Growth vs Value Stocks: Timing the Smart Investment Switch

Knowing when to invest in growth stocks vs value stocks can make or break your portfolio’s performance. Think of it like a pro surfer who times the wave perfectly – except you’re riding the stock market’s tides. In this playbook, we dive into the key differences between high-octane growth stocks and the steady eddies called value stocks. Understanding their potential can lead to smarter investment decisions. We shed light on what market conditions favor each type and how to spot the prime time to switch gears. Get ready to balance risk and reward like a pro, using fundamental and technical analysis to nail down the perfect mix of growth and value in your investment strategy. Say goodbye to guesswork and hello to smart, timely investment shifts that could power your portfolio to new heights. Welcome to the ultimate guide to mastering the market’s waves.

Understanding Growth and Value Stocks

Defining Growth Stocks and Their Potential

Let’s talk about growth stocks. These are shares from firms that grow fast. They reinvest earnings to grow. High earnings growth is their mark. But they do not pay big dividends. Instead, they use money to expand, innovate, and stay ahead. This makes the prices of these stocks rise quickly. Tech companies often fit this bill. They change, grow, and make new things. Investing here aims for high return. But there’s more risk. Prices can swing a lot. So, it’s big gains or big losses with these stocks.

Characteristics and Appeal of Value Stocks

Now, think about value stocks. These stocks seem cheap. They trade for less than their book value. This can happen for many reasons. Maybe the market missed their true worth. Or, the company went through tough times but can bounce back. Mature firms are often in this group. They share profits as dividends. This appeals to careful spenders. Their stock prices don’t move as much. This gives stability. For those who like safe bets, it’s all about dividends and steady returns.

When choosing stocks, look at your own goals. We all want our money to grow. Some dream of quick gains. Others seek a sure, slow increase. There’s no one answer for all. Each choice means a different path. Your pick should match your comfort with risk. It should also follow your wish for gains. Some invest just for dividends. Others seek the thrill of the next big thing. The key is to learn all you can. Knowledge helps in finding what’s right for you.

Assessing Market Conditions and Timing for Investment

Identifying Optimal Investment Periods

When do you put money into growth stocks? The simple answer: During market upswings. Growth stocks soar high when markets rise. They are like race cars, zooming ahead as things look up. You’ll spot these stocks in tech or healthcare. They are companies making waves with new things. Think of the latest gadget everyone wants. That’s growth stock territory.

These stocks don’t like bad times, though. When markets fall, they can take a hit. This is when you watch closely. Get set to buy these high-fliers when prices are fair. It’s not smart to jump in when they peak. Timing matters. Buy when future growth is bright but others haven’t noticed yet. This means you should stay sharp! Look at market trends and where the crowd is headed.

Economic Indicators and Market Cycles’ Impacts on Stock Choices

Now let’s chat about value stocks. When’s the right time? Look for when the market slows or dips. Value stocks are like tugboats—they power through rough seas without much fuss. These are stocks from solid firms. They’ve been around and have sturdy roots. They might not grow fast, but they give steady cash through dividends.

You find these value gems by digging into numbers. See what a firm truly owns and earns. Check if the price is less than what it’s really worth. That’s your cue.

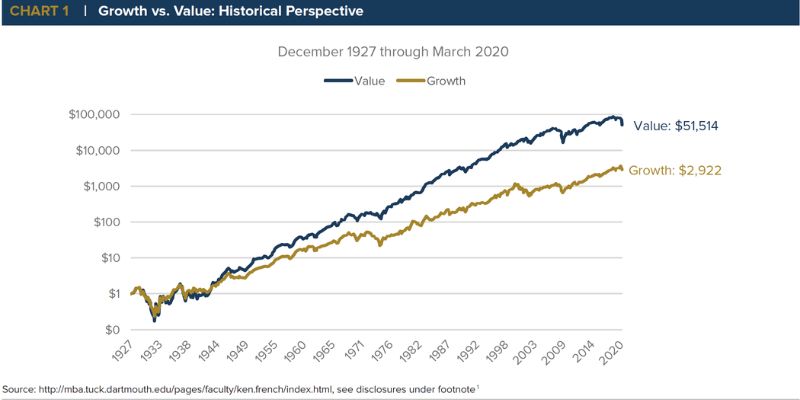

Market cycles play a big part too. They tell you when to lean into growth or value stocks. A bull market? Growth stocks might be your go-to. Bear market? Value stocks call out to you. The key is to adapt with the times, not fight against them. It’s like surfing. Ride the wave that the market sends your way.

Economic signs help too. Things like job numbers, spending trends, and how businesses do. These clues show if growth stocks are ready to leap or if it’s time for value stocks to shine.

It’s a bit of art and science. You can’t just guess. Use data and gut feel. Look at what’s worked before, but also be bold to try new moves. Spot patterns and learn from them. Be ready to shift gears when needed.

Remember, it’s not about quick cash. It’s about smart picks that grow over time. Think of your goals. Mix both growth and value stocks to match them. This way, you spread out risks and keep your money goals on track.

Investing is a journey, not a sprint. Watch the signs, think ahead, and plan. Always have a mix that fits your needs. Then, no matter the market dance, you stay steady on your feet. And stay upbeat! With a keen eye, you’ll find your chance to win big with growth and value stocks.

Strategies for Balancing Growth and Value in Your Portfolio

Risk Assessment and Diversification Tactics

When putting money into stocks, we need to play it smart with risks. Imagine your money like eggs. You wouldn’t put all your eggs in one basket, right? That’s risky! If that basket falls, all goes boom. So, we spread them out. That’s what we call diversifying. Think of growth stocks like fast bikes. They can get you places quick, but they can be risky. Value stocks are more like sturdy cars. They get you where you need to go, safe and sound. We need both.

To mix it up right, first, see how much risk you can handle. Are you okay with bumps on the road? If yes, maybe add more growth stocks. These are usually from companies that reinvest earnings to grow fast. But remember, fast can also mean a fast fall. On the other hand, if you like a smooth ride, value stocks might be better. They are often from solid companies at good prices. They might not race ahead but they offer safety and often pay dividends.

Now, let’s talk about eggs—I mean, money—again. We don’t throw all of them into growth or value at once. We put them in at different times. That’s spreading them out, not just by type but by time too. Smart, huh?

Entry Points for Growth and Value Stocks

Entry points are like finding the best time to jump into a game of jump rope. You watch it swing, you wait for the right moment, and then you jump in. For growth stocks, you want to jump in when the market is going up. Look for signals like a strong economy and happy news about companies growing fast. That’s when growth stocks can really shine.

Value stocks? You jump in at a different time. Look for when the market is low or just starting to warm up again. That’s when you can find solid companies priced low. They’re like hidden gems in the dirt. Buy them cheap, then wait for their real worth to shine through.

The trick in all of this is timing. We can’t see the future, but we can watch and learn. We watch the market, study companies, and learn when to jump in. And we never stop learning, because the market never stops changing. You get your timing right, and you can win big. Get it wrong, and well, you learn for next time.

We keep our eyes on things like economic signs. Low job numbers or companies not making money? Might be good for value stocks. Loads of new jobs and companies enjoying fat profits? Hello, growth stocks!

It’s like a dance, you see. Part science, part art. And the music? It’s played by the market. You learn the steps, you listen to the rhythm, and with some practice, you get better at it. So keep dancing, keep diversifying, and keep watching for those entry points! The more you do it, the better you’ll get at balancing those eggs—I mean stocks—and the less you’ll worry about them breaking.

Advanced Techniques in Stock Analysis and Timing

Leveraging Fundamental and Technical Analysis

Let’s dive right into the mix of fundamental and technical analysis. These are the tools you need to pick the best stocks. For growth stocks, look at the company’s potential to make big moves. This could be due to new products or expanding markets. Check things like earnings growth rate and how they spend money on their business.

For value stocks, focus on what you can get for less. These stocks often seem cheap compared to the money they make or the assets they have. That’s where you find hidden gems. Use ratios like price-to-earnings and price-to-book to spot deals.

Now, what about when the chart lines dance on a screen? That’s technical analysis. It helps you see patterns in stock prices. You look for trends and use them to guess where prices will go next. It adds a layer to your skill set, making sure you enter at good prices and exit before storms hit.

Market Sector Opportunities and Timing the Switch

Sector plays are big in growth vs value debates. Some sectors, like tech, often lead in growth. Others, like utilities, are classic value spots. But it’s not about picking teams. It’s about knowing when to play each side. You want to be in growth when those stocks race ahead. But when they slow down, it’s time to switch to value.

Watch for shifts in the economy. Say interest rates climb. Growth might take a hit as costs go up. Here, value can shine, offering safety and dividends. Keep an eye on those economic indicators. They’re your weather vanes. They signal when a sector might wake up or cool off.

Remember, not all value stocks are in dull industries. Tech can do value too. Look for mature companies here. They may not grow fast, but they spin off cash, ripe for dividends.

Getting the switch right between growth and value isn’t just luck. It’s about reading the room—the economy, the charts, and the sectors. This is how you tap into better investment periods.

Good timing gets you good prices for growth stocks or these cheaper value picks. And it’s not just about buying. Knowing when to sell is just as key. Say a growth stock’s price rockets but hits a ceiling. The charts and financials will tell you it’s time to take profits.

In the end, mix both analyses for a clear view. Don’t just count on one. Each has a role in your investing game plan. You can’t ignore the numbers or the chart patterns if you want to win. And always keep your goals in sight. They’ll help you choose the right stock at the right time.

Ready to learn the ropes? Keep tabs on the markets, sharpen those analysis skills, and you’ll set yourself up for smarter, more timed investment moves.

In this post, we explored the world of growth and value stocks. We learned growth stocks have big potential and value stocks are like hidden gems. Knowing when to invest is key, and we looked at the best times based on the market’s ups and downs. I shared ways to mix growth and value stocks to keep your money safe and sound. We also got smart about using deep analysis to find the best stock picks and timing the market.

Here’s my final take: getting your mix of stocks right matters a lot. It can help your money grow and protect it too. Remember, the market’s always moving, so stay sharp and use what you’ve learned here. Happy investing!

Q&A :

When is the best time to invest in growth stocks?

Growth stocks typically represent companies that are expected to grow at an above-average rate compared to the market. A good time to invest in growth stocks is when the economy is in the expansion phase and consumer confidence is high, often leading to increased spending and investment in innovative companies. However, because growth stocks can be volatile, it’s important to ensure that they align with your risk tolerance and investment goals.

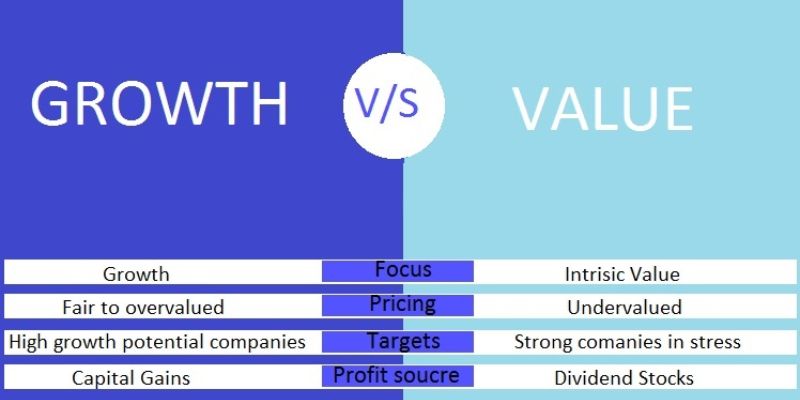

How do you differentiate between growth and value stocks?

Value stocks are shares of companies that tend to trade at a lower price relative to their fundamentals, such as dividends, earnings, or sales, making them appealing to investors who are looking for a bargain. In contrast, growth stocks are associated with companies that are expected to grow at a significantly higher rate than the overall market, and thus, their stock prices are higher in relation to their current earnings. The key difference lies in the company’s performance expectations and stock valuation.

Why might an investor choose value stocks over growth stocks?

An investor might choose value stocks over growth stocks for several reasons. Typically, value stocks are considered to be less volatile than growth stocks and may offer a higher level of dividend yield, which can be attractive for income-seeking investors. Additionally, value stocks can provide potential for capital appreciation if they are undervalued and subsequently adjust to their intrinsic worth. This investment strategy may appeal to conservative investors or those who want to take a contrarian approach to market trends.

What are the risks and rewards associated with investing in growth stocks?

Investing in growth stocks comes with a higher degree of risk and volatility due to their reliance on future growth expectations, which are not guaranteed. The rewards of investing in growth stocks can be substantial if the companies realize their potential and continue to grow at an accelerated pace, leading to significant stock price appreciation. On the downside, these stocks can decline sharply if the anticipated growth does not materialize or market conditions change.

How do market conditions affect the performance of growth stocks versus value stocks?

Market conditions play a critical role in the performance of growth and value stocks. Growth stocks tend to perform well during economic expansions when market optimism is high, and capital is flowing into innovative sectors. Conversely, during economic downturns, value stocks may outperform growth stocks as investors seek out stable companies with solid fundamentals that are trading at discounted prices. Additionally, interest rate changes can have a disparate impact on these types of stocks—value stocks often fare better during periods of rising rates, while growth stocks may be more sensitive to rate hikes.