What triggers a stock market recovery? It’s the question on every investor’s mind after a plunge. Here, I’ll pull back the curtain on the secret drivers that kickstart a market turnaround. Learn to spot the early hints of an economic bounce-back. We’ll dive into how market signals and revival vibes point the way. Understand why the jobless rate fall and GDP uptick matter. Stay tuned as I break down the big roles central banks and governments play. It’s all about the special moves they make to get things going again. Peek into businesses and your fellow spenders to see how they shape the comeback. And for those looking to invest smart after a downturn, we’ll explore how to make your moves count. Get ready to spot those recovery triggers and invest with confidence.

Recognizing the Early Signs of Economic Recovery

How Positive Market Indicators Reflect Revival Sentiments

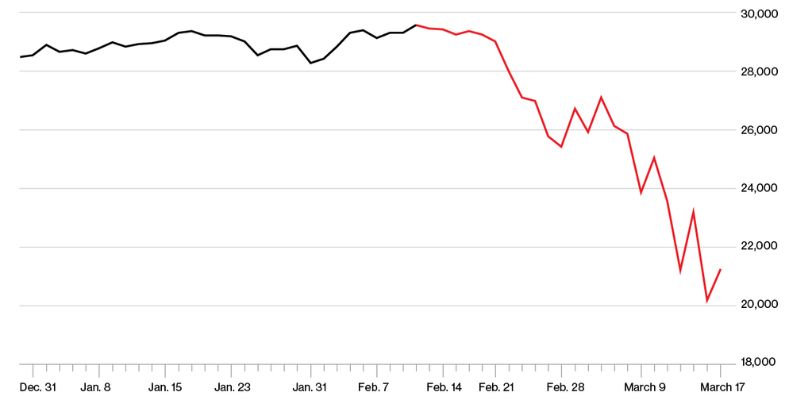

When the stock market falls, it can feel gloomy. But soon, hope peeks through when signs show a turnaround might be close. Seeing these signs early can be like finding a secret map that leads to treasure. People who know what to look for might spot a recovery before it takes off.

The stock market is like a mirror that shows how folks feel about the economy. When folks start to see things getting better, it can lead to a rebound. Positive signs include more jobs and when companies start to earn more money. These bits of good news build trust among investors and hint that better times are ahead.

When investor trust grows, they put more money into stocks, which helps prices go up. This is what we call investor confidence restoration. It means people are starting to believe in a bright future. And a strong belief often leads to real results.

The Role of Unemployment Rate Decline and GDP Growth

Now, let’s dig into something really telling – jobs. When more people work, they can spend on things they need and want. This is when the unemployment rate decline shows its power. Less jobless folks mean more money moving around, which is great for businesses.

Then there’s GDP, short for how much stuff a country makes and sells. When GDP growth happens, it means the economy is getting back on track. Everyone likes to see these numbers go up because it usually means times are improving.

A drop in jobless rates and a rise in GDP sends a clear message: things are looking up. It shows businesses are humming along and people are getting back to work. When these numbers get better, it adds juice to the economy’s engine, pushing it forward.

These early signs are not secret codes; they’re out in the open. But you need to know where to look. Once you see them, you can get ready for a possible stock market rebound. And being ready means you can make smart moves that could lead to big wins as things get better.

Remember, a recovery doesn’t happen all at once. It’s a climb back up, filled with steps both big and small. And as we track these steps, like jobs and growth, we can get clues that a brighter financial day is on its way. This is the time when being alert pays off, letting you ride the wave of recovery all the way to the shore.

The Influence of Central Banks and Governmental Policies

Assessing the Effectiveness of Central Bank Interventions and Interest Rate Adjustments

Let’s talk central banks and their big role in a stock market’s upturn. When a market dives, they jump in, like superheroes in suits. They slash interest rates, making it cheaper to borrow money. This can light a fire under the stock market. Folks find low rates mighty appealing. They start buying homes and cars, which gets factories humming and workers working. More work means more cash flying around the economy, which can lead to a happier stock market.

Central banks don’t stop there. They buy up bonds through a trick called quantitative easing. This pumps money into banks. With more money to lend, banks can help businesses grow and hire. When companies shine, their stocks often do too.

You might be wondering, “Do these central bank moves always work?” Well, not always, but when they do, we see investor smiles as stocks climb. We keep a sharp eye on central bank moves. They tell us a lot about where the market might head next and why.

Fiscal Stimulus Impact on Market Dynamics

Now, let’s chat about how governments also step up to boost the market. They hand out money or cut taxes to make folks and companies feel richer. This tactic, known as fiscal stimulus, pours cash into folks’ pockets. And what do people do with cash? They spend it. They hire workers, and businesses boom. And guess what booms next? Yep, the stock market.

This money magic doesn’t only turn sad markets happy. It can keep them up and dodging the next bump. Governments aim for a balance – enough juice to speed up growth but not so much we get wild inflation.

Stocks perk up when they hear good news about these government moves. It’s a sign that help is on the way. So, when you hear “fiscal stimulus” on the news, picture a giant market pick-me-up in a cup. And if you’re keen to know how this spells out for your stocks, think bright thoughts. You just might see dollar signs as recovery rolls in.

When central banks and governments tag team, they can pack a punch that pushes the market uphill. They give a nudge to investor confidence and put wind in the sails of stocks. Sure as the sun rises, markets grumble now and then. But with the right moves from our money maestros, a rebound might just be around the corner. Keep your eye on these powerful players. They often hold the key to the market’s comeback story.

Corporate and Consumer Behavior Influencing Market Trajectory

Tracking Corporate Earnings Growth and its Market Implications

After a market fall, company profits can kickstart a rally. When firms start pocketing more money, the good news spreads. Investors hear that, they feel good, and start to buy more stocks. It’s like a big high five spreading through the market. People see these gains in earnings as a sign that businesses are doing well again.

This buying boost from investors can really get stocks soaring. It’s not just one or two companies either. When lots of them show better profits, it’s like a wave lifting all the boats in the harbor. And it’s not just a fluke – this is a key point. The growth in earnings has to be strong and steady. A one-off good report won’t do it; investors want to see a pattern of companies doing better. They want to know that the whole economy is finding its footing again.

Consumer Spending Trends and Investor Risk Appetite Signals

Next up, let’s chat about shopping – not the mall kind, but the kind where what people buy can show where the economy’s heading. After a rough patch in stocks, if folks start opening their wallets more, that’s a big deal. It tells investors that normal life is coming back, that maybe it’s safe to dive back into the market.

People buying stuff is a sure sign they feel okay about their own money. When they spend more, the businesses they buy from make more too. It’s a loop of good vibes and cash flow. But it’s not just about buying more; it’s about what they’re buying. If they go for riskier stuff, it means they are not as scared about losing money. That’s a big green light for folks who watch the markets – it says folks are ready to take a chance again.

This risk mood isn’t just about everyday people, though. Big-time investors feel it too. They’re key players in a stock rebound because they put in lots of money, pushing prices up. When they think it’s worth the gamble, you can bet others will follow. They kind of set the trend.

So, tracking how companies perform and watching what people buy can give us real clues about a market bounce-back. It’s amazing, isn’t it, how something as simple as folks buying more stuff can signal that good times might be rolling back into town? And it goes to show how connected everything is – from shopping bags to stock tickers.

Alright, let’s hit the next point. It’s kind of like detective work, figuring out what will lift stocks from their slump. But get this, it’s not just a guessing game. Watching these signs – the company cash and shopping habits – that’s solid ground for predicting a stock stand-up. Keep an eye on these, and you might just catch the next rally wave before it rolls in.

Strategic Post-Recession Investing and Market Sentiment

Navigating Post-Recession Investment Strategies for Long-term Gains

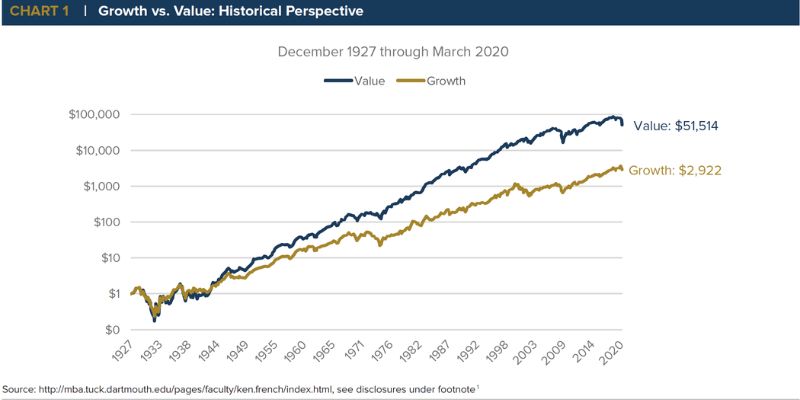

Let’s chat about making smart moves after a downturn. A bear market can scare folks. But it often sets the stage for a stock market rebound. The trick lies in spotting signs of economic recovery. These signs point to better days and savvy investing can lead to long-term gains.

What catches my eye first? Look for an uptick in corporate earnings growth. When companies start earning more, it’s a signal. It means things might be looking up in the market. This growth can stir up investor confidence. And as you can guess, this can kick off a stock market rally.

Central bank actions mean a lot too. They step in to steady the ship. They might drop interest rates or go for something called quantitative easing. This makes borrowing cheaper. It can shoot life back into the economy. Plus, the government might chip in with fiscal stimulus. This cash boost can juice up spending and investment.

So, how about when folks start spending again? Consumer spending trends getting better is key. It shows that people feel good about the economy. More spending can lead to more jobs. A drop in the unemployment rate adds to the good vibes. More jobs mean more cash in pockets. And again, this circles back to boosting the market.

Market Sentiment Analysis and Investor Confidence Restoration

Now, market mood swings matter a lot. Yes, the real numbers are important. But what people feel about the market? That’s gold. When optimism seeps back in, it can fuel a rally. That’s market sentiment for you.

Investor confidence needs a comeback for stocks to soar again. And it can slowly creep back when things look steady. A dip in market volatility shows calmer times. That helps bring folks back to the market. Financial market stability makes investors breathe easier. They’re more likely to take the plunge and invest again.

Then watch how governments and banks play the game. Their economic policies can make or break recovery. Stimulus effects don’t just pump up the markets. They can steer us clear of another crash.

Lastly, let’s talk risks. Everybody’s got a different taste for it. But when a recovery seems near, folks might take on more risk. The investor risk appetite grows. And when people feel bolder, they invest more. That’s more fuel for the stock market rebound.

Bear in mind, it’s not just about one thing. It’s a mix. A mix of steadier jobs, folks spending, calm markets, and solid company profits. If you get the recipe right, you’re in for some good times ahead. Keep your eyes open. Watch for these signs. And remember, smart investing after a recession takes guts. But it can set you up for big wins in the long run.

We’ve looked at signs that point to an economic comeback. We saw how stock markets react, and how job numbers and a country’s total money can tell us if things are getting better. We talked about what the big banks and governments are doing to help, like changing interest rates and giving out extra money to stir up the economy.

We also checked out how companies and shoppers act, and what this does to stocks and investment risks. At the end of the day, knowing how to invest after tough times can really pay off and bring back trust in the markets.

I think it’s smart to keep an eye on these things. They show us where the money is moving and hint at how strong our economy is. So, watch the signs, think about what actions you might take and remember, with the right moves, you can win even when times are tough.

Q&A :

What Are the Main Factors That Trigger a Stock Market Recovery?

A stock market recovery can be initiated by several key factors such as stabilization of geopolitical situations, reversal of economic downturns through fiscal or monetary policies, improvement in corporate earnings, or a decrease in inflation rates. Positive news on these fronts can restore investor confidence and encourage investment market activities, potentially leading to a rally or recovery in stock prices.

How Does Investor Sentiment Affect Stock Market Recovery?

Investor sentiment plays a crucial role in the stock market as it can influence both selling and buying behaviors. Optimism among investors can lead to increased buying and investing, driving stock prices up. Conversely, widespread pessimism can prompt selling and withdrawal from the market. A shift towards positive sentiment is usually a significant trigger for a market recovery, as it signals a collective anticipation of future economic strengthening.

Can Government Intervention Help in Stock Market Recovery?

Yes, government intervention can be critical in aiding a stock market recovery. Actions such as lowering interest rates, providing fiscal stimulus, or implementing regulatory reforms can help improve market liquidity, stabilize the financial sector, and encourage spending and investment. These interventions can reassure investors and contribute to the restoration of confidence in the market, potentially leading to a recovery.

What Role Do Economic Indicators Play in Triggering Stock Market Recovery?

Economic indicators such as GDP growth rates, employment data, and consumer spending figures are closely watched by investors as they give insight into the health of the economy. Positive changes in these indicators can signal to investors that the economy may be improving, which can trigger buying activity and potentially lead to a stock market recovery.

Is There a Correlation Between Global Events and Stock Market Recovery?

Global events, such as the conclusion of a trade war, the signing of international treaties, or resolution of global conflicts, can have a profound impact on stock markets worldwide. Such events can alleviate uncertainty, lower risk, and pave the way for economic growth, which in turn can serve as a catalyst for stock market recovery. Investors often look for resolution of major global events as a sign that it’s safe to reinvest in the market.