whole market. Think of a row of dominoes. When one falls, they all start falling. That’s how a crash can happen very, very quickly.

Now, there are rules to stop these things. They are called trading halts. If stocks go down too much too fast, they stop trading for a bit. This gives everyone time to think and calm down. It’s like a time-out in a game.

Geopolitical Events and Their Impact on Markets

Geopolitical events are things like wars, elections, or big changes in government. They can shake up markets a lot. You see, people who invest in stocks like things to be stable. When big news comes out, it can scare them. This changes how they feel, which is their sentiment.

For example, if a country is in trouble or there’s talk of war, investors might sell their stocks. They do this to move their money to a safer place. We can call these geopolitical instability market effects. These events can change prices in stock markets across the world.

When people hear bad news, they might want to sell fast. This can lead to panic selling. It’s like when you hear a loud noise and want to run away. If many people start selling their stocks, prices can drop. This makes more people sell, and soon, you have a crash.

Sometimes, these events can lead to what’s known as an economic collapse. This is when things get really bad for a country’s money and business. When this happens, it can spread to other countries too. It’s like getting a cold and giving it to your friends. This is financial contagion.

So, what we know is that systems like high-frequency trading can risk a crash. Also, big world news can make markets fall. It’s like weather for stocks, sunny one day and stormy the next. Watching these can help us guess when trouble might come. But remember, it’s always a guess. Stocks are tricky and can surprise us all!

Financial Policies and Their Influence on Market Stability

Central Bank Interest Rate Decisions

Let’s talk about how banks shake things up in the stock world. When central banks change interest rates, it’s big news for stocks. If they hike rates up, borrowing cash gets pricier. This can make folks jittery about spending. So, less money flows around, and this can pull down stock prices. Companies can’t borrow as easy to grow, and this hurts their worth on the stock market.

Now, think about it the other way. If central banks cut rates, it’s like a party for borrowing! Businesses can get loans cheap, spend more, and grow fast. This often pumps up stock prices. But there’s a catch. Do this too much, and it can lead to a wild ride with too much debt. Later on, this can lead to a painful crash when the debt bubble pops.

Legislative Changes and Market Liquidity

Next up, let’s dive into how the rules of the game impact the stock party. New laws can change how easy it is to buy and sell stocks—this is what we call market liquidity. Good liquidity means you can sell stocks without losing cash in the deal. It keeps the stock party buzzing. But, change the rules, and it can cause a jam. If it’s harder to sell, people might start a selling spree out of fear. This dashes the stock prices down fast.

Also, some laws can make it tough for banks to lend money. That means companies could struggle to get the dough they need. It can be like a big red stop light for stock prices. Less money moving can lead to a big stock market tumble.

So, while we can’t say “this will for sure cause a crash,” we know these actions from banks and governments sure do stir the pot. They can either spice up the stock party or be the rain on the stock parade. It’s all about watching those moves and being ready.

Behavioral Dynamics Behind Market Movements

Panic Selling and the Psychology of a Crash

Why do folks dump stocks fast, causing a huge dip? They fear loss. Fear sparks panic selling. People rush to sell stocks before prices drop more. It’s like a stampede. Once a few investors sell out of fear, it spreads quickly. It’s a chain reaction. Everyone rushes to the exit at once.

But what stirs up this fear? It could be bad news about money or a rumor of big trouble. Sometimes, just a hint that bad things are coming can cause panic. Take 2008, for instance. Banks were failing, and people lost trust. They sold their stocks out of pure worry.

Imagine playing musical chairs. Everyone circles, the music stops, and there’s a dash for a seat. Panic selling is a lot like that. Folks fear being the last one standing when the music stops – or, in this case, the last one holding stocks when prices hit rock bottom.

The Influence of Media and Investor Sentiment Shifts

How does the news change what people think about the stock market? Big time. When the media shares bad news, it can make folks think things will get worse. This can shift how people feel about the market – their investor sentiment.

If investors lose faith, they might sell their stocks. It can spread wide, like a cold in winter. Once many people think the market will fall, their actions can make it happen. It’s a self-fulfilling thing.

For example, let’s talk about a rumor of a new tax that could hurt stock prices. If the news blasts this story, people might get scared. They believe their stocks will lose value soon. So, they sell quickly to save money. Then, prices do drop because everyone’s selling. It’s like a snowball rolling down a hill, getting bigger as it goes.

So, keep an eye on how people feel and what the news is saying. A big shift in these can point to a storm brewing in the stock world. When folks start acting scared, a crash may be close. It’s not just about numbers. It’s about hearts and minds, too.

In this post, we explored the guts of a stock market crash. We saw how economy signs and trust can shake the market. Then, we dug into market hype and high prices. We can’t ignore how tech in trading and big world events can stir up trouble too. The big rules set by the banks and new laws play a huge part. And we can’t forget how our own fears and the news can make us buy or sell fast.

I want you to take away this: the market is a mix of facts and feelings. Things like policy, world events, and what we hear can sway it. But don’t forget, it’s our choices in that mix that can change the game. Keep a cool head and think long-term. That’s my final two cents on this wild ride we call the stock market.

Q&A :

What are the main factors that can lead to a stock market crash?

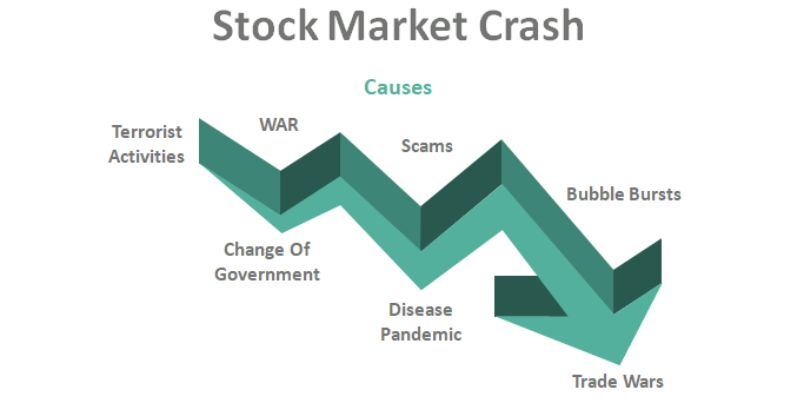

The primary triggers for a stock market crash often include economic imbalances, such as excessive speculation, high inflation rates, or an overvalued market. Other potential catalysts can include geopolitical unrest, sudden regulatory changes, mass sell-offs by investors reacting to adverse news, or financial crises that affect investor confidence and lead to panic selling.

How do interest rates influence stock market crashes?

Interest rates can have a significant impact on the stock market; when central banks raise interest rates, borrowing costs increase, which can reduce corporate profits and consumer spending. Consequently, higher interest rates can lower stock valuations and potentially trigger a market sell-off if the increase is abrupt or more significant than anticipated by investors.

Can a stock market crash be predicted?

While certain economic indicators may provide warnings, predicting the exact timing of a stock market crash is extremely difficult even for seasoned experts. Analysts may identify overvaluation, rising debt levels, or speculative investment bubbles as warning signs, but many external factors can contribute to a crash, making precise predictions challenging.

What is the role of investor psychology in a stock market crash?

Investor psychology plays a critical role in the stock market, as emotions like fear and greed can drive trading behavior. During a market downturn, fear can lead to panic selling, exacerbating a crash. Conversely, excessive optimism in a bull market can inflate asset prices unsustainably, which can later lead to a sharp correction.

How do stock market crashes affect the average investor?

Stock market crashes can substantially impact the average investor’s portfolio, often resulting in significant losses in a short period. This can affect long-term investment goals, retirement plans, and overall financial stability. Investors who sell in a panic may lock in losses, while those who hold their positions may experience a recovery over time, depending on the market’s rebound. It’s typically advised for average investors to have a balanced and diversified portfolio to mitigate the risks associated with market volatility.