Growth vs. Value Stocks Demystified: Making Smart Investment Choices

You want to make smart investment choices. Knowing what is the difference between growth and value stocks? is key. These two paths can shape your portfolio’s destiny. Growth stocks race ahead, seeking thrilling highs. Value stocks, steadfast and secure, offer comforting stability. Your future hinges on this choice. Dive into this guide, as we break down these vital investing strategies, show which suit your goals, and help you shape your investment journey. Prepare to take control and make informed decisions for your investment portfolio.

Understanding Growth vs Value Investing

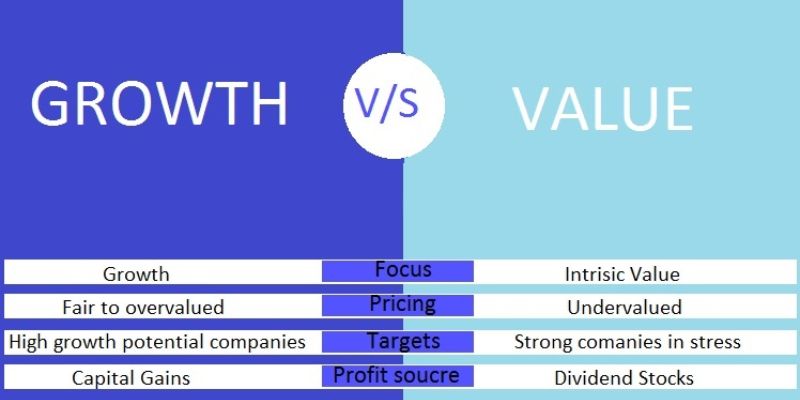

Defining Growth and Value Stocks

Let’s talk about smart money moves. When we look at stocks, we notice two main types: growth and value. Growth stocks are the race cars of the stock market. They’re companies that people expect to grow fast. They don’t often pay dividends, since they’re too busy using money to grow bigger. Think of tech whizzes like Netflix or Amazon when they were just starting out.

Now, value stocks are like hidden treasures. They’re selling for less than what they may be worth. These companies might have been around for a while like Coca-Cola or Ford. They often pay dividends. That’s like getting a small thank you for owning their stock. Investors find value stocks tempting when they seem cheaper than they should be.

Core Principles of Growth vs Value Investing

Let’s dig deeper into growth vs value investing. These aren’t just fancy words. They’re real plans that guide people on what to buy. The growth investing play is about betting on companies that one thinks will have better-than-average gains. Investors expect the stock price to shoot up because the company is growing so fast!

On the flip side, value investing is like being a deal hunter. It means looking for stocks that seem too low in price. Think of it like finding a brand-new pair of cool shoes but at half the cost! These investors aim for stocks that could be worth much more later.

When one picks stocks, it’s smart to check the company’s details, like how much money they make. Comparing growth and value stocks is also about what risks one can take and what gains they hope to make. And everyone wants their money to grow over time, right?

So there we are – growth stocks are about “go big or go home.” Big dreams, big plans, which can mean big wins or losses. Value stocks are about finding a great deal and waiting for it to pay off. It’s like a savings plan that could surprise everyone later. The cool part is that one doesn’t have to choose. A smart investor often has both growth and value stocks. That’s what we call a diversified portfolio. It’s like not putting all eggs in one basket.

We love growth stocks for their zip but need value stocks to help us sleep at night. Each has its earth-shaking ups and whisper-quiet downs. Whether someone loves the thrill of fast growth or prefers the steady promise of value, knowing their style is key. Understanding their differences helps us make choices that feel right for our money. Now, isn’t that a smart way to play the game?

Analyzing Key Characteristics and Metrics

Financial Metrics for Stock Comparison

Let’s dig into how we can tell growth stocks from value stocks by looking at money numbers, also known as financial metrics. Growth stocks are like rocket ships; they shoot up fast, aiming for the stars. They reinvest money to grow quick. So, they might not pay dividends. But, their stock prices can climb high, which is exciting!

Now, let’s chat about value stocks. These are more like treasure you find at a yard sale. They cost less than what they’re really worth. This could be because folks are overlooking them or maybe they’re not as flashy as newer companies. They often pay dividends, giving you a little extra cash while you hold the stock.

To find the treasures, you gotta compare numbers. Key numbers look at how much money a company makes and how much debt it has. A big one is the P/E ratio, which is like a price tag for stocks. Low P/E means the stock might be on sale.

P/E Ratio Analysis and Market Capitalization Differences

The P/E ratio is short for price-to-earnings ratio. It tells you if a stock’s price is high or low compared to its earnings. For growth stocks, this number is usually high. Why? Because people think the company will make more money later. They’re willing to pay more now, betting on future growth.

Value stocks are on the other side. Their P/E ratios are often low. It’s like they’re saying, “I’m cheaper compared to how much money I make!” A low P/E ratio might be a sign that a stock is a good deal. It means you’re paying less for each dollar the company earns.

Another thing to look at is market cap, which means market capitalization. It shows how big a company is in the eyes of the stock market. A high market cap often goes hand in hand with growth stocks. These companies are big shots in the market. But remember, bigger doesn’t always mean better. It’s about finding the right fit for your money.

Small market cap might mean a company is smaller or not as well-known. This can often be true for value stocks. But small can be mighty! These under-the-radar companies might just need some time to shine.

When you’re choosing stocks, think about your goals and how long you want to invest. This is your investment time horizon. Growth stocks can be thrilling but risky. They can make big moves up but can also drop fast. Value stocks might move slower, but they can be steady players, often paying dividends.

People love growth stars like the tech giants. They’ve changed our lives and grown a ton. But don’t forget about the less flashy value stocks. They could be like hidden gems, just waiting to be discovered.

Investing isn’t just about picking stocks. It’s about balance, using a mix of different types of stocks to build a strong team. That’s what smart investment choices are all about. It’s like making a meal. You need different ingredients to make it good. Same with stocks—you need variety to help your money grow over time and to feel secure in your choices. Remember to spread your investments, so if one doesn’t work out, you’ve got others that might.

When you put it all together, you want a basket of stocks that sets you up for a win. You want growth and value working together, making your money work hard for you. By understanding these numbers and what they mean, you’re on your way to making smarter choices with your investments.

Investment Strategies and Market Trends

Portfolio Diversification and Asset Allocation

When we talk about making smart money moves, it’s all about mixing things up. Think of your investments like a smoothie. You wouldn’t blend just one fruit, right? Same goes for stocks. Mixing different kinds makes your money work harder. This mix-up is what we call portfolio diversification. It’s how you spread your cash across growth and value stocks, plus other stuff, to keep risks low and chances of winning high.

Let’s break it down. Growth stocks are like hot, new tech gadgets—they’re exciting and can grow fast. Big names like Apple show us that. But they can also be risky. Now, value stocks are your sturdy, less flashy bets. They might look boring, like an old pair of jeans, but they’re steady and often give you dividends, which is money back in your pocket.

When we look at asset allocation, it’s how much money you put in different baskets—stocks, bonds, real estate, or even cash. It’s like deciding how much ice cream or spinach to put in your smoothie. You want it just right. For growth vs value investing, some folks like more growth because they dream big, while others stick with value to play it safe.

Now, to pick the best mix, you should think about how long you want to invest. If you’ve got lots of time, maybe you go heavy on growth. But if you need your money soon, value might be your friend. Your age, goals, and how much you like taking risks also play a big part in this choice.

Equity Market Trends Influencing Growth and Value Stocks

The stock market’s like a wild wave—up and down, fast and slow. Equity market trends tell us which way the wave’s going. If the market’s booming, growth stocks could shoot up high. But if things look grim, value stocks might be safer, keeping you from a wipeout.

We keep an eye on things like the S&P 500, seeing if growth or value stocks are winning. Sometimes, tech sector growth stocks lead the pack, making big waves. Other times, undervalued stock selection is the key, picking those hidden gems before they shine.

Remember, big events can shake things up too. Like if interest rates jump or tumble, it can help or hurt different stocks. For example, when rates go up, it’s tougher for growth companies because their loans get pricier. But for value companies, it might not be such a big deal.

So, when we talk investment time horizon, don’t just watch the clock. Look around, see what’s happening in the world, and how it might turn those market waves. You want to ride them, not get slammed!

In the end, it’s all a balancing act. Think about what’s going on today, but also keep an eye out for tomorrow. Blend up growth and value, check the market vibe, and hang ten, my friend. With a top-notch mix, you’re all set to tackle those big money goals.

Risk Management and Performance Expectations

Long-term Investment Potential and Risk Profiles

When you pick stocks, think about long trips. Some cars are fast but use lots of gas. Others are slow but can go far on a tank. Growth stocks are like fast cars. They can speed up quick, but they may need to stop more. These stocks don’t usually pay dividends. Instead, they put money back into the business to grow fast. But they can crash if things go bad, which means they’re riskier.

Value stocks are like those slow, steady cars. They’re not fancy, but they’re reliable and can go a long way. These stocks are often cheaper than what they’re really worth. They may also pay nice dividends. This makes them less risky, which is good for those rough roads in the market.

So, let’s break it down. Growth stocks have a chance to make more money, but they can also lose more. Value stocks may not make money as fast, but they’re steadier and can be safer.

When looking at a company’s basics, like how much money it makes, you can see if a stock is a growth type or a value type. Use tools like the P/E ratio, which tells you how much you pay for each dollar the company earns.

Now, think about how these stocks fit into your life plans. If you’re saving for something far away, like retirement, you might pick different stocks than if you need the money soon.

Anticipating Bull vs Bear Market Impact on Growth and Value Stocks

Markets go up and down. They’re like weather seasons. Sometimes, it’s sunny and stocks go up, which we call a bull market. Other times, it’s stormy and stocks go down, known as a bear market.

Growth stocks love the sun. During bull markets, they can really soar. People are happy to pay more for these fast growers when everything looks bright. But when storms hit, these stocks can fall hard. They’re like trees that grow tall but can snap in strong winds.

On the other side, value stocks are built for all seasons. Even when things get tough, they can hold up better than growth stocks. They’re like houses built to weather the storm. In bear markets, people like their sturdiness.

Now, remember that past trips don’t always tell you about the roads ahead. Just because a stock did well before doesn’t mean it will again. But looking back can give clues about how it might do.

In the end, picking stocks is all about balance. It’s good to have a mix of the fast and the steady. This way, no matter the weather, you’re set up to keep moving toward your goals.

In this post, we learned about growth versus value stocks and their core principles. We looked at the financial numbers that matter and how to tell these stocks apart. We talked about mixing different types of stocks to keep your money safe, and how market trends affect them. Finally, we talked about the long game and how to plan for ups and downs in the market.

My final thought is simple: know your goals, do your homework, and stay steady. Investing is a personal journey, and whether you lean toward growth or value, understanding what you’re doing will help you build a strong portfolio for your future. Keep an eye on the market, be smart with risks, and you’ll be set to make the most of your investments.

Q&A :

What distinguishes growth stocks from value stocks?

Growth stocks represent companies expected to grow at an above-average rate compared to other businesses in the market. They typically reinvest earnings into expansion projects or operational enhancements and often do not pay dividends. Value stocks, on the other hand, are shares of companies that appear to be undervalued by the market. These stocks trade at low multiples to their book value or have a high dividend yield. Investors in value stocks anticipate profits due to market re-evaluation or intrinsic value realization.

How do growth and value stocks react to market changes?

Growth stocks tend to be more sensitive to market changes, as they have higher valuations that hinge on future expectations. During market downturns, growth stocks may experience significant volatility. Conversely, value stocks often have more stable performance during market fluctuations because they are considered undervalued, possibly providing a level of protection against market volatility. However, they may not rise as quickly in a bull market compared to growth stocks.

Can you blend growth and value stock investing strategies?

Yes, investors can blend growth and value stock strategies, an approach referred to as growth at a reasonable price (GARP). This strategy involves selecting growth stocks that are believed to be trading at reasonable valuations. GARP investors look for companies with consistent earnings growth and signs of value, such as a low price-to-earnings ratio, to potentially minimize risk and capitalize on the strengths of both investment styles.

Why might an investor choose value stocks over growth stocks?

Investors might choose value stocks over growth stocks for reasons including the potential for dividends, lower price volatility, and the idea of purchasing stocks at a “discount” to their inherent value. These factors can provide a cushion during economic downturns and offer stable, long-term returns. Value investing also aligns with the philosophy of buying undervalued assets and selling them when their price reflects their intrinsic worth.

What are the risks associated with investing in growth and value stocks?

Investing in growth stocks carries the risk of overvaluation, where the high price-to-earnings ratios may not justify the future earnings potential. Additionally, growth stocks may be more volatile and susceptible to market corrections. Value stocks could remain undervalued for prolonged periods, and if the market’s perception does not change, the anticipated returns may not materialize. They also carry the risk of being value traps, where the company’s stock price is low for reasons fundamental to the business, such as declining industry relevance or poor management.